Press release

Microinsurance Market Size Worth US$ 141.6 Billion during 2024-2032, With a CAGR of 5.1% | IMARC Group

According to the latest report by IMARC Group, titled "Microinsurance Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2032," provides an extensive analysis of the industry, including microinsurance market size, share, trends, and growth opportunities. The report also covers competitor and regional analysis and the latest advancements in the market. The global microinsurance market size reached US$ 89.6 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 141.6 Billion by 2032, exhibiting a growth rate (CAGR) of 5.1% during 2024-2032.Microinsurance Market Overview:

Microinsurance refers to the provision of insurance services tailored for low-income earners and individuals in developing economies. This financial product aims to protect vulnerable populations against specific perils, such as illness, accidents, or natural disasters, in exchange for regular premium payments that are proportionate to their income. The hallmark characteristics of microinsurance include affordability, simplicity, and accessibility. Typically, microinsurance policies have low premiums and low coverage limits to cater to the specific financial constraints of the target customer base. The working mechanism involves simplified underwriting processes and claims settlements, often enabled through mobile technology or community-based models.

The benefits of microinsurance are manifold. It helps protect the livelihoods of low-income individuals by providing financial support in times of crisis, ensuring that they can recover from setbacks and continue their economic activities. It promotes risk mitigation and resilience among vulnerable populations, reducing their dependence on informal safety nets and charity. It plays a vital role in poverty reduction and social development.

Offering insurance coverage helps individuals and communities manage risks and break the cycle of poverty. It enhances financial inclusion by providing access to formal financial services and promoting savings and investment behaviors. It has gained recognition and support from governments, development organizations, and insurers worldwide as a powerful tool for inclusive growth and social protection. Efforts are being made to expand the reach and effectiveness of microinsurance by leveraging technology, innovative distribution models, and partnerships between insurers, microfinance institutions, and development organizations.

Get Sample Copy of Report at - https://www.imarcgroup.com/microinsurance-market/requestsample

Global Microinsurance Market Growth:

The global market is primarily driven by the growing awareness of financial tools among low-income populations. In line with this, the rise of fintech solutions is facilitating the delivery of affordable and accessible insurance products. Moreover, the expansion of mobile networks in emerging economies is making it easier for consumers to sign up for and manage insurance policies. In addition to this, increasing natural disasters due to climate change are emphasizing the need for affordable insurance solutions.

Besides this, collaborations between governments and microfinance institutions are proving instrumental in legitimizing the market. Also, the growing number of social enterprises focusing on financial inclusivity is impacting the market positively. The market is further propelled by the scaling of peer-to-peer insurance models that leverage community funds. Apart from this, the development of customized insurance products, designed to meet the unique needs of rural and low-income urban dwellers, is spurring market growth.

Explore the Full Report with Charts, Table of Contents, and List of Figures: https://www.imarcgroup.com/microinsurance-market

Key Market Segmentation:

Breakup by Product Type:

• Property Insurance

• Health Insurance

• Life Insurance

• Index Insurance

• Accidental Death and Disability Insurance

• Others

Breakup by Model Type:

• Partner Agent Model

• Full-Service Model

• Provider Driven Model

• Community-Based/Mutual Model

• Others

Breakup by Provider:

• Microinsurance (Commercially Viable)

• Microinsurance Through Aid/Government Support

Breakup by Region:

• North America (United States, Canada)

• Europe (Germany, France, United Kingdom, Italy, Spain, Others)

• Asia Pacific (China, Japan, India, Australia, Indonesia, Korea, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa (United Arab Emirates, Saudi Arabia, Qatar, Iraq, Other)

Competitive Landscape:

The report has also analysed the competitive landscape of the market along with the profiles of the key players.

Key Highlights of the Report:

• Market Performance

• Market Outlook

• Porter's Five Forces Analysis

• Market Drivers and Success Factors

• SWOT Analysis

• Value Chain

• Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Browse More Reports:

• https://industrytoday.co.uk/market-research-industry-today/personal-protective-equipment-market-size-worth-us-1150-billion-during-2023-2028-with-a-cagr-of-87-imarc-group

• https://industrytoday.co.uk/it/blockchain-gaming-market-report-2024-size-us-8544-billion-trends-top-companies-growth-cagr-of-652-forecast-2032

• https://industrytoday.co.uk/market-research-industry-today/family-offices-market-report-2024-size-us-2926-billion-share-latest-trends-outlook-forecast-report-2032

• https://industrytoday.co.uk/transportation_and_logistics/cold-chain-logistics-market-size-worth-us-50165-billion-during-2023-2028-with-a-cagr-of-1440-imarc-group

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Americas:- +1 631 791 1145 | Africa and Europe :- +44-702-409-7331 | Asia: +91-120-433-0800, +91-120-433-0800

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Microinsurance Market Size Worth US$ 141.6 Billion during 2024-2032, With a CAGR of 5.1% | IMARC Group here

News-ID: 3332998 • Views: …

More Releases from IMARC Group

India Digital Health Market is Expected to Reach USD 84,076.5 Million by 2034 | …

Introduction

According to IMARC Group's report titled "India Digital Health Market Size, Share, Trends and Forecast by Type, Component, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including India digital health market share, growth, trends, and regional insights.

How Big is the India Digital Health Market?

The India digital health market size reached USD 19,145.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 84,076.5…

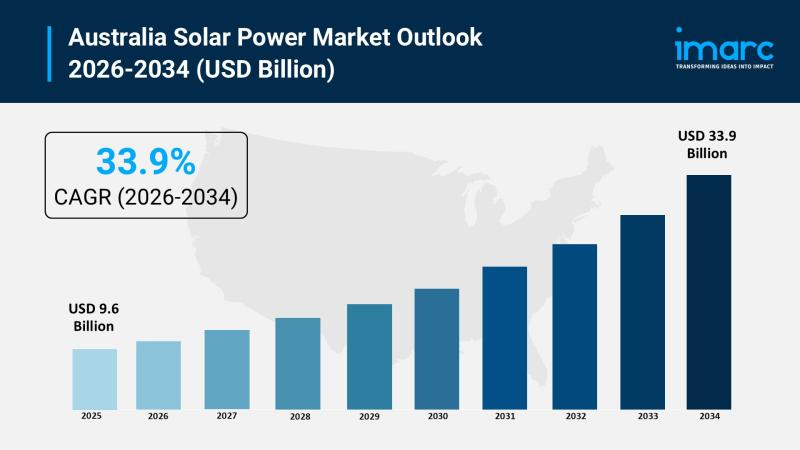

Australia Solar Power Market 2026 | Projected to Reach USD 33.9 Billion by 2034

Market Overview

The Australia solar power market reached USD 9.6 Billion in 2025 and is forecast to grow to USD 33.9 Billion by 2034. The market exhibits a robust growth rate of 15.00% during the forecast period 2026-2034. This expansion is driven by supportive government policies, technological advancements, and increasing adoption across residential, commercial, and utility sectors, positioning solar energy as a cornerstone of Australia's clean energy future.

Grab a sample PDF…

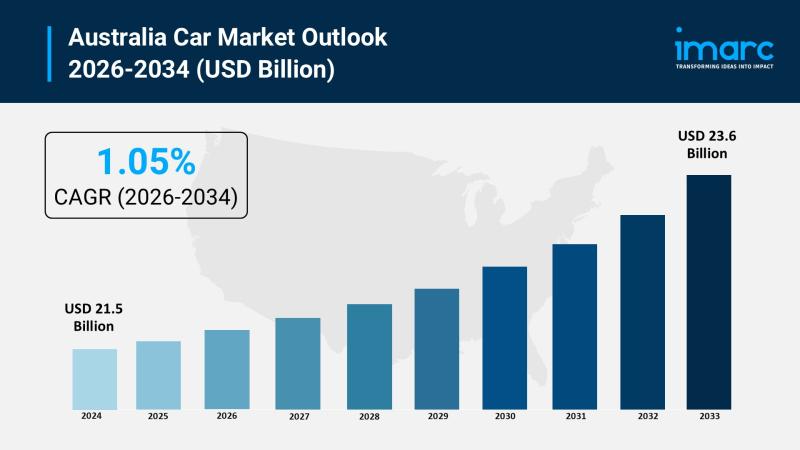

Australia Car Market 2026 | Surge to Grow to USD 23.6 Billion by 2034

Market Overview

The Australia car market reached a size of USD 21.5 Billion in 2025 and is forecasted to grow to USD 23.6 Billion by 2034. The market is expected to expand at a CAGR of 1.05% throughout the forecast period from 2026 to 2034. Growth is driven primarily by increasing demand for electric vehicles, SUVs, and connected car technologies, spurred by environmental awareness, lifestyle changes, and technological innovation toward sustainable…

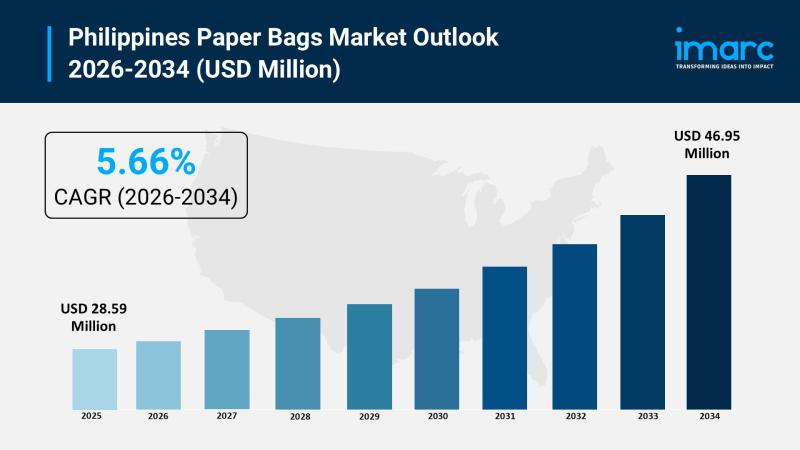

Philippines Paper Bags Market 2026 | Expected to Reach USD 46.95 Million by 2034

Market Overview

The Philippines paper bags market size was valued at USD 28.59 Million in 2025 and is expected to reach USD 46.95 Million by 2034, with a growth rate of 5.66% CAGR from 2026 to 2034. This growth is driven by increasing environmental concerns, government bans on single-use plastics, and rising adoption by retailers and foodservice providers. The expanding food and beverage sector, coupled with heightened awareness of plastic pollution,…

More Releases for Microinsurance

Microinsurance for Vulnerable Communities Market Is Booming Worldwide | Major Gi …

The latest analysis of the worldwide Microinsurance for Vulnerable Communities market by HTF MI Research evaluates the market's size, trends, and forecasts through 2033. Microinsurance for Vulnerable Communities market study includes extensive research data and proofs to give managers, analysts, industry experts, and other key personnel a ready-to-access, self-analyzed study to help understand market trends, growth drivers, opportunities, and upcoming challenges as well as about competitors.

Key Players in This Report…

Digital Microinsurance Market Hits New High | Major Giants BIMA, MicroEnsure, AX …

HTF MI just released the Global Digital Microinsurance Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2024-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies profiled in Digital Microinsurance Market are: BIMA, MicroEnsure, AXA…

Microinsurance Market Size & Share | Growth Report - 2034

According to the report by Expert Market Research (EMR), the global microinsurance market reached a value of USD 82.87 billion in 2024. Aided by the growing demand for accessible and affordable insurance solutions among low-income populations, the market is projected to grow at a CAGR of 6.50% between 2025 and 2034, reaching USD 155.56 billion by 2034.

Microinsurance, a subset of insurance tailored for low-income individuals, provides financial protection against specific…

Government Initiatives Fueling Growth In The Microinsurance Market: Powering Inn …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts

What Is the Expected CAGR for the Microinsurance Market Through 2025?

In the past few years, we have observed significant expansion in the size of the microinsurance market. The market's growth is projected to rise from $95.69 billion in 2024 to $101.82 billion in 2025, experiencing a compound annual…

Government Initiatives Fueling Growth In The Microinsurance Market: A Significan …

The Microinsurance Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Microinsurance Market Size and Projected Growth Rate?

In recent times, the microinsurance market has seen impressive growth. The market is projected to expand from $95.69 billion in 2024 to $101.82 billion in 2025,…

Government Initiatives Fueling Growth In The Microinsurance Market Driver: A Maj …

What industry-specific factors are fueling the growth of the microinsurance market?

The microinsurance market is projected to see substantial growth due to increasing government-initiated programs for microinsurance. Government initiatives often consist of projects, policies, or actions instituted by governmental bodies, with the purpose of addressing societal issues, promoting specific interests, or achieving particular outcomes within a specific sector or within society at large. These initiatives often prove beneficial for small business…