Press release

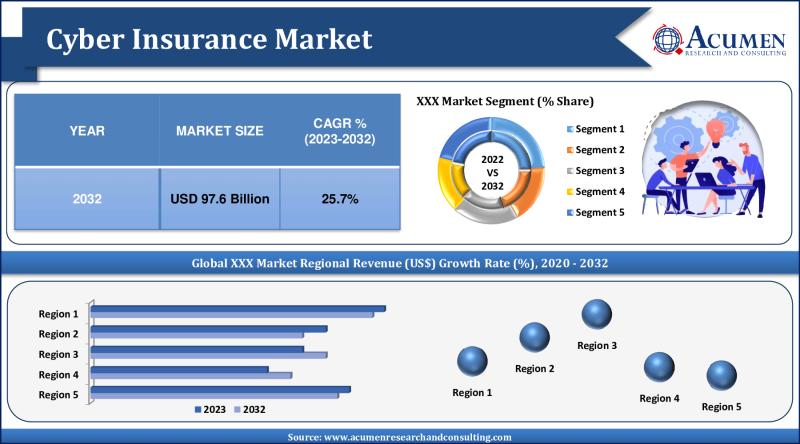

Cyber Insurance Market Growth Trajectory: Size to Reach USD 97.6 Billion by 2032, Expanding Growth Opportunities

The global Cyber Insurance Market is expected to exhibit strong growth during the forecast period, driven by the increasing frequency and severity of cyber-attacks worldwide. This analysis provides insights into market size, trends, drivers, challenges, regional outlook, and competitors. Cyber insurance is a type of insurance that covers financial losses resulting from cyber attacks, such as data breaches, ransomware, and identity theft. It can help businesses recover from the financial costs of a cyber attack, as well as the costs of responding to and mitigating the attack. Cyber insurance can also help businesses protect their reputation and brand value. In the event of a cyber attack, cyber insurance can help businesses pay for public relations and crisis management services. Cyber insurance is becoming increasingly important as cyber attacks become more common and more sophisticated. Businesses of all sizes should consider purchasing cyber insurance to protect themselves from the financial and reputational risks of a cyber attack. Here are some of the key benefits of cyber insurance:● Financial protection from the costs of a cyber attack

● Help with responding to and mitigating a cyber attack

● Protection of reputation and brand value

● Peace of mind knowing that you are protected from the financial and reputational risks of a cyber attack

Download Sample Report Copy of This Report from Here: https://www.acumenresearchandconsulting.com/request-sample/3365

Cyber Insurance Market Highlights and Statistics:

● Market size will reach USD 97.6 billion by 2032 from USD 10.1 billion in 2022, expanding at a CAGR of 25.7% during the forecast period.

● North America held the largest share exceeding 36% in 2022 owing to mandated data protection regulations.

● BFSI dominated the end-user segment with over 26.0% share in 2022.

● Rising adoption across healthcare, retail, financial services, and public sectors.

● Increasing launch of tailored products catering to specific industry risks.

Cyber Insurance Market Overview and Growth Factors:

The cyber insurance market is expected to grow significantly in the coming years due to the increasing number of cyber attacks. Ransomware, data breaches, and identity theft are just some of the most common types of cyber attacks that businesses face today. These attacks can have a devastating impact on businesses, costing them millions of dollars in damages and lost revenue. Cyber insurance can help businesses protect themselves from these risks by providing financial compensation for losses incurred as a result of a cyber attack. However, there are some challenges that the cyber insurance market faces. One challenge is that it can be difficult to assess the unique risks of each client. This is because cyber attacks are constantly evolving, and new threats are emerging all the time. Another challenge is that it can be difficult to price cyber insurance plans accurately. This is because the cost of a cyber attack can vary depending on the severity of the attack and the size of the business. Despite these challenges, the cyber insurance market is expected to grow significantly in the coming years. This is because businesses are becoming increasingly aware of the risks of cyber attacks, and they are looking for ways to protect themselves.

Trends Influencing Cyber Insurance Market Growth:

● Integration of technologies like AI, ML, and big data analytics for advanced risk assessment.

● Adoption of blockchain solutions for secure, transparent data sharing between insurers and clients.

● Development of tailored industry-specific cyber insurance products and pricing plans.

● Offering of value-added services like incident response assistance, proactive security audits, etc.

● Rising partnerships between insurers, brokers, and parametric model providers.

Major Growth Drivers:

● Surge in cyber risks across industries causing financial and reputational losses.

● Expanding attack surfaces with remote working, cloud migrations etc.

● Lack of adequate security infrastructure across organizations driving adoption.

● Stringent data protection regulations and compliance mandates.

● Increased outsourcing by enterprises raising liability concerns.

Key Challenges in the Cyber Insurance Market:

● Difficulties in accurately evaluating unique client cyber risks and exposures.

● Limited historical loss data for developing pricing and underwriting models.

● Low policy renewals and lack of customer stickiness.

● Coverage gaps for new attack vectors like IoT devices and infrastructure.

● Reluctance among companies to disclose data breaches and vulnerabilities.

Get TOC's From Here@ https://www.acumenresearchandconsulting.com/table-of-content/cyber-insurance-market

Segmentation:

Based on the Component

● Solution

● Services

Based on the Insurance Type

● Packaged

● Stand-alone

Based on the Organization Size

● Small and Medium Enterprises

● Large Enterprises

Based on the End Use Industry

● Retail

● BFSI

● Healthcare

● IT and Telecom

● Other

Regional Overview Cyber Insurance Market:

● North America is expected to hold the largest share of the market during the forecast period. This is attributed to the high adoption of cyber insurance by businesses in the region.

● Europe is expected to be the second-largest market for cyber insurance during the forecast period. This is attributed to the increasing number of cyber attacks in the region and the growing awareness of cyber security risks.

● Asia Pacific is expected to be the fastest-growing market for cyber insurance during the forecast period. This is attributed to the rising demand for cyber insurance from businesses in the region.

Major Companies Offering Cyber Insurance:

American International Group Inc., Chubb Ltd., Zurich Insurance Group, XL Group Ltd, Beazley Group, Munich Re, Allianz SE, Berkshire Hathaway Inc., AXIS Insurance Group Ltd., Lockton Companies Inc., etc.

Ask Query Here: Richard@acumenresearchandconsulting.com or sales@acumenresearchandconsulting.com

To Purchase this Premium Report@ https://www.acumenresearchandconsulting.com/buy-now/0/3365

201, Vaidehi-Saaket, Baner - Pashan Link Rd, Pashan, Pune, Maharashtra 411021

Acumen Research and Consulting (ARC) is a global provider of market intelligence and consulting services to information technology, investment, telecommunication, manufacturing, and consumer technology markets. ARC helps investment communities, IT professionals, and business executives to make fact based decisions on technology purchases and develop firm growth strategies to sustain market competition. With the team size of 100+ Analysts and collective industry experience of more than 200 years, Acumen Research and Consulting assures to deliver a combination of industry knowledge along with global and country level expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cyber Insurance Market Growth Trajectory: Size to Reach USD 97.6 Billion by 2032, Expanding Growth Opportunities here

News-ID: 3208391 • Views: …

More Releases from Acumen Research and Consulting

Physical AI Market Set to Surge to USD 83,642.5 Million by 2035 - Groundbreaking …

Global Physical AI Market Report 2026-2035: Robust Growth, Transformational Trends, and Unmatched Opportunities

The Physical AI Market is on the brink of remarkable expansion with groundbreaking advancements in artificial intelligence systems that interact intelligently with the physical world. According to a new market study by Acumen Research and Consulting, the global physical AI market is projected to grow from USD 3,137.5 Million in 2025 to USD 83,642.5 Million by 2035, exhibiting…

Semiconductor Packaging Market to Double from USD 44.21 Billion in 2024 to USD 1 …

Acumen Research And Consulting announces the release of its latest industry report highlighting the robust growth of the Semiconductor Packaging Market. The report reveals that the global market, valued at USD 44.21 billion in 2024, is projected to reach USD 104.76 billion by 2033, expanding at a steady Compound Annual Growth Rate (CAGR) of 10.1% between 2025 and 2033. This rapid growth underscores the increasing importance of packaging innovations in…

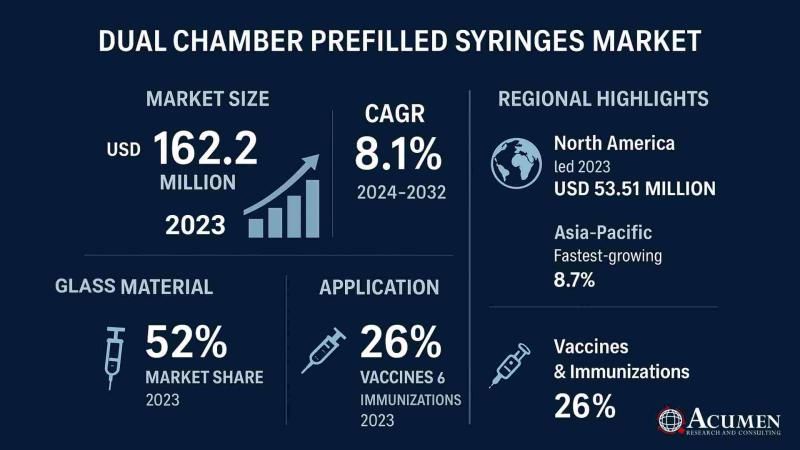

Global Dual Chamber Prefilled Syringes Market to Reach USD 323.7 Million by 2032 …

According to the latest report by Acumen Research and Consulting, the global Dual Chamber Prefilled Syringes Market is witnessing rapid expansion, driven by rising adoption of advanced drug delivery systems, increasing demand for biologics, and the growing emphasis on patient safety and convenience.

The Dual Chamber Prefilled Syringes Market Size was valued at USD 162.2 million in 2023 and is projected to reach USD 323.7 million by 2032, growing at a…

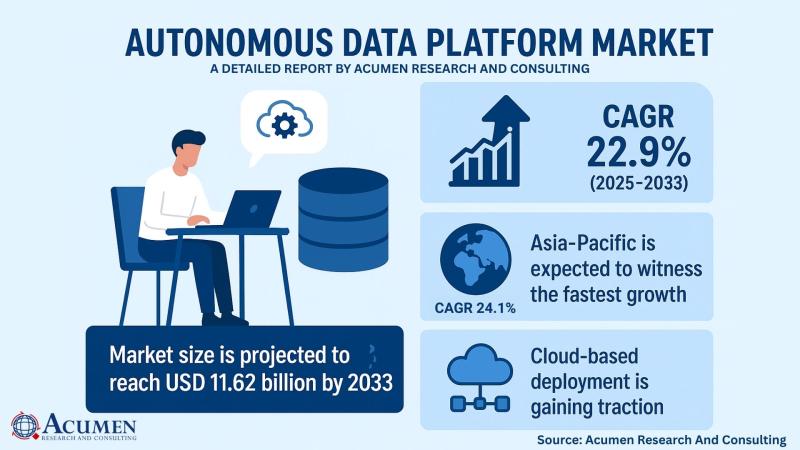

Autonomous Data Platform Market to Reach USD 11.62 Billion by 2033, Growing at a …

The global Autonomous Data Platform Market is experiencing significant growth, driven by the increasing demand for AI-driven data management and real-time analytics across various industries. According to a comprehensive market analysis by Acumen Research and Consulting, the market was valued at USD 1.85 billion in 2024 and is projected to reach USD 11.62 billion by 2033, expanding at a robust compound annual growth rate (CAGR) of 22.9% during the forecast…

More Releases for Cyber

Cyber Insurance Market to Expand Rapidly, Fueled by Cyber Threats

According to the latest market research study published by P&S Intelligence, the global cyber insurance market is expected to witness significant growth, with a projected rise from USD 16.1 billion in 2024 to USD 65.2 billion by 2032, expanding at a robust CAGR of 19.3%.

This growth is driven by the increasing frequency of cyberattacks, such as data breaches and ransomware incidents, coupled with rising regulatory pressures on businesses to adopt…

Express your Cyber Attitude with Zeelool Cyber Punk Glasses

Zeelool follows the trend of fashion and launches a series of new and unique cyberpunk glasses, its unique futuristic design concept and sense of technology, perfectly interpreting the aesthetic connotation of cyberpunk culture, the frame uses neon transparent material and black lines intertwined, as if with the digital world constructed in cyberpunk novels, awakening the infinite reverie of people for the virtual reality and holographic technology.

Highlights of Cyberpunk Glasses:

…

Cyber Security Market Research Reports, Cyber Security Market Revenue, Issues an …

The Cyber security, also denoted to as IT security, emphasizes on maintenance computers, programs, networks, and data from unrestrained or spontaneous admittance. It contains network security, application security, endpoint security, identity administration, data security, cloud security, and infrastructure security. As the cyber threats have augmented at an alarming rate, security solutions have been achievement traction, worldwide. Solutions such as antivirus software and firewalls have grown-up in involvedness and recognized to…

Cyber Security Market Research Reports | Cyber Security Market Revenue | Future …

The Cyber security, also mentioned to as IT security, emphasizes on maintenance computers, programs, networks, and data from unrestrained or spontaneous admittance. It contains network security, application security, endpoint security, distinctiveness management, data security, cloud security, and infrastructure safekeeping. As cyber threats have augmented at an alarming rate, security solutions have been purchase traction, globally. Solutions such as antivirus software and firewalls have grown up in complexity and demonstrated to…

Market Research Reports Of Cyber Security | Cyber Security Market Growth Analysi …

Cyber security market is very fragmented & highly competitive market that comprises several global & regional players. Cyber Security is a key concern that helps the organizations to monitor, detect, report, and contradict cyber threats for maintaining data confidentiality. As the innovation is developing and new applications are coming into market, programmers are finding the new escape clauses and taking the significant & secret information's from the servers and selling…

Cyber Institute receives Best Cyber Security Education Initiative - USA

The Cyber Institute received the 2019 US Business News Best Cyber Security Education Initiative - USA for their programs to help reduce barriers into cybersecurity and STEM related careers by advancing traditional and non-traditional pathways; for women and minorities in particular. By increasing access to education, employment, and workforce development, we believe they will have greater opportunities for self-determination and self-reliance.

The Cyber Institute received the prestigious international US Business News…