Press release

Reinsurance Market is Expected to Reach US$ 1,106.0 Billion by 2032- IMARC Group

The latest report by IMARC Group, titled "Reinsurance Market Report by Type (Facultative Reinsurance, Treaty Reinsurance), Mode (Online, Offline), Distribution Channel (Direct Writing, Broker), Application (Property and Casualty Reinsurance, Life and Health Reinsurance), and Region 2024-2032, The global reinsurance market size reached US$ 536.4 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 1,106.0 Billion by 2032, exhibiting a growth rate (CAGR) of 8.37% during 2024-2032.Factors Affecting the Growth of the Keyword Industry:

Climate Change and Natural Disasters:

The increasing frequency and severity of natural disasters attributed to climate change significantly impact the global reinsurance market. As extreme weather events like hurricanes, floods, and wildfires become more common, insurance claims surge, pushing primary insurers to seek reinsurance to distribute the financial risk. This demand for reinsurance not only helps insurers maintain financial stability in the aftermath of catastrophic events but also drives innovation in risk assessment and pricing models within the reinsurance sector, leading to more accurate predictions and tailored risk management strategies.

Regulatory Complexity:

The reinsurance market is intricately affected by the complexity of regulatory environments across different jurisdictions. As governments worldwide implement stricter financial solvency and reporting standards, insurance companies face increased pressure to comply with these evolving regulations. Reinsurance plays a pivotal role by providing insurers with the necessary risk transfer mechanisms and capital relief solutions to meet regulatory requirements. This ensures that insurers can maintain a balance between compliance and operational efficiency, making regulatory complexity a key driver for the reinsurance industry's growth and evolution.

Technological Advancements:

Technological advancements are revolutionizing the reinsurance industry by introducing sophisticated risk assessment tools, enhancing data analytics capabilities, and streamlining operational processes. The adoption of artificial intelligence, machine learning, and blockchain technology allows reinsurers to analyze vast amounts of data for better risk modeling and decision-making. These innovations lead to more accurate pricing, reduced claims processing times, and improved customer service. As technology continues to evolve, it remains a critical driver for the reinsurance market, enabling companies to offer more competitive and innovative solutions.

Competitive Landscape with Key Player:

• Axa S.A.

• Barents Re Reinsurance Company Inc.

• BMS Group Limited

• Everest Re Group Ltd.

• Hannover Re (Talanx)

• Lloyd's of London

• Markel Corporation

• Munich RE

• RGA Reinsurance Company

• SCOR SE

• Swiss Re

• Tokio Marine Holdings Inc.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/reinsurance-market/requestsample

Report Segmentation:

The report has segmented the market into the following categories:

Type Insights:

• Facultative Reinsurance

• Treaty Reinsurance

o Proportional Reinsurance

o Non-proportional Reinsurance

Treaty reinsurance represents the largest segment by type because it offers insurers a comprehensive and systematic way to cede multiple risks under a single contract, enhancing efficiency and coverage stability across their portfolios.

Mode Insights:

• Online

• Offline

Offline mode holds the largest segment in the reinsurance market due to the complex nature of reinsurance transactions which often require detailed negotiations and personalized risk assessments best conducted through direct interactions.

Distribution Channels Insights:

• Direct Writing

• Broker

Direct writing is the largest segment by distribution channel in the reinsurance market because it allows reinsurers to build stronger relationships with their clients, offering tailored solutions and services directly without intermediaries, ensuring clarity and efficiency in communications and transactions.

Application Insights:

• Property and Casualty Reinsurance

• Life and Health Reinsurance

o Disease Insurance

o Medical Insurance

Life and health reinsurance is the largest segment by application due to the rising global awareness of health issues and the increasing demand for life and health insurance products, driving insurers to seek reinsurance to manage these growing risk exposures effectively.

Market Breakup by Region:

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

North America is the largest market by region in the reinsurance sector, attributed to the high concentration of insurance companies, the advanced regulatory framework, and the frequent occurrence of natural disasters which drive the demand for reinsurance coverage in this area.

Explore Full Report with Table of Contents: https://www.imarcgroup.com/reinsurance-market

Global Keyword Market Trends:

The global reinsurance market is driven by a combination of factors, such as the increasing occurrences of natural disasters due to climate change, which significantly impacts the demand for reinsurance, as insurers seek to mitigate risks associated with catastrophic events. Moreover, the growing complexity of the regulatory environment across different jurisdictions necessitates reinsurance solutions that can help insurance companies comply with legal requirements while managing their risk exposures effectively.

Additionally, technological advancements are transforming the reinsurance sector by enabling better risk assessment models and more efficient operational processes, thus enhancing the overall market efficiency. Apart from this, the expansion of the insurance industry in emerging markets presents opportunities for reinsurance companies to diversify their risk portfolios and explore new growth avenues.

Browse More Latest Reports:

• Warm Air Furnaces Market: https://www.imarcgroup.com/industrial-furnaces-market

• Aseptic Processing Market: https://www.imarcgroup.com/aseptic-packaging-market

• Automotive ecall Market: https://www.imarcgroup.com/automotive-ecall-market

• Epoxy Curing Agent Market: https://www.imarcgroup.com/epoxy-curing-agent-market

• Nanofiltration Membranes Market: https://www.imarcgroup.com/nanofiltration-membranes-market

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163

About Us.

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Reinsurance Market is Expected to Reach US$ 1,106.0 Billion by 2032- IMARC Group here

News-ID: 3381564 • Views: …

More Releases from IMARC Group

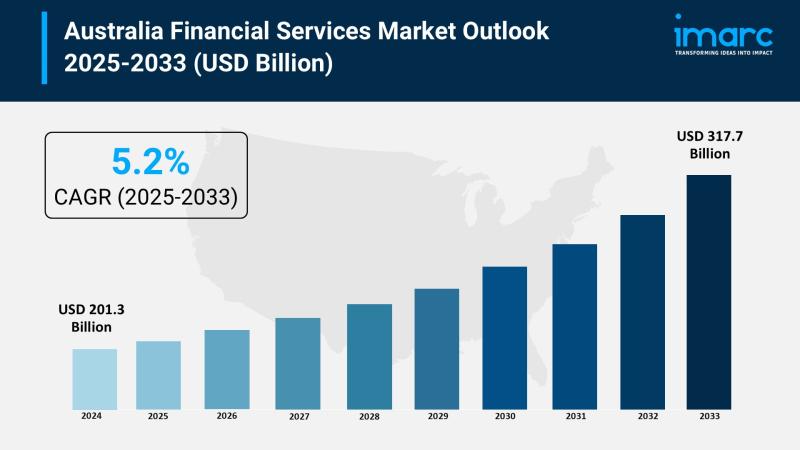

Australia Financial Services Market 2025 | Worth USD 317.7 Billion to 2025-2033

Market Overview

The Australia financial services market size reached USD 201.3 Billion in 2024 and is projected to grow to USD 317.7 Billion by 2033. The market is expected to expand steadily with a compound annual growth rate of 5.2% during the forecast period from 2025 to 2033. Key factors driving this growth include the rising demand for digital banking, regulatory advancements, strong economic performance, increasing fintech investments, and enhanced consumer…

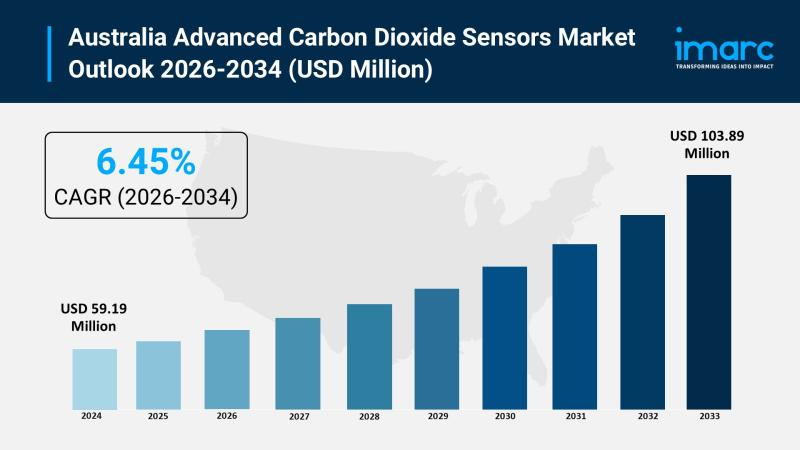

Australia Advanced Carbon Dioxide Sensors Market | Worth USD 103.89 Million 2026 …

Market Overview

The Australia advanced carbon dioxide sensors market size was USD 59.19 Million in 2025 and is expected to grow to USD 103.89 Million by 2034. The market growth is driven by strong government-led emissions reduction policies, enhanced building standards for CO2 monitoring, and the integration of IoT-enabled sensor technologies in smart buildings. These trends are supported by increased focus on indoor air quality and workplace health, fueling innovation in…

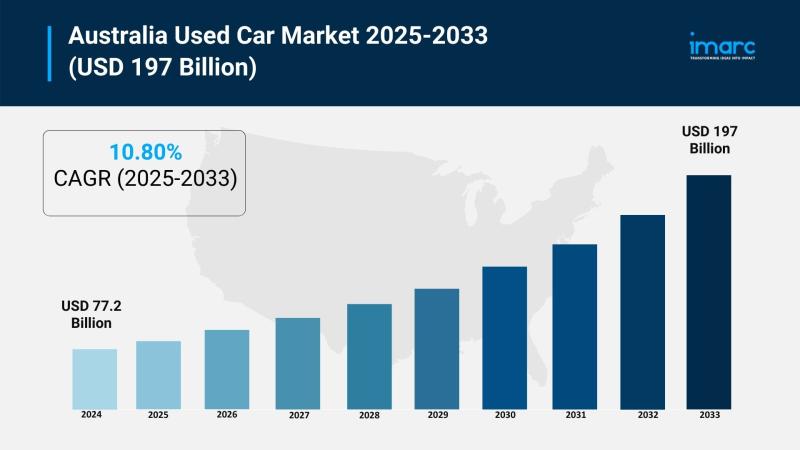

Australia Used Car Market Projected to Reach USD 197 Billion by 2033

Market Overview

The Australia used car market was valued at USD 77.2 Billion in 2024 and is projected to reach USD 197 Billion by 2033. The market is experiencing strong growth driven by affordability concerns, rising demand for reliable pre-owned vehicles, and the increasing role of digital platforms that simplify transactions. Economic pressures and the shift toward cost-effective vehicle options are further accelerating expansion, making the used car market a vital…

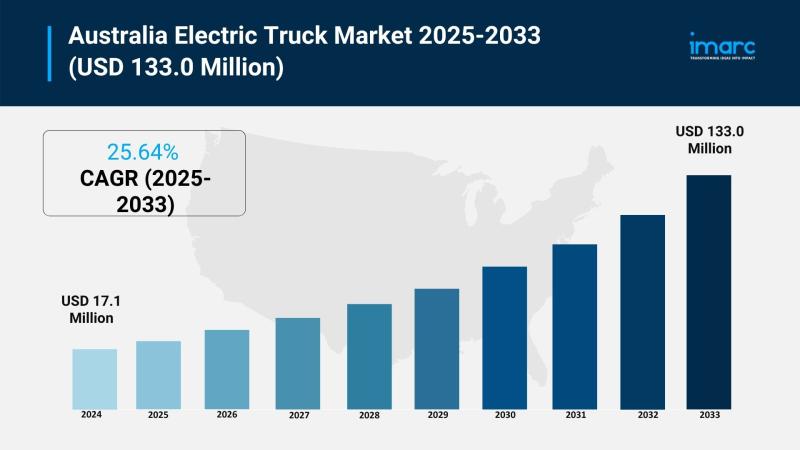

Australia Electric Truck Market Projected to Reach USD 133.0 Million by 2033

Market Overview

The Australia electric truck market reached USD 17.1 Million in 2024 and is projected to expand to USD 133.0 Million by 2033. With a forecast period spanning 2025 to 2033, the market is growing significantly due to stringent government emissions regulations, rising fuel costs, and advancements in battery and charging infrastructure technologies. Investments in fleet electrification and sustainable transport solutions are further driving market share growth. For further details,…

More Releases for Reinsurance

Reinsurance Services Market SWOT Analysis by Key Players Hannover Re, Korean Rei …

The Latest research coverage on Reinsurance Services Market provides a detailed overview and accurate market size. The study is designed considering current and historical trends, market development and business strategies taken up by leaders and new industry players entering the market. Furthermore, study includes an in-depth analysis of global and regional markets along with country level market size breakdown to identify potential gaps and opportunities to better investigate market status,…

Crop Reinsurance Market Is Booming So Rapidly | Munich Reinsurance, Swiss Reinsu …

The Crop Reinsurance Market study with 65+ market data Tables, Pie charts & Figures is now released by HTF MI. The research assessment of the Market is designed to analyze futuristic trends, growth factors, industry opinions, and industry-validated market facts to forecast till 2029. The market Study is segmented by key a region that is accelerating the marketization. This section also provides the scope of different segments and applications that…

Agriculture Reinsurance Market Is Booming Worldwide : Agroinsurance, Swiss Reins …

The Latest Released Agriculture Reinsurance market study has evaluated the future growth potential of Agriculture Reinsurance market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers, challenges,…

Recent Reinsurance Market Investment Activity From Established Companies Are to …

The latest release from WMR titled Reinsurance Market Research Report 2022-2028 (by Product Type, End-User / Application, and Regions / Countries) provides an in-depth assessment of the Reinsurance including key market trends, upcoming technologies, industry drivers, challenges, regulatory policies, key players company profiles, and strategies. Global Reinsurance Market study with 100+ market data Tables, Pie Chat, Graphs & Figures is now released BY WMR. The report presents a complete assessment…

Life Reinsurance Market is Going to Boom | Swiss Re, Munich Reinsurance, Korean …

Advance Market Analytics published a new research publication on “Life Reinsurance Market Insights, to 2026″ with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Life Reinsurance market was mainly driven by the increasing R&D spending across the world.

Some of the key players profiled in…

Reinsurance Market To See Stunning Growth | Munich, Korean Reinsurance, Swiss

Latest Market Research on “Reinsurance Market” is now released to provide hidden gems performance analysis in recent years and years to come. The study explains a detailed overview of market dynamics, segmentation, product portfolio, business plans, and the latest development in the industry. Staying on top of market trends & drivers is always remain crucial for decision-makers and marketers to hold emerging opportunity.

Get the inside scoop with Sample report https://www.htfmarketreport.com/sample-report/3185812-global-reinsurance-market-26

Know…