Press release

Digital Banking Platform Market Size, Share, Growth, Trends and Analysis 2024-2031| Appway, Backbase, CREALOGIX, ebanklT,

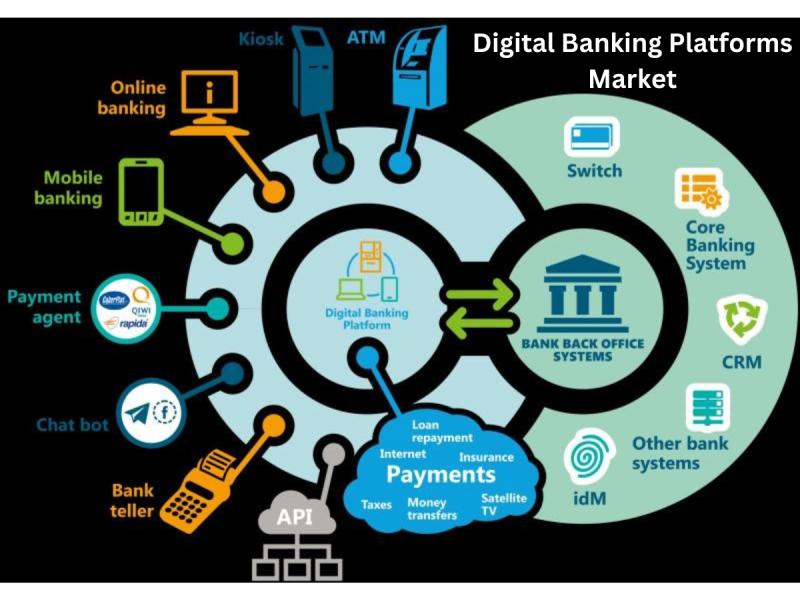

The Digital Banking Platform Market research delivers comprehensive research on the present stage of the market, covers market size with respect to assessment as sales volume, and provides a precise forecast of the market scenario over the estimated period. Also focuses on the product, application, manufacturers, suppliers, and regional segments of the market. Digital Banking Platform report research highlights market driving factors, an overview of the market growth, industry size, and market share. Since this Digital Banking Platform report depicts the constantly evolving needs of clients, vendors, and purchasers in different regions, it becomes simple to target specific products and generate large revenues in the global market.The Global Digital Banking Platform Market size was valued at USD 25.18 billion in 2022 and is expected to grow at a CAGR of 20.9% during the forecast period (2024-2031), from USD 30.44 billion in 2023 to USD 138.96 billion in 2031. It is expected.

(Exclusive Offer: Flat 20% discount on this report)

Click Here to Get Free Sample PDF Copy of Latest Research on Digital Banking Platform Market 2024 Before Purchase:

https://www.theresearchinsights.com/request_sample.php?id=530874

Our Sample Report May Includes:

1. 2031 Updated Report Introduction, Overview, and In-depth industry analysis.

2. 120+ Pages Research Report (Inclusion of Updated Research).

3. Provide Chapter-wise guidance on Request.

4. 2024 Updated Regional Analysis with Graphical Representation of Size, Share & Trends.

5. Includes Updated List of table & figures.

6. Updated Report Includes Top Market Players with their Business Strategy, Sales Volume, and Revenue Analysis.

Top Key Players are covered in this report:

Appway,

Backbase,

CREALOGIX,

ebanklT,

EdgeVerve,

Intellect Design Arena,

Finastra,

ieDigital,

ETRONIKA,

Fidor,

Fiserv,

Halcom,

NETinfo,

Kony,

NF Innova,

Oracle,

SAB,

SAP,

Sopra,

TCS,

Technisys,

Temenos,

BNY Mellon,

Worldline.

Digital Banking Platform Market Segmentation

On The Basis of Banking Types:

• Retail Banking

• Corporate Banking

On The Basis of Banking Modes:

• Online Banking

• Mobile Banking

Segment by Application

Digital Banking Platforms Market research report on the basis of deployment types:

• On-premises

• Cloud

SPECIAL OFFER: AVAIL UP TO 20% DISCOUNT ON THIS REPORT:

https://www.theresearchinsights.com/ask_for_discount.php?id=530874

Which regions are leading the Digital Banking Platform Market?

• North America (United States, Canada and Mexico)

• Europe (Germany, UK, France, Italy, Russia and Turkey etc.)

• Asia-Pacific (China, Japan, Korea, India, Australia, Indonesia, Thailand, Philippines, Malaysia and Vietnam)

• South America (Brazil, Argentina, Columbia etc.)

• Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa)

Key Points Covered in Digital Banking Platform Market Report:

• Digital Banking Platforms Overview, Definitions and Classification Market Drivers and Barriers

• Digital Banking Platform Market Competition by Manufacturers

• Digital Banking Platform Capacity, Production, Revenue (Value) by region, 2024-2031

• Digital banking platform supply (production), consumption, export, import by region (2024-2031)

• Digital banking platform production, revenue (value), price trends by type {PC, mobile}

• Digital Banking Platform Market Analysis by Application {Retail Digital Banking, SME Digital Banking, Enterprise Digital Banking Customers}

• Digital Banking Platform Manufacturer Profile/Analysis Digital Banking Platform Manufacturing Cost Analysis, Industry/Supply Chain Analysis, Sourcing Strategy and Downstream Buyers, Marketing

• Analysis of key manufacturers/players specific strategies, connected distributors/merchants standardization, regulatory and collaboration initiatives, industry roadmap and value chain market effect factors.

Digital Banking Platform Industry Overview

The digital banking platform market is moving towards fragmentation. This is because companies and solutions are entering the market, creating a fragmented environment within the digital banking ecosystem. However, with technological advancements and product innovations, small and medium-sized companies are securing new contracts and partnerships to strengthen their market presence.

Buy Now Full Report @ https://www.theresearchinsights.com/checkout?id=530874

Advantages of Digital Banking Platform Market Research:

• Enabling Regional Analysis and Market Scope Definition.

• Providing a Strong Foundation for Business Decision-Making and Strategy Adaptation.

• Helping Companies Identify Opportunities in the Digital Banking Platform Market and Expand into New Market Segments.

• Determining the Optimal Market Position to Enhance Customer Service and Competitiveness.

• Establishing and Enhancing a Mechanism for Collecting Marketing Data and Improving Overall Business Operations.

Note: All of the reports that we list have been tracking the impact of COVID-19 on the market. In doing this, both the upstream and downstream flow of the entire supply chain has been taken into account. In addition, where possible we will provide an additional COVID-19 update report/supplement to the report in Q3, please check with the sales team.

About us:

The Research Insights - A world leader in analysis, research and consulting that can help you renew your business and change your approach. With us you will learn to make decisions with fearlessness. We make sense of inconveniences, opportunities, circumstances, estimates and information using our experienced skills and verified methodologies. Our research reports will provide you with an exceptional experience of innovative solutions and results. We have effectively led companies around the world with our market research reports and are in an excellent position to lead digital transformations. Therefore, we create greater value for clients by presenting advanced opportunities in the global market.

Contact Us:

Robin

Sales Manager

+ 91-996-067-0000

+312-313-8080

www.theresearchinsights.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Banking Platform Market Size, Share, Growth, Trends and Analysis 2024-2031| Appway, Backbase, CREALOGIX, ebanklT, here

News-ID: 3437296 • Views: …

More Releases from The Research Insights

Latest Research Report on Travel Services Market by Forecast to 2032

The Global Travel Services Market has experienced substantial growth, driven by increasing globalization, rising disposable incomes, technological advancements, and growing consumer preference for experiential travel. The market encompasses a wide range of services, including travel planning, transportation, accommodation, and tourism activities. This article provides a detailed analysis of the market size, share, trends, and growth prospects, highlighting the factors shaping the industry's future through 2032.

𝐂𝐥𝐢𝐜𝐤 𝐭𝐡𝐞 𝐥𝐢𝐧𝐤 𝐭𝐨 𝐠𝐞𝐭 𝐚…

Commercial Insurance Market is Expected to Grow at a CAGR 2024 - 2031

The Commercial Insurance Insights of 2024 is a thorough analysis that offers a thorough look at the market's size, revenues, market shares, various categories, drivers, and other pertinent factors in addition to trends and possible new developments. Aside from the 2031 forecast period, the research study discusses market restraints and regional industrial presence that may impact market growth patterns. In PDF version, the Commercial Insurance Market study comprises an extensive…

Portable Power Station Market Forecast 2024-2031 - 46.6% CAGR Growth by 2031

The Portable Power Station Insights of 2024 is a thorough analysis that offers a thorough look at the market's size, revenues, market shares, various categories, drivers, and other pertinent factors in addition to trends and possible new developments. Aside from the 2031 forecast period, the research study discusses market restraints and regional industrial presence that may impact market growth patterns. In PDF version, the Portable Power Station Market study comprises…

Portable Power Station Market To Grow at a Stayed CAGR from 2024 to 2031

The Portable Power Station Insights of 2024 is a thorough analysis that offers a thorough look at the market's size, revenues, market shares, various categories, drivers, and other pertinent factors in addition to trends and possible new developments. Aside from the 2031 forecast period, the research study discusses market restraints and regional industrial presence that may impact market growth patterns. In PDF version, the Portable Power Station Market study comprises…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…