Press release

Online Banking Market is Booming Due to Increasing Use of Mobile Phone And The Internet | SNS Insider

Online Banking Market Overview:Since it provides a detailed market assessment across significant geographies like North America, Europe, Asia Pacific, Middle East, Latin America, and the Rest of the World, the study is helpful for existing companies, prospective entrants, and potential investors. The most recent Online Banking Market analysis evaluates worldwide and regional market estimations and predictions for all of the segments covered within the research scope. The methodology estimates revenue using historical market data. This study covers market trends, leading firms, supply chain trends, technological advancements, key developments, and future business plans.

The Online Banking Market data were created using both primary and secondary sources. The market size is calculated using sales revenue from each segment and sub segment included in the study's scope. The market sizing analysis employs both top-down and bottom-up approaches for data validation and accuracy checks. To provide a thorough and in-depth overview of the market, other aspects of the industry have been assessed, including the supply chain, downstream buyers, and sourcing strategy. Additionally, market positioning research, which considers factors like target consumer, brand strategy, and pricing plan, will be presented to study buyers.

"As per the SNS Insider Research, the Online Banking Market was valued at US$ 18.94 Bn in 2022, and is projected to reach US$ 47.24 Bn by 2030, with growing healthy CAGR of 12.1% over the Forecast Period 2023-2030."

Get a Sample Report of Online Banking Market 2022 @ https://www.snsinsider.com/sample-request/1233

Major Key players:

• ACI Worldwide

• Microsoft Corporation

• Fiserv, Inc

• Tata Consultancy Services

• Cor Financial Solutions Ltd

• Oracle Corporation

• Temenos Group AG

• Rockall Technologies

• EdgeVerve Systems Limited

Market Segmentation:

As there is substantial capacity for expansion in the Online Banking Market, there will be several opportunities for market participants to seize them. The study's segment analysis will help identify how each category will affect market growth over the coming years. The market report has segmented the market by type, application, end-use, and geography.

Market Segmentation and Sub-Segmentation included are:

By Type:

• Informational services

• Transactional services

• Communicative services

By Software:

• Customized software

• Standard software

By Banking Type:

• Retail Banking

• Corporate Banking

• Investment Banking

By Service Type:

• Payments

• Processing Services

• Customer & Channel Management

• Wealth Management

• Others

Enquire about the Report @ https://www.snsinsider.com/enquiry/1233

Competitive Outlook:

The research includes current business summaries, gross margins, selling prices, sales income, sales volume, product specifications with pictures, and contact details for each of the market's top rivals. The viability of new projects that might succeed in the global market in the near future is highlighted in a descriptive section in the report's conclusion, along with the market's overall scope in terms of investment feasibility in several Online Banking market segments.

Key Highlights of the Online Banking Market Report:

• How COVID-19 affects business operations and revenue generation in the target market.

• Outlining in detail the factors that would restrain the market's expansion.

• Reliable predictions of upcoming trends and perceptible changes in consumer behavior.

• Detailed information on the elements that may influence market expansion in the upcoming years.

• A comprehensive analysis of the market's competitive environment and in-depth data on each provider.

Get complete report details @ https://www.snsinsider.com/reports/online-banking-market-1233

Table of Contents - Major Key Points:

1. Introduction

2. Research Methodology

3. Market Dynamics

4. Impact Analysis

5. Value Chain Analysis

6. Porter's 5 Forces Model

7. PEST Analysis

8. Online Banking Market Segmentation, By Type

9. Online Banking Market Segmentation, By Software

10. Online Banking Market Segmentation, By Banking Type

11. Online Banking Market Segmentation, By Service Type

12. Regional Analysis

13. Company Profiles

14. Competitive Landscape

15. Conclusion

Buy Single User PDF of Online Banking Market Report @ https://www.snsinsider.com/checkout/1233

Contact Us:

Akash Anand

Head of Business Development & Strategy

info@snsinsider.com

Office No.305-B, Arissa Avenue, Fountain Road, Kharadi, Pune, Maharashtra 411014

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Our staff is dedicated to giving our clients reliable information, and with expertise working in the majority of industrial sectors, we're proud to be recognized as one of the world's top market research firms. We can quickly design and implement pertinent research programs, including surveys and focus groups, and we have the resources and competence to deal with clients in practically any company sector.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Online Banking Market is Booming Due to Increasing Use of Mobile Phone And The Internet | SNS Insider here

News-ID: 2987641 • Views: …

More Releases from SNS Insider

Private Cloud Services Market Forecast Predicts Promising Growth Ahead

Private Cloud Services Market Scope and Overview

The Private Cloud Services Market has witnessed significant growth in recent years, fueled by the increasing adoption of cloud computing technologies across various industries. Private clouds offer enhanced security, control, and customization compared to public cloud services, making them a preferred choice for enterprises seeking to leverage cloud capabilities while maintaining data sovereignty and compliance. This report delves into the competitive landscape, market segmentation,…

Video Surveillance Market Analysis Unveils Insights for Growth and Development

Video Surveillance Market Scope and Overview

The Video Surveillance Market has seen significant growth over the past few decades, driven by advancements in technology and an increasing need for security across various sectors. Video surveillance systems, once primarily used for security purposes, have now expanded their applications to include monitoring, analysis, and even preventive measures in various industries. This report provides a comprehensive analysis of the video surveillance market, covering its…

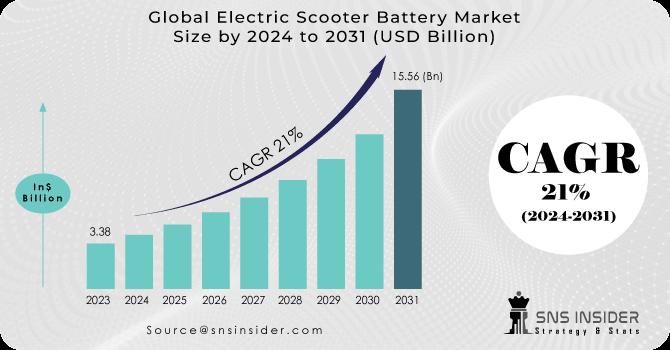

Electric Scooter Battery Market Charges Ahead, Propelling Sustainable Urban Mobi …

The Global Electric Scooter Battery Market is experiencing a remarkable surge, fueled by the rising demand for eco-friendly and convenient transportation solutions in urban environments. As cities around the world grapple with traffic congestion, air pollution, and the need for sustainable mobility, the electric scooter battery market is poised to play a pivotal role in shaping the future of urban transportation. According to a comprehensive market research report, the electric…

Solar-Powered Vehicle Market Accelerates Towards a Sustainable Future, Projected …

The Global Solar-Powered Vehicle Market is rapidly gaining momentum, driven by the urgent need to combat climate change and reduce greenhouse gas emissions. As the world transitions towards a greener and more sustainable future, the adoption of solar-powered vehicles is emerging as a game-changer in the automotive industry. According to a comprehensive market research report, the solar-powered vehicle market, valued at $1.27 billion in 2023, is expected to reach a…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…