Press release

Trade Finance Market : Latest Industry Trends, Trades, Supply, Demand, Prospects by 2032

Allied Market Research published a report, titled, "Trade Finance Market by Product Type (Commercial Letters of Credit (LCs), Standby Letters of Credit (LCs), Guarantees, and Others), Provider (Banks, Trade Finance Houses, and Others), Application (Domestic and International), and End User (Traders, Importers, and Exporters): Global Opportunity Analysis and Industry Forecast, 2021-2030." According to the report, the global trade finance industry generated $44.09 billion in 2020, and is estimated to reach $90.21 billion by 2030, witnessing a CAGR of 7.4% from 2021 to 2030.Drivers, restraints, and opportunities

Increase in need for safety and security of trading activities, surge in adoption by small & medium enterprises (SMEs) in developing countries, and new trade agreements drive the growth of the global trade finance market. However, increase in trade wars and high cost of implementation hinder the market growth. On the other hand, integration of blockchain in trade finance creates new opportunities in the coming years.

Download Sample Report: https://www.alliedmarketresearch.com/request-sample/4332

Covid-19 Scenario

The Covid-19 pandemic impacted the capacity of banks in emerging countries to provide trade finance service efficiently. Moreover, there have been massive failures by traders in completing payments.

Many financial institutions such as Bank of America have been focused on trade digitization and innovation for both in-house and in partnership with other fintech firms. The adoption of technologies is expected to increase during the post-pandemic.

The commercial letters of credit (LCs) segment to continue its leadership status during the forecast period

Based on product type, the commercial letters of credit (LCs) segment contributing to the highest share in 2020, accounting for more than two-fifths of the global trade finance market, and is projected to continue its leadership status during the forecast period. This is due to increase in global trade, different laws in each country, language barriers, and difficulty in knowing each party personally. However, the guarantees segment is expected to witness the highest CAGR of 9.0% from 2021 to 2030.

Interested to Procure the Data? Inquire here @ https://www.alliedmarketresearch.com/purchase-enquiry/4332

The importers segment to continue its lead during the forecast period

Based on end user, the importers segment accounted for the highest share in 2020, holding nearly three-fifths of the global trade finance market, and is projected to continue its lead during the forecast period. This is due to rise in operational costs, cutting-edge competition, and incremental risks such as data theft, increase in importers protection, highly publicized market abuse scandals, improper regulatory implementations, and steady expansion in direct trade execution. However, the traders segment is estimated to portray the largest CAGR of 15.5% from 2021 to 2030. This is attributed to availing money before delivery of exports and prevention of financial troubles. Moreover, trade finance improves supply chain efficiency for the traders.

Asia-Pacific, followed by Europe and North America, to maintain its dominant share by 2030

Based on region, Asia-Pacific, followed by Europe and North America, held the highest market share in 2020, accounting for nearly two-fifths of the global trade finance market, and is projected to maintain its dominant share in terms of revenue by 2030. Moreover, this region is projected to manifest the largest CAGR of 10.0% during the forecast period. This is due to increase in demand for trade finance for the security in trading transaction from verticals such as commercial facilities and banks in the region.

Get detailed COVID-19 impact analysis on the Trade Finance Market @ https://www.alliedmarketresearch.com/request-for-customization/4332?reqfor=covid

Leading market players

Asian Development Bank

Bank of America Corporation

BNP Paribas S.A.

Citigroup Inc.

Euler Hermes Group

HSBC Holdings PLC

JPMorgan Chase & Co.

Mitsubishi UFJ Financial Inc.

The Royal Bank of Scotland Group plc

Standard Chartered PLC

Related Reports:

Buy Now Pay Later Market https://www.alliedmarketresearch.com/buy-now-pay-later-market-A12528

Health Insurance Market https://www.alliedmarketresearch.com/health-insurance-market

Trade Credit Insurance Market https://www.alliedmarketresearch.com/trade-credit-insurance-market-A08305

Digital Lending Platform Market https://www.alliedmarketresearch.com/digital-lending-platform-market

Europe Debt Collection Software Market https://www.alliedmarketresearch.com/europe-debt-collection-software-market

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

Follow us on LinkedIn and Twitter

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

Pawan Kumar, the CEO of Allied Market Research, is leading the organization toward providing high-quality data and insights. We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Trade Finance Market : Latest Industry Trends, Trades, Supply, Demand, Prospects by 2032 here

News-ID: 3092263 • Views: …

More Releases from Allied Market Research

Mortar Ammunition Market Demand, Growth Opportunities, Analysis by Top Key Playe …

Mortar ammunitions are stealth, robust and modern devices that can launch to a counter at short and low nearing activities. Modern-age mortars are light in weight and portable in nature. These ammunitions generally come in two types: fin-stabilized and spin-stabilized. Fin-Stabilized projectiles obtain stability through use of fins located at the aft of projectile. Spin-stabilized projectile technology has been used for aerodynamic stabilization. Glided path is auto-tracked and spinning creates…

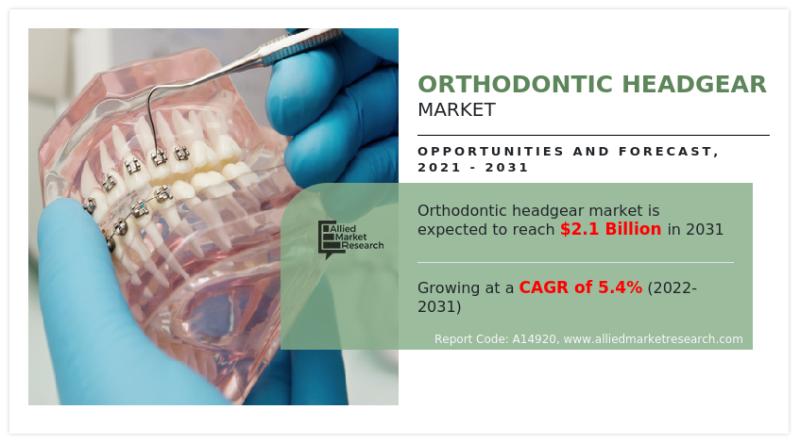

Orthodontic Headgear Market is Projected to Reach $2,094.00 Million by 2031, Gro …

The Orthodontic Headgear Market is a dynamic and integral segment of the orthodontic industry, playing a pivotal role in the correction of malocclusions and the alignment of teeth. Orthodontic headgear is a crucial orthodontic appliance used to address a wide range of dental and skeletal irregularities, such as overbites, underbites, and spacing issues. This market is witnessing substantial growth as orthodontic treatments become increasingly popular for both functional and cosmetic…

Olive Oil Market Analysis, Size, Growth, Trends, Segmentation, Opportunity and F …

The global olive oil industry was valued at $18,552.6 million in 2022, and is projected to reach $30,196.4 million by 2032, registering a CAGR of 5.2% from 2023 to 2032.

The olive oil market has experienced significant growth driven by several prime determinants. The increase in awareness and adoption of healthier lifestyles have led consumers to seek alternatives to traditional cooking oils, with olive oil being recognized for its numerous health…

Hotel Toiletries Market Revenue is expected to Surpass $50.5 billion by 2031

The hotel toiletries market was valued at $17.9 billion in 2021, and is estimated to reach $50.5 billion by 2031, growing at a CAGR of 10.8% from 2022 to 2031.

Get Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/75060

There is a greater demand for hotel toiletries with the growth of the tourism industry and the rise in international travel. Improved transportation, economic growth, globalization, technology advancements, and other initiatives have…

More Releases for Trade

Trade Intelligence for Global Trade: Benchmarking Competitors with Verified Trad …

In the modern supply chain battlefield, knowledge is not just power-it's leverage. Understanding how your competitors move in the global trade space can make the difference between a strategic win and a costly misstep. Yet, many companies still rely on fragmented or outdated information, missing out on key shifts that trade intelligence platforms can now uncover easily.

The Blind Spot in Traditional Competitive Research

Traditional competitor analysis typically relies on market reports,…

Decoding Chongqing's Cross-Border Trade through the Yumaotong Smart Trade Platfo …

Since its launch on May 13, the New Western International Land - Sea Corridor - Yumaotong Smart Trade Platform (hereinafter referred to as the 'Yumaotong Smart Trade Platform') has welcomed 420 enterprises, including over 100 foreign companies. At the 7th Western China International Fair held in Chongqing on May 22, Deng Ai, head of the platform, said that it offered global businesses a one-stop, full-chain, professional service from capturing trade…

Trade Show Displays: Maximizing Your Trade Show Booth Design

Trade shows are a critical aspect of any business that wants to showcase its products, services, and brand to potential customers, partners, and investors. Trade show displays are one of the most crucial elements in trade show marketing, and they play a significant role in determining the success of a company's presence at a trade show. In this article, we'll explore the different types of displays for trade shows and…

The future of international trade and worldwide network: Global Trade Plaza

The future of international trade and worldwide network: Global Trade Plaza

A radical change to support continuous growth in supply traffic.

Connecting all manufacturers, suppliers, traders, exporters, and importers.

Open the door to the future of safe international trade.

B2B marketplace Global Trade Plaza wants to redefine the supply chain. The growth due to digitalization has touched multiple fields, but couldn't do much for the intercountry supply. We are here with…

US-China trade war shifting cement seaborne trade flows

In 2018, the total number of active cement carriers surpassed 360 units, with the total dead weight tonnage topping 2.7 million, the highest figure recorded since 2010.

According to CW Research’s 2019 update of the World Cement, Clinker & Slag Sea-Based Trade Report, the upward trend was underpinned by a growing demand for cement carriers in key domestic trade markets.

Specialized cement carriers move about 25 million tons of cement per…

Suisse Trade – Holding Trade Seminar in Tokyo in December 2016

Suisse Trade is a full-fledged Forex trading firm that is renowned worldwide for rendering clients with the best assistance in commodity and Forex based trading. The company has been consistently successful in presenting clients with the most formidable instruments to trade in currency and commodities markets. The tasks undertaken by the company also involve spot and cash trades, limited risk options on futures as well as contracts. It has always…