Press release

Digital Banking Market Will Hit USD 10.3 trillion By 2028 | CAGR 4.50% - Facts and Factors

According to Facts and Factors, the global digital banking market was worth USD 7.9 trillion in 2021 and is estimated to grow to USD 10.3 trillion by 2028, with a compound annual growth rate (CAGR) of approximately 4.50% over the forecast period.The Digital Banking Market has developed swiftly in recent years and has made a significant contribution to the global financial situation in terms of growth rate, market share, and sales generation. The report titled "Digital Banking Market Report" is an analytical study that presents a comprehensive explanation of the industry along with information on significant aspects of the market. This covers market demands, major players, profitable trading tactics, and a futuristic outlook.

The report includes changes in Digital Banking market dynamics and demand patterns associated with the current COVID-19 pandemic. The report gives an in-depth analysis of the growth prospects, business area, and futuristic scope based on the impact of COVID-19 on the overall growth of the industry. The study report also contains an analysis of the present and future impact of the pandemic on the Digital Banking market, as well as the outlook after COVID-19.

Request Access Full Report is Available @ https://www.fnfresearch.com/digital-banking-market-by-banking-type-retail-banking-100

The report presents a market forecast for the period 2022-2028. It gives a detailed description of the key drivers, restraints, future growth opportunities, as well as challenges and risks in the Digital Banking market. The report further includes the developments and advancements in products designed and technologies to drive the growth of the market.

The report furnishes a detailed analysis of the leading players in the market along with their expansion plans, strategies, and business overview. The top players analyzed in the report are:

Alkami, Apiture, Appway, Backbase, BNY Mellon, Intellect Design Area, EdgeVerve, ebankIT, Finastra, Fiserv, Oracle, MuleSoft, nCino, NCR, NETinfo, SAP, Sopra Banking Software, TCS, Technisys, Temenos, TPS, Velmie, Worldline, JPMorgan Chase, China Merchants Bank, Wells Fargo, HSBC Group

The report systematically renders extensive analysis in the form of figures, tables, charts, and graphs. Combined data covers access to an in-depth study of current and future market prospects.

The Digital Banking market report presents a value chain and industry chain analysis for an entire view of the Digital Banking Market. The study contains market analysis along with a detailed analysis of product types, application segments, growth rate, market size, as well as current and emerging trends in the industry.

FREE: Request Sample is Available @ https://www.fnfresearch.com/sample/digital-banking-market-by-banking-type-retail-banking-100

(The sample of this report is quickly available on demand).

Advantages of Inquiring a "FREE PDF" Sample Report Before Purchase:

• New COVID-19 pandemic impact & current market scenario analysis

• A brief introduction to the research report and an overview of the Digital Banking market

• Understand key players in the market with their revenue analysis

• Geographical introduction of global as well as the regional analysis

• Selected illustrations of market trends and insights

• Facts & Factors (FnF) research methodology

(Note: The sample of this report is updated with COVID-19 impact analysis before delivery)

Digital Banking Market Segmentation:

In market segmentation by types of Digital Banking, the report includes-

Component

Platforms & Services

In market segmentation by applications of the Digital Banking, the report includes the following uses-

Banking Type

Retail Banking

Corporate Banking

Investment Banking

(We customize your report according to your research need. Ask our sales team for report customization.)

Report Coverage

The report presents an essential overview of the Digital Banking industry including consumption, production, definition, types, applications, and manufacturing technology. Additionally, The report is divided by type, application, manufacturers, and regions for the competitive landscape analysis. The report then evaluates 2022-2028 development trends to analyze upstream raw materials, downstream demand, and current market dynamics of the Digital Banking market.

Furthermore, the report includes analytical data in a systematic format that is divided into figures, tables, charts, and graphs. This permits readers or users to completely understand the market situation. Additionally, the Digital Banking report intends to give a forward-looking prospect and draw an informative conclusion to aid the reader to make profitable business decisions.

Geographically, the Digital Banking market is segmented into main regions of the world and provides a comprehensive consumption, market share, and sales analysis for 2022-2028. The regional segmentation covers North America, Europe, the Middle East and Africa, the Asia-Pacific region, as well as Latin America.

Inquire more about this report@ https://www.fnfresearch.com/inquiry/digital-banking-market-by-banking-type-retail-banking-100

The key scope of the Digital Banking Market:

• In-depth analysis of the Digital Banking industry

• Rising Market Sectors and Industry Segments Research

• Identify the growth pattern in market segments and sub-segments

• Strategic guidance for formulating investment strategies and defining business plans

• Evaluation of market segmentation based on types, applications, demand, price, and supply analysis

• Analysis of main key drivers, restraints and opportunities for an entire understanding of the business

The report ends with a complete analysis of the segments believed to dominate the market, a regional analysis, an estimate of the market share and size, along with a detailed Porter's five forces analysis and SWOT analysis. The Digital Banking report also incorporates the return analysis and feasibility analysis.

Customization For Digital Banking Market @ https://www.fnfresearch.com/customization/digital-banking-market-by-banking-type-retail-banking-100

Thanks for reading our research report. If you have any further questions, please contact us.

Note - In order to provide a more accurate market forecast, all our reports will be updated before delivery by considering the impact of COVID-19.

(*If you have any special requirements, please let us know and we will offer you the report you want.)

Key Offerings:

• Market Size, Trends, & Forecast by Revenue | 2022-2028

• Market Dynamics - Leading Trends, Growth Drivers, Restraints, and Investment Opportunities

• Market Segmentation - A detailed analysis by segmentation, and by Region

• Competitive Landscape - Top Key Vendors and Other Prominent Vendors

Read Our Other More Reports@

https://www.openpr.com/news/2875458/usd-40-2-billion-global-software-defined-storage-market-size

https://www.openpr.com/news/2875488/hr-business-analytics-market-revenue-to-hit-usd-979-9-million

https://www.openpr.com/news/2875518/global-ab-testing-market-share-likely-to-grow-at-a-cagr-of-9-by-2026

https://www.fnfresearch.com/news/global-anti-counterfeit-pharmaceuticals-and-cosmetics-packaging-market

https://www.fnfresearch.com/news/global-aircraft-lightning-protection-market

https://www.fnfresearch.com/news/global-automotive-parts-magnesium-die-casting-market

https://www.fnfresearch.com/news/global-biobanking-market

https://www.linkedin.com/pulse/global-digital-pathology-market-size-projected-expand-ram-rupnur

https://www.linkedin.com/pulse/global-e-learning-market-size-share-demand-trends-analysis-ram-rupnur

https://www.linkedin.com/pulse/global-cross-border-b2c-e-commerce-market-size-poised-ram-rupnur

https://tealfeed.com/global-arc-flash-protective-clothing-market-r1nad

https://tealfeed.com/global-testing-inspection-certification-tic-metals-rlwko

Contact Us:

Facts & Factors

A 2108, Sargam,

Nanded City,

Sinhagad Road,

Pune 411041, India

USA: +1-347-989-3985

Email: sales@fnfresearch.com

Web: https://www.fnfresearch.com

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client's/customer's conviction in our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Banking Market Will Hit USD 10.3 trillion By 2028 | CAGR 4.50% - Facts and Factors here

News-ID: 2875547 • Views: …

More Releases from Facts & Factors

Trending: Military Vehicle Electrification Market Size & Share To Exceed USD 9.5 …

The Military Vehicle Electrification Market has developed swiftly in recent years and has made a significant contribution to the global financial situation in terms of growth rate, market share, and sales generation. The report titled Military Vehicle Electrification Market is an analytical study that presents a comprehensive explanation of the industry along with information on significant aspects of the market.

Request Access Full Report is Available @ https://www.fnfresearch.com/military-vehicle-electrification-market

This covers market…

Global AIOps (Artificial Intelligence for IT Operations) Market - Size, Share, G …

The research report presents a strategic analysis of the AIOps (Artificial Intelligence for IT Operations) Market analysis through top players, size, share, key drivers, challenges, opportunities, competitive landscape, market attractiveness analysis, new product launches, technological innovations, and growth contributors. Further, the market attractiveness index is provided based on a five-forces analysis.

View the Full Report with Table of Contents @ https://www.fnfresearch.com/artificial-intelligence-for-it-operations-market

This report mainly focuses on the top players and their…

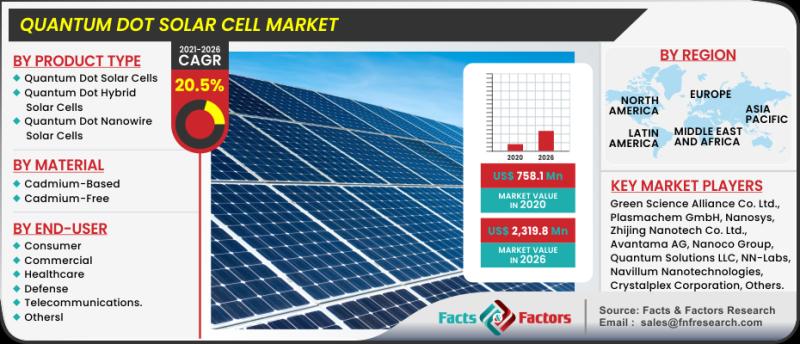

Exceptional Growth in Global Quantum Dot Solar Cell Market Size, Share to Gain U …

The Quantum Dot Solar Cell Market has developed swiftly in recent years and has made a significant contribution to the global financial situation in terms of growth rate, market share, and sales generation.

Request Access Full Report is Available @ https://www.fnfresearch.com/quantum-dot-solar-cell-market

The report titled "Quantum Dot Solar Cell Market" is an analytical study that presents a comprehensive explanation of the industry along with information on significant aspects of the market. This…

Global Energy Meter Market Size, Share, Growth, Business Strategies and Forecast …

The Energy Meter Market has developed swiftly in recent years and has made a significant contribution to the global financial situation in terms of growth rate, market share, and sales generation.

Request Access Full Report is Available @ https://www.fnfresearch.com/energy-meter-market

The report titled Energy Meter Market is an analytical study that presents a comprehensive explanation of the industry along with information on significant aspects of the market. This covers market demands, major…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…