Press release

Carbon Credit Trading Platform Market to Reach USD 609.75 million by 2030, Top Players - Nasdaq, Eex Group, Carbon Trade Exchange, Air Carbon Exchange (Acx), Carbonplace

The Carbon Credit Trading Platform market was valued at USD 107 million in 2022, and it is projected to reach USD 609.75 million by 2030, growing at a compound annual growth rate (CAGR) of 24.3% during the forecast period from 2023 to 2030, according to SNS Insider.A Carbon Credit Trading Platform is a digital marketplace that facilitates the buying and selling of carbon credits. Carbon credits are a financial instrument that represents a reduction or removal of greenhouse gas (GHG) emissions. These credits are generated through projects that promote sustainable practices, such as renewable energy projects, reforestation initiatives, or energy efficiency improvements.

Key Players Covered in Carbon Credit Trading Platform market report are: Nasdaq, Inc., Eex Group, Carbon Trade Exchange, Air Carbon Exchange (Acx), Carbonplace, CME Group, Xpansiv, Climate Trade, Planetly, Toucan, Carbon Credit Capital., Flowcarbon, Likvidi, Carbonex, Betacarbon, and other key players will be included in the final report.

Get Report Sample @ https://www.snsinsider.com/sample-request/2794?utm_source=Mayur

Market Analysis

The global Carbon Credit Trading Platform market is poised for significant growth in the coming years, driven by the increasing need for sustainable practices and the urgent fight against climate change. As the world grapples with the environmental impact of carbon emissions, governments, corporations, and individuals are recognizing the significance of carbon offsetting. Carbon credit trading platforms provide a transparent and efficient marketplace for buying and selling carbon credits, enabling entities to comply with emission reduction targets and promote sustainability. The increasing adoption of carbon offsetting initiatives is expected to drive the demand for carbon credit trading platforms.

Segmentation Analysis

The dominance of the Voluntary Carbon Market segment and the Utilities segment within the Carbon Credit Trading Platform market is driven by different factors. The Voluntary Carbon Market segment benefits from corporate sustainability initiatives and growing consumer demand for environmentally responsible practices. On the other hand, the Utilities segment is driven by regulatory requirements, a large carbon footprint, and investor pressure. Together, these two segments shape the landscape of the market, fostering environmental responsibility, and facilitating the transition towards a low-carbon economy.

Carbon Credit Trading Platform Market Segmentation as Follows:

By Type:

• Voluntary Carbon Market

• Regulated Carbon Market

By System Type:

• Cap & Trade

• Baseline & Credit

By End-use:

• Utilities

• Industrial

• Aviation

• Petrochemical

• Energy

• Others

Get Free Quarterly Updates, click on the link to enquire more @ https://www.snsinsider.com/enquiry/2794?utm_source=Mayur

Impact of Recession

A recession can have a notable impact on the Carbon Credit Trading Platform market, leading to reduced economic activity, lower investment capacity, increased risk aversion, limited government support, and potential market consolidation. However, with strategic interventions and a focus on long-term sustainability, the market can adapt and find opportunities even in challenging economic times.

Regional Status & Analysis

As the world intensifies efforts to combat climate change, carbon credit trading platforms have emerged as a crucial tool in driving emission reductions. Europe's proactive stance on climate change, robust regulatory frameworks, and strong commitment to sustainability give the continent a significant advantage in dominating the Carbon Credit Trading Platform market. With well-established systems such as the EU ETS and a growing demand for carbon credits, European countries are poised to play a pivotal role in shaping the future of emissions trading and driving global environmental progress.

Conclusion

The market holds significant promise for the future. The increasing global focus on sustainability, evolving regulatory frameworks, technological advancements, and corporate sustainability initiatives are driving the demand for these platforms.

Frequently Asked Questions/ Key Reasons to Purchase this Report

What is the projected outlook for Carbon Credit Trading Platform market growth?

By 2030, the market for carbon credit trading platforms is projected to reach a value of USD 609.75 million.

What are the major factors influencing the Carbon Credit Trading Platform market?

As more businesses align their strategies with sustainability goals, the demand for carbon credit trading platforms is expected to surge.

Who are the leading players in the Carbon Credit Trading Platform market?

Nasdaq, Inc., Toucan, Carbon Credit Capital, Flowcarbon,Air Carbon Exchange (Acx), Carbonplace, CME Group, Eex Group, Carbon Trade Exchange, Xpansiv, Climate Trade, Planetly, Likvidi, Carbonex.

Table of Content

Chapter 1 Introduction

Chapter 2 Research Methodology

Chapter 3 Market Dynamics

Chapter 4. Impact Analysis (COVID-19, Ukraine- Russia war, Ongoing Recession on Major Economies)

Chapter 5 Value Chain Analysis

Chapter 6 Porter's 5 forces model

Chapter 7 PEST Analysis

Chapter 8 Carbon Credit Trading Platform Market Segmentation, By Type

Chapter 9 Carbon Credit Trading Platform Market Segmentation, By System Type

Chapter 10 Carbon Credit Trading Platform Market Segmentation, By End-use

Chapter 11 Regional Analysis

Chapter 12 Company profile

Chapter 13 Competitive Landscape

Chapter 14 Use Case and Best Practices

Chapter 15 Conclusion

Buy Carbon Credit Trading Platform Market Report @ https://www.snsinsider.com/checkout/2794?utm_source=Mayur

Contact Us:

Akash Anand - Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

Website: https://www.snsinsider.com/

About US:

SNS Insider has been a leader in data and analytics globally with its authentic consumer and market insights. The trust of our clients and business partners has always been at the center of who we are as a company. We are a business that leads the industry in innovation, and to support the success of our clients, our highly skilled engineers, consultants, and data scientists have consistently pushed the limits of the industry with innovative methodology and measuring technologies.

We assist our clients to anticipate industrial, economic, and consumer trends to drive disruptive change by fusing global experience with local information from experts throughout the world. We bring context to strategic and tactical data by bridging approaches based on data science and field research, assisting you in addressing your most pressing problems and spotting possibilities.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Carbon Credit Trading Platform Market to Reach USD 609.75 million by 2030, Top Players - Nasdaq, Eex Group, Carbon Trade Exchange, Air Carbon Exchange (Acx), Carbonplace here

News-ID: 3157814 • Views: …

More Releases from SNS Insider

Private Cloud Services Market Forecast Predicts Promising Growth Ahead

Private Cloud Services Market Scope and Overview

The Private Cloud Services Market has witnessed significant growth in recent years, fueled by the increasing adoption of cloud computing technologies across various industries. Private clouds offer enhanced security, control, and customization compared to public cloud services, making them a preferred choice for enterprises seeking to leverage cloud capabilities while maintaining data sovereignty and compliance. This report delves into the competitive landscape, market segmentation,…

Video Surveillance Market Analysis Unveils Insights for Growth and Development

Video Surveillance Market Scope and Overview

The Video Surveillance Market has seen significant growth over the past few decades, driven by advancements in technology and an increasing need for security across various sectors. Video surveillance systems, once primarily used for security purposes, have now expanded their applications to include monitoring, analysis, and even preventive measures in various industries. This report provides a comprehensive analysis of the video surveillance market, covering its…

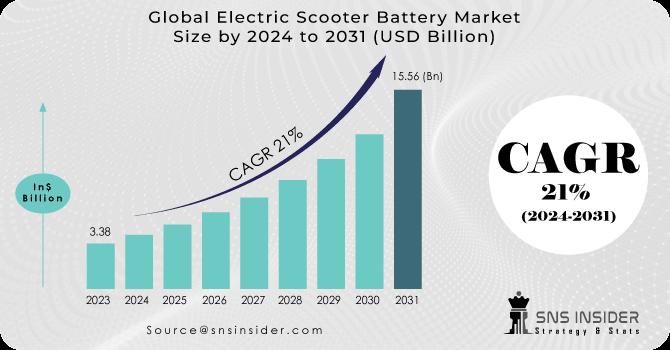

Electric Scooter Battery Market Charges Ahead, Propelling Sustainable Urban Mobi …

The Global Electric Scooter Battery Market is experiencing a remarkable surge, fueled by the rising demand for eco-friendly and convenient transportation solutions in urban environments. As cities around the world grapple with traffic congestion, air pollution, and the need for sustainable mobility, the electric scooter battery market is poised to play a pivotal role in shaping the future of urban transportation. According to a comprehensive market research report, the electric…

Solar-Powered Vehicle Market Accelerates Towards a Sustainable Future, Projected …

The Global Solar-Powered Vehicle Market is rapidly gaining momentum, driven by the urgent need to combat climate change and reduce greenhouse gas emissions. As the world transitions towards a greener and more sustainable future, the adoption of solar-powered vehicles is emerging as a game-changer in the automotive industry. According to a comprehensive market research report, the solar-powered vehicle market, valued at $1.27 billion in 2023, is expected to reach a…

More Releases for Carbon

Carbon-Carbon Composite Market to Reach $3.31 Billion by 2031 | SGL Carbon, Toyo …

NEW YORK, (UNITED STATES) - QY Research latest 'Carbon-Carbon Composite Market 2025 Report' offers an unparalleled, in-depth analysis of the industry, delivering critical market insights that empower businesses to enhance their knowledge and refine their decision-making processes. This meticulously crafted report serves as a catalyst for growth, unlocking immense opportunities for companies to boost their return rates and solidify their competitive edge in an ever-evolving market. What sets this report…

Carbon Black Market Next Big Thing | Cabot, Tokai Carbon, Jiangxi Black Carbon, …

Market Research Forecast published a new research publication on "Global U.S. U.S. Carbon Black Market Insights, to 2030" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study, you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market-associated stakeholders. The growth of the U.S. U.S. Carbon Black Market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive…

Carbon-Carbon Composite Material Market Size, Share 2024, Impressive Industry Gr …

Report Description: -

QY Research's latest report 'Carbon-Carbon Composite Material Market 2024 Report' provides a comprehensive analysis of the industry with market insights will definitely facilitate to increase the knowledge and decision-making skills of the business, thus providing an immense opportunity for growth. Finally, this will increase the return rate and strengthen the competitive advantage within. Since it's a personalised market report, the services are catered to the particular difficulty. The…

Carbon Black Market Scenario & Industry Applications 2020-2025 | Phillips Carbon …

The global carbon black market size is projected to surpass USD 18 billion by 2025. Carbon black act as a reinforcement material for tires and rubber, and possess electrical conductive properties. Carbon black provide pigmentation, conductivity, and UV protection for a number of coating applications along with toners and printing inks for specific color requirements. Its multiple application across various end product along with rising economic outlook has significantly enhanced…

Global Carbon-Carbon Composite Market 2020-2026 SGL Carbon, Toyo Tanso, Tokai Ca …

Global Carbon-Carbon Composite Market 2020-2026 analysis Report offers a comprehensive analysis of the market. It will therefore via depth Qualitative insights, Historical standing and verifiable projections regarding market size. The projections featured inside the report square measure derived victimisation verified analysis methodologies and assumptions. Report provides a progressive summary of the Carbon-Carbon Composite business 2020 together with definitions, classifications, Carbon-Carbon Composite market research, a decent vary of applications and Carbon-Carbon…

Global Carbon Black Market to 2026| Cabot, Orion Engineered Carbons, Birla Carbo …

Albany, NY, 10th January : Recent research and the current scenario as well as future market potential of "Carbon Black Market - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2018 - 2026" globally.

Carbon Black Market - Overview

Carbon black (CB) is manufactured through partial combustion of heavy hydrocarbons under controlled temperature and pressure to obtain fine particles and aggregates having a wide range of structure and surface properties. This…