Press release

Cyber Insurance Market Expected to Reach US$ 31.7 Billion by 2028 | IMARC Group

According to the latest report by IMARC Group "Cyber Insurance Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2023-2028", The global cyber insurance market size reached US$ 9.8 Billion in 2022. Looking forward, IMARC Group expects the market to reach US$ 31.7 Billion by 2028, exhibiting a growth rate (CAGR) of 22.39% during 2023-2028. This report can serve as an excellent guide for investors, researchers, consultants, marketing strategists and all those who are planning to foray into the market in any form.Cyber insurance is a service that protects businesses against digital threats, such as malicious hacks, data breaches, malware, distributed denial-of-service (DDoS), malware, and ransomware. It also provides financial coverage for sensitive customer information, including credit cards, health records and social security, account, and driver's license numbers. It informs customers about cybersecurity incidents, recovers compromised data, restores their identities, and repairs damaged computer systems. Nowadays, various insurers worldwide are offering personalized plans depending on business requirements. These plans cover legal expenses and fees for physical damage and income loss.

Note: We are regularly tracking the direct effect of COVID-19 on the market, along with the indirect influence of associated industries. These observations will be integrated into the report.

Get a PDF Sample for more detailed market insights: https://www.imarcgroup.com/cyber-insurance-market/requestsample

Cyber Insurance Market Trends and Drivers:

The growing use of electronic devices for storing data is making organizations more vulnerable to cyber-attacks and data breaches. This is primarily influencing the demand for cyber insurance to recover the costs, resume core operations, and stabilize the company. As it also helps the company safeguard themselves against infringement of networks and sensitive data, cyber insurance is finding widespread application in small and medium-sized enterprises (SMEs). Apart from this, governing bodies of various countries are implementing stringent policies for improving user privacy rights and security. This is anticipated to further strengthen the market growth in the coming years.

Competitive Landscape:

The competitive landscape of the market has been studied in the report with the detailed profiles of the key players operating in the market.

Some of the key players operating in the market are:

Allianz SE

American International Group Inc.

AON Plc

AXA XL

Berkshire Hathaway Inc.

Chubb Limited (ACE Limited)

Lockton Companie

Munich Re

Society of Lloyd's

Zurich Insurance Group.

For more information about this report visit: https://www.imarcgroup.com/cyber-insurance-market

The report has segmented the market on the basis of Product Type, Distribution Channel, and Region.

Breakup by Component:

Solution

Services

Breakup by Insurance Type:

Packaged

Stand-alone

Breakup by Organization Size:

Small and Medium Enterprises

Large Enterprises

Breakup by End Use Industry:

BFSI

Healthcare

IT and Telecom

Retail

Others

Market Breakup by Region:

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

If you want latest primary and secondary data (2023-2028) with Cost Module, Business Strategy, Distribution Channel, etc. Click request free sample report, published report will be delivered to you in PDF format via email within 24 to 48 hours of receiving full payment.

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

Contact US

IMARC Group

30 N Gould St Ste R

Sheridan, WY 82801 USA - Wyoming

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Americas:- +1 631 791 1145 | Africa and Europe :- +44-702-409-7331 | Asia: +91-120-433-0800, +91-120-433-0800

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cyber Insurance Market Expected to Reach US$ 31.7 Billion by 2028 | IMARC Group here

News-ID: 2917667 • Views: …

More Releases from IMARC Group

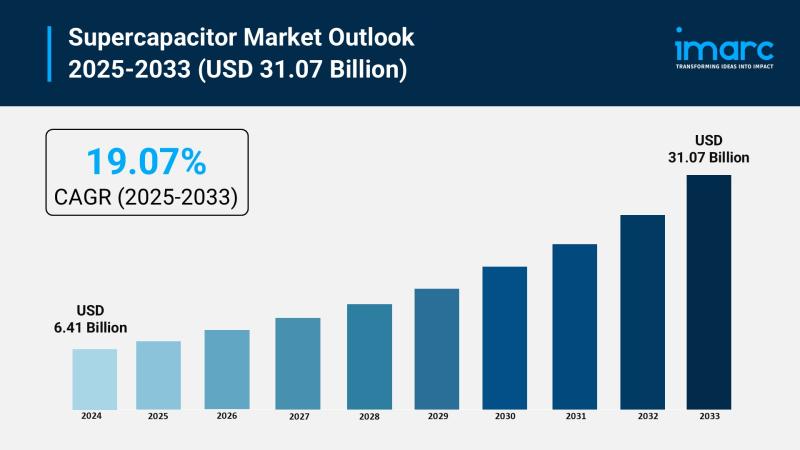

Supercapacitor Market Size to Reach $31.07B by 2033: Trends & Opportunities

Market Overview:

The supercapacitor market is experiencing rapid growth, driven by electrification of automotive systems, renewable energy and grid stabilization, and expansion of industrial automation and robotics. According to IMARC Group's latest research publication, "Supercapacitor Market Size, Share, Trends and Forecast by Product Type, Module Type, Material Type, End Use Industry, and Region, 2025-2033", the global supercapacitor market size was valued at USD 6.41 Billion in 2024. Looking forward, IMARC Group…

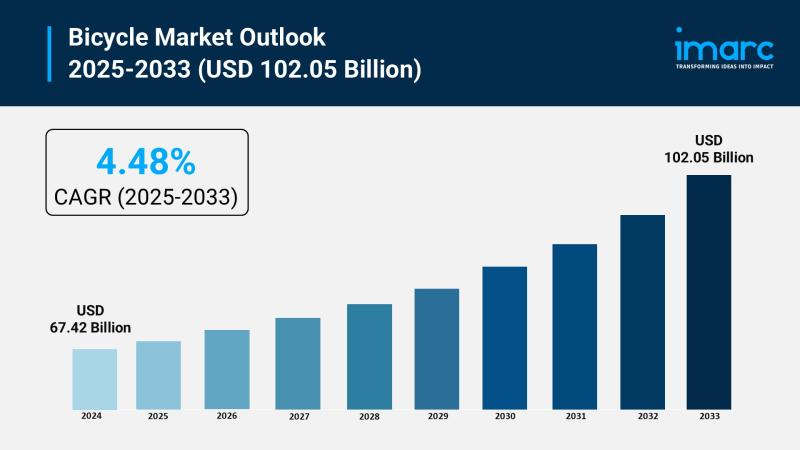

Bicycle Market Size to Surpass $102.05B by 2033: Growth & Insights

Market Overview:

The bicycle market is experiencing rapid growth, driven by global expansion of cycling infrastructure, rising health consciousness and preventative wellness, and technological advancements in e-bike propulsion. According to IMARC Group's latest research publication, "Bicycle Market Size, Share, Trends and Forecast by Type, Technology, Price, Distribution Channel, End User, and Region, 2025-2033", The global bicycle market size was valued at USD 67.42 Billion in 2024. Looking forward, IMARC Group estimates…

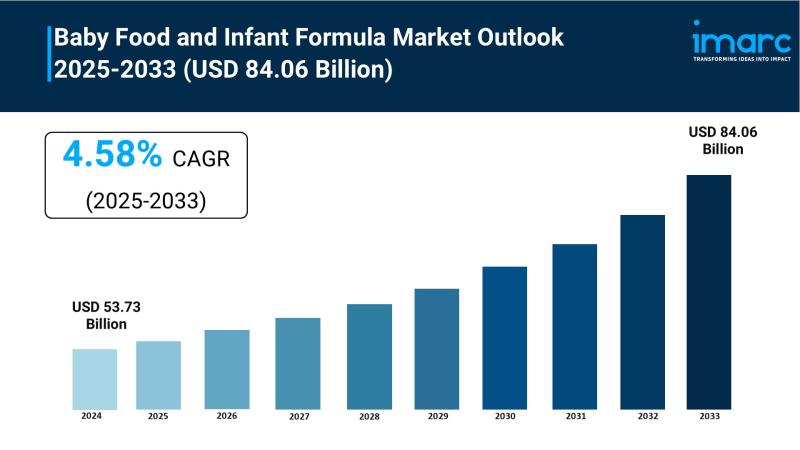

Baby Food and Infant Formula Market to Reach USD 84.06 Billion by 2033, Growing …

Market Overview:

The Baby Food and Infant Formula Market is experiencing steady expansion, driven by Increasing Awareness of Nutritional Needs for Infants, Rising Number of Working Women, and Technological Advancements and Product Innovation. According to IMARC Group's latest research publication, "Baby Food and Infant Formula Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global baby food and infant formula market size reached USD 53.73 Billion in 2024.…

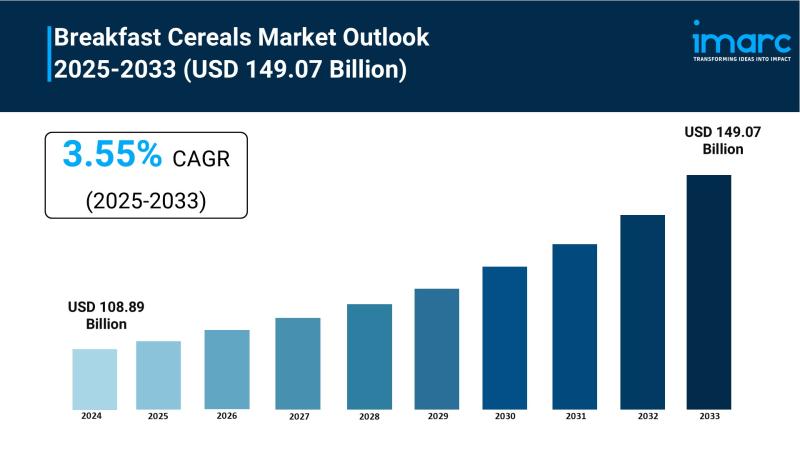

Breakfast Cereals Market to Reach USD 149.07 Billion by 2033, Growing at a CAGR …

Market Overview:

The Breakfast Cereals Market is experiencing rapid growth, driven by Health and Wellness Awareness, Busy Lifestyles and On-the-Go Demand and Rising Disposable Incomes and Global Market Expansion . According to IMARC Group's latest research publication, "Breakfast Cereals Market : Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global breakfast cereals market size was valued at USD 108.89 Billion in 2024. Looking forward, IMARC Group estimates…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…