Press release

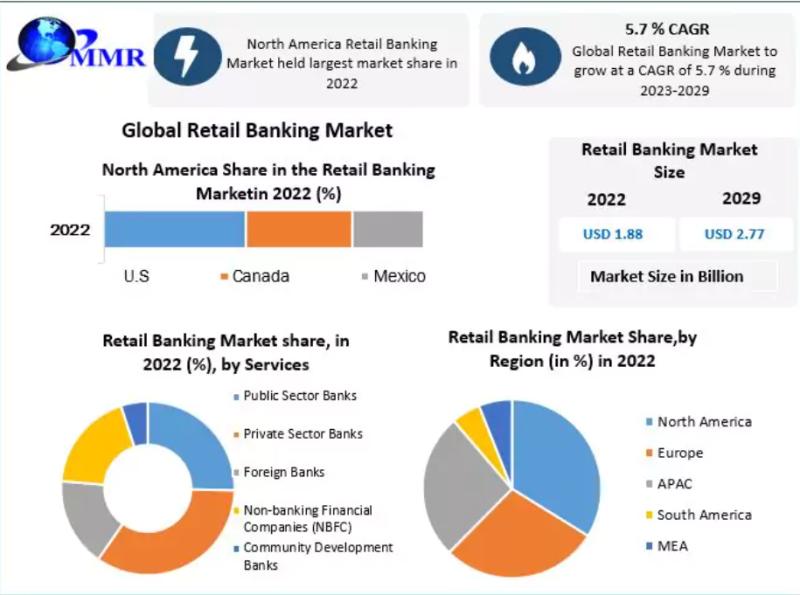

Retail Banking Market to reach USD 2.77 Bn by 2029, emerging at a CAGR of 5.7 percent and forecast 2023-2029

Retail Banking Market Report Scope and Research MethodologyThe scope of the report encompasses an extensive exploration of both traditional financial institutions and innovative fintech companies in the retail banking sector. It delves into the strategies, offerings, and market presence of established giants like JPMorgan Chase, Bank of America, and HSBC, while also highlighting the disruptive influence of fintech disruptors such as PayPal, Square, and Revolut. The report captures the dynamic interplay between these entities, elucidating how they shape the market's dynamics and competitive dynamics.

To ensure the accuracy and reliability of the findings, the research methodology employed is robust and comprehensive. The report leverages a combination of primary and secondary research techniques to gather data, validate insights, and derive meaningful conclusions. Extensive primary research involves surveys, interviews, and interactions with industry experts, stakeholders, and key market players. Secondary research sources include authoritative databases, industry reports, scholarly articles, and reputable publications.

Get to Know More About This Market Study: https://www.maximizemarketresearch.com/market-report/retail-banking-market/195573/

What are Retail Banking Market Dynamics:

Digital Transformation to Drive the Retail Banking Market: Digital technology evolution has changed the retail banking sector. With the proliferation of smartphones, internet connectivity, and user-friendly banking apps, customers now expect seamless and convenient digital banking experiences to support digitalization. This shift has helped to drive banks to invest heavily in digital infrastructure, offering features such as mobile banking, online transactions, and 24/7 customer support. This transformation improved operational efficiency for banks and also enabled them to reach a broader customer base. The integration of artificial intelligence (AI) and machine learning (ML) technologies is expected to allow banks to offer tailored financial products, personalized recommendations, and automated customer service, further enhancing the overall customer experience.

Presence of the Financial Industry to Influence Market Growth: In emerging markets, the pursuit of financial inclusion has played a crucial role in driving the growth of retail banking. Many individuals previously excluded from traditional banking services are now gaining access to basic financial products through mobile banking and digital platforms. Retail banks are expanding their technology to offer affordable and accessible banking solutions. The increase of mobile payment apps, contactless payments, and digital wallets is key evolution of payment systems and the introduction of new payment solutions has significantly impacted the retail banking market.

Request a Free Sample Copy or View Report Summary: https://www.maximizemarketresearch.com/request-sample/195573

Retail Banking Market Regional Insights:

The global retail banking market exhibits distinct regional patterns, each influenced by unique economic, technological, and regulatory factors. North America holds a prominent position, having dominated the market share in 2022. This dominance is underpinned by a well-established banking infrastructure, consistent technological innovation, and a high level of digital adoption. The region boasts some of the world's largest banks and financial institutions and has been a forefront runner in pioneering digital banking innovations. The presence of advanced infrastructure, coupled with widespread smartphone penetration and a burgeoning population, fuels the growth of digital banking services. Emphasis on user-friendly interfaces, personalized services, and regulatory compliance further paves the way for lucrative opportunities in the North American retail banking market.

In contrast, the Asia Pacific region showcases a different growth trajectory, fueled by the surge in retail savings and investments. A remarkable 69.7% of liquid assets deposited in banks are attributed to retail investors in this region. Rapid population growth, rising disposable incomes, and pervasive technology adoption converge to drive the retail banking market's expansion in Asia Pacific. Digital wallets, online banking, and peer-to-peer lending platforms have garnered substantial popularity. Additionally, technologies such as artificial intelligence, blockchain, and biometric authentication play pivotal roles in influencing the region's growth. Despite the proliferation of distribution channels, challenges in coordinating touchpoints often lead to suboptimal customer experiences. Nevertheless, the evolving landscape in Asia Pacific provides substantial potential for the growth and transformation of the retail banking sector.

Request For Free Inquiry Report: https://www.maximizemarketresearch.com/inquiry-before-buying/195573

What is Retail Banking Market Segmentation:

by Type

Public Sector Banks

Private Sector Banks

Foreign Banks

Community Development Banks

Non-banking Financial Companies (NBFC)

by Services

Saving and Checking Account

Transactional Account

Personal Loan

Home Loan

Mortgages

Debit and Credit Cards

ATM Cards

Certificates of Deposits

Request For Customization Report: https://www.maximizemarketresearch.com/request-customization/195573

Who are Retail Banking Market Key Players:

1. Wells Fargo

2. Mitsubishi UFJ Financial Group

3. Bank of America

4. Barclays

5. ICBC

6. China Construction Bank Deutsche Bank

7. HSBC

8. JPMorgan Chase

9. Citigroup

10. NP Paribas

11. BNP Paribas

12. Banco Santander, S.A.

13. The Royal Bank of Scotland Group plc (RBS)

14. Société Générale S.A.

15. ING Groep N.V.

16. BBVA (Banco Bilbao Vizcaya Argentaria)

17. UBS Group AG

18. Standard Chartered PLC

Table of content for the Retail Banking Market includes:

1. Global Retail Banking Market: Research Methodology

2. Global Retail Banking Market: Executive Summary

• Market Overview and Definitions

• Introduction to the Global Market

• Summary

• Key Findings

• Recommendations for Investors

• Recommendations for Market Leaders

• Recommendations for New Market Entry

3. Global Retail Banking Market: Competitive Analysis

• MMR Competition Matrix

• Market Structure by region

• Competitive Benchmarking of Key Players

• Consolidation in the Market

• M&A by region

• Key Developments by Companies

• Market Drivers

• Market Restraints

• Market Opportunities

• Market Challenges

• Market Dynamics

• PORTERS Five Forces Analysis

• PESTLE

• Regulatory Landscape by region

• North America

• Europe

• Asia Pacific

• Middle East and Africa

• South America

• COVID-19 Impact

4 . Company Profile: Key players

• Company Overview

• Financial Overview

• Global Presence

• Capacity Portfolio

• Business Strategy

• Recent Developments

Key Offerings:

• Past Market Size and Competitive Landscape (2022 to 2029)

• Past Pricing and price curve by region (2022 to 2029)

• Market Size, Share, Size and Forecast by different segment | 2022-2029

• Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

• Market Segmentation - A detailed analysis by growth and trend

• Competitive Landscape - Profiles of selected key players by region from a strategic perspective

• Competitive landscape - Market Leaders, Market Followers, Regional player

• Competitive benchmarking of key players by region

• PESTLE Analysis

• PORTER's analysis

• Value chain and supply chain analysis

• Legal Aspects of business by region

• Lucrative business opportunities with SWOT analysis

• Recommendations

More Related Reports:

Industrial Water Service Market https://www.maximizemarketresearch.com/market-report/industrial-water-service-market/198388/

Decaffeinated Coffee Market https://www.maximizemarketresearch.com/market-report/decaffeinated-coffee-market/198492/

Denim Finishing Agents market https://www.maximizemarketresearch.com/market-report/denim-finishing-agents-market/198621/

Herbal Extract in Nutraceuticals Market https://www.maximizemarketresearch.com/market-report/herbal-extract-in-nutraceuticals-market/198543/

NLP in Education Market https://www.maximizemarketresearch.com/market-report/nlp-in-education-market/198814/

Multispectral Camera Market https://www.maximizemarketresearch.com/market-report/multispectral-camera-market/198785/

Cross Laminated Timber Market https://www.maximizemarketresearch.com/market-report/global-cross-laminated-timber-market/65493/

Global Internet of Everything Market https://www.maximizemarketresearch.com/market-report/global-internet-of-everything-ioe-market/63546/

Collagen Peptide and Gelatin Market https://www.maximizemarketresearch.com/market-report/global-collagen-peptide-and-gelatin-market/39064/

3D Scanner Market https://www.maximizemarketresearch.com/market-report/global-3d-scanner-market/28003/

Remodeling Market https://www.maximizemarketresearch.com/market-report/remodeling-market/147390/

Ethernet Switch Market https://www.maximizemarketresearch.com/market-report/global-ethernet-switch-market/63266/

Expanded Polypropylene Foam market https://www.maximizemarketresearch.com/market-report/global-expanded-polypropylene-foam-market/93313/

Automotive Coolant Market https://www.maximizemarketresearch.com/market-report/automotive-coolant-market/11151/

Drug Discovery Services Market https://www.maximizemarketresearch.com/market-report/global-drug-discovery-services-market/6672/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 444 West Lake Street, Floor 17,

Chicago, IL, 60606, USA.

✆ +1 800 507 4489

✆ +91 9607365656

🖂 mailto:sales@maximizemarketresearch.com

🌐 https://www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of the majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Retail Banking Market to reach USD 2.77 Bn by 2029, emerging at a CAGR of 5.7 percent and forecast 2023-2029 here

News-ID: 3181820 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

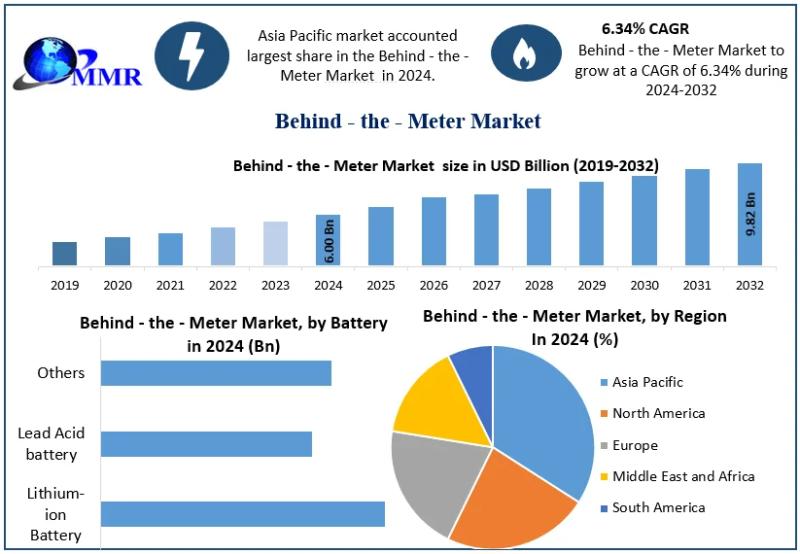

Behind the Meter Market to Surge to USD 9.82 Billion by 2032 - Unmatched Growth …

According to Maximize Market Research, the Global Behind the Meter Market was valued at USD 6.00 Billion in 2024 and is projected to reach USD 9.82 Billion by 2032 at a 6.34 % CAGR, driven by growth in residential, commercial, and industrial energy storage adoption.

Market Overview

The Behind the Meter Market consists of energy storage systems installed on the consumer side of the utility meter. These systems store electricity generated from…

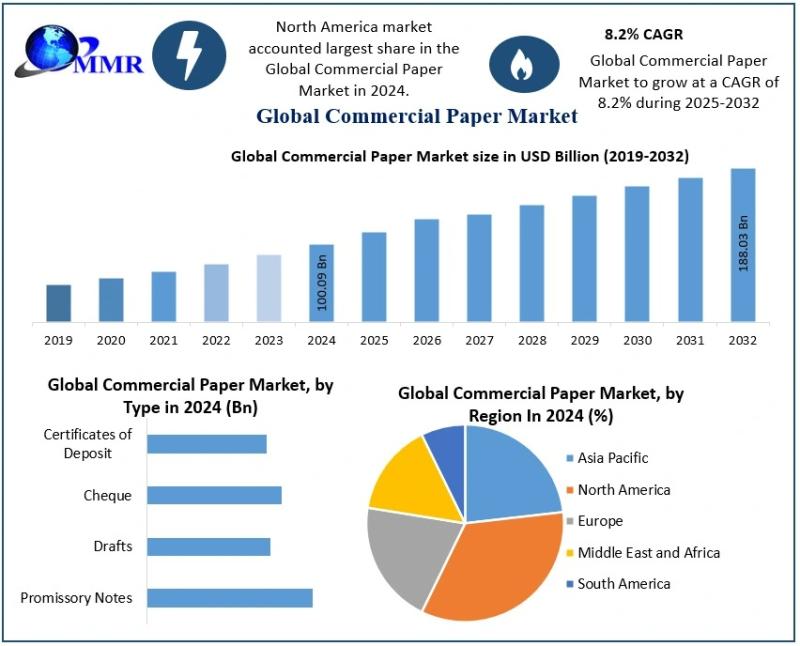

Commercial Paper Market Expected to Witness Steady Growth Driven by Short-Term C …

The Commercial Paper Market size was valued at USD 100.09 Billion in 2024 and the total Commercial Paper revenue is expected to grow at a CAGR of 8.2% from 2025 to 2032, reaching nearly USD 188.03 Billion.

Curious to peek inside? Grab your sample copy of this report now: https://www.maximizemarketresearch.com/request-sample/199690/

The Commercial Paper Market is gaining strong momentum as corporations, financial institutions, and large enterprises increasingly rely on short-term unsecured debt instruments…

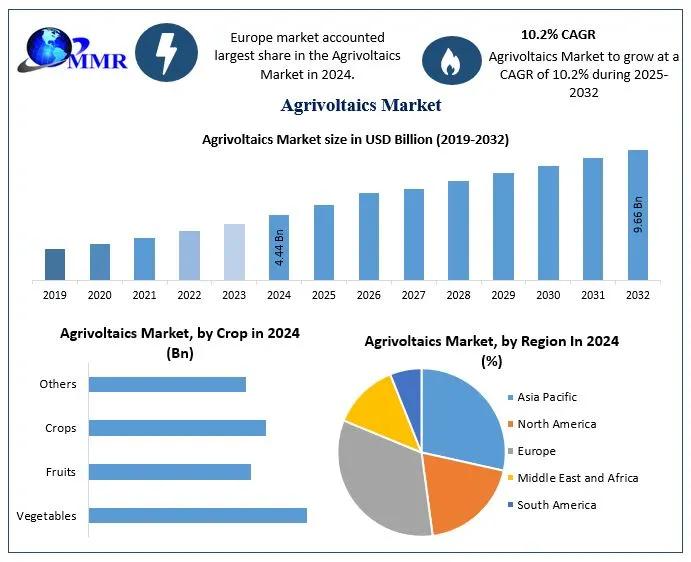

Agrivoltaics Market to Reach USD 9.66 Billion by 2032: Unlocking Dual-Use Land f …

The Global Agrivoltaics Market size was valued at USD 4.44 Billion in 2024 and is anticipated to reach nearly USD 9.66 Billion by 2032, growing at a CAGR of 10.2 % from 2025 to 2032, driven by rising demand for renewable energy solutions and sustainable agriculture practices.

Market Overview

Agrivoltaics - also called "dual-use farming" - integrates photovoltaic (PV) solar power systems with agricultural land, enabling simultaneous cultivation and energy generation on…

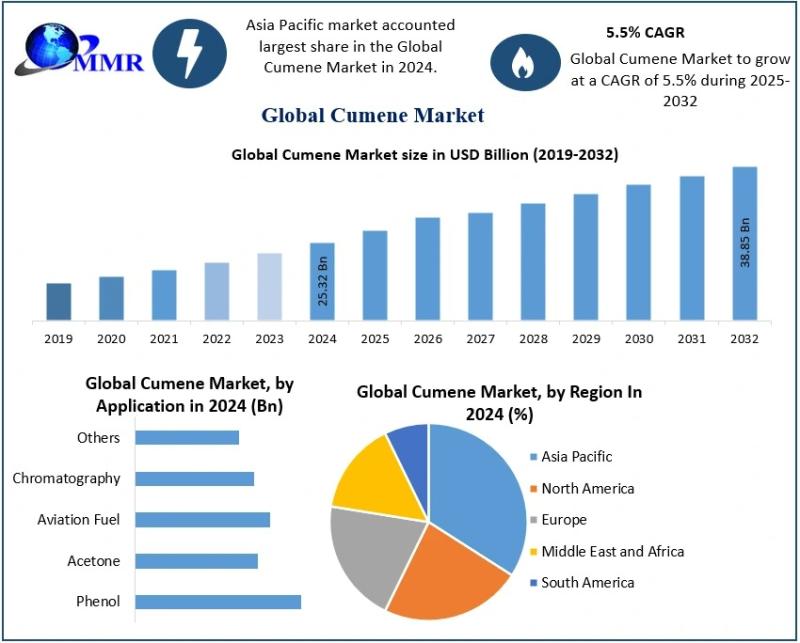

Cumene Market Outlook 2032: Asia-Pacific Emerges as the Fastest-Growing Region a …

The Cumene Market size was valued at USD 25.32 Billion in 2024 and the total Cumene revenue is expected to grow at a CAGR of 5.5% from 2025 to 2032, reaching nearly USD 38.85 Billion.

The Cumene Market is witnessing consistent expansion as rising demand from downstream chemical industries strengthens its global footprint. Cumene, also known as isopropylbenzene, is a critical aromatic hydrocarbon primarily used in the production of phenol and…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…