Press release

United States Bancassurance Market Size To Hit US$ 60.3 Billion By 2028, at CAGR of 5.2%

IMARC Group, a leading market research company, has released a report titled "United States Bancassurance Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2023-2028", According to the report, The United States bancassurance market size reached US$ 44.0 Billion in 2022. Looking forward, IMARC Group expects the market to reach US$ 60.3 Billion by 2028, exhibiting a growth rate (CAGR) of 5.2% during 2023-2028.Bancassurance refers to an affiliation between a bank and insurance firm that permits the organization to offer various insurance plans, products, and services. It is widely employed in the banking, financial services, and insurance (BFSI) industry for improving the overall sales, profit, and product portfolios offered by a firm. Bancassurance can be differentiated into two approaches, including integrated and non-integrated models. Amongst these, the integrated model is associated with banks whereas, the non-integrated model is joint with the official financial service.

Request for a free sample copy of this report: https://www.imarcgroup.com/united-states-bancassurance-market/requestsample

United States Bancassurance Market Trends and Drivers:

Numerous initiatives undertaken by the Federal Government of the United States to improve the BFSI industry infrastructure are majorly driving the United States bancassurance market. The rising requirement for effective insurance policies amongst the geriatric population is further contributing the market growth. Other than this, the increasing utilization of smart devices across different financial institutions, such as smartphones, computers, and laptops, is increasingly influencing consumer purchasing patterns, which is creating a positive outlook for the market across the country.

Report Segmentation:

The report has segmented the market into the following categories:

Breakup by Product Type:

Life Bancassurance

Non-Life Bancassurance

Breakup by Model Type:

Pure Distributor

Exclusive Partnership

Financial Holding

Joint Venture

Breakup by Region:

Northeast

Midwest

South

West

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Analyst for Customization and Browse full report with TOC & List of Figure: https://www.imarcgroup.com/united-states-bancassurance-market

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

Contact US

IMARC Group

Email: sales@imarcgroup.com

USA: +1-631-791-1145 | Asia: +91-120-433-0800

Address: 134 N 4th St. Brooklyn, NY 11249, USA

Follow us on Twitter: @imarcglobal

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release United States Bancassurance Market Size To Hit US$ 60.3 Billion By 2028, at CAGR of 5.2% here

News-ID: 3036027 • Views: …

More Releases from IMARC Group

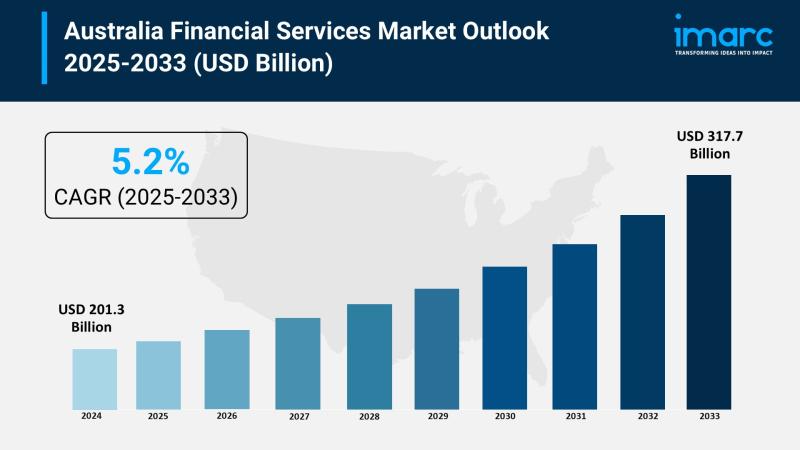

Australia Financial Services Market 2025 | Worth USD 317.7 Billion to 2025-2033

Market Overview

The Australia financial services market size reached USD 201.3 Billion in 2024 and is projected to grow to USD 317.7 Billion by 2033. The market is expected to expand steadily with a compound annual growth rate of 5.2% during the forecast period from 2025 to 2033. Key factors driving this growth include the rising demand for digital banking, regulatory advancements, strong economic performance, increasing fintech investments, and enhanced consumer…

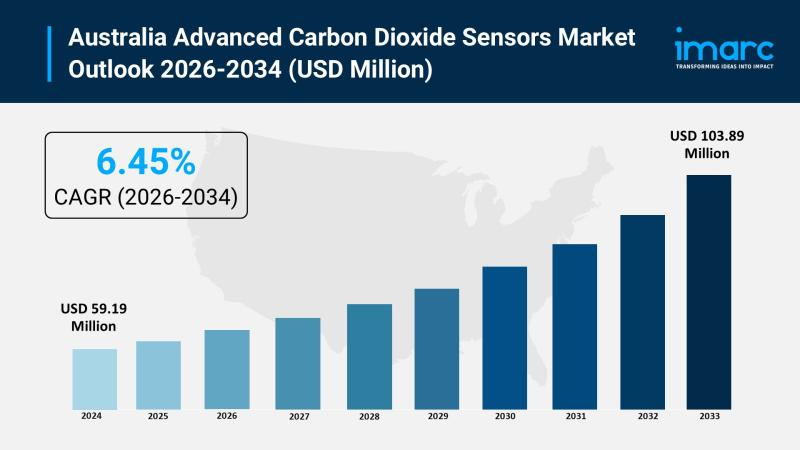

Australia Advanced Carbon Dioxide Sensors Market | Worth USD 103.89 Million 2026 …

Market Overview

The Australia advanced carbon dioxide sensors market size was USD 59.19 Million in 2025 and is expected to grow to USD 103.89 Million by 2034. The market growth is driven by strong government-led emissions reduction policies, enhanced building standards for CO2 monitoring, and the integration of IoT-enabled sensor technologies in smart buildings. These trends are supported by increased focus on indoor air quality and workplace health, fueling innovation in…

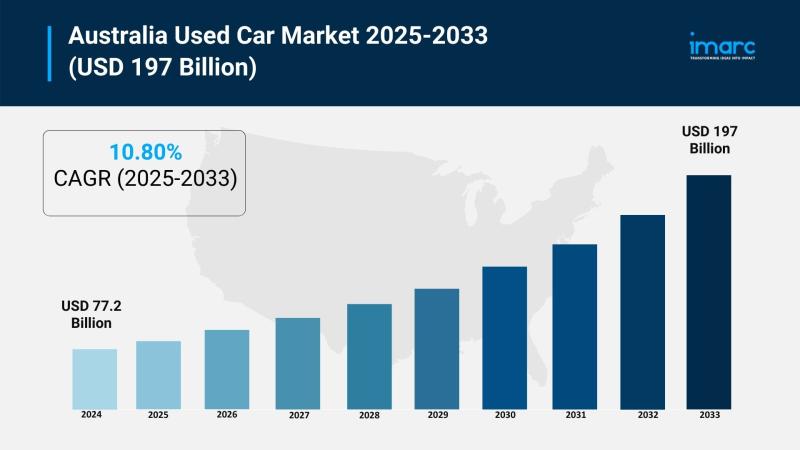

Australia Used Car Market Projected to Reach USD 197 Billion by 2033

Market Overview

The Australia used car market was valued at USD 77.2 Billion in 2024 and is projected to reach USD 197 Billion by 2033. The market is experiencing strong growth driven by affordability concerns, rising demand for reliable pre-owned vehicles, and the increasing role of digital platforms that simplify transactions. Economic pressures and the shift toward cost-effective vehicle options are further accelerating expansion, making the used car market a vital…

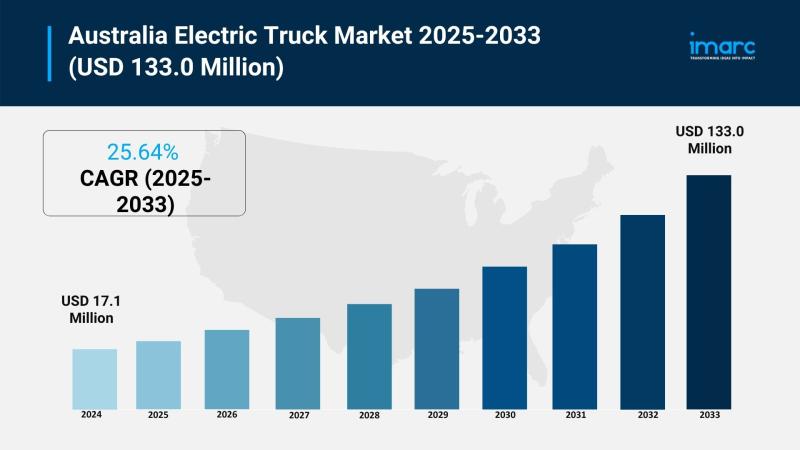

Australia Electric Truck Market Projected to Reach USD 133.0 Million by 2033

Market Overview

The Australia electric truck market reached USD 17.1 Million in 2024 and is projected to expand to USD 133.0 Million by 2033. With a forecast period spanning 2025 to 2033, the market is growing significantly due to stringent government emissions regulations, rising fuel costs, and advancements in battery and charging infrastructure technologies. Investments in fleet electrification and sustainable transport solutions are further driving market share growth. For further details,…

More Releases for Bancassurance

Bancassurance Market: An Extensive Analysis Predicts Significant Future Growth

According to USD Analytics the Global Bancassurance Market is projected to register a high CAGR from 2025 to 2034.

The latest study released on the Global Bancassurance Market by USD Analytics Market evaluates market size, trend, and forecast to 2034. The Bancassurance market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study…

Bancassurance Products Market 2025: A Decade of Phenomenal Growth Ahead

The Bancassurance Products Market 2025-2033 report provides a comprehensive analysis of Types (Life Insurance, Non-life Insurance), Application (Aldult, Child, Others), Analysis of Industry Trends, Growth, and Opportunities, R&D landscape, Data security and privacy concerns Risk Analysis, Pipeline Products, Assumptions, Research Timelines, Secondary Research and Primary Research, Key Insights from Industry Experts, Regional Outlook and Forecast, 2025-2033.

Major Players of Bancassurance Products Market are:

ABN AMRO Bank, ANZ, Banco Bradesco, American Express, Banco Santander,…

GCC Bancassurance Market 2024: Trends, Growth Drivers, and Opportunities

The Business Research Company recently released a comprehensive report on the Global Food Inclusions Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

According to The Business Research Company's, The food inclusions market size…

Bancassurance Market Growth, Size, Trends,Share Analysis 2024-2033

"The Business Research Company recently released a comprehensive report on the Global Bancassurance Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…

Global Bancassurance Market Professional 2027-

Global Bancassurance Market Size Is Projected To Reach US$ 2291.7 Million By 2027, From US$ 2008.8 Million In 2020, At A CAGR Of 1.9% During 2021-2027

QY Research recently published a research report titled, "Global Bancassurance Market Report, History and Forecast , Breakdown Data by Manufacturers, Key Regions, Types and Application". The research report attempts to give a holistic overview of the Bancassurance market by keeping the information simple, relevant, accurate,…

Bancassurance Technology Market To Incur Rapid Extension During 2020-2025

Global Bancassurance Technology Market essentials: an introduction of the market, characterizations, types, applications and supply chain scenario; Bancassurance Technology industry approaches and designs; type details; producing forms; cost structures. It also informs global fundamental regions economic situations, including the Bancassurance Technology product value, benefit, restraints, generation, demand and supply, and Bancassurance Technology industry development rate and so on. The report presents SWOT and Bancassurance Technology PESTEL analysis, speculation plausibility, and…