Press release

Contactless Payment market: New Prospects to Emerge by 2029 | American Express, Thales, Giesecke & Devrient

"QY Research holds tons of experience in offering comprehensive and accurate analysis of global as well as regional markets. The report presented here is an industry-best compilation of detailed and quality research studies on the global Contactless Payment market. It provides SWOT, PESTLE, and other important types of analysis to give a real and complete picture of the current and future scenarios of the global Contactless Payment market. The analysts and researchers authoring the report have provided deeper competitive analysis of the global Contactless Payment market along with exhaustive company profiling of leading market players. Each market player is studied on the basis of market share, recent developments, future growth plans, and other significant factors. All of the statistics and data, including CAGR, market size, and market share, provided in the report are highly reliable and accurate. They have been verified and revalidated using in-house and external sources. The report comes out as a powerful tool that could enable market players to plan out effective strategies to improve their share of the global Contactless Payment market. Our result-oriented market experts provide research-based recommendations to help market players gain success in their targeted global and regional markets. On the whole, the report is just the right tool that market players can keep in their arsenal to increase their competitiveness.Final Contactless Payment Report will add the analysis of the impact of COVID-19 on this Market.

Contactless Payment Market competition by top manufacturers/Key players Profiled:

American Express

Thales

Giesecke & Devrient

Heartland Payment Systems

Ingenico Group

Inside Secure

MasterCard Worldwide

Microsoft

Oberthur Technologies

On Track innovations

Opus Software Solutions

Paypal

Proxama

Renesas Electronic

Discover

Verifone Systems

Visa

Wirecard

Apple

Tencent

Alibaba

UnionPay

Chase

Request to Download PDF Sample Copy of Report: https://www.qyresearch.com/sample-form/form/5630999/Global-Contactless-Payment-Market-Research-Report-2023

Competitive Analysis:

Global Contactless Payment Market is highly fragmented and the major players have used various strategies such as new product launches, expansions, agreements, joint ventures, partnerships, acquisitions, and others to increase their footprints in this market. The report includes market shares of Contactless Payment Market for Global, Europe, North America, Asia-Pacific, South America and Middle East & Africa.

Scope of the Report:

The all-encompassing research weighs up on various aspects including but not limited to important industry definition, product applications, and product types. The pro-active approach towards analysis of investment feasibility, significant return on investment, supply chain management, import and export status, consumption volume and end-use offers more value to the overall statistics on the Contactless Payment Market. All factors that help business owners identify the next leg for growth are presented through self-explanatory resources such as charts, tables, and graphic images.

The report offers in-depth assessment of the growth and other aspects of the Contactless Payment market in important countries (regions), including:

North America(United States, Canada and Mexico)

Europe (Germany, France, UK, Russia and Italy)

Asia-Pacific (China, Japan, Korea, India, Southeast Asia and Australia)

South America (Brazil, Argentina, Colombia)

Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa)

Our industry professionals are working reluctantly to understand, assemble and timely deliver assessment on impact of COVID-19 disaster on many corporations and their clients to help them in taking excellent business decisions. We acknowledge everyone who is doing their part in this financial and healthcare crisis.

Share Your Questions Here For More Details On this Report or Customization's As Per Your Need: https://www.qyresearch.com/customize-request/form/5630999/Global-Contactless-Payment-Market-Research-Report-2023

Table of Contents

Report Overview: It includes major players of the global Contactless Payment Market covered in the research study, research scope, and Market segments by type, market segments by application, years considered for the research study, and objectives of the report.

Global Growth Trends: This section focuses on industry trends where market drivers and top market trends are shed light upon. It also provides growth rates of key producers operating in the global Contactless Payment Market. Furthermore, it offers production and capacity analysis where marketing pricing trends, capacity, production, and production value of the global Contactless Payment Market are discussed.

Market Share by Manufacturers: Here, the report provides details about revenue by manufacturers, production and capacity by manufacturers, price by manufacturers, expansion plans, mergers and acquisitions, and products, market entry dates, distribution, and market areas of key manufacturers.

Market Size by Type: This section concentrates on product type segments where production value market share, price, and production market share by product type are discussed.

Market Size by Application: Besides an overview of the global Contactless Payment Market by application, it gives a study on the consumption in the global Contactless Payment Market by application.

Production by Region: Here, the production value growth rate, production growth rate, import and export, and key players of each regional market are provided.

Consumption by Region: This section provides information on the consumption in each regional market studied in the report. The consumption is discussed on the basis of country, application, and product type.

Company Profiles: Almost all leading players of the global Contactless Payment Market are profiled in this section. The analysts have provided information about their recent developments in the global Contactless Payment Market, products, revenue, production, business, and company.

Market Forecast by Production: The production and production value forecasts included in this section are for the global Contactless Payment Market as well as for key regional markets.

Market Forecast by Consumption: The consumption and consumption value forecasts included in this section are for the global Contactless Payment Market as well as for key regional markets.

Value Chain and Sales Analysis: It deeply analyzes customers, distributors, sales channels, and value chain of the global Contactless Payment Market.

Key Findings: This section gives a quick look at important findings of the research study.

About Us:

QY Research established in 2007, focus on custom research, management consulting, IPO consulting, industry chain research, data base and seminar services. The company owned a large basic data base (such as National Bureau of statistics database, Customs import and export database, Industry Association Database etc), expert's resources (included energy automotive chemical medical ICT consumer goods etc.

Table of Contents:

1 Report Overview

1.1 Study Scope

1.2 Market Analysis by Type

1.2.1 Global Contactless Payment Market Size Growth Rate by Type: 2018 VS 2022 VS 2029

1.2.2 Smart Cards

1.2.3 NFC Chips

1.2.4 Point of Sale Terminals

1.2.5 Mobile Handsets

1.2.6 Other Devices

1.3 Market by Application

1.3.1 Global Contactless Payment Market Growth by Application: 2018 VS 2022 VS 2029

1.3.2 Managed Services

1.3.3 Professional Services

1.3.4 Multi-Channel Payment

1.4 Study Objectives

1.5 Years Considered

1.6 Years Considered

2 Global Growth Trends

2.1 Global Contactless Payment Market Perspective (2018-2029)

2.2 Contactless Payment Growth Trends by Region

2.2.1 Global Contactless Payment Market Size by Region: 2018 VS 2022 VS 2029

2.2.2 Contactless Payment Historic Market Size by Region (2018-2023)

2.2.3 Contactless Payment Forecasted Market Size by Region (2024-2029)

2.3 Contactless Payment Market Dynamics

2.3.1 Contactless Payment Industry Trends

2.3.2 Contactless Payment Market Drivers

2.3.3 Contactless Payment Market Challenges

2.3.4 Contactless Payment Market Restraints

3 Competition Landscape by Key Players

3.1 Global Top Contactless Payment Players by Revenue

3.1.1 Global Top Contactless Payment Players by Revenue (2018-2023)

3.1.2 Global Contactless Payment Revenue Market Share by Players (2018-2023)

3.2 Global Contactless Payment Market Share by Company Type (Tier 1, Tier 2, and Tier 3)

3.3 Players Covered: Ranking by Contactless Payment Revenue

3.4 Global Contactless Payment Market Concentration Ratio

3.4.1 Global Contactless Payment Market Concentration Ratio (CR5 and HHI)

3.4.2 Global Top 10 and Top 5 Companies by Contactless Payment Revenue in 2022

3.5 Contactless Payment Key Players Head office and Area Served

3.6 Key Players Contactless Payment Product Solution and Service

3.7 Date of Enter into Contactless Payment Market

3.8 Mergers & Acquisitions, Expansion Plans

4 Contactless Payment Breakdown Data by Type

4.1 Global Contactless Payment Historic Market Size by Type (2018-2023)

4.2 Global Contactless Payment Forecasted Market Size by Type (2024-2029)

5 Contactless Payment Breakdown Data by Application

5.1 Global Contactless Payment Historic Market Size by Application (2018-2023)

5.2 Global Contactless Payment Forecasted Market Size by Application (2024-2029)

6 North America

6.1 North America Contactless Payment Market Size (2018-2029)

6.2 North America Contactless Payment Market Growth Rate by Country: 2018 VS 2022 VS 2029

6.3 North America Contactless Payment Market Size by Country (2018-2023)

6.4 North America Contactless Payment Market Size by Country (2024-2029)

6.5 United States

6.6 Canada

7 Europe

7.1 Europe Contactless Payment Market Size (2018-2029)

7.2 Europe Contactless Payment Market Growth Rate by Country: 2018 VS 2022 VS 2029

7.3 Europe Contactless Payment Market Size by Country (2018-2023)

7.4 Europe Contactless Payment Market Size by Country (2024-2029)

7.5 Germany

7.6 France

7.7 U.K.

7.8 Italy

7.9 Russia

7.10 Nordic Countries

8 Asia-Pacific

8.1 Asia-Pacific Contactless Payment Market Size (2018-2029)

8.2 Asia-Pacific Contactless Payment Market Growth Rate by Region: 2018 VS 2022 VS 2029

8.3 Asia-Pacific Contactless Payment Market Size by Region (2018-2023)

8.4 Asia-Pacific Contactless Payment Market Size by Region (2024-2029)

8.5 China

8.6 Japan

8.7 South Korea

8.8 Southeast Asia

8.9 India

8.10 Australia

9 Latin America

9.1 Latin America Contactless Payment Market Size (2018-2029)

9.2 Latin America Contactless Payment Market Growth Rate by Country: 2018 VS 2022 VS 2029

9.3 Latin America Contactless Payment Market Size by Country (2018-2023)

9.4 Latin America Contactless Payment Market Size by Country (2024-2029)

9.5 Mexico

9.6 Brazil

10 Middle East & Africa

10.1 Middle East & Africa Contactless Payment Market Size (2018-2029)

10.2 Middle East & Africa Contactless Payment Market Growth Rate by Country: 2018 VS 2022 VS 2029

10.3 Middle East & Africa Contactless Payment Market Size by Country (2018-2023)

10.4 Middle East & Africa Contactless Payment Market Size by Country (2024-2029)

10.5 Turkey

10.6 Saudi Arabia

10.7 UAE

11 Key Players Profiles

11.1 American Express

11.1.1 American Express Company Detail

11.1.2 American Express Business Overview

11.1.3 American Express Contactless Payment Introduction

11.1.4 American Express Revenue in Contactless Payment Business (2018-2023)

11.1.5 American Express Recent Development

11.2 Thales

11.2.1 Thales Company Detail

11.2.2 Thales Business Overview

11.2.3 Thales Contactless Payment Introduction

11.2.4 Thales Revenue in Contactless Payment Business (2018-2023)

11.2.5 Thales Recent Development

11.3 Giesecke & Devrient

11.3.1 Giesecke & Devrient Company Detail

11.3.2 Giesecke & Devrient Business Overview

11.3.3 Giesecke & Devrient Contactless Payment Introduction

11.3.4 Giesecke & Devrient Revenue in Contactless Payment Business (2018-2023)

11.3.5 Giesecke & Devrient Recent Development

11.4 Heartland Payment Systems

11.4.1 Heartland Payment Systems Company Detail

11.4.2 Heartland Payment Systems Business Overview

11.4.3 Heartland Payment Systems Contactless Payment Introduction

11.4.4 Heartland Payment Systems Revenue in Contactless Payment Business (2018-2023)

11.4.5 Heartland Payment Systems Recent Development

11.5 Ingenico Group

11.5.1 Ingenico Group Company Detail

11.5.2 Ingenico Group Business Overview

11.5.3 Ingenico Group Contactless Payment Introduction

11.5.4 Ingenico Group Revenue in Contactless Payment Business (2018-2023)

11.5.5 Ingenico Group Recent Development

11.6 Inside Secure

11.6.1 Inside Secure Company Detail

11.6.2 Inside Secure Business Overview

11.6.3 Inside Secure Contactless Payment Introduction

11.6.4 Inside Secure Revenue in Contactless Payment Business (2018-2023)

11.6.5 Inside Secure Recent Development

11.7 MasterCard Worldwide

11.7.1 MasterCard Worldwide Company Detail

11.7.2 MasterCard Worldwide Business Overview

11.7.3 MasterCard Worldwide Contactless Payment Introduction

11.7.4 MasterCard Worldwide Revenue in Contactless Payment Business (2018-2023)

11.7.5 MasterCard Worldwide Recent Development

11.8 Microsoft

11.8.1 Microsoft Company Detail

11.8.2 Microsoft Business Overview

11.8.3 Microsoft Contactless Payment Introduction

11.8.4 Microsoft Revenue in Contactless Payment Business (2018-2023)

11.8.5 Microsoft Recent Development

11.9 Oberthur Technologies

11.9.1 Oberthur Technologies Company Detail

11.9.2 Oberthur Technologies Business Overview

11.9.3 Oberthur Technologies Contactless Payment Introduction

11.9.4 Oberthur Technologies Revenue in Contactless Payment Business (2018-2023)

11.9.5 Oberthur Technologies Recent Development

11.10 On Track innovations

11.10.1 On Track innovations Company Detail

11.10.2 On Track innovations Business Overview

11.10.3 On Track innovations Contactless Payment Introduction

11.10.4 On Track innovations Revenue in Contactless Payment Business (2018-2023)

11.10.5 On Track innovations Recent Development

11.11 Opus Software Solutions

11.11.1 Opus Software Solutions Company Detail

11.11.2 Opus Software Solutions Business Overview

11.11.3 Opus Software Solutions Contactless Payment Introduction

11.11.4 Opus Software Solutions Revenue in Contactless Payment Business (2018-2023)

11.11.5 Opus Software Solutions Recent Development

11.12 Paypal

11.12.1 Paypal Company Detail

11.12.2 Paypal Business Overview

11.12.3 Paypal Contactless Payment Introduction

11.12.4 Paypal Revenue in Contactless Payment Business (2018-2023)

11.12.5 Paypal Recent Development

11.13 Proxama

11.13.1 Proxama Company Detail

11.13.2 Proxama Business Overview

11.13.3 Proxama Contactless Payment Introduction

11.13.4 Proxama Revenue in Contactless Payment Business (2018-2023)

11.13.5 Proxama Recent Development

11.14 Renesas Electronic

11.14.1 Renesas Electronic Company Detail

11.14.2 Renesas Electronic Business Overview

11.14.3 Renesas Electronic Contactless Payment Introduction

11.14.4 Renesas Electronic Revenue in Contactless Payment Business (2018-2023)

11.14.5 Renesas Electronic Recent Development

11.15 Discover

11.15.1 Discover Company Detail

11.15.2 Discover Business Overview

11.15.3 Discover Contactless Payment Introduction

11.15.4 Discover Revenue in Contactless Payment Business (2018-2023)

11.15.5 Discover Recent Development

11.16 Verifone Systems

11.16.1 Verifone Systems Company Detail

11.16.2 Verifone Systems Business Overview

11.16.3 Verifone Systems Contactless Payment Introduction

11.16.4 Verifone Systems Revenue in Contactless Payment Business (2018-2023)

11.16.5 Verifone Systems Recent Development

11.17 Visa

11.17.1 Visa Company Detail

11.17.2 Visa Business Overview

11.17.3 Visa Contactless Payment Introduction

11.17.4 Visa Revenue in Contactless Payment Business (2018-2023)

11.17.5 Visa Recent Development

11.18 Wirecard

11.18.1 Wirecard Company Detail

11.18.2 Wirecard Business Overview

11.18.3 Wirecard Contactless Payment Introduction

11.18.4 Wirecard Revenue in Contactless Payment Business (2018-2023)

11.18.5 Wirecard Recent Development

11.19 Apple

11.19.1 Apple Company Detail

11.19.2 Apple Business Overview

11.19.3 Apple Contactless Payment Introduction

11.19.4 Apple Revenue in Contactless Payment Business (2018-2023)

11.19.5 Apple Recent Development

11.20 Google

11.20.1 Google Company Detail

11.20.2 Google Business Overview

11.20.3 Google Contactless Payment Introduction

11.20.4 Google Revenue in Contactless Payment Business (2018-2023)

11.20.5 Google Recent Development

11.21 Tencent

11.21.1 Tencent Company Detail

11.21.2 Tencent Business Overview

11.21.3 Tencent Contactless Payment Introduction

11.21.4 Tencent Revenue in Contactless Payment Business (2018-2023)

11.21.5 Tencent Recent Development

11.22 Alibaba

11.22.1 Alibaba Company Detail

11.22.2 Alibaba Business Overview

11.22.3 Alibaba Contactless Payment Introduction

11.22.4 Alibaba Revenue in Contactless Payment Business (2018-2023)

11.22.5 Alibaba Recent Development

11.23 UnionPay

11.23.1 UnionPay Company Detail

11.23.2 UnionPay Business Overview

11.23.3 UnionPay Contactless Payment Introduction

11.23.4 UnionPay Revenue in Contactless Payment Business (2018-2023)

11.23.5 UnionPay Recent Development

11.24 Chase

11.24.1 Chase Company Detail

11.24.2 Chase Business Overview

11.24.3 Chase Contactless Payment Introduction

11.24.4 Chase Revenue in Contactless Payment Business (2018-2023)

11.24.5 Chase Recent Development

12 Analyst's Viewpoints/Conclusions

13 Appendix

13.1 Research Methodology

13.1.1 Methodology/Research Approach

13.1.2 Data Source

13.2 Disclaimer

13.3 Author Details

QY RESEARCH, INC.

17890 CASTLETON STREET

SUITE 369, CITY OF INDUSTRY

CA - 91748, UNITED STATES OF AMERICA

+1 626 539 9760 / +91 8669986909

hitesh@qyresearch.com / enquiry@qyresearch.com

About Us:

QY Research established in 2007, focus on custom research, management consulting, IPO consulting, industry chain research, data base and seminar services. The company owned a large basic data base (such as National Bureau of statistics database, Customs import and export database, Industry Association Database etc), expert's resources (included energy automotive chemical medical ICT consumer goods etc."

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Contactless Payment market: New Prospects to Emerge by 2029 | American Express, Thales, Giesecke & Devrient here

News-ID: 2903814 • Views: …

More Releases from QYResearch, Inc.

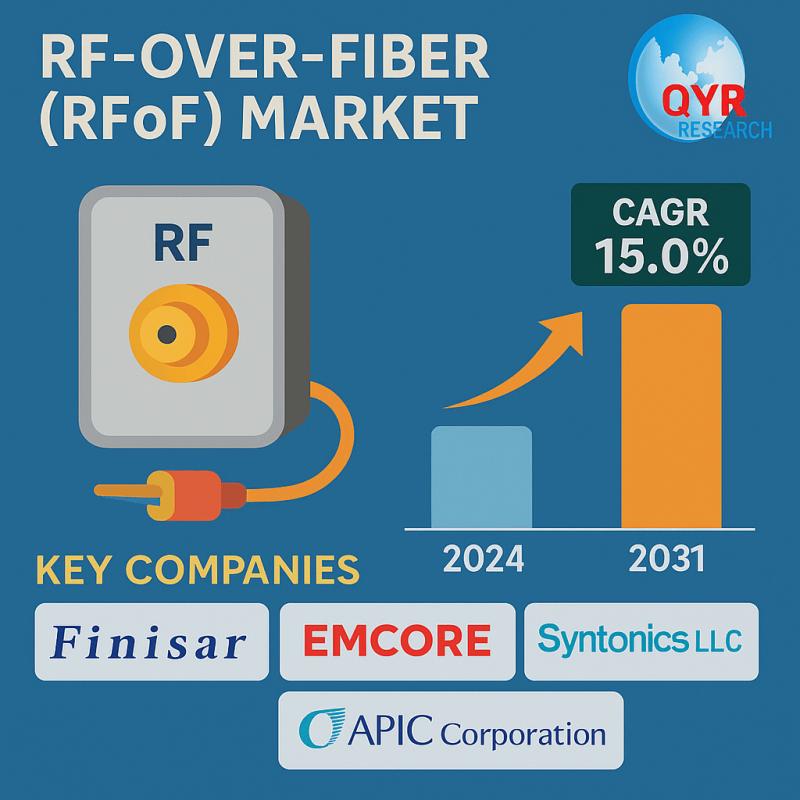

RF-over-Fiber (RFoF) Market Projected to Grow at a CAGR of 15.0% | Forecast 2025 …

Los Angeles, United State: The global RF-over-Fiber (RFoF) Market was valued at US$ 551 million in 2024 and is anticipated to reach US$ 1447 million by 2031, witnessing a CAGR of 15.0% during the forecast period 2025-2031. The research report targets specific customer segments to help companies effectively market their products and drive strong sales in the global RF-over-Fiber (RFoF) Market. It organizes valuable and relevant market insights to match…

Divinyl Sulfone Market 2024's Technological Tapestry: Advancements Shaping the M …

"The thorough study and analysis report is a fantastic and essential tool for worldwide market players to obtain a competitive advantage over their rivals. It contains accurate and validated projections for the global Divinyl Sulfone industry's size, CAGR, production, consumption, and sales. Additionally, it offers projections for industry revenue and volume until 2026. The report's readers may quickly learn about the major prospects, difficulties, and development drivers of the worldwide…

Divinyl Sulfone Market Balancing Acts: Gross Margins, Costs, and Revenue Predict …

"The thorough study and analysis report is a fantastic and essential tool for worldwide market players to obtain a competitive advantage over their rivals. It contains accurate and validated projections for the global Divinyl Sulfone industry's size, CAGR, production, consumption, and sales. Additionally, it offers projections for industry revenue and volume until 2026. The report's readers may quickly learn about the major prospects, difficulties, and development drivers of the worldwide…

Divinyl Sulfone Market Bright Horizons: Positive Market Indicators Revealed | Bo …

"The thorough study and analysis report is a fantastic and essential tool for worldwide market players to obtain a competitive advantage over their rivals. It contains accurate and validated projections for the global Divinyl Sulfone industry's size, CAGR, production, consumption, and sales. Additionally, it offers projections for industry revenue and volume until 2026. The report's readers may quickly learn about the major prospects, difficulties, and development drivers of the worldwide…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…