Press release

Anti-Money Laundering and KYC in Banking Market is set to Fly High Growth in Years to Come | BAE Systems, SAS, Feedzai

The Latest published market study on Global Anti-Money Laundering And KYC In Banking Market provides an overview of the current market dynamics in the Anti-Money Laundering And KYC In Banking space, as well as what our survey respondents all outsourcing decision-makers predict the market will look like in 2030. The study breaks the market by revenue and volume (wherever applicable) and price history to estimate the size and trend analysis and identify gaps and opportunities. Some of the players that are in coverage of the study are Oracle, BAE Systems, SAS, Nice Actimize, Featuresapce, Transunion & Feedzai.Get ready to identify the pros and cons of the regulatory framework, local reforms, and its impact on the Industry. Know how Leaders in Anti-Money Laundering And KYC In Banking are keeping themselves one step forward with our latest survey analysis

Download Free Sample Pages in PDF (With Full TOC, Tables, & Figures) of Global Anti-Money Laundering And KYC In Banking Market @ https://www.htfmarketreport.com/sample-report/3355956-2020-2025-global-anti-money-laundering-and-kyc-in-banking-market-report-production-and-consumption-professional-analysis

Major highlights from the Study along with most frequently asked questions:

1) What so unique about this Global Anti-Money Laundering And KYC In Banking Assessment?

Market Factor Analysis: In this economic slowdown, the impact on various industries is huge. Moreover, the increase in demand & supply gap as a result of the sluggish supply chain and the production line has made the market worth observing. It also discusses technological, regulatory, and economic trends that are affecting the market. It also explains the major drivers and regional dynamics of the global market and current trends within the industry.

Market Concentration: Includes C4 Index, HHI, Comparative Anti-Money Laundering And KYC In Banking Market Share Analysis (Y-o-Y), Major Companies, Emerging Players with Heat Map Analysis

Market Entropy: Randomness of the market highlighting aggressive steps that players are taking to overcome the current scenario. Development activity and steps like expansions, technological advancement, M&A, joint ventures, and launches are highlighted here.

Patent Analysis: Comparison of patents issued by each player per year.

Peer Analysis: An evaluation of players by financial metrics such as EBITDA, Net Profit, Gross Margin, Total Revenue, Segmented Market Share, Assets, etc to understand management effectiveness, operation, and liquidity status.

2)Why only a few Companies are profiled in the report?

Industry standards like NAICS, ICB, etc are considered to derive the most important manufacturers. More emphasis is given to SMEs that are emerging and evolving in the market with their product presence and technologically upgraded modes, current version includes players like "Oracle, BAE Systems, SAS, Nice Actimize, Featuresapce, Transunion & Feedzai" etc and many more.

** Companies reported may vary subject to Name Change / Merger etc.

Complete Purchase of 2023 Latest Edition of Global Anti-Money Laundering And KYC In Banking Report @ https://www.htfmarketreport.com/buy-now?format=1&report=3355956

3) What details will the competitive landscape provide?

A value proposition chapter to gauge Anti-Money Laundering And KYC In Banking market. 2-Page profiles of all listed companies with 3 to 5 years of financial data to track and comparison of business overview, product specification, etc.

4) What is all regional segmentation covered? Can specific countries of interest be added?

A country that is included in the analysis is North America (Covered in Chapter 8), United States, Canada, Mexico, Europe (Covered in Chapter 9), Germany, UK, France, Italy, Spain, Others, Asia-Pacific (Covered in Chapter 10), China, Japan, India, South Korea, Southeast Asia, Others, Middle East and Africa (Covered in Chapter 11), Saudi Arabia, UAE, South Africa, Others, South America (Covered in Chapter 12), Brazil & Others

** Countries of primary interest can be added if missing.

5) Is it possible to limit/customize the scope of study to applications of our interest?

Yes, the general version of the study is broad, however, if you have limited application in your scope & target, then the study can also be customized to only those applications. As of now, it covers applications Banks and Financials, Insurance Providers & Gaming.

** Depending upon the requirement the deliverable time may vary.

To comprehend Global Anti-Money Laundering And KYC In Banking market dynamics in the world mainly, the worldwide Anti-Money Laundering And KYC In Banking market is analyzed across major global regions. A customized study by a specific region or country can be provided, usually, the client prefers below

• North America: United States of America (US), Canada, and Mexico.

• South & Central America: Argentina, Chile, Colombia, and Brazil.

• Middle East & Africa: Kingdom of Saudi Arabia, United Arab Emirates, Turkey, Israel, Egypt, and South Africa.

• Europe: the UK, France, Italy, Germany, Spain, Nordics, BALTIC Countries, Russia, Austria, and the Rest of Europe.

• Asia: India, China, Japan, South Korea, Taiwan, Southeast Asia (Singapore, Thailand, Malaysia, Indonesia, Philippines & Vietnam, etc) & Rest

• Oceania: Australia & New Zealand

Enquire for customization in Report @ https://www.htfmarketreport.com/enquiry-before-buy/3355956-2020-2025-global-anti-money-laundering-and-kyc-in-banking-market-report-production-and-consumption-professional-analysis

Basic Segmentation Details

Global Anti-Money Laundering And KYC In Banking Product Types In-Depth: Solution & Services

Global Anti-Money Laundering And KYC In Banking Major Applications/End users: Banks and Financials, Insurance Providers & Gaming

Geographical Analysis: North America (Covered in Chapter 8), United States, Canada, Mexico, Europe (Covered in Chapter 9), Germany, UK, France, Italy, Spain, Others, Asia-Pacific (Covered in Chapter 10), China, Japan, India, South Korea, Southeast Asia, Others, Middle East and Africa (Covered in Chapter 11), Saudi Arabia, UAE, South Africa, Others, South America (Covered in Chapter 12), Brazil & Others & Rest of World

For deep analysis of Anti-Money Laundering And KYC In Banking Market Size, Competition Analysis is provided which includes Revenue (M USD) by Players (2021-2023E) & Market Share (%) by Players (2021-2023E) complemented with concentration rate.

Browse for Full Report at @: https://www.htfmarketreport.com/reports/3355956-2020-2025-global-anti-money-laundering-and-kyc-in-banking-market-report-production-and-consumption-professional-analysis

Actual Numbers & In-Depth Analysis of Global Anti-Money Laundering And KYC In Banking Market Size Estimation and Trends Available in Full Version of the Report.

Thanks for reading this article, you can also make sectional purchases or opt-in for a regional report by limiting the scope to only North America, ANZ, Europe or MENA Countries, Eastern Europe, or European Union.

Contact Us:

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +1 434 322 0091

sales@htfmarketintelligence.com

Connect with us at LinkedIn | Facebook | Twitter

About Author:

HTF Market Intelligence consulting is uniquely positioned empower and inspire with research and consulting services to empower businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events and experience that assist in decision making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Anti-Money Laundering and KYC in Banking Market is set to Fly High Growth in Years to Come | BAE Systems, SAS, Feedzai here

News-ID: 3248932 • Views: …

More Releases from HTF Market Intelligence Consulting Private Limited

Heating Coil for Heat Treatment Market to See Revolutionary Growth: Watlow, Chro …

HTF MI just released the Global Heating Coil for Heat Treatment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2026-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major Manufacturers are covered: Watlow, Chromalox, NIBE Induction,…

CAD-CAM Dental Systems Market to Witness Phenomenal Growth |Medit, 3Shape, Planm …

HTF MI just released the Global CAD-CAM Dental Systems Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2026-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major Manufacturers are covered: Dentsply Sirona, Straumann, 3Shape, Ivoclar Vivadent,…

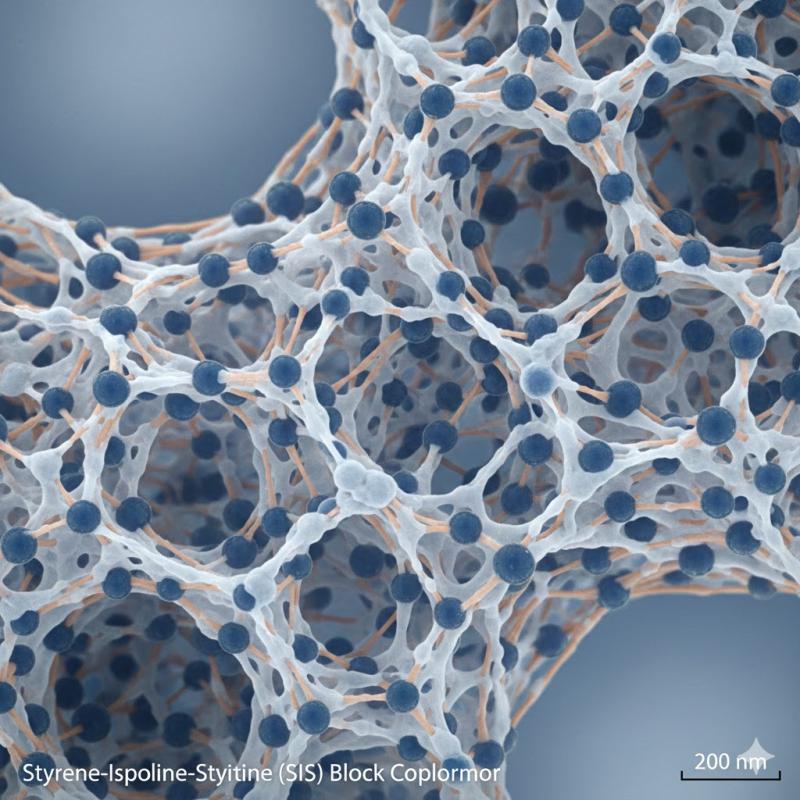

Styrene-Isoprene-Styrene (SIS) Market is Booming Worldwide | Major Giants Arlanx …

HTF MI just released the Global Styrene-Isoprene-Styrene (SIS) Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2026-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major Manufacturers are covered: Kraton Polymers, Sinopec, LCY Chemical, TSRC, Zeon…

Smokeless Gunpowder Market Is Going to Boom | Major Giants Hodgdon, Alliant Powd …

HTF MI just released the Global Smokeless Gunpowder Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies profiled in Smokeless Gunpowder Market are:

Hodgdon, Alliant Powder, IMR…

More Releases for Laundering

Surge In Money Laundering Cases Drives Growth Of Anti-Money Laundering Software …

Use code ONLINE20 to get 20% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

Anti-Money Laundering Software Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

The market size for anti-money laundering software has seen swift expansion in the past few years. Its growth is expected to rise from $2.85 billion in 2024 to $3.22 billion in 2025, with a…

Prominent Anti-Money Laundering Market Share Trend for 2025: SaaS Anti-Money Lau …

What industry-specific factors are fueling the growth of the anti-money laundering market?

The increasing emphasis on internet banking and digital transactions is anticipated to drive the anti-money laundering market's expansion in the future. Digital transactions involve money transfer from one payment account to another via a computer, mobile phone, or other digital device. Technologies aimed at preventing money laundering are employed to deter online fraud and mitigate risks associated with digital…

Leading Growth Driver in the Anti-Money Laundering Software Market in 2025: Surg …

Which drivers are expected to have the greatest impact on the over the anti-money laundering software market's growth?

The surge in incidents related to money laundering is anticipated to boost the anti-money laundering software industry. Money laundering typically involves transforming unlawfully obtained capital into lawful funds. The significant growth in money laundering incidents has facilitated the widespread use of anti-money laundering software programs to meet the regulatory demands of organizations seeking…

Anti-Money Laundering: Global Market Outlook

Summary:

Anti-money laundering (AML) comprises laws, policies, and regulations to safeguard financial frauds and illegal activity. Organizations must comply with these regulations even though compliance led financial institutions do have compliance departments and purchase software solutions. As times are changing, organizations are becoming more adaptive to the AML technologies and the end-user industry is reflecting various important trends shaping how they are being utilized. Increasing stringent regulations and compliance obligations for…

Rising Money Laundering Cases To Boost Anti-Money Laundering Market Growth

Factors such as the surging number of money laundering cases and mounting information technology (IT) expenditure will facilitate the anti-money laundering (AML) market growth during the forecast period (2021-2030). According to P&S Intelligence, the market generated a revenue of $2.4 billion revenue in 2020. Moreover, the surging volume of digital payments, rising technological advancements, and mounting internet traffic will also accelerate the market growth in the foreseeable future. Financial institutions…

Increasing Prevalence of Money Laundering Driving Anti-Money Laundering Market G …

The global anti-money laundering market reached a value of $3 billion in 2020 and it is predicted to exhibit huge expansion between 2021 and 2030 (forecast period). The market is being driven by the surging incidence of money laundering cases and the burgeoning demand for monitoring money laundering activities. Additionally, the soaring information technology (IT) expenditure in several countries is also pushing up the requirement for anti-money laundering (AML) solutions…