Press release

Olive Oil Market: US$ 15.22 Bn Revenue Expected by 2029, 6.13% CAGR - Key Players Include DEOLEO, SOVENA, and BORGES INTERNATIONAL GROUP

Crop Insurance Market Report Scope and Research Methodology:The Crop Insurance Market Report provides a comprehensive analysis of the global crop insurance industry, including market trends, drivers, challenges, and opportunities. The report scope encompasses an in-depth study of the market dynamics, competitive landscape, and key players. It also includes a detailed research methodology that outlines the approach taken to gather and analyze market data, ensuring accuracy and reliability. The report aims to provide valuable insights into the crop insurance market to help stakeholders make informed decisions.

Stay ahead in the competitive landscape of the Crop Insurance Market with our comprehensive research report summary, tailored to your unique business needs:https://www.maximizemarketresearch.com/market-report/crop-insurance-market/148613/

What are Crop Insurance Market Dynamics:

The Crop Insurance Market is driven by several key dynamics. One of the primary factors fueling market growth is the increasing frequency and severity of climate-related disasters, such as droughts, floods, and storms, which can significantly impact crop yields. As a result, farmers are increasingly turning to crop insurance to protect their investments and mitigate financial risks. Additionally, government initiatives and policies aimed at promoting agricultural sustainability and food security are driving the adoption of crop insurance. Moreover, advancements in technology, such as satellite imaging and data analytics, are enhancing the accuracy and efficiency of crop insurance products, further driving market growth.

Please click the following link to access a sneak peek into the dynamic world of the Crop Insurance Market : https://www.maximizemarketresearch.com/request-sample/148613

Crop Insurance Market Regional Insights:

The Asia-Pacific region, with its rapid population growth and industrial development, has emerged as a key market for Crop Insurance. The region is poised for significant market growth, projected to grow at a Compound Annual Growth Rate (CAGR) of 29% during the forecast period. Countries like China and India are pivotal in driving this growth, benefiting from extensive agricultural lands and favorable climatic conditions. The increasing demand for crop insurance in Asia-Pacific is a direct result of the region's expanding agricultural sector and the need to safeguard against climate-related risks, highlighting the importance of crop insurance in ensuring food security and sustainable agricultural practices.

Submit your request for a free inquiry report today: https://www.maximizemarketresearch.com/inquiry-before-buying/148613

What is Crop Insurance Market Segmentation:

In the global Crop Insurance market, Coverage Type is segmented into Multi-peril Crop Insurance (MPCI) and crop-hail insurance. MPCI, a government-sponsored program regulated by the government but offered and serviced by private crop insurance companies and brokers, is preferred by more than 78% of farmers who purchase crop insurance. The cost of insurance and the payout amount in case of loss are determined by the crop's value. MPCI covers over 120 crops, though availability may vary by geographic area.

MPCI policies must be purchased each planting season by federal government deadlines before crops are grown. These policies may include incentives for replanting or penalties for not replanting if damage is discovered early in the growing season. Due to the various benefits offered by MPCI, it is expected to dominate the market during the forecast period.

In terms of Application, the Crop Insurance Market is segmented into Banks, Insurance Companies, Brokers/Agents, and Others. Insurance companies currently dominate the market, followed by banks and brokers, a trend expected to continue in the forecast period. For example, in India, since the inception of the PMFBY scheme, insurance companies have received USD 16.31 billion in premium payments and paid USD 8.73 billion in loss claims to farmers, resulting in a savings of almost 31%. The scheme has benefited 72.5 million farmers between April 2016 and December 14, 2020. Farmers submitted 269.9 million crop insurance applications covering 235.4 million hectares of crops, according to the department.

Request a customized report tailored to your specific requirements: https://www.maximizemarketresearch.com/request-sample/148613

Who are Crop Insurance Market Key Players:

1. Agriculture Insurance Co. of India Ltd.

2. American Financial Group Inc.

3. American International Group Inc.

4. AmTrust Financial Services Inc.

5. AXA Group

6. Chubb Ltd.

7. Groupama Assurances Mutuelles

8. ICICI Bank Ltd.

9. Indian Farmers Fertiliser Cooperative Ltd. (IFFCO)

10. QBE Insurance Group Ltd.

11. Santam Ltd.

12. Sompo Holdings Inc.

13. The New India Assurance Co. Ltd.

14. Tokio Marine Holdings Inc.

15. Zurich Insurance Co. Ltd.

Table of content for the Crop Insurance Market includes:

1. Global Crop Insurance Market: Research Methodology

2. Global Crop Insurance Market: Executive Summary

● Market Overview and Definitions

● Introduction to the Global Market

● Summary

● Key Findings

● Recommendations for Investors

● Recommendations for Market Leaders

● Recommendations for New Market Entry

3.Global Crop Insurance Market: Competitive Analysis

● MMR Competition Matrix

● Market Structure by region

● Competitive Benchmarking of Key Players

● Consolidation in the Market

● M&A by region

● Key Developments by Companies

● Market Drivers

● Market Restraints

● Market Opportunities

● Market Challenges

● Market Dynamics

● PORTERS Five Forces Analysis

● PESTLE

● Regulatory Landscape by region

● North America

● Europe

● Asia Pacific

● Middle East and Africa

● South America

● COVID-19 Impact

4 . Company Profile: Key players

● Company Overview

● Financial Overview

● Global Presence

● Capacity Portfolio

● Business Strategy

● Recent Developments

Key Offerings:

● Past Market Size and Competitive Landscape (2023 to 2029)

● Past Pricing and price curve by region (2023 to 2029)

● Market Size, Share, Size and Forecast by different segment | 2023-2029

● Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

● Market Segmentation - A detailed analysis by growth and trend

● Competitive Landscape - Profiles of selected key players by region from a strategic perspective

● Competitive landscape - Market Leaders, Market Followers, Regional player

● Competitive benchmarking of key players by region

● PESTLE Analysis

● PORTER's analysis

● Value chain and supply chain analysis

● Legal Aspects of business by region

● Lucrative business opportunities with SWOT analysis

● Recommendations

More Related Reports:

Educational Toy Market https://www.maximizemarketresearch.com/market-report/educational-toy-market/147976/

Manufacturing Analytics Market https://www.maximizemarketresearch.com/market-report/manufacturing-analytics-market/52701/

Procurement Software Market https://www.maximizemarketresearch.com/market-report/global-procurement-software-market/26731/

China Smartphone Market https://www.maximizemarketresearch.com/market-report/china-smartphone-market/85746/

Semiconductor Memory Market https://www.maximizemarketresearch.com/market-report/semiconductor-memory-market/122409/

Global Camping Equipment Market https://www.maximizemarketresearch.com/market-report/global-camping-equipment-market/103396/

Makeup Market https://www.maximizemarketresearch.com/market-report/global-makeup-market/110212/

Global Artificial Intelligence in Retail Market https://www.maximizemarketresearch.com/market-report/artificial-intelligence-ai-in-retail-market/1893/

Plastic Market https://www.maximizemarketresearch.com/market-report/global-plastic-market/100495/

3D Printing Metal Market https://www.maximizemarketresearch.com/market-report/3d-printing-metal-market-2018-2026/195/

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

Maximize Market Research is a versatile market research and consulting company staffed with professionals from various industries. Our expertise spans industries such as science and engineering, electronic components, industrial equipment, technology, communication, automotive, chemicals, general merchandise, beverages, personal care, and automated systems. We offer market-verified industry estimations, technical trend analysis, essential market research, strategic advice, competition analysis, production and demand analysis, and client impact studies, among other services.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Olive Oil Market: US$ 15.22 Bn Revenue Expected by 2029, 6.13% CAGR - Key Players Include DEOLEO, SOVENA, and BORGES INTERNATIONAL GROUP here

News-ID: 3388550 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Electric Enclosure Market to Reach USD 115.16 Billion by 2032, Growing at 8.57% …

Electric enclosures are protective cabinets designed to house electrical and electronic components such as switches, circuit boards, and displays. Their primary purpose is to safeguard users from electric shocks while protecting sensitive equipment from environmental hazards. Typically installed within walls, electric enclosures offer both functional and aesthetic benefits by concealing wires and maintaining a clean, organized look.

These enclosures find widespread applications across multiple sectors including power transmission and distribution, energy…

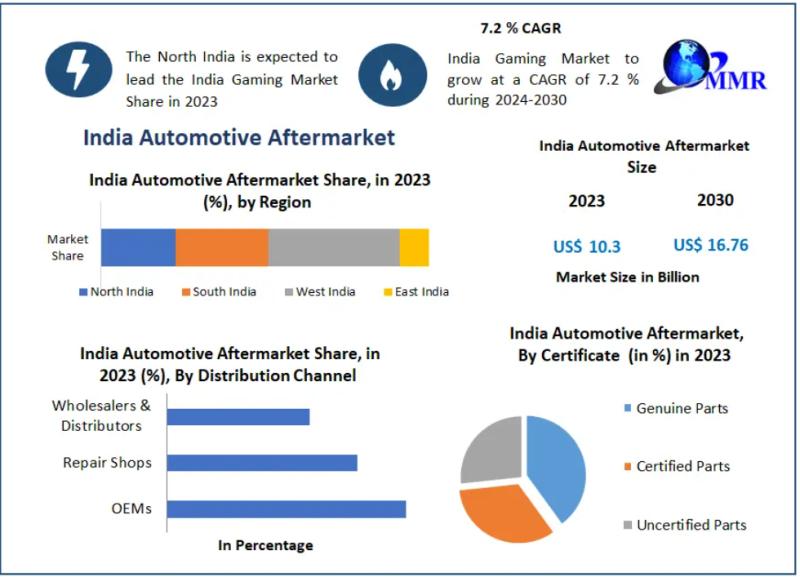

India Automotive Aftermarket: Rising Focus on Vehicle Maintenance, Upgrades, and …

India Automotive Aftermarket - Market Overview

The India Automotive Aftermarket represents a critical pillar of the country's mobility ecosystem, encompassing replacement parts, accessories, diagnostics, maintenance, and repair services for vehicles already in operation. Valued at USD 10.3 billion in 2023, the market is benefiting from India's expanding vehicle parc of over 340 million vehicles, increasing vehicle age, and rising consumer awareness around preventive maintenance. The aftermarket plays a vital role in…

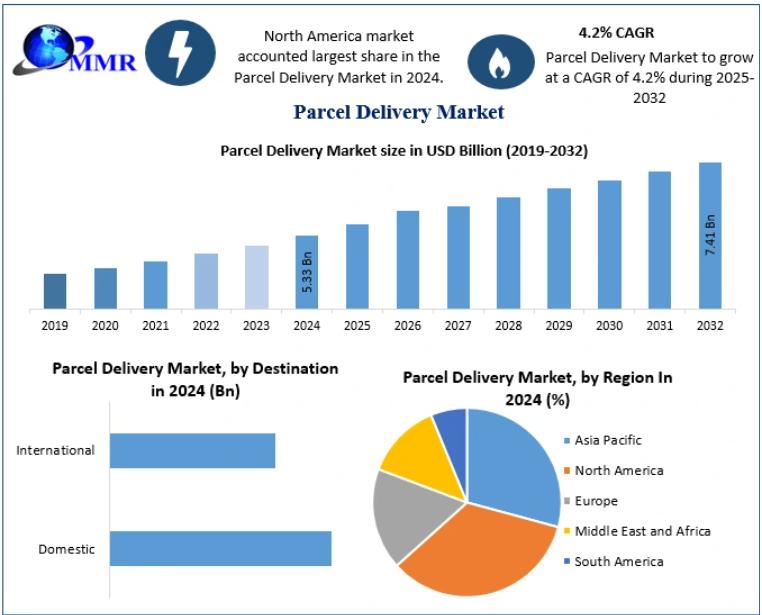

Parcel Delivery Market: Growing Demand for Fast, Reliable, and Technology-Driven …

Parcel Delivery Market Insights

Market Overview

The Global Parcel Delivery Market is experiencing steady growth driven by increasing e-commerce adoption, internet penetration, and cross-border trade. Parcel delivery involves transporting goods via road, rail, air, or sea, with services ranging from express delivery to standard courier options. The sector benefits from technological advancements, such as GPS tracking, RFID, autonomous delivery vehicles (ADVs), and electric vehicles (EVs) for last-mile delivery, improving efficiency and customer…

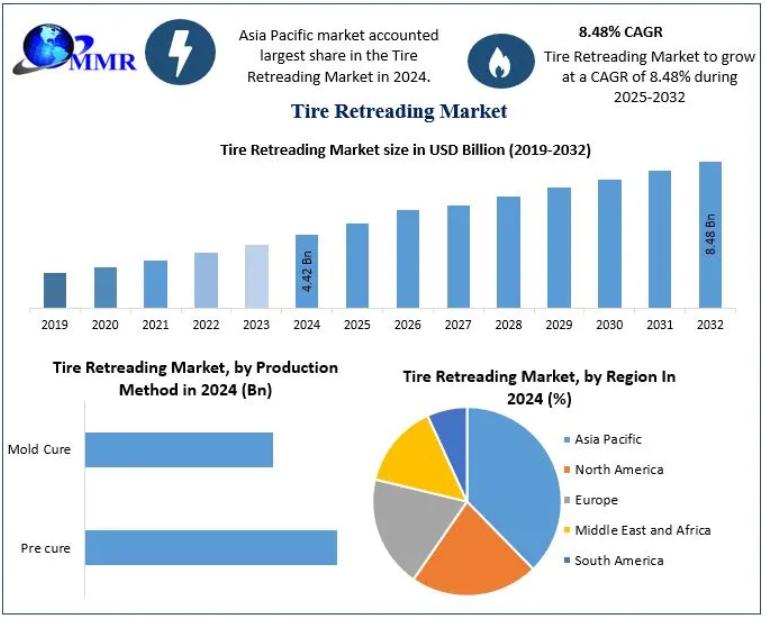

Tire Retreading Market: Rising Focus on Cost-Effective, Sustainable, and High-Pe …

Global Tire Retreading Market - Overview

The Global Tire Retreading Market is an integral part of the circular economy, offering a sustainable alternative to new tires by reducing raw material consumption and energy usage during production. Retreaded tires are widely used in commercial and transport vehicles, providing cost-effective, environmentally friendly solutions without compromising performance or durability. The adoption of retreading technologies is transforming supply chains in the transportation sector, enabling companies…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…