Press release

AI in Banking Market : Latest Industry Trends, Trades, Supply, Demand, Prospects by 2032

Allied Market Research published a report, titled, "AI in Banking Market by Component (Solution and Service), Enterprise Size (Large Enterprise and SMEs), Applications (Risk Management Compliance & Security, Customer Service, Back Office/Operations, Financial Advisory and Others) and Technology (Machine Learning & Deep Learning, Natural Language Processing (NLP), Computer Vision and Others): Global Opportunity Analysis and Industry Forecast, 2021-2030."According to the report published by Allied Market Research, the global AI in banking market was estimated at $3.88 billion in 2020 and is expected to hit $64.03 billion by 2030, registering a CAGR of 32.6% from 2021 to 2030.Drivers, restraints, and opportunities-

Rise in investment by banking companies in AI and machine learning, surge in preference for personalized financial services, and increase in collaboration between financial institutes and AI & machine learning solution companies drive the growth of the global AI in banking market. On the other hand, higher deployment cost of AI and machine learning and lack of skilled labor restrain the growth to some extent. However, upsurge in government initiatives and growing investments to leverage the AI technology are expected to create lucrative opportunities in the industry.

Download Sample Report @ https://www.alliedmarketresearch.com/request-sample/12236

COVID-19 scenario-

The outbreak of COVID-19 is anticipated to have a positive impact on growth of AI in banking market. This is attributed to rise in demand for anti-money laundering (AML) and fraud detection solutions during the pandemic situation.

At the same time, with the significant rise in digitization among both the financial institutes and end users, the demand for AI technology has been increased so as to reduce the load on the banking servers, thereby easing up transaction delays throughout this unprecedented time.

Buy Now with 15% Discount@ https://www.alliedmarketresearch.com/checkout-final/ad5e6b89b508bb3cc59fa2db8842b589

The Customer Relationship Management (CRM) segment to retain the lion's share-

On the basis of solution type, the Customer Relationship Management (CRM) segment held the major share in 2020, garnering nearly one-fifth of the global AI in banking market. The same segment is also projected to cite the fastest CAGR of 34.0% throughout the forecast period. Growing need for CRM solution to gain deeper insights into customer's habits and personal preferences drives the segment growth.

The machine learning & deep learning segment to dominate by 2030-

On the basis of technology, the machine learning & deep learning segment contributed to the lion's share in 2020, holding around one-third of the global AI in banking market. However, the same segment is also expected to cite the fastest CAGR of 33.5% from 2021 to 2030. This is attributed to increase in adoption of machine learning among banking institutes to support artificial intelligence software developed by various companies to improve their bias decisions while doing critical jobs.

North America held the major share in 2020-

By region, the market across North America dominated in 2020, garnering more than two-fifths of the global AI in banking market, owing to increase in demand for advanced analytics in this province. Simultaneously, the Asia-Pacific region is expected to cite the fastest CAGR of 34.3% throughout the forecast period. This is due to increase in investment by banks across China, Japan, and India for analyzing loan sanction patterns.

Key players in the industry-

BigML, Inc.

Cisco Systems, Inc.

Fair Isaac Corporation

SAP SE

Hewlett Packard Enterprise Development LP

SAS Institute Inc.

International Business Machines Corporation

Amazon Web Services Inc.

Microsoft Corporation

RapidMiner, Inc.

Interested to Procure the Data? Inquire Here @ https://www.alliedmarketresearch.com/purchase-enquiry/12236

Buy Similar Insights and Get a 15% Discount:

Data Analytics in Banking Market https://www.alliedmarketresearch.com/data-analytics-in-banking-market-A16647

AI in Fintech Market https://www.alliedmarketresearch.com/ai-in-fintech-market-A16644

Finance Cloud Market https://www.alliedmarketresearch.com/finance-cloud-market-A12545

Fire Insurance Market https://www.alliedmarketresearch.com/fire-insurance-market-A11106

Insurance Analytics Market https://www.alliedmarketresearch.com/insurance-analytics-market-A07602

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

Follow us on LinkedIn and Twitter

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

Pawan Kumar, the CEO of Allied Market Research, is leading the organization toward providing high-quality data and insights. We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release AI in Banking Market : Latest Industry Trends, Trades, Supply, Demand, Prospects by 2032 here

News-ID: 3090932 • Views: …

More Releases from Allied Market Research

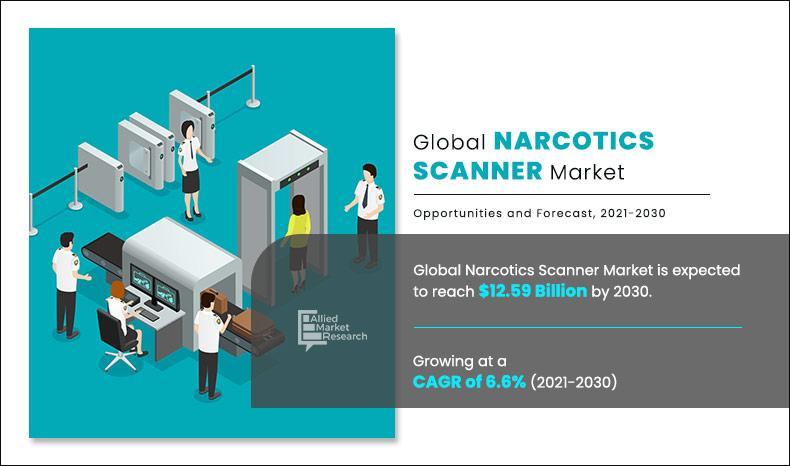

Narcotics Scanner Market Analysis and Forecast with a CAGR of 6.6% (2021-2030)

Narcotics scanner market size was valued at $6.89 billion in 2020, and is projected to reach $12.59 billion by 2030, registering with a CAGR of 6.6% from 2021 to 2030.

The growth of the global narcotics scanner market is driven by surge in consumption of drugs and related materials across the globe and modernization of the law enforcement agencies in developing countries. Growing requirement for improved security against the narcotics threats…

Herbal Die tary Supplement Market Size, Industry Analysis, Growth Drivers, Oppor …

The herbal die tary supplement market size was valued at $11 billion in 2022, and is estimated to reach $21.4 billion by 2032, growing at a CAGR of 7.1% from 2023 to 2032.

Herbal die tary supplements are natural items made from plants or plant extracts that are taken to supplement the diet and improve health and well-being. These supplements frequently contain a combination of vitamins, minerals, amino acids, and other…

Mobile Application Security Market Growing at 26.3% CAGR Reach USD 37.1 Billion …

Allied Market Research published a new report, titled, "Mobile Application Security Market Growing at 26.3% CAGR Reach USD 37.1 Billion by 2032." The report offers an extensive analysis of key growth strategies, drivers, opportunities, key segments, Porter's Five Forces analysis, and competitive landscape. This study is a helpful source of information for market players, investors, VPs, stakeholders, and new entrants to gain a thorough understanding of the industry and determine…

MarTech Market Witnessing CAGR of 18.5% Hit USD 1.7 Trillion by 2032

The global marketing technology market is experiencing growth due to several factors, including the increasing digital transformation, the surge in demand for personalized experience, and the proliferation of automation and efficiency. However, data privacy and compliance, and the high cost of implementation are expected to hamper market growth. Furthermore, the growing integration of AI and ML technologies and the increase in demand for real-time marketing are anticipated to provide lucrative…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…