Press release

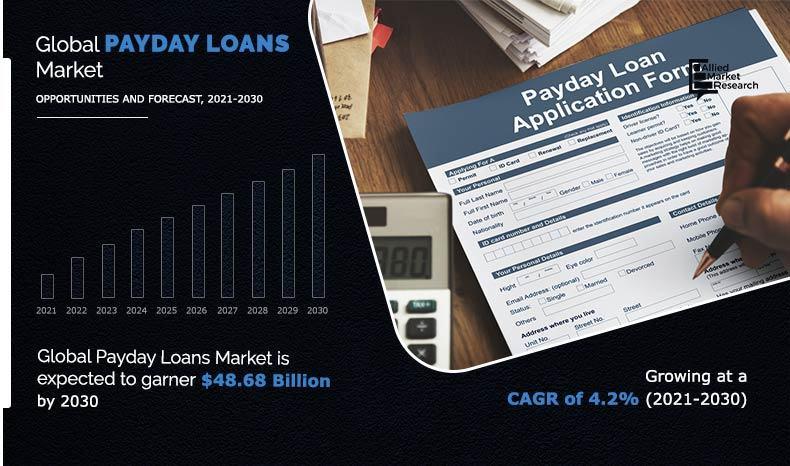

Payday Loans Market to Hit $48.68 Billion by 2030 | CashNetUSA, Myjar, Lending Stream, Speedy Cash, Silver Cloud Financial, Inc., Titlemax

According to a recent report published by Allied Market Research, titled, "Payday Loans Market by Type, Marital Status and Customer Age: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payday loans market size was valued at $32.48 billion in 2020, and is projected to reach $48.68 billion by 2030, growing at a CAGR of 4.2% from 2021 to 2030.𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂

https://www.alliedmarketresearch.com/request-sample/A10012

Payday loan is a type of short-term cash loans that is provided to borrowers with high interest rate without any collateral provided by the borrowers. In addition, as payday loans continue to attract new users, more market participants are becoming aware of the need for straightforward tools designed to manage payday loans for borrowers of all skill levels which is driving the growth of the market.

Moreover, payday loan providers are typically small credit merchants who provide loans to the borrowers from physical platform as well as through online platform. In addition, payday loans help people in emergency need of cash without the need of any proof, which is driving the market. Furthermore, the key factor that drives the market includes growing awareness about the payday loan among the youth population and fast loan approval with no restriction on usage.

In addition, presence of large number of payday lenders positively impacts the growth of the market. However, factors such high interest rates and negative impact of payday loans on credit score are expected to hamper the payday loans market growth. On the contrary, rise in adoption of advance technology among the payday lenders is expected to offer remunerative opportunities for the expansion of the market during the forecast period.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧:

https://www.alliedmarketresearch.com/request-for-customization/A10012

Depending on marital status, single is expected to hold the largest global payday loans market as individuals are rapidly using payday loans for full filling their daily necessities. However, married is expected to witness significant growth rate during the forecast period, owing to growing need to repay the loan amount among the married people as well as to pay unexpected debt and medical bill provides lucrative opportunity for the market.

Region wise, the global payday loans market was dominated by North America, and is expected to retain its position during the forecast period. This is attributed to increase in adoption of advance technologies such as cloud technology, big data, artificial intelligence, and machine learning for automating the payday loan solutions and providing online payday solutions with high privacy. However, Asia-Pacific is expected to witness significant growth rate during the forecast period, owing to rising payday loan awareness among the youth and growth in number of payday lenders in Asia-Pacific.

COVID-19 Impact Analysis

The outbreak of COVID-19 is anticipated to have a positive impact on the growth of the global payday loans market trends. With the rise of COVID-19 pandemic, millions of people have lost their jobs and pay day loans have experienced a significant boost due to growing government support and favorable government schemes for the workers. In addition, many payday lenders wanted to repeat the same that has been repeating for the past two recessions that occurred in 1923 and 1926, i.e. to target the low earners to boost the market.

However, due to several COVID-19 relief schemes many unemployed and low earners have been saved and are able to protect themselves from the temptation of payday loans. In addition, even with the ongoing schemes, many youngsters are taking payday loans to keep continuing with their living style before pandemic and job loss. Furthermore, according to a study of consumer spending, it was found that majority of the people in the U.S. have reduced their spending and are instead trying to resolve their old debts as soon as possible. This change in behavior is however negatively impacting the growth of the market.

𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠 :

https://www.alliedmarketresearch.com/purchase-enquiry/A10012

Key Findings Of The Study

Depending on type, the storefront payday loans accounted for the largest global payday loans market share in 2020.

Region wise, North America accounted highest revenue in 2020.

Depending on marital status, the single generated the highest revenue in 2020.

The key players profiled in the global payday loans market analysis are Speedy Cash, Titlemax, CashNetUSA, Silver Cloud Financial, Inc., TMG Loan Processing, THL Direct, Lending Stream, Creditstar, Myjar, and Cashfloat. These players have adopted various strategies to increase their market penetration and strengthen their position in the payday loan industry.

𝐓𝐨𝐩 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

U.S. Personal Finance Software Market https://www.alliedmarketresearch.com/us-personal-finance-software-market

North America Travel Insurance Market https://www.alliedmarketresearch.com/north-america-travel-insurance-market

Predictive Analytics in Banking Market https://www.alliedmarketresearch.com/predictive-analytics-in-banking-market

Asia-Pacific Digital Remittance Market https://www.alliedmarketresearch.com/asia-pacific-digital-remittance-market

U.S. Surplus Lines Insurance Market https://www.alliedmarketresearch.com/us-surplus-lines-insurance-market-A06543

Digital Banking Platforms Market https://www.alliedmarketresearch.com/digital-banking-platforms-market

ATM Managed Services Market https://www.alliedmarketresearch.com/atm-managed-services-market

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

https://medium.com/@kokate.mayuri1991

https://www.scoop.it/u/monika-718

https://bfsibloghub.blogspot.com/

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Payday Loans Market to Hit $48.68 Billion by 2030 | CashNetUSA, Myjar, Lending Stream, Speedy Cash, Silver Cloud Financial, Inc., Titlemax here

News-ID: 3395194 • Views: …

More Releases from mayuri.deore@alliedanalytics.com

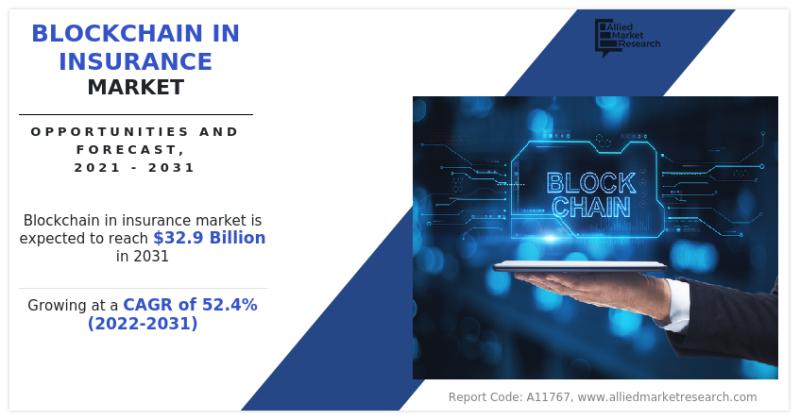

Blockchain In Insurance Market is Offered Along with Information Related to Key …

global blockchain in insurance market generated $496.9 million in 2021, and is estimated to reach $32.9 billion by 2031, witnessing a CAGR of 52.4% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, key investment pockets, value chains, regional landscape, and competitive scenario. The report is a helpful source of information for leading market players, new entrants, investors, and stakeholders in devising strategies…

More Releases for Cash

Your Cash Pro Unlocks Immediate Cash from Lapsed Life Insurance

Available to Policyholders Aged 65 or Older with Policies of $100,000 or More

Your Cash Pro is redefining what happens when a life insurance policy no longer fits. Built on transparency and compassion, the company helps policyholders convert lapsed or unneeded policies into immediate cash. Each transaction is structured to protect the policyholder's interests, and Your Cash Pro extends the impact by donating 50% of its own proceeds, never from the…

Teller Cash Recycler Market: Optimizing Cash Management for a Smarter Banking Fu …

The Teller Cash Recycler (TCR) market is witnessing strong momentum as financial institutions, retailers, and cash-heavy industries embrace automation to enhance operational efficiency. Valued at US$ 4,143.47 million in 2024, the market is projected to reach US$ 6,441.49 million by 2033, growing at a steady CAGR of 5.16%.

𝐓𝐡𝐞 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐬𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐞𝐫𝐞: - https://www.astuteanalytica.com/request-sample/teller-cash-recycler-market

TCRs automate cash deposit, dispensing, and recycling functions, significantly reducing manual cash handling and improving transaction…

Cell Phone Cash Review: Is Cell Phone Cash Legit? Find Out!

Ever wondered if you can make money just by using your smartphone? I started looking into cell phone cash with a lot of doubt. With so many sca.ms out there, figuring out if this program is real was key. This review aims to find out if cell phone cash is a genuine way to make money or just another sc.am.

Let's dive into this question together and see what I found…

Optimizing Cash Flow and Customer Satisfaction with Order to Cash Process Mining

Businesses have always been concerned about optimizing the process of business operations and the maximization of cash flow without compromising customer satisfaction. This has led many businesses today to use O2C process mining ( https://businessprocessxperts.com/process-mining/ ), a useful analytical method that helps them fulfill orders effectively and efficiently.

This analytical method helps in the identification of areas in the order fulfillment process, where there is a need for improvement and inefficiency.

𝗞𝗲𝘆…

"Cash Advance by Cash Tools" App Launched for iPhone Users

The "Cash Advance by Cash Tools" app offers up to $1,000 in quick, interest-free advances with flexible repayment options.

Image: https://www.abnewswire.com/uploads/6fb3472a9cfae1320523530583628e84.png

Cash Tools Inc., a financial technology company, has launched its latest service, "Cash Advance by Cash Tools," available now on the App Store [https://apps.apple.com/us/app/cash-advance-by-cash-tools/id6615087395] for iPhone users. This app aims to provide a straightforward and accessible way for individuals to manage short-term financial needs by offering immediate cash advances without traditional…

Car's Cash For Junk Clunkers Pays Cash On The Spot

Image: https://www.getnews.info/wp-content/uploads/2024/05/1716349569.png

Car's Cash gives free quotes over the phone or by email. The buyers pick up the car and pays cash on the spot, sometimes on the same day. A pink slip is not needed.

Car's Cash For Junk Clunkers [https://carscashforjunkclunkerslosangelesca.com/] and Henry Ford are pleased to announce that they pay cash on the spot for junkers cluttering the landscape. Upfront free quotes are available over the phone or by…