Press release

Banking Software Market to Witness a Pronounce Growth Rate ~19.8% of CAGR by 2032

Banking software works as a back-end office system. Banks are focusing on adopting banking software solutions to effectively manage all banking transactions to provide customers with better services and empower the customer. Banking software satisfies the needs of banks by automating their banking procedures and improving client efficiency. Moreover, banking software provides tailored solutions to meet the particular needs of potential customers. Worldwide, mid and large-size institutions can access cutting-edge technology and cost-effective banking solutions owing to banking software.Allied Market Research published a report, titled, "Banking Software Market by Component (Software, and Services), Deployment Mode (On-premise, and Cloud), and End User (Banks and Financial Institution): Global Opportunity Analysis and Industry Forecast, 2023-2032". According to the report, the global Banking software Market was valued at $11,735.92 million in 2022 and is estimated to reach $69,872.19 million by 2032, exhibiting a CAGR of 19.8% from 2023 to 2032.

Download Research Report Sample & TOC: https://www.alliedmarketresearch.com/request-sample/109776

Prime determinants of growth

Increase in demand for digital banking solutions and the surge in adoption of cloud-based solutions is boosting the growth of the global banking software market. in addition, increase in use of mobile banking the positively impacts growth of the banking software market. However, security issues and privacy concerns and high implementation cost is hampering the banking software market growth. On the contrary, increase in the adoption of Artificial Intelligence based banking system is expected to offer remunerative opportunities for expansion of the banking software market during the forecast period.

The service segment to maintain its leadership status throughout the forecast period.

Based on the component, the software segment held the highest market share in 2022, accounting for more than two-thirds of the global banking software market revenue, as it provides personalized services, accelerates throughput, and reduces operational costs. However, the service segment is projected to manifest the highest CAGR of 21.9% from 2023 to 2032, owing to these services reduce management concerns efficiently with personalized assistance and optimized performance development.

The on-premise segment to maintain its leadership status throughout the forecast period

Based on deployment mode, the on-premise segment held the highest market share in 2022, accounting for more than three-fifths of the global banking software market revenue, owing to its huge adoption as it takes the complete responsibility of integration of the software and solving any issue related to security. However, the cloud segment is projected to manifest the highest CAGR of 21.7% from 2023 to 2032, due to huge adoptions as it takes the complete responsibility of integration of the software and solving any issue related to security.

Inquiry before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/109776

The banks segment to maintain its lead position during the forecast period

Based on end users, the banks segment accounted for the largest share in 2022, contributing to more than three-fourths of the global banking software market revenue, owing to increase in automation and digitalization for better management. However, the financial institution segment is expected to portray the largest CAGR of 24.6% from 2023 to 2032 and is projected to maintain its lead position during the forecast period, owing to increasing demand for technologies that help financial institutions to reduce manual work and increase operational efficiency.

North America maintains its dominance by 2022

Based on region, North America held the highest market share in terms of revenue in 2022, accounting for nearly two-fifths of the global banking software market revenue, owing to presence of most successful banking software businesses in the region. However, the Asia-Pacific region is expected to witness the fastest CAGR of 22.7% from 2023 to 2032 and is likely to dominate the market during the forecast period, owing to increasing government initiatives in the banking industry and an increasing number of mobile and internet users in developing nations such as India and China are accounted development of private and rural banking.

Leading Market Players: -

• Oracle Corporation,

• SAP SE,

• Tata Consultancy Services Limited,

• Finastra International Limited,

• IBM Corporation,

• EdgeVerve Systems Limited,

• Fidelity National Information Services Inc,

• Fiserv Inc,

• Microsoft Corporation,

• Salesforce.com, Inc.,

The report provides a detailed analysis of these key players of the global Banking software market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Request Customization@ https://www.alliedmarketresearch.com/request-for-customization/109776

Banking Software Market Key Segments:

By Deployment Mode

• On-premise

• Cloud

By End User

• Banks

• Financial Institution

By Component

• Solution

• Service

Trending Reports in BFSI Industry:

Southeast Asia Commercial Banking Market: https://www.alliedmarketresearch.com/southeast-asia-commercial-banking-market-A17164

Intelligent Virtual Assistant (IVA) Based Banking Market: https://www.alliedmarketresearch.com/intelligent-virtual-assistant-based-banking-market-A12745

Europe Open Banking Market: https://www.alliedmarketresearch.com/europe-open-banking-market-A16019

AI in Banking Market: https://www.alliedmarketresearch.com/ai-in-banking-market-A11871

Banking and Payment Smart Cards Market: https://www.alliedmarketresearch.com/banking-and-payment-smart-cards-market-A12935

Private Banking Market: https://www.alliedmarketresearch.com/private-banking-market-A14753

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

Follow us on LinkedIn and Twitter

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients in making strategic business decisions and achieving sustainable growth in their respective market domains.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms the utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high-quality data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of the domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Banking Software Market to Witness a Pronounce Growth Rate ~19.8% of CAGR by 2032 here

News-ID: 3237378 • Views: …

More Releases from Allied Market Research

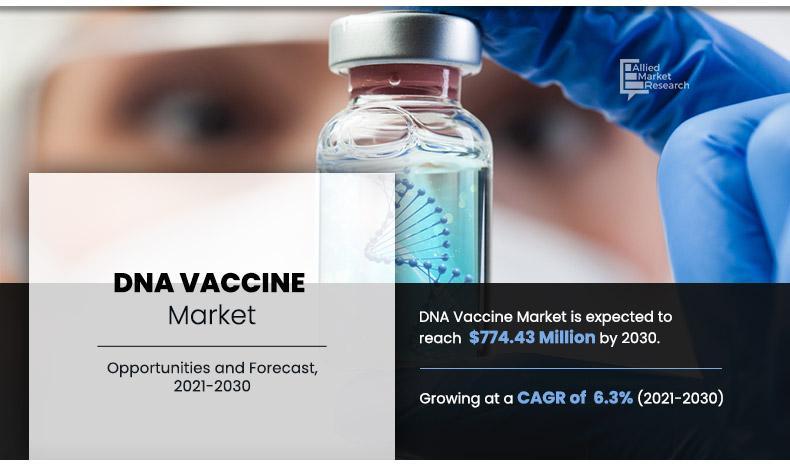

Global DNA Vaccine market to Hit $774.43M by 2030 (6.3% CAGR) Driven by Rising C …

DNA vaccines represent a groundbreaking approach to immunization, leveraging the power of genetics to stimulate a robust immune response. Unlike traditional vaccines that use weakened or inactivated pathogens, DNA vaccines introduce a small piece of genetic material to instruct cells to produce specific proteins that trigger an immune response. This article explores the potential of DNA vaccines, highlighting their unique advantages, advancements, and the transformative impact they may have on…

Aviation Weather RADAR Market Strategies, In-depth Analysis, Key Players and Geo …

The aviation weather RADAR system is the tool used by pilots for strategic and tactical planning of a safe flight trajectory. Each aircraft has a radar antenna mounted in the nose of the aircraft. This antenna catches signals, which are then processed by a computer, enabling the pilots to view the same and make necessary weather predictions. Since the aviation industry is highly competitive, the generated profits are attributed to…

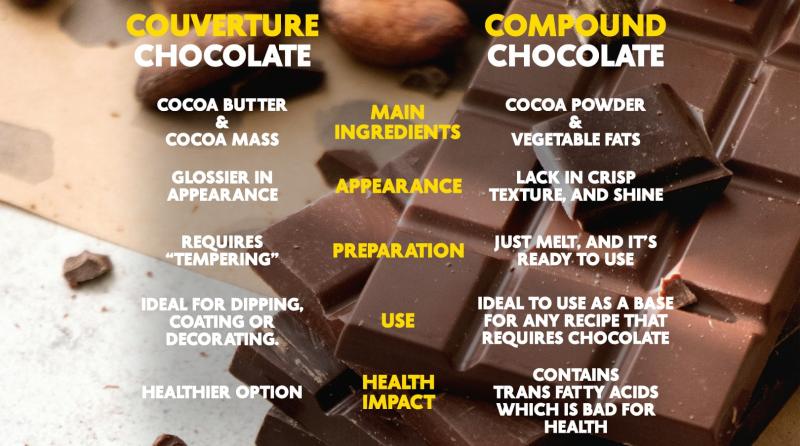

Chocolate Couverture Market by Growth, Emerging Trends and Forecast by 2023-2032

Chocolate couverture is high-quality chocolate with extra cocoa butter, which imparts glossy texture, and is used to cover sweets and cakes. Couverture chocolate bars contain cocoa solids, cocoa butter, sugar, and other basic chocolate bar ingredients. The major change is with the texture of cocoa that is ground to a finer texture than regular chocolates and contains more cocoa butter. Various forms of chocolate coverture are available in the market…

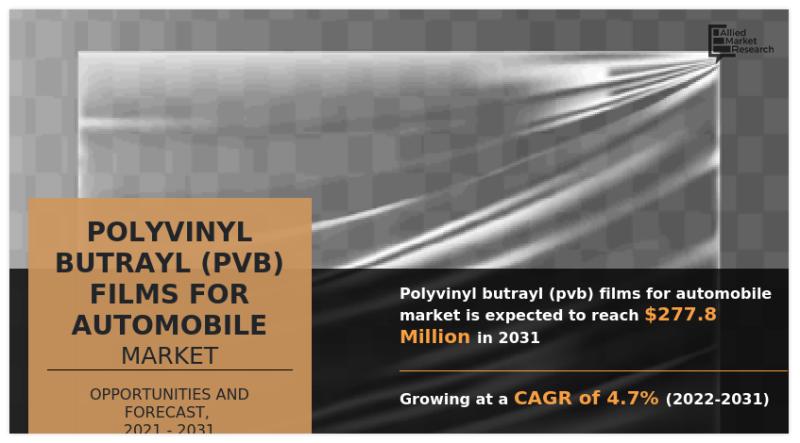

Trends in Polyvinyl Butrayl (PVB) Films for Automobile Market 2026: Transforming …

As per the report published by Allied Market Research, the global polyvinyl butrayl (PVB) films for automobile market was pegged at $189.2 million in 2021, and is expected to reach $227.8 million by 2031, growing at a CAGR of 4.7% from 2022 to 2031.

The report provides an in-depth analysis of top segments, changing market trends, value chain, key investment pockets, competitive scenario, and regional landscape. The report is…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…