Press release

Commercial Real Estate Brokerage and Management Market Size to Reach US$ 455.8 Billion by 2032 | With a 6.24% CAGR

IMARC Group's report titled "Commercial Real Estate Brokerage and Management Market Report by Type (Brokerage, Management), Solution (Sales, Leasing, and Others), Application (Offices, Industrial, Retail, Multifamily, and Others), and Region 2024-2032". The global commercial real estate brokerage and management market size reached US$ 260.0 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 455.8 Billion by 2032, exhibiting a growth rate (CAGR) of 6.24% during 2024-2032.Grab a sample PDF of this report: https://www.imarcgroup.com/commercial-real-estate-brokerage-management-market/requestsample

Factors Affecting the Growth of the Commercial Real Estate Brokerage and Management Industry:

● Technological Advancements:

Innovations in digital marketing platforms and the integration of advanced data analytics tools enable brokers to reach a wider audience, streamline transactions, and provide enhanced client services. Property management companies are leveraging technology to automate routine tasks, improve operational efficiency, and enhance tenant experiences. Leveraging technology not only enhances competitiveness but also positions firms as industry leaders capable of delivering innovative solutions. Brokerage and management firms can gain a strategic advantage, attract tech-savvy clients, and adapt to the evolving demands of the market by investing in advanced technologies.

● Changing Preferences of Individuals:

The growing demand for commercial real estate brokerage and management on account of the rising need for healthcare facilities and medical office spaces is offering a positive market outlook. In addition, brokerage firms specializing in healthcare real estate can capitalize on this demand by facilitating transactions and advisory services related to healthcare properties. Apart from this, the increasing demand for distribution centers and last-mile delivery facilities due to changing preferences of individuals for online shopping is bolstering the market growth.

● Rapid Urbanization:

The rising demand for commercial real estate properties among individuals due to rapid urbanization is contributing to the growth of the market. People are increasingly migrating to cities in search of employment opportunities and a better quality of life. The escalating demand for office spaces, retail outlets, and residential complexes due to improving living standards of individuals across the globe is impelling the market growth. This trend is creating opportunities for brokerage firms to facilitate transactions and property management companies to ensure efficient utilization of space.

Leading Companies Operating in the Global Commercial Real Estate Brokerage and Management Industry:

● CBRE Group Inc.

● Century 21 Real Estate LLC (Anywhere Real Estate Inc.)

● Colliers International Group Inc.

● Jones Lang LaSalle IP Inc.

● Keller Williams Realty Inc.

● Kidder Mathews Inc.

● Mitsui Fudosan Co Ltd.

● Newmark Group Inc.

● Savills Inc. (Savills plc)

● Voit Real Estate Services

Explore full report with table of contents: https://www.imarcgroup.com/commercial-real-estate-brokerage-management-market

Commercial Real Estate Brokerage and Management Market Report Segmentation:

By Type:

● Brokerage

● Management

Brokerage represents the largest segment on account of its ability to generate revenue through commissions earned on successful property transactions.

By Solution:

● Sales

● Leasing

● Others

Sales hold the biggest market share as it involves higher transaction values and commissions as compared to leasing transactions.

By Application:

● Offices

● Industrial

● Retail

● Multifamily

● Others

Industrial accounts for the largest market share due to the thriving e-commerce sector.

Regional Insights:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

North America enjoys a leading position in the commercial real estate brokerage and management market, which can be attributed to the rising adoption of advanced tools and platforms for property marketing and data analytics.

Global Commercial Real Estate Brokerage and Management Market Trends:

The growing demand for commercial real estate brokerage and management due to the increasing awareness about environmental, social, and governance (ESG) factors is positively influencing the market. In addition, tenants, investors, and regulators are recognizing the importance of sustainable buildings, energy efficiency, and socially responsible practices. Brokerage firms and management companies are prioritizing environmental sustainability practices to attract eco-conscious clients.

Apart from this, the rising demand for flexible workspaces and sustainable buildings and amenities is contributing to the growth of the market. Brokerage firms and management companies are understanding these trends to attract and retain tenants and maximize property occupancy rates.

Trending Reports By IMARC Group:

Under Desk Treadmill Market: https://www.imarcgroup.com/under-desk-treadmill-market

Ship Hull Inspection Services Market: https://www.imarcgroup.com/ship-hull-inspection-services-market

Fantasy Sports Market: https://www.imarcgroup.com/fantasy-sports-market

Toilet Tank Market: https://www.imarcgroup.com/toilet-tank-market

Liquid Analytical Instrument Market: https://www.imarcgroup.com/liquid-analytical-instrument-market

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARCs information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Commercial Real Estate Brokerage and Management Market Size to Reach US$ 455.8 Billion by 2032 | With a 6.24% CAGR here

News-ID: 3383828 • Views: …

More Releases from IMARC Group

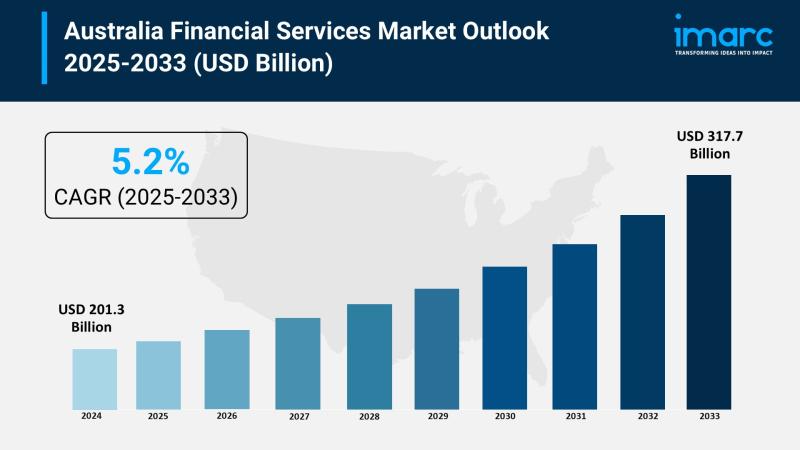

Australia Financial Services Market 2025 | Worth USD 317.7 Billion to 2025-2033

Market Overview

The Australia financial services market size reached USD 201.3 Billion in 2024 and is projected to grow to USD 317.7 Billion by 2033. The market is expected to expand steadily with a compound annual growth rate of 5.2% during the forecast period from 2025 to 2033. Key factors driving this growth include the rising demand for digital banking, regulatory advancements, strong economic performance, increasing fintech investments, and enhanced consumer…

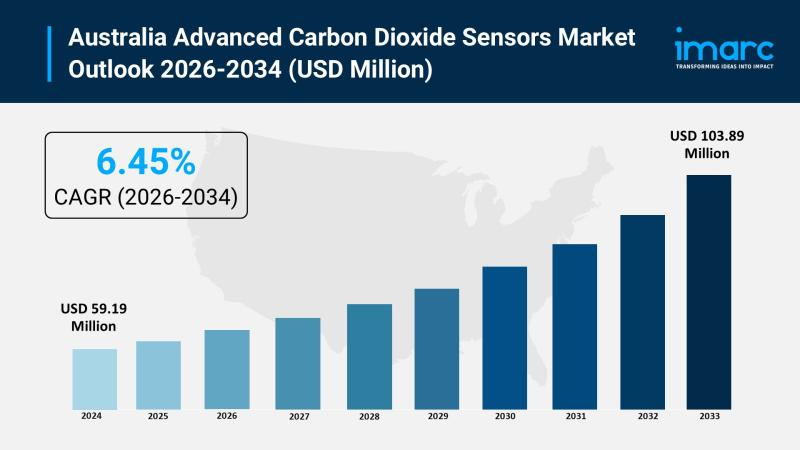

Australia Advanced Carbon Dioxide Sensors Market | Worth USD 103.89 Million 2026 …

Market Overview

The Australia advanced carbon dioxide sensors market size was USD 59.19 Million in 2025 and is expected to grow to USD 103.89 Million by 2034. The market growth is driven by strong government-led emissions reduction policies, enhanced building standards for CO2 monitoring, and the integration of IoT-enabled sensor technologies in smart buildings. These trends are supported by increased focus on indoor air quality and workplace health, fueling innovation in…

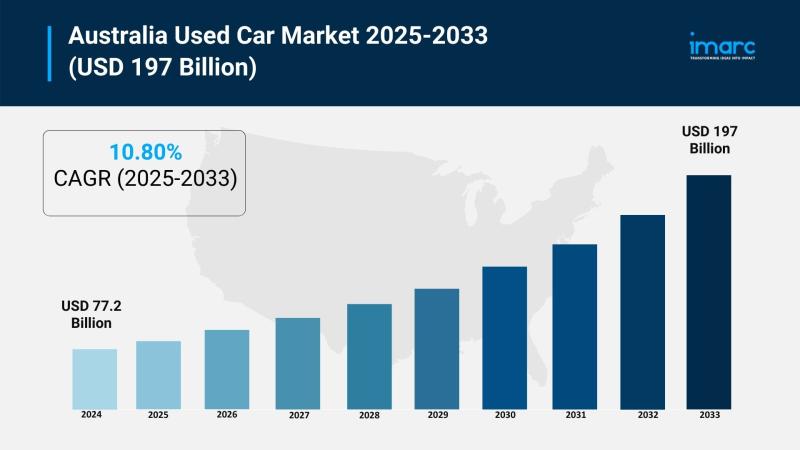

Australia Used Car Market Projected to Reach USD 197 Billion by 2033

Market Overview

The Australia used car market was valued at USD 77.2 Billion in 2024 and is projected to reach USD 197 Billion by 2033. The market is experiencing strong growth driven by affordability concerns, rising demand for reliable pre-owned vehicles, and the increasing role of digital platforms that simplify transactions. Economic pressures and the shift toward cost-effective vehicle options are further accelerating expansion, making the used car market a vital…

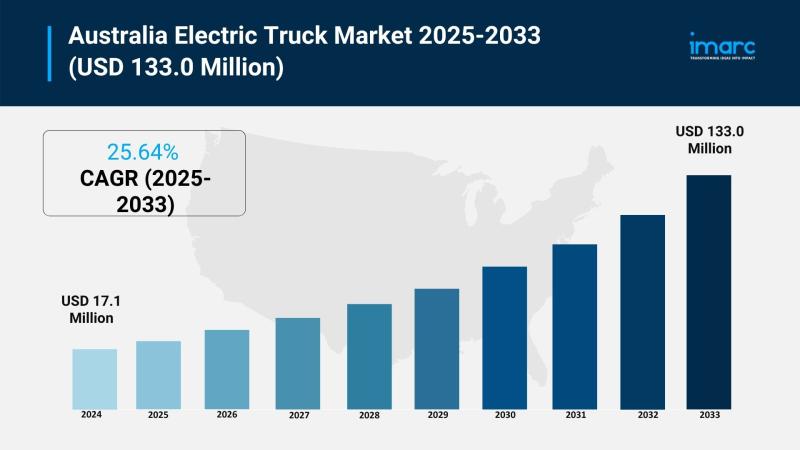

Australia Electric Truck Market Projected to Reach USD 133.0 Million by 2033

Market Overview

The Australia electric truck market reached USD 17.1 Million in 2024 and is projected to expand to USD 133.0 Million by 2033. With a forecast period spanning 2025 to 2033, the market is growing significantly due to stringent government emissions regulations, rising fuel costs, and advancements in battery and charging infrastructure technologies. Investments in fleet electrification and sustainable transport solutions are further driving market share growth. For further details,…

More Releases for Brokerage

Prominent Mortgage Brokerage Services Market Trend for 2025: Technological Advan …

How Are the key drivers contributing to the expansion of the mortgage brokerage services market?

The increasing need for personalized financial guidance is likely to fuel the growth of the mortgage brokerage services market in the coming years. Personalized financial guidance involves creating financial strategies based on an individual's financial needs and goals. This demand is growing due to factors such as inflation, economic growth, interest rates, and technological progress. Mortgage…

Prediction market Kalshi launches brokerage integrations

Image: https://www.globalnewslines.com/uploads/2025/01/1738333447.jpg

New York, NY - Feb 3, 2025 - Kalshi, America's largest regulated prediction market, today announced the capability to integrate prediction markets with traditional financial brokerages.

The ability to integrate event contracts with brokerages significantly increases the number of Americans who will have access to prediction markets, signifying that further growth for the industry is imminent.

"A few years ago, prediction markets were a niche corner of the internet. We built…

Insurance Brokerage Market Size and Forecast

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- The global Insurance Brokerage Market is expected to record a CAGR of XX.X% from 2024 to 2031 In 2024, the market size is projected to reach a valuation of USD XX.X Billion. By 2031 the valuation is anticipated to reach USD XX.X Billion.

Insurance Brokerage Market Size and Scope

The insurance brokerage market is substantial and continues to expand, driven by the increasing demand for insurance solutions across various…

Online Financial Brokerage Market Next Big Thing | Major Giants- Financial Broke …

Advance Market Analytics published a new research publication on "Online Financial Brokerage Market Insights, to 2028" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Online Financial Brokerage market was mainly driven by the increasing R&D spending across the world.

Some of the key players…

Online Financial Brokerage Market, Online Discount Brokerage Market: Ken Researc …

Financial Brokerage Market –during the recent trend the financial market across the Philippines is one of the most fortunate financial markets in the South-Asia region with the very few financial products recommended for trading at recent but will enhance during a few years. In addition, the Trading activities across the Philippines region is exceedingly delimited owing to very low trading capacity and reasonably fewer trading accounts, most of the brokerage…

Cloud Services Brokerage Market Report 2018: Segmentation by Service Type (Catal …

Global Cloud Services Brokerage market research report provides company profile for Accenture (Ireland), DoubleHorn (US), Jamcracker (US), IBM (US), HPE (US), RightScale (US), Dell (US), Wipro (India), Arrow Electronics (US), ActivePlatform (Belarus), Cloudmore (Sweden) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate,…