Press release

Insuring Tomorrow: B2B2C Insurance Market to Surge to USD 1.8 Billion by 2031

Unraveling the Dynamics of the B2B2C Insurance Market: Trends, Growth, and OpportunitiesIn the ever-evolving landscape of insurance, the emergence of the B2B2C model has heralded a new era of connectivity, efficiency, and innovation. By bridging the gap between businesses and consumers, this model has transformed the insurance landscape, offering a seamless and cost-effective solution for all stakeholders involved. As we delve into the intricacies of the global B2B2C insurance market, we uncover a tapestry of trends, propelled by rapid technological advancements, changing consumer behavior, and shifting market dynamics.

Download sample PDF copy of report: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=79708&utm_source=OpenPR_Ajay&utm_medium=OpenPR

Navigating the Global B2B2C Insurance Landscape

According to recent industry insights, the global B2B2C insurance market stood at a valuation of US$ 777.8 million in 2022. However, the journey doesn't end there. Projections indicate a promising trajectory, with a projected CAGR of 10.0% from 2023 to 2031, set to propel the market to a staggering US$ 1.8 billion by the dawn of 2031. Behind these numbers lie a myriad of factors reshaping the B2B2C insurance landscape, from the rapid growth of the automotive sector to the surge in adoption of Artificial Intelligence (AI) in insurance.

The Rise of B2B2C Insurance: Redefining Insurance Dynamics

At the heart of the B2B2C insurance model lies a commitment to efficiency, connectivity, and value creation. By leveraging existing relationships between insurers and businesses, this model offers a win-win solution for all parties involved. Businesses gain access to a range of insurance products tailored to their specific needs, while consumers benefit from a seamless and convenient purchasing experience. Moreover, insurers tap into new customer segments, expand their market reach, and foster deeper relationships with businesses and consumers alike.

Customization Request for the Research Report: https://www.transparencymarketresearch.com/sample/sample.php?flag=CR&rep_id=79708&utm_source=OpenPR_Ajay&utm_medium=OpenPR

Unlocking Opportunities in the Automotive Sector

The automotive sector stands as a beacon of growth for the B2B2C insurance market. With companies seeking to protect their investments from potential losses, the demand for specialized insurance coverage is on the rise. From comprehensive coverage for vehicles to product liability coverage, B2B2C insurance offers a range of options tailored to the unique needs of the automotive sector. As the sector continues to evolve, driven by technological advancements and changing consumer preferences, the B2B2C insurance market is poised to witness exponential growth in the coming years.

Harnessing the Power of Artificial Intelligence

In an era defined by technological innovation, Artificial Intelligence (AI) emerges as a game-changer for the B2B2C insurance landscape. By leveraging AI-powered solutions such as telematics and advanced analytics, insurers can offer more personalized and tailored insurance products to businesses and consumers. From improved risk management capabilities to enhanced customer service, AI offers a plethora of benefits that are reshaping the insurance landscape. By automating mundane tasks and streamlining processes, AI enables insurers to focus their resources on core tasks, driving efficiency and profitability.

Contact us for Special Discount and Pricing: https://www.transparencymarketresearch.com/sample/sample.php?flag=D&rep_id=79708&utm_source=OpenPR_Ajay&utm_medium=OpenPR

Regional Dynamics: Exploring Opportunities Across Borders

As we traverse the global insurance landscape, regional nuances come to the fore, offering a tapestry of opportunities and growth potential. In Asia Pacific, rapid urbanization and industrialization in developing countries are fueling market dynamics, driving the adoption of B2B2C insurance solutions. Meanwhile, in North America, technological advancements in the insurance sector, coupled with the growth of the e-commerce sector, are propelling market growth. Government initiatives to promote the adoption of online insurance policies further bolster market dynamics in the region, creating a conducive environment for B2B2C insurance players to thrive.

More Trending Reports by Transparency Market Research -

Water Flosser Market - https://www.globenewswire.com/news-release/2022/07/22/2484427/0/en/Water-Flosser-Market-to-be-Valued-at-US-1-7-Bn-by-2031-TMR-Study.html

Sports Betting Market - https://www.globenewswire.com/en/news-release/2022/08/22/2502370/0/en/Sports-Betting-Market-to-Rise-at-a-CAGR-of-9-8-during-Forecast-Period-2022-2031-notes-TMR-Study.html

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Nikhil Sawlani

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-3453

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insuring Tomorrow: B2B2C Insurance Market to Surge to USD 1.8 Billion by 2031 here

News-ID: 3366682 • Views: …

More Releases from Transparency Market Research

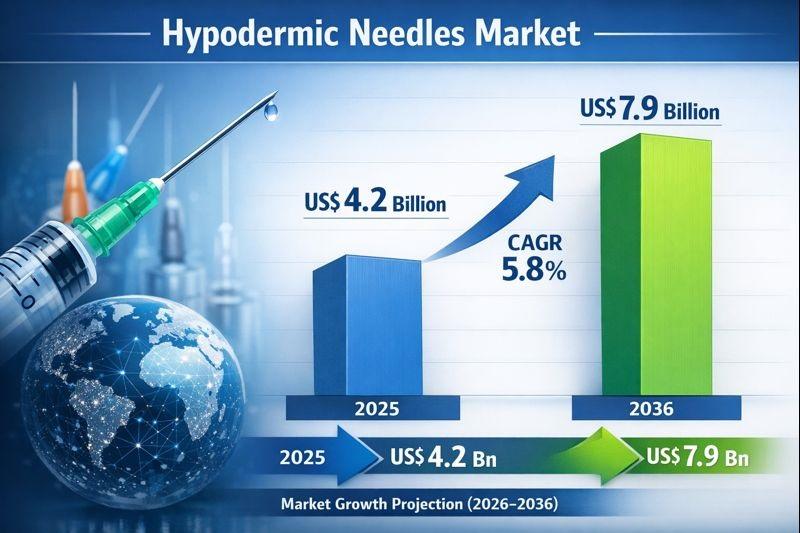

Hypodermic Needles Market to Reach US$ 7.9 Billion by 2036 on Rising Injectable …

The global hypodermic needles market was valued at approximately US$ 4.2 billion in 2025 and is projected to reach around US$ 7.9 billion by 2036, expanding at a CAGR of nearly 5.8% from 2026 to 2036, driven by the rising prevalence of diabetes, cancer, and chronic diseases, growing demand for injectable drugs and biologics, and the expansion of global vaccination and immunization programs; increasing adoption of safety-engineered and disposable needles,…

Connected Car Market to Reach US$ 467.2 Billion by 2036, Driven by Rising Adopti …

The global connected car market is entering a high-growth phase as vehicles increasingly evolve into software-defined, data-driven mobility platforms. Valued at US$ 100.8 billion in 2025, the market is projected to reach an impressive US$ 467.2 billion by 2036, expanding at a robust CAGR of 12.3% from 2026 to 2036. This growth is fueled by rapid advancements in automotive connectivity, rising consumer demand for intelligent features, and strong integration of…

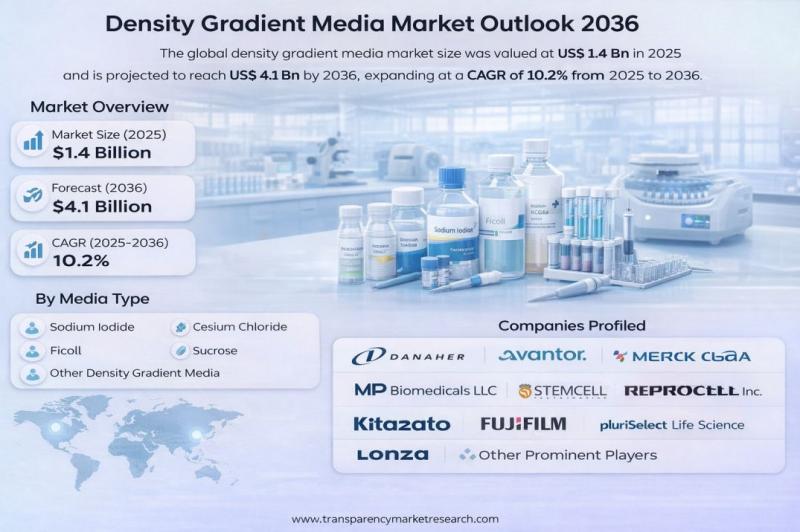

Density Gradient Media Market to Reach US$ 4.1 Billion by 2036, Driven by Rapid …

The global density gradient media market was valued at US$ 1.4 Billion in 2025 and is projected to reach US$ 4.1 Billion by 2036, expanding at a robust CAGR of 10.2% from 2025 to 2036. The market's rapid growth is primarily driven by increasing demand for rapid infectious disease screening, expanding cell therapy and immunology research, and continuous technological advancements improving sensitivity and multiplexing in laboratory workflows.

Access key findings and…

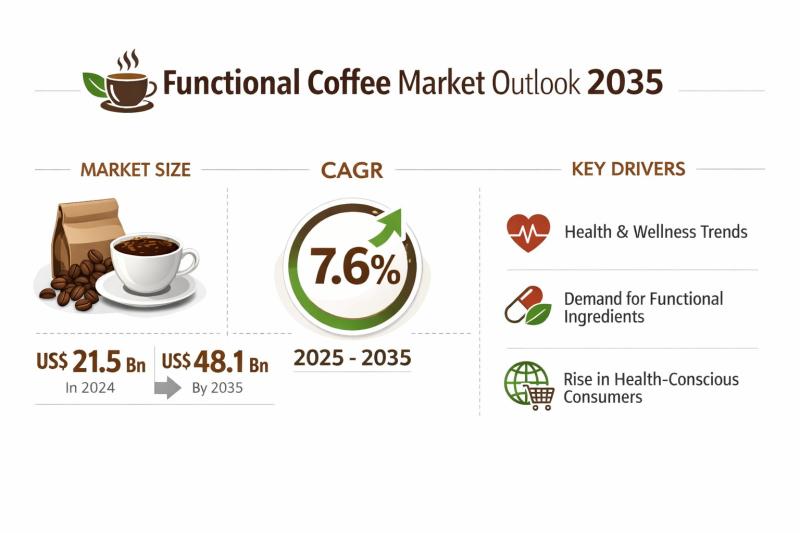

Functional Coffee Market Expanding at 7.6% CAGR Through 2035 - By Product Type / …

The global functional coffee market was valued at US$ 21.5 Bn in 2024 and is projected to reach US$ 48.1 Bn by 2035, expanding at a compound annual growth rate (CAGR) of 7.6% from 2025 to 2035. This steady growth trajectory reflects the strong convergence of coffee consumption habits with rising demand for functional and wellness-oriented beverages. Functional coffee has transitioned from a niche category to a mainstream product offering,…

More Releases for B2B2C

Expanding Automobile Industry Propels Growth In B2B2C Insurance Market: The Driv …

"Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

B2B2C Insurance Market Size Growth Forecast: What to Expect by 2025?

The B2B2C insurance market has experienced substantial growth in the past few years. The market which was valued at $4.27 billion in 2024 is set to increase to $4.61 billion come 2025, with a compound annual growth rate…

Italy's B2B2C Insurance Market to Hit $150.68 Billion by 2026

According to a recent report published by Allied Market Research, titled, "Italy B2B2C Insurance Market by Insurance Type, Application, and Industry Vertical: Opportunity Analysis and Industry Forecast, 2022-2026," the Italy B2B2C insurance market size was valued at $86.56 billion in 2017, and is projected to reach $150.68 billion by 2026, growing at a CAGR of 8.8% from 2022 to 2026.

➡️Request Research Report Sample & TOC : https://www.alliedmarketresearch.com/request-sample/A31484

The inclusion of insurance…

B2B2C Insurance Market Insights: Growth Drivers, Challenges, and Regional Trends …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global B2B2C Insurance Market- (By Product (Life, Non-life (Health Insurance, Home Insurance, Vehicle Insurance, Personal Insurance, Accident Insurance, Others (Transport, Credit Insurance, etc.)), By Geographical scope (National, Multi-Country, Regional, Global), By Company size (Large Enterprise, Small & medium Enterprise), By Nature of business (Brick & Mortar, E-Commerce, Multi-channel, Non-Commercial, Service Company), By End Use Industry (Banks…

B2B2C Insurance Market Growth and Restrain Factors Analysis Report

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global B2B2C Insurance Market- (By Product (Life, Non-life (Health Insurance, Home Insurance, Vehicle Insurance, Personal Insurance, Accident Insurance, Others (Transport, Credit Insurance, etc.)), By Geographical scope (National, Multi-Country, Regional, Global), By Company size (Large Enterprise, Small & medium Enterprise), By Nature of business (Brick & Mortar, E-Commerce, Multi-channel, Non-Commercial, Service Company), By End Use Industry (Banks…

B2B2C Insurance Market Growth and Restrain Factors Analysis Report

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global B2B2C Insurance Market- (By Product (Life, Non-life (Health Insurance, Home Insurance, Vehicle Insurance, Personal Insurance, Accident Insurance, Others (Transport, Credit Insurance, etc.)), By Geographical scope (National, Multi-Country, Regional, Global), By Company size (Large Enterprise, Small & medium Enterprise), By Nature of business (Brick & Mortar, E-Commerce, Multi-channel, Non-Commercial, Service Company), By End Use Industry (Banks…

B2B2C Insurance Market, depending on the specific focus you want: Convenience Ta …

B2B2C Insurance Market worth $1.77 Bn by 2031 - Exclusive Report by InsightAce Analytic Pvt. Ltd.

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global B2B2C Insurance Market- (By Product (Life, Non-life (Health Insurance, Home Insurance, Vehicle Insurance, Personal Insurance, Accident Insurance, Others (Transport, Credit Insurance, etc.)), By Geographical scope (National, Multi-Country, Regional, Global), By Company size

(Large Enterprise, Small & medium Enterprise), By Nature…