Press release

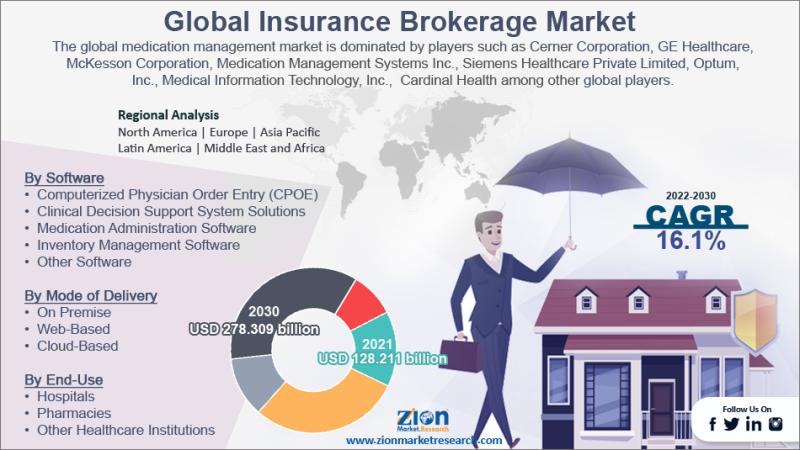

Global Insurance Brokerage Market Size to Grow USD 278.309 Billion By 2030: Zion Market Research

The global insurance brokerage market size was worth around USD 128.21 Billion in 2021 and is predicted to grow to around USD 278.30 Billion by 2030 with a compound annual growth rate (CAGR) of Roughly 16.1% between 2022 and 2030.Insurance brokerage refers to the profession of financial advisers specially dedicated to the insurance segment. It is run by people called insurance brokers that act as an intermediary between an insurance company and the insurance buyer which can either be an individual or a commercial establishment. To register as an insurance broker or to run an insurance brokerage firm, every country has its sets of rules and regulations that have to be abided by. To cover insurance agents and brokers under one umbrella, the most commonly used term is insurance producers. Insurance brokers talk or negotiate on the behalf of insurance buyers, unlike insurance agents who work for insurance companies.

Browse Press Release - https://www.zionmarketresearch.com/news/global-insurance-brokerage-market

Companies or people working in this financial segment earn through the means of commission, the percentage of which may vary between nations or sometimes within states in the name country. Although the insurance broker earns commission from the insurance company, their best interest lies in the benefit of the insurance buyer and hence they can be more trusted. Furthermore, insurance brokerage companies earn financial gains by providing consulting or advisory services.

The global insurance brokerage market is expected to benefit from the rising number of insurance companies across the world. Since the market is full of multiple players offering varied types of insurance policies with sometimes confusing clauses, terms, and conditions, it can get intimidating for insurance buyers, especially when they are buying it for the first time. Insurance, in general, is an intimidating aspect for many buyers and they prefer to obtain some advice from a knowledgeable and experienced entity before investing in the same. With the growth in the number of insurance providers, the demand for insurance brokers is at an all-time high since they are expected to conduct research and analysis before submitting recommendations to the clients of finalizing a deal.

Additionally, the generally rising demand for health insurance along with growth in post-purchase services are expected to act as growth contributors in the global market. The growing number of independent players in underdeveloped economies as well as the exhaustive measures undertaken by dominant players to create a larger consumer database could also contribute to the global market growth.

One of the key global market restraints is the general perception of consumers about the profession in general since insurance brokers do not work for particular companies. They act as independent entities and hence many people do not trust them with financial services. On the more technical side, the global market could register certain growth limitations due to the growing research on artificial intelligence which is projected to overtake the insurance broker profession by the end of the decade, as many analysts.

Request Free Sample Report @ https://www.zionmarketresearch.com/sample/insurance-broking-market

The growing demand for vehicle insurance may provide growth opportunities whereas direct purchasing by consumers could act as a major challenge

The global insurance brokerage market is segmented based on mode, type, end-user, and region

Based on type, the global market is segmented into general insurance, life insurance, health insurance, and others

The global market was dominated by the life insurance segment in 2021 due to the simplicity and permanent solution such insurance provides to people with families and loved ones

Majority of people tend to pay premiums for whole life insurance which covers a larger aspect of life

The health insurance segment is expected to contribute significantly mostly driven by rising corporate efforts toward human resources

For instance, Arthrex is known to pay almost 100% of employee insurance coverage and 50% for spouse insurance coverage

Based on end-user, the global market is divided into individuals and corporate

The segmental growth was driven by the corporate segment in 2021 and it is majorly because corporations and businesses tend to invest in multi-million dollar insurance schemes for various projects. Such transactions are better dealt with the intervention of a third party who has a better hold over the insurance market

Individual insurance policy takers may find insurance agents as fitting assistance

In 2019, Marsh & McLennan registered an annual revenue of USD 16.7 billion

North America is projected to lead the global insurance brokerage market as it has in previous years with the United States acting as the main contributor. The growth is driven by the growing government initiatives to encourage insurance schemes in the country for its population along with the already existing and completely functional insurance programs. Furthermore, the US is home to some of the most dominant financial advisory companies running in the segment. Factors like increasing unpredicted incidents causing loss of lives, and assets, growing disposable income allowing people to spend on other non-basic essentials, growing government initiative to promote insurance buying for medical or non-medical purposes, and the rapid adoption of advanced technology to promote insurance brokerage over online channels are projected to help the global market growth further. Given the benefits of using insurance brokerage, the end consumers could prefer opting for them instead of insurance clients.

This review is based on a report by Zion Market Research, titled "Insurance Brokerage Market By Mode (Online and Offline), By Type (General Insurance, Life Insurance, Health Insurance, and Others), By End-User (Individuals and Corporate), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2022 - 2030."- Report at https://www.zionmarketresearch.com/report/insurance-broking-market

Key Market Players & Competitive Landscape

The global insurance brokerage market is led by players like:

Marsh and McLennan Companies Inc.

Alliant Insurance Services Inc.

HUB International Ltd.

Navnit Insurance Broking Pvt. Ltd.

Mahindra Insurance Brokers Ltd.

Truist Financial Corp.

Recent Developments:

In August 2022, Steadfast Group announced the acquisition of Insurance Brands Australia (IBA), an award-winning insurance advice and distribution business for AUD 301 million. IBA houses more than 400 insurance professionals working across 70 countries

In November 2022, Marsh and McLennan Agency acquired Focus Insurance, founded in 2001. The latter focuses on customizing personal insurance programs for consumers throughout the USA

The global insurance brokerage market is segmented as follows:

By Mode

Online

Offline

By Type

General Insurance

Life Insurance

Health Insurance

Others

By End-User

Individuals

Corporate

By Region

North America

The U.S.

Canada

Europe

France

The UK

Spain

Germany

Italy

Rest of Europe

Asia Pacific

China

Japan

India

South Korea

Southeast Asia

Rest of Asia Pacific

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

GCC

South Africa

Rest of Middle East & Africa

Request Customized Copy Of Report @ https://www.zionmarketresearch.com/custom/5563

FREQUENTLY ASKED QUESTIONS

Which key factors will influence insurance brokerage market growth over 2022-2030?

What will be the value of the insurance brokerage market during 2022-2030?

Which region will contribute notably towards the insurance brokerage market value?

Which are the major players leveraging the insurance brokerage market growth?

What's included In the Report?

Top Market Players with Sales, Revenue, and Business Strategies Analysis

Market Growth Drivers and Restraints

Market Opportunities & Challenges

Research Methodology

Analysis of the market of various perspectives

Explore Related Reports:

https://www.openpr.com/news/2917420/global-medication-management-market-size-to-grow-usd-5-87

https://www.openpr.com/news/2917523/global-licorice-extract-market-size-to-grow-at-a-cagr-of-4-8

https://3dprinting.einnews.com/pr_news/607676517/land-mobile-radio-lmr-system-market-to-record-remarkable-surge-through-accruing-of-usd-50-12-bn-earnings-by-2028

https://applesamsung.einnews.com/pr_news/607676517/land-mobile-radio-lmr-system-market-to-record-remarkable-surge-through-accruing-of-usd-50-12-bn-earnings-by-2028

https://biotech.einnews.com/pr_news/607676517/land-mobile-radio-lmr-system-market-to-record-remarkable-surge-through-accruing-of-usd-50-12-bn-earnings-by-2028

https://cebit.einnews.com/pr_news/607676517/land-mobile-radio-lmr-system-market-to-record-remarkable-surge-through-accruing-of-usd-50-12-bn-earnings-by-2028

https://ces.einnews.com/pr_news/607676517/land-mobile-radio-lmr-system-market-to-record-remarkable-surge-through-accruing-of-usd-50-12-bn-earnings-by-2028

https://ems.einnews.com/pr_news/607676517/land-mobile-radio-lmr-system-market-to-record-remarkable-surge-through-accruing-of-usd-50-12-bn-earnings-by-2028

https://gdc.einnews.com/pr_news/607676517/land-mobile-radio-lmr-system-market-to-record-remarkable-surge-through-accruing-of-usd-50-12-bn-earnings-by-2028

https://nanotech.einnews.com/pr_news/607676517/land-mobile-radio-lmr-system-market-to-record-remarkable-surge-through-accruing-of-usd-50-12-bn-earnings-by-2028

https://satellites.einnews.com/pr_news/607676517/land-mobile-radio-lmr-system-market-to-record-remarkable-surge-through-accruing-of-usd-50-12-bn-earnings-by-2028

https://semiconductors.einnews.com/pr_news/607676517/land-mobile-radio-lmr-system-market-to-record-remarkable-surge-through-accruing-of-usd-50-12-bn-earnings-by-2028

https://smartwatch.einnews.com/pr_news/607676517/land-mobile-radio-lmr-system-market-to-record-remarkable-surge-through-accruing-of-usd-50-12-bn-earnings-by-2028

https://tech.einnews.com/pr_news/607676517/land-mobile-radio-lmr-system-market-to-record-remarkable-surge-through-accruing-of-usd-50-12-bn-earnings-by-2028

https://web20.einnews.com/pr_news/607676517/land-mobile-radio-lmr-system-market-to-record-remarkable-surge-through-accruing-of-usd-50-12-bn-earnings-by-2028

Contact Us:

Zion Market Research

244 Fifth Avenue, Suite N202

New York, 10001, United States

Tel: +49-322 210 92714

USA/Canada Toll-Free No.1-855-465-4651

Email: sales@zionmarketresearch.com

Website: https://www.zionmarketresearch.com

Read Blog - https://zmrblog.com/

About Us

Zion Market Research is an obligated company. We create futuristic, cutting edge, informative reports ranging from industry reports, company reports to country reports. We provide our clients not only with market statistics unveiled by avowed private publishers and public organizations but also with vogue and newest industry reports along with pre-eminent and niche company profiles. Our database of market research reports comprises a wide variety of reports from cardinal industries. Our database is been updated constantly in order to fulfill our clients with prompt and direct online access to our database. Keeping in mind the client's needs, we have included expert insights on global industries, products, and market trends in this database. Last but not the least, we make it our duty to ensure the success of clients connected to us-after all-if you do well, a little of the light shines on us.

Our Expertise

In Zion Market Research, we have built our team with industry analysts, domain experts, and consultants, who leverage their global experience that help us deliver excellence in all projects we undertake. Zion Market Research publishes over 100+ market research reports that provide data covering following aspects:

Market Research

Market Sizing and Forecasts

Industry Entry Strategies

Niche Market Trends

Novel Sustainability Trends

Innovation Trends

Customer Cognizance

Distribution Channel Assessment

Primary Interviews

Consumer Surveys

Secondary Research

Zion Market Research publishes high quality, in-depth market research reports that help clients in obtaining deep clarity on current business trends and future developments. We believe that only in-depth and detailed information can help clients take efficient business decisions.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Insurance Brokerage Market Size to Grow USD 278.309 Billion By 2030: Zion Market Research here

News-ID: 2917552 • Views: …

More Releases from Zion Market Research

Halal Food Market to Reach USD 16.84 Billion by 2034, Expanding at 18.04% CAGR

The global halal food market, valued at USD 3.21 billion in 2024, is projected to reach USD 16.84 billion by 2034 at a robust CAGR of 18.04%. This extraordinary growth is fueled by a rapidly rising global Muslim population, increasing demand for certified halal-compliant food, expanding global halal trade networks, and the emergence of halal as a trusted, premium, ethical, and hygienic food label even for non-Muslim consumers.

Key Market Highlights

Metrics Insight

2024…

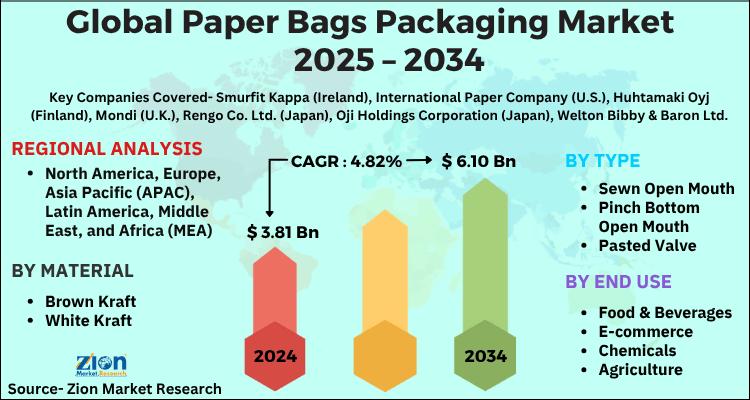

Paper Bags Packaging Market to Reach USD 6.10 Billion by 2034, Expanding at 4.82 …

The global paper bags packaging market, valued at USD 3.81 billion in 2024, is projected to reach USD 6.10 billion by 2034, growing at a 4.82% CAGR between 2025 and 2034. The market is gaining momentum on the back of sustainability mandates, stringent global regulations against single-use plastic, rising consumer environmental consciousness, and the rapid expansion of e-commerce and foodservice industries adopting recyclable packaging.

Key Market Highlights

Indicator Insight

2024 Market Value USD 3.81 Billion

2034…

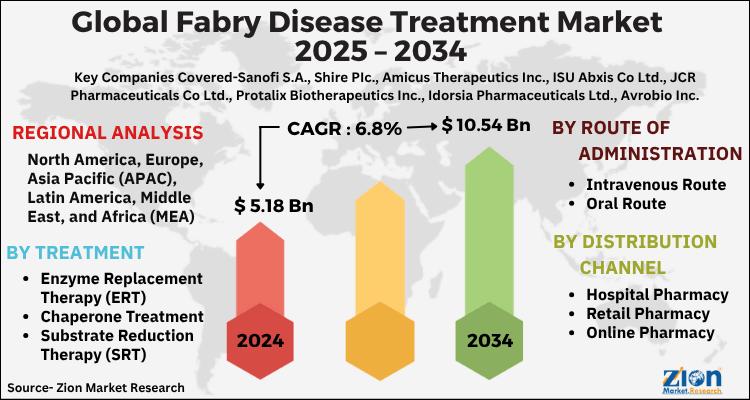

Fabry Disease Treatment Market to Reach USD 10.54 Billion by 2034, Expanding at …

The global Fabry disease treatment market, valued at USD 5.18 billion in 2024, is projected to reach USD 10.54 billion by 2034, growing at a 6.8% CAGR (2025-2034). Market momentum is driven by rising disease awareness and diagnosis, expanding enzyme replacement therapy (ERT) utilization, progress in chaperone and substrate reduction therapies (SRT), and an advancing pipeline in gene and next-generation ERTs. Persistent unmet need-stemming from organ involvement (renal, cardiac, cerebrovascular),…

Snow Sports Apparel Market to Reach USD 5.37 Billion by 2034, Expanding at 7.3% …

The global snow sports apparel market, valued at USD 2.65 billion in 2024, is projected to reach USD 5.37 billion by 2034, growing at a 7.3% CAGR (2025-2034). Growth is driven by the rising popularity of winter sports and outdoor recreation, fabric and garment-tech innovations (breathability, waterproofing, thermal regulation), and the accelerating role of e-commerce, social media, and athlete-led branding in discovery and conversion.

Strategic Market Insights & Key Performance Indicators

2024…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…