Press release

Voice Banking Market to reach USD 2.74 Bn by 2029, emerging at a CAGR of 10.81 percent and forecast 2023-2029

Voice Banking Market Report Scope and Research Methodology :This report delves into the Voice Banking Market's dynamics through a comprehensive research methodology, analyzing market trends, drivers, restraints, opportunities, and challenges on a global and regional scale. The report provides valuable insights into the market's evolution, enabling readers to grasp the market's potential and its transformative impact on the banking industry.

Request a Free Sample Copy or View Report Summary: https://www.maximizemarketresearch.com/request-sample/169729

Voice Banking Market Dynamics:

The growth of voice-based technology in the banking sector stands out as a prime driver for the Voice Banking Market. Recent studies indicate that 72% of banking and finance experts consider voice technology pivotal for the future of banks. Benefits like enhanced security through biometric authentication and increased accessibility for customers are propelling the adoption of voice technology.

Voice Banking Market Regional Insights:

North America led the Voice Banking Market in 2022, driven by the increasing role of voice assistants in the banking sector. The adoption of contactless payments and the growing preference for voice technology contribute to North America's market dominance. Meanwhile, the Asia Pacific region, particularly countries like China, India, and Japan, are experiencing a surge in awareness and adoption of voice-based payments. Efforts by organizations like the National Payments Corporation of India to promote voice-based payment systems are propelling growth in the APAC region.

Request For Free Inquiry Report: https://www.maximizemarketresearch.com/inquiry-before-buying/169729

Voice Banking Market Segmentation:

by Component

1. Solution

2. Services

by Deployment Mode

1. On-Premise

2. Cloud

by Technology

1. Large Enterprises

2. Small and Medium-sized Enterprises

by Application

1. Banks

2. NBFCs

3. Credit Unions

4. Others

by Technology

1. Machine Learning

2. Deep Learning

3. Natural Language Processing

4. Others

Voice Banking Market Key Players:

1. U.S. Bank (US)

2. Citigroup (US)

3. Axis Bank(India)

4. HSBC (UK)

5. NatWest Group (UK)

6. IndusInd Bank (India)

7. BankBuddy (India)

8. Central 1 Credit Union (Canada)

9. ICICI bank (India)

10. United Bank of India (India)

11. DBS Bank (Singapore)

12. Acapela Group. (Belgium)

13. Emirates NBD Bank (UAE)

More Related Reports: https://www.maximizemarketresearch.com/market-report/voice-banking-market/169729/

Table of content for the Voice Banking Market includes:

Global Voice Banking Market : Research Methodology

Global Voice Banking Market : Executive Summary

Market Overview and Definitions

Introduction to the Global Market

Summary

Key Findings

Recommendations for Investors

Recommendations for Market Leaders

Recommendations for New Market Entry

Global Voice Banking Market : Competitive Analysis

MMR Competition Matrix

Market Structure by region

Competitive Benchmarking of Key Players

Consolidation in the Market

M&A by region

Key Developments by Companies

Market Drivers

Market Restraints

Market Opportunities

Market Challenges

Market Dynamics

PORTERS Five Forces Analysis

PESTLE

Regulatory Landscape by region

North America

Europe

Asia Pacific

Middle East and Africa

South America

COVID-19 Impact

Company Profile: Key players

Company Overview

Financial Overview

Global Presence

Capacity Portfolio

Business Strategy

Recent Developments

Key Offerings:

Past Market Size and Competitive Landscape

Past Pricing and price curve by region

Market Size, Share, Size and Forecast by different segment | 2023-2029

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

Market Segmentation - A detailed analysis by growth and trend

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

Related Report :

Latin America Emergency Medical Service (EMS) Products Market https://www.maximizemarketresearch.com/market-report/latin-america-emergency-medical-service-ems-products-market/2880/

Global Dehydrated Onions Market https://www.maximizemarketresearch.com/market-report/global-dehydrated-onions-market/24539/

High Protein Coffee Market https://www.maximizemarketresearch.com/market-report/high-protein-coffee-market/75174/

India Packaging Machinery Market https://www.maximizemarketresearch.com/market-report/india-packaging-machinery-market/127040/

Global Refinery Service and Maintenance Market https://www.maximizemarketresearch.com/market-report/global-refinery-service-and-maintenance-market/82603/

Global Copper Busbar and Profiles Market https://www.maximizemarketresearch.com/market-report/global-copper-busbar-and-profiles-market/76368/

Global Electric Kiln Market https://www.maximizemarketresearch.com/market-report/global-electric-kiln-market/107942/

Global Flat Carbon Steel Market https://www.maximizemarketresearch.com/market-report/global-flat-carbon-steel-market/63906/

Baby & Pregnancy Skincare Products Market https://www.maximizemarketresearch.com/market-report/baby-pregnancy-skincare-products-market/122817/

Fructo-Oligosaccharides (FOS) Market https://www.maximizemarketresearch.com/market-report/fructo-oligosaccharides-fos-market/123240/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 444 West Lake Street, Floor 17,

Chicago, IL, 60606, USA.

✆ +1 800 507 4489

✆ +91 9607365656

🖂 mailto:sales@maximizemarketresearch.com

🌐 https://www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of the majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Voice Banking Market to reach USD 2.74 Bn by 2029, emerging at a CAGR of 10.81 percent and forecast 2023-2029 here

News-ID: 3183458 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Commercial Kitchen Appliances Market Poised for Robust Growth, Expected to Reach …

The global Commercial Kitchen Appliances Market, valued at US$ 101.65 billion in 2023, is witnessing strong momentum driven by the rapid expansion of the foodservice industry, technological innovation, and evolving consumer lifestyles. According to the latest market analysis, the industry is projected to grow at a compound annual growth rate (CAGR) of 6.7% from 2024 to 2030, reaching nearly US$ 160.05 billion by the end of the forecast period.

Commercial kitchen…

E-Bike Market Poised for Robust Expansion, Projected to Reach USD 153.42 Billion …

The global E-Bike Market is entering a transformative growth phase, underpinned by accelerating demand for eco-friendly transportation, rapid advances in battery and motor technologies, and strong policy support for sustainable urban mobility. Valued at USD 60.65 Billion in 2024, the market is projected to expand at a compound annual growth rate (CAGR) of 12.3% from 2025 to 2032, reaching nearly USD 153.42 Billion by 2032. As cities worldwide seek to…

Data Center Liquid Immersion Cooling Market Set for Rapid Expansion, Driven by H …

Data Center Liquid Immersion Cooling Market to Grow from USD 640.94 Million in 2023 to USD 3,340.83 Million by 2030, Registering a Robust CAGR of 26.6% (2024-2030)

The global Data Center Liquid Immersion Cooling Market is witnessing a transformative phase as data center operators worldwide seek advanced, energy-efficient cooling solutions to address rising power densities, sustainability mandates, and escalating operational costs. Valued at USD 640.94 million in 2023, the market…

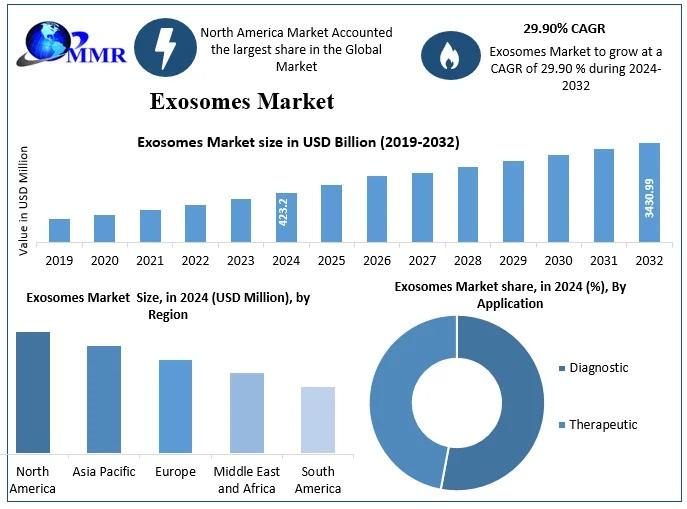

Exosomes Market Forecast: USD 3,430.99 Million Opportunity by 2032

Exosomes Market size was valued at USD 423.2 Mn in 2024 and is expected to reach USD 3430.99 Mn by 2032, at a CAGR of 29.90

The global exosomes market is currently poised for explosive growth, fundamentally driven by the paradigm shift toward non-invasive diagnostics and the rising prominence of "liquid biopsies" in oncology. Once considered mere cellular waste, these extracellular vesicles are now recognized as critical mediators of intercellular communication,…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…