Press release

Loan Servicing Software Market Thriving Worldwide: SimpleNexus, Sageworks Lending, Floify

Latest research study released on the Global Loan Servicing Software Market by HTF MI Research evaluates market size, trend, and forecast to 2030. The Loan Servicing Software market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.The global Loan Servicing Software market size is expanding at robust growth of 15.2%, sizing up market trajectory from USD 2.3 Billion in 2023 to USD 9.5 Billion by 2029.

Key Players in This Report Include:

SimpleNexus (United States), Sageworks Lending (United States), Floify (United States), Sofi (United States), Bryt (India), Turnkey Lender (United States), Loansifter (United States), Finflux (India), Applied Business Software (United States), C-Loans, Inc (United States), Emphasys Software (United States), Fiserv, Inc (United States)..

Download Sample Report PDF (Including Full TOC, Table & Figures) @ https://www.htfmarketintelligence.com/sample-report/global-loan-servicing-software-market

Definition:

Loan servicing software is a type of financial software designed to help lenders manage their loan portfolios. The software automates loan management tasks such as loan origination, loan servicing, payment processing, collections, and reporting. It helps lenders streamline their loan servicing processes and improve their operational efficiency. The loan servicing software market refers to the industry that develops and sells such software solutions to financial institutions and other lenders. This market includes a variety of software vendors, ranging from small start-ups to established enterprise software providers, who offer loan servicing software as a standalone product or as part of a broader suite of financial software solutions. The market for loan servicing software is driven by the growing demand for automation and digitalization in the financial industry, as well as the need for lenders to manage their loan portfolios more effectively and efficiently.

On the off chance that you are engaged with the industry or expect to be, at that point this investigation will give you a complete perspective. It's crucial you stay up with the latest sectioned by Applications [Large Enterprises, Small and Medium-sized Enterprises (SMEs)], Product Types [Commercial Loan Software, Loan Servicing Software, Loan Origination Software, Others] and some significant parts of the business.

Market Trends:

Implementation of Artificial Intelligence (AI) in Loan Servicing Solutions

Market Drivers:

Rising Demand for Automated Management in Real Estate & Rental Operations

Market Opportunities:

Opportunities in the Asia Pacific Region

Market Restraints:

Opportunities in the Asia Pacific Region

Market Challenges:

Opportunities in the Asia Pacific Region

Buy Complete Assessment of Connected Home Security System market Now @

https://www.htfmarketintelligence.com/buy-now?format=1&report=2240

Loan Servicing Software Market by Key Players: SimpleNexus (United States), Sageworks Lending (United States), Floify (United States), Sofi (United States), Bryt (India), Turnkey Lender (United States), Loansifter (United States), Finflux (India), Applied Business Software (United States), C-Loans, Inc (United States), Emphasys Software (United States), Fiserv, Inc (United States).

Geographically, the detailed analysis of consumption, revenue, market share, and growth rate of the following regions:

- The Middle East and Africa (South Africa, Saudi Arabia, UAE, Israel, Egypt, etc.)

- North America (United States, Mexico & Canada)

- South America (Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, etc.)

- Europe (Turkey, Spain, Turkey, Netherlands Denmark, Belgium, Switzerland, Germany, Russia UK, Italy, France, etc.)

- Asia-Pacific (Taiwan, Hong Kong, Singapore, Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia).

Avail Limited Period Offer /Discount on Immediate purchase @

https://www.htfmarketintelligence.com/request-discount/global-loan-servicing-software-market

Points Covered in Table of Content of Global Connected Home Security System Market:

Chapter 01 - Loan Servicing Software Executive Summary

Chapter 02 - Market Overview

Chapter 03 - Key Success Factors

Chapter 04 - Global Loan Servicing Software Market - Pricing Analysis

Chapter 05 - Global Loan Servicing Software Market Background

Chapter 06 - Global Loan Servicing Software Market Segmentation

Chapter 07 - Key and Emerging Countries Analysis in Global Loan Servicing Software Market

Chapter 08 - Global Loan Servicing Software Market Structure Analysis

Chapter 09 - Global Loan Servicing Software Market Competitive Analysis

Chapter 10 - Assumptions and Acronyms

Chapter 11 - Loan Servicing Software Market Research Methodology

Browse for Full Report at @

https://www.htfmarketintelligence.com/report/global-loan-servicing-software-market

Key questions answered:

• How feasible is Loan Servicing Software market for long-term investment?

• What are influencing factors driving the demand for Loan Servicing Software near future?

• What is the impact analysis of various factors in the Global Loan Servicing Software market growth?

• What are the recent trends in the regional market and how successful they are?

Thanks for reading this article; you can also get individual chapter-wise sections or region-wise report versions like North America, LATAM, Europe, Australia or Southeast Asia.

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +1 434 322 0091

sales@htfmarketintelligence.com

About Author:

HTF Market Intelligence Consulting is uniquely positioned to empower and inspire with research and consulting services to empower businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, resea rch, tools, events, and experience that assist in decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Loan Servicing Software Market Thriving Worldwide: SimpleNexus, Sageworks Lending, Floify here

News-ID: 3390958 • Views: …

More Releases from HTF Market Intelligence Consulting Private Limited

AI-Powered Pharmacovigilance Market Rewriting Long Term Growth Story | Microsoft …

HTF MI just released the Global AI-Powered Pharmacovigilance Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major Giants in AI-Powered Pharmacovigilance Market are:

IBM (USA), Oracle (USA), Microsoft…

Regenerative Agriculture System Market SWOT Analysis and Forecast for Next 5 Yea …

The latest study released on the Global Regenerative Agriculture System Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Regenerative Agriculture System study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider…

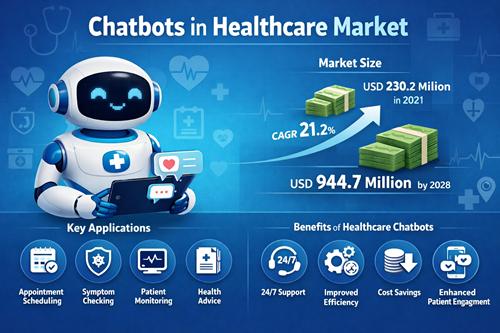

Chatbots in Healthcare Market is Going to Boom | Major Giants Buoy Health, Buoy …

Latest research study released on the Global Chatbots in Healthcare Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Chatbots in Healthcare market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the…

Reception Robots Market Is Going to Boom | Major Giants Keenon Robotics, Savioke …

HTF MI just released the Global Reception Robots Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2026-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major Companies Covered Reception Robots Market are:

SoftBank Robotics, LG Electronics, UBTECH…

More Releases for Loan

Navigating the Loan Landscape with Retail Loan Origination Systems

In the world of finance, obtaining a loan is a common practice for individuals looking to buy a home, start a business, or meet various financial needs. Behind the scenes, a crucial player in this process is the Retail Loan Origination System (RLOS). In simple terms, an RLOS is the engine that powers the loan application journey, making it smoother and more efficient for both borrowers and lenders.

Click Here for…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

New Jersey Loan Modification Lawyer Daniel Straffi Releases Insightful Article o …

New Jersey loan modification lawyer Daniel Straffi (https://www.straffilaw.com/loan-modifications) of Straffi & Straffi Attorneys at Law has recently published an informative article addressing the complexities and solutions surrounding loan modifications in New Jersey. The piece, aimed at helping homeowners understand their options to prevent foreclosure, sheds light on the legal avenues available to modify loan terms effectively.

In the article, the New Jersey loan modification lawyer explores various scenarios that may lead…

Business Loan - What is a Business Loan?

Business Loans are funds available to all types of businesses from banks, non-banking financial companies (NBFCs), or other financial institutions. Business Loans can be tailor-made to meet the specific needs of growing small and large businesses. These loans offer your business the opportunity to scale up and give it the cutting-edge necessary for success in today's competitive world.

Business Loans for the micro-small-medium enterprise (MSME) sector in India are particularly…

Business Loan - Apply Business Loan With Lowest EMI–loanbaba.com

Business loan is the perfect loan option for established entrepreneurs. Typically, it helps in expanding the business. Any idea or plans the business owner may have for the business, he or she can apply business loan with lowest EMI to execute them. But before getting the loan, there are few important steps that need to be followed by the borrower. Step one involves putting together the necessary paperwork. Submission of…