Press release

Title insurance Market 2023-2032 is Thriving Worldwide with Key Players WFG, Commonwealth

Title insurance protects lenders and buyers from financial loss due to defects in a title to a property. During a transfer of property ownership, title insurance protects homebuyers and mortgage lenders against defects or problems with the title. Depending on the policy, the title insurance company may be responsible for paying specified legal damages if a title dispute arises during or after a sale.Download Sample Report: https://www.alliedmarketresearch.com/request-toc-and-sample/15128

Title insurance protects both lenders and homebuyers against loss or damage occurring from liens, or defects in the title or actual ownership of a property. Common claims(https://www.alliedmarketresearch.com/claims-processing-software-market-A06934) filed against a title are back taxes, liens from mortgage loans, home equity lines of credit, easements, and conflicting wills. Unlike traditional insurance, which protects against future events, title insurance protects against claims for past occurrences. So, to protect people from unexpected loss, it is expected to foster the growth of this market.

The global Title insurance market is segmented on the basis of Type, End User, and Region. Based on type, the market is divided into Owner's Title Insurance and Lender's Title Insurance. In terms of End User, the market is categorized into Individual and Enterprises. Geographically, the market is analyzed across several regions such as North America, Europe, Asia-Pacific, and Latin America, Middle East & Africa (LAMEA).

COVID-19 scenario analysis

The rise in COVID-19 cases around the world is causing an economic slowdown. The pandemic has a significant impact on developed countries. Businesses in most countries have suffered as a result of partial or total lockdowns. This, in turn, is expected to have an adverse effect on the title insurance market in the coming years.

Furthermore, during lockdowns, many people shifted from big cities to their hometowns due to closure of offices, which resulted in the increase in purchase of new properties in small towns. This, as a result, had a positive impact on the title insurance market.

Buy Now: https://www.alliedmarketresearch.com/checkout-final/03f15cfe5d5730947cc7b4e777be2ce0

Top impacting factors: market scenario analysis, trends, drivers, and impact analysis

Higher transparency due to the adoption of digitalization and increase in the real estate(https://www.alliedmarketresearch.com/real-estate-loans-market-A10048) business is driving the growth of the market. However, lack of awareness and changes in exposure and claims experience are expected to hamper the growth of the market. Contrarily, SMEs, which is the fastest growing segment, backed by increasing online presence can be seen as an opportunity for the market.

The title insurance market trends are as follows:

Changes in exposure and claims experience:

The insurance market's exposure patterns have shifted dramatically in recent years. Several coverages have been removed from basic insurance plans. During the pandemic, various business sectors were forced to shut down by their respective countries' governments for an extended period of time, which hampered business growth. Therefore, insurers have observed an increase in the number of claims. As a result of increased claims, the insurance department has become more active and strict in handling claims. Therefore, changes in exposure and claim experience are expected to hamper the growth of the market.

SMEs growing segment backed by increasing online presence:

With the growing number of data frauds, breaches, and thefts in companies to protect the property title of business, demand for title insurance could be raised in the near future. Moreover, the number of SME startups among the consumer segment is growing tremendously, and property acquisitions are increasing by new start-ups. So, to protect businesses from fraud, demand for title issuance is rising, and similarly, online presence and details of documents are expected to create a lucrative opportunity for the SME insurance market in the coming years.

Enquire Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/15128

Key benefits of the report:

This study presents analytical depiction of the title insurance market along with the current trends and future estimations to determine the imminent investment pockets.

The report presents information related to key drivers, restraints, and opportunities along with detailed analysis of the market share.

The current market is quantitatively analyzed to highlight the title insurance market growth scenario.

Porter's five forces analysis illustrates the potency of buyers & suppliers in the market.

The report provides a detailed market analysis depending on the present and future competitive intensity of the market.

Key Market Players:

WFG, Commonwealth, National Title Insurance, Fidelity National Title Insurance Company, Stewart Title Guaranty, Chicago Title Insurance, First American, Lawyers Title, Investors Title, Westcor Land Title Insurance.

Trending Reports:

AI in Insurance Market: https://www.alliedmarketresearch.com/ai-in-insurance-market-A11615

Critical Illness Insurance Market: https://www.alliedmarketresearch.com/critical-illness-insurance-market-A19460

Europe Gadget Insurance Market: https://www.alliedmarketresearch.com/europe-gadget-insurance-market-A47276

Credit Card Issuance Services Market: https://www.alliedmarketresearch.com/credit-card-issuance-services-market-A31800

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Title insurance Market 2023-2032 is Thriving Worldwide with Key Players WFG, Commonwealth here

News-ID: 3164801 • Views: …

More Releases from Allied Market Research

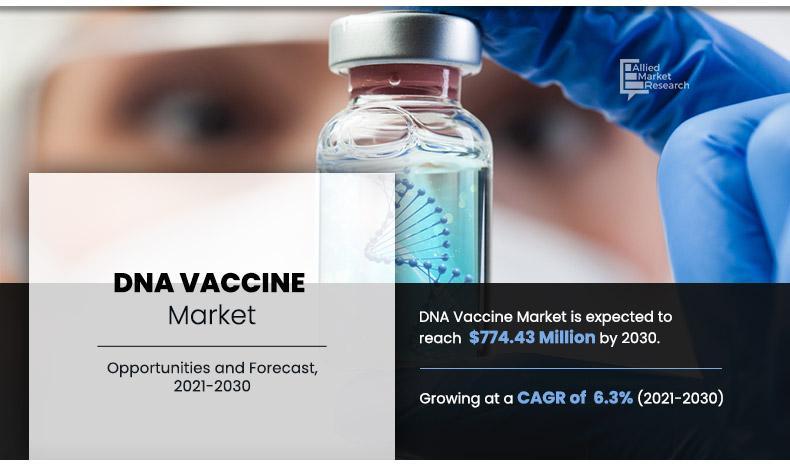

Global DNA Vaccine market to Hit $774.43M by 2030 (6.3% CAGR) Driven by Rising C …

DNA vaccines represent a groundbreaking approach to immunization, leveraging the power of genetics to stimulate a robust immune response. Unlike traditional vaccines that use weakened or inactivated pathogens, DNA vaccines introduce a small piece of genetic material to instruct cells to produce specific proteins that trigger an immune response. This article explores the potential of DNA vaccines, highlighting their unique advantages, advancements, and the transformative impact they may have on…

Aviation Weather RADAR Market Strategies, In-depth Analysis, Key Players and Geo …

The aviation weather RADAR system is the tool used by pilots for strategic and tactical planning of a safe flight trajectory. Each aircraft has a radar antenna mounted in the nose of the aircraft. This antenna catches signals, which are then processed by a computer, enabling the pilots to view the same and make necessary weather predictions. Since the aviation industry is highly competitive, the generated profits are attributed to…

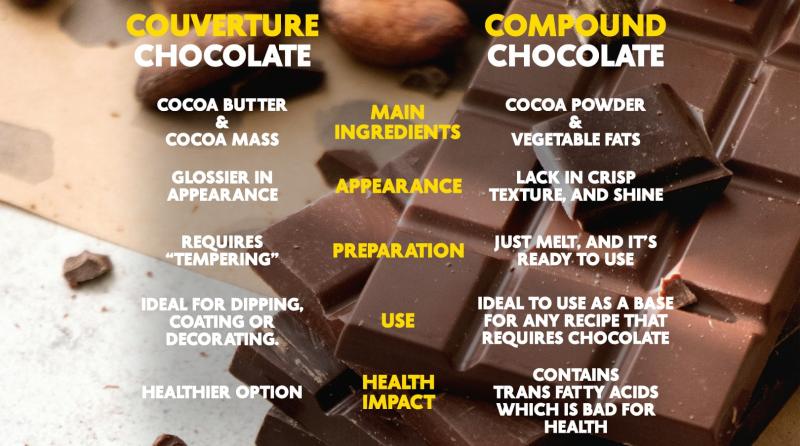

Chocolate Couverture Market by Growth, Emerging Trends and Forecast by 2023-2032

Chocolate couverture is high-quality chocolate with extra cocoa butter, which imparts glossy texture, and is used to cover sweets and cakes. Couverture chocolate bars contain cocoa solids, cocoa butter, sugar, and other basic chocolate bar ingredients. The major change is with the texture of cocoa that is ground to a finer texture than regular chocolates and contains more cocoa butter. Various forms of chocolate coverture are available in the market…

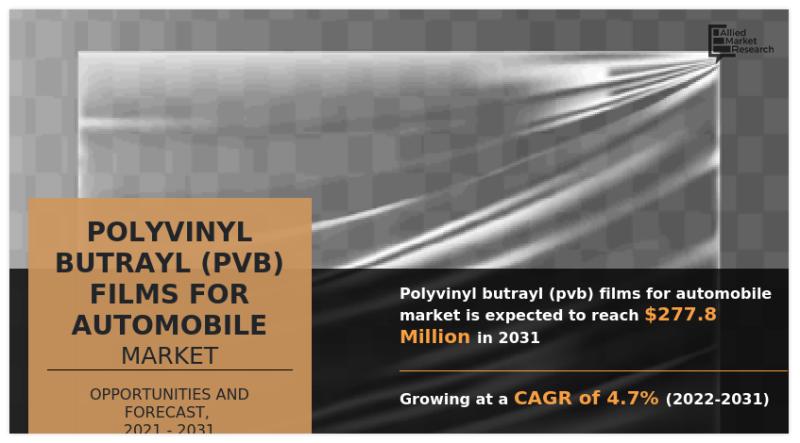

Trends in Polyvinyl Butrayl (PVB) Films for Automobile Market 2026: Transforming …

As per the report published by Allied Market Research, the global polyvinyl butrayl (PVB) films for automobile market was pegged at $189.2 million in 2021, and is expected to reach $227.8 million by 2031, growing at a CAGR of 4.7% from 2022 to 2031.

The report provides an in-depth analysis of top segments, changing market trends, value chain, key investment pockets, competitive scenario, and regional landscape. The report is…

More Releases for Title

Future Scope of Title Production Software Market Is Booming Worldwide 2025-2032 …

The research report on the Title Production Software Market provides detailed statistics, trends, and analyses that clarify the current and future landscape of the industry. It identifies key growth drivers, constraints, trends, and opportunities, along with assessments of the competitive landscape and detailed company profiles. The report presents year-over-year growth rates along with the compound annual growth rate (CAGR), offering crucial insights for decision-makers through a detailed pricing analysis. Additionally,…

Title Insurance Market Is Booming Worldwide | Limited, Fidelity National Title I …

According to HTF Market Intelligence, the Global Title Insurance Market market to witness a CAGR of 10.6% during the forecast period (2025-2030). The Latest Released Title Insurance Market Market Research assesses the future growth potential of the Title Insurance Market market and provides information and useful statistics on market structure and size.

This report aims to provide market intelligence and strategic insights to help decision-makers make sound investment decisions and identify…

Title Insurance Market With Product Type (Residential Title Insurance, Commercia …

Title Insurance market size was valued at USD 53627.26 million in 2021 and is expected to expand at a CAGR of 7.93% during the forecast period, reaching USD 84756.6 million by 2027.

Title Insurance market research report provides all information related to the industry. It provides market insight by providing its client with real data that helps them make important decisions. It provides an overview of the market which includes its…

Title Insurance Market is Booming Worldwide | Stewart Title Guaranty Company, We …

The latest study released on the Global Title Insurance Market by AMA Research evaluates market size, trend, and forecast to 2027. The Title Insurance market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Key Players in…

Title Insurance Market: Reasons Why Opportunity Knocks Again For Top Grossing Co …

The Title Insurance Market research report provides in-depth information on market trends, market capacity, industry size, growth factors, share, innovations, competitive environment, business problems, and more. This report's historical data confirms demand growth on a global, national, and regional scale. The studies on the global industry cover everything from comprehensive research to market size and forecasting to dynamics, growth factors, prospects, and hazards, as well as vendor knowledge. The research…

Title Insurance Market Poised for Excellent Growth During | Title Resources Guar …

Advance Market Analytics published a new research publication on "Title Insurance Market Insights, to 2026" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market stakeholders. The growth of the Title Insurance market is mainly driven by the increasing R&D spending across the world.

Get Free Sample Copy with TOC, Graphs &…