Press release

Asset Performance Management Market Size, Share, Trends, Growth Analysis and Forecast to 2026

The report "Asset Performance Management Market with COVID-19 Impact, by Component (Solutions (Asset Strategy, Asset Reliability, and Predictive Asset Management) and Services), Deployment Type, Organization Size, Vertical, and Region - Global Forecast to 2026", size is expected to grow at a Compound Annual Growth Rate (CAGR) of 10.1% during the forecast period, to reach USD 4.0 billion by 2026 from USD 2.5 billion in 2021.Get Sample Of Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=72801714

Asset failures can lead to production loss, and according to Reliability Web, unplanned downtime in manufacturing can cost a company as much as USD 260,000 an hour. An organization incurs unplanned repair costs due to asset failures. Research from Exxon Mobil shows that more than 50% of safety incidents occur during abnormal operations shutdown and start-up. In September 2021, the crash of a cable car near the picturesque Lake Maggiore in northern Italy occurred after a cable snapped and an emergency brake failed. In the crash, 14 people were killed, and many were injured. Thus, asset management is the critical component that helps and safeguards businesses against major asset failures and helps ensure that major assets are never left in a state where they run-to-failure. Asset Performance Management (APM) solutions improve the reliability and availability of physical assets while minimizing risk and operating costs. Typically, APM includes condition monitoring, predictive maintenance, and Reliability Centered Maintenance (RCM). APM ensures improved business processes and streamlined production and enterprise operations.

APM solutions help comply with health and safety standards and industry and environmental regulations

To better grapple with the rapidly changing landscape, industrial organizations are increasingly looking for asset performance management solutions to ensure industrial assets not only run at peak efficiency but are compliant with all applicable regulations. From Occupational Safety and Health Act (OSHA) to Chemical Safety Board (CSB) to API, several regulations relate directly to asset operation and maintenance, making asset performance management a logical application for ensuring compliance. Keeping up with compliance requirements is not the only objective an organization achieves. In addition to simplifying and streamlining regulatory compliance, asset performance management integrity has helped organizations achieve benefits such as a 14% reduction in corrective maintenance and a 25% increase in preventative maintenance. GE Digital Predix Asset Performance Management (Predix APM) includes the asset performance management integrity solution. The solution suggests process safety rules that correspond to OSHA and ISA/IEC standards. The features offered by the solution include approach-agnostic, mechanical integrity, RBI, and safety lifecycle management.

Rising trend of proactive asset performance management with IIoT, predictive, and prescriptive analytics

According to a recent survey conducted by GE Digital, 87% of manufacturing and oil & gas executives were surveyed and stated that big data and analytics are their top three priorities. That number soars to 94% for power generation. The urgency to connect and act on machine data is widespread, and the opportunities are well recognized. This acts as a major driving force for the asset performance management market. Further, companies from energy & utilities are typically asset-intensive. Their daily operations depend strongly on the performance of their physical assets. As a result, these organizations strive continuously to optimize their asset performance. For instance, in UtilityCo., leveraged advanced analytics in asset management unlock savings of 20% to 25% in operating expenses and 40% to 60% in capital expenditures. UtilityCo. could effectively use advanced analytics in asset management in four ways. First, it optimized capital expenditures by maintaining the current risk and spending less. Second, it lowered preventive-maintenance operating expenses by optimizing preventive-maintenance activities. Third, it lowered corrective-maintenance (CM) operating expenses by lowering the spending on CM after the riskiest assets had been replaced. And fourth, it replaced the riskiest assets to help achieve higher reliability (measured as lower SAIDI and SAIFI2 performance) due to fewer failures.

Get More Info @ https://www.marketsandmarkets.com/Market-Reports/asset-performance-management-market-72801714.html

The rising emphasis on asset performance management will continue for the coming years owing to various benefits. The major benefits include savings of millions of dollars by streamlining their maintenance operations, as approaches have evolved from reactive to preventive to Predictive Maintenance (PdM). It enables organizations to better understand the health of their equipment and keep it running safely to meet manufacturing/production goals. Further, advanced technologies, such as AR, IoT, AI, PdM, digital twin, and telematics, as the next big thing in industrial services, would help to accurately forecast the future of physical assets.

Top Key Players

The asset performance management market comprises major providers, such as AVEVA (UK), AspenTech (US), Bentley Systems (US), GE Digital (US), SAP (Germany), IBM (US), Detechtion Technologies (US), ARMS Reliability (US), ABB (Switzerland), Uptake (US), DNV (Norway), SAS (US), Siemens Energy (Germany), Oracle (US), Infor (US), Nexus Global (US), BISTel (South Korea), Operational Sustainability (US), Rockwell Automation (US), IPS Intelligent Process Solutions (Germany), Yokogawa (Japan), Honeywell (US), Emerson (US), GrayMatter (US), and Plasma (US). The study includes an in-depth competitive analysis of key players in the asset performance management market with their company profiles, recent developments, COVID-19 developments, and key market strategies.

Contact:

Mr. Aashish Mehra

MarketsandMarkets™ INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA: 1-888-600-6441

Email: sales@marketsandmarkets.com

About MarketsandMarkets™

MarketsandMarkets™ provides quantified B2B research on 30,000 high growth niche opportunities/threats which will impact 70% to 80% of worldwide companies' revenues. Currently servicing 7500 customers worldwide including 80% of global Fortune 1000 companies as clients. Almost 75,000 top officers across eight industries worldwide approach MarketsandMarkets™ for their painpoints around revenues decisions.

Our 850 fulltime analyst and SMEs at MarketsandMarkets™ are tracking global high growth markets following the "Growth Engagement Model - GEM". The GEM aims at proactive collaboration with the clients to identify new opportunities, identify most important customers, write "Attack, avoid and defend" strategies, identify sources of incremental revenues for both the company and its competitors. MarketsandMarkets™ now coming up with 1,500 MicroQuadrants (Positioning top players across leaders, emerging companies, innovators, strategic players) annually in high growth emerging segments. MarketsandMarkets™ is determined to benefit more than 10,000 companies this year for their revenue planning and help them take their innovations/disruptions early to the market by providing them research ahead of the curve.

MarketsandMarkets's flagship competitive intelligence and market research platform, "Knowledge Store" connects over 200,000 markets and entire value chains for deeper understanding of the unmet insights along with market sizing and forecasts of niche markets.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Asset Performance Management Market Size, Share, Trends, Growth Analysis and Forecast to 2026 here

News-ID: 2784551 • Views: …

More Releases from Markets and Markets

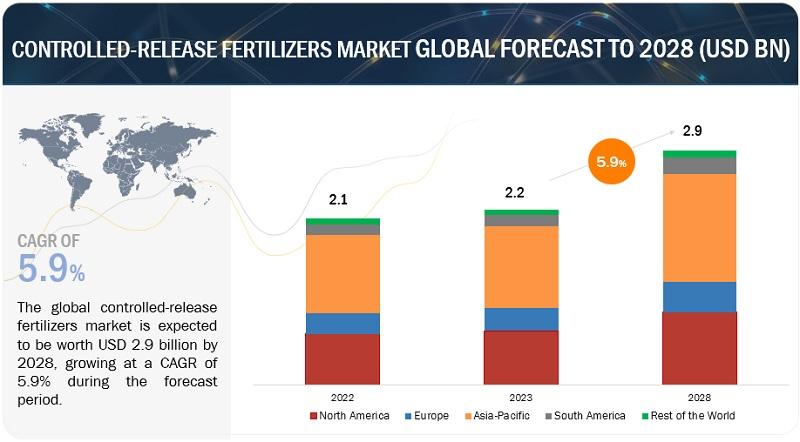

Controlled-release Fertilizers Market Latest Trends, Demands, Overview and Analy …

The controlled-release fertilizers market is experiencing notable growth, estimated at USD 2.2 billion in 2023 and projected to reach USD 2.9 billion by 2028. This reflects a compound annual growth rate (CAGR) of 5.9% during the forecast period. The demand for controlled-release fertilizers is increasing due to their benefits in enhancing nutrient efficiency, reducing environmental impact, and supporting sustainable agricultural practices.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=136099624

These fertilizers are prized for their ability…

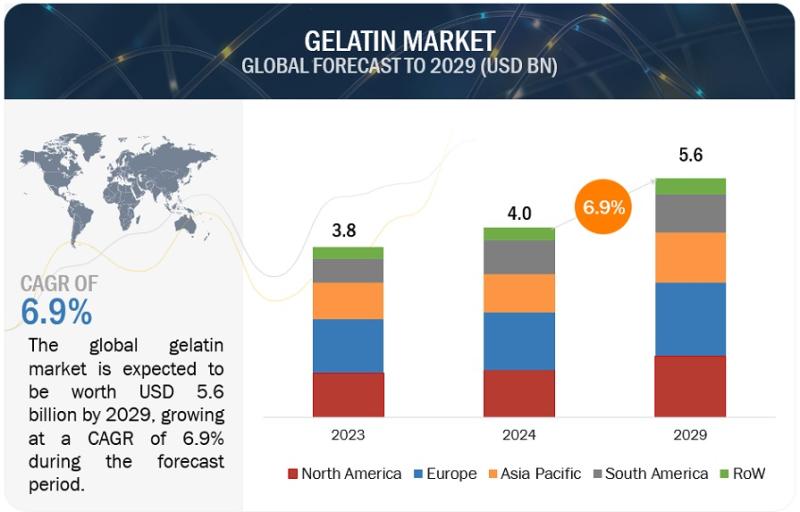

Gelatin Market is Projected to Reach $5.6 billion by 2029, at a CAGR of 6.9% fro …

According to a research report titled "Gelatin Market by Source (Animal, Plants), By Applications (Food & Beverages, Pharmaceuticals, Health & Nutrition, Cosmetics, Personal Care, Animal Feed), Type (Type A, Type B), Function (Thickener, Stabilizer, Gelling Agent) - Global Forecast to 2029," published by MarketsandMarkets, the gelatin market is poised for significant growth. The market, valued at USD 4.0 billion in 2024, is projected to reach USD 5.6 billion by 2029,…

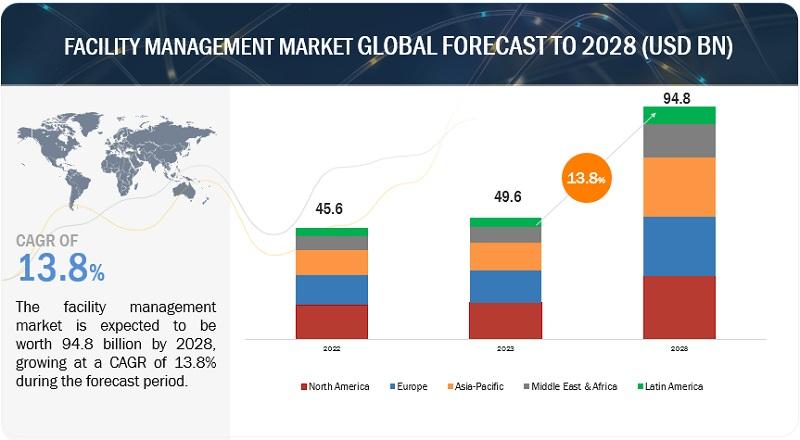

Facility Management Market Status, Revenue, Growth Rate, Services and Solutions

According to a research report "Facility Management Market by Offering (Solutions (IWMS, BIM, Facility Operations & Security Management) and Services), Vertical (BFSI, Retail, Construction & Real Estate, Healthcare & Life sciences) and Region - Global Forecast to 2028" published by MarketsandMarkets, the facility management market is estimated at USD 49.6 billion in 2023 to USD 94.8 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 13.8%.

Download PDF Brochure:…

Endpoint Security Market Size, Revenue, Growth Rate Analysis and Forecast 2024

According to a research report "Endpoint Security Market by Solution (Endpoint Protection Platform and Endpoint Detection and Response), Service, Deployment Mode, Organization Size, Vertical (Healthcare, Retail and eCommerce, and Government), and Region - Global Forecast to 2024", published by MarketsandMarkets, the global endpoint security market size is expected to grow from USD 12.8 billion in 2019 to USD 18.4 billion by 2024, at a Compound Annual Growth Rate (CAGR) of…

More Releases for Asset

Klydex Global Inc Expands Asset Coverage with New Multi-Asset Listing Framework

The new listing structure accelerates asset onboarding and improves market diversification.

Colorado, United States, 1st Dec 2025 - Klydex Global, Inc introduced an expanded multi-asset listing framework that accelerates the onboarding of high-quality digital assets. The new structure enhances screening procedures, technical integration, and market-readiness evaluation to support global asset diversification.

Klydex Global, Inc announced the launch of its enhanced multi-asset listing framework, representing a significant step toward diversifying asset choices for…

Asset Performance Management Market Is Driven By Asset Performance Management In …

Asset Performance Management (APM) has emerged as a critical solution for industries aiming to enhance the performance, reliability, and efficiency of their assets. APM systems utilize data analytics, predictive maintenance, and monitoring technologies to optimize asset performance, minimize downtime, and maximize operational efficiency. The global Asset Performance Management market is characterized by key drivers and notable trends that are reshaping how industries manage and maintain their critical assets.

Download Free PDF…

Asset Management Software

In today's dynamic business landscape, efficient asset management is more critical than ever. Sunsmart Asset Management Software is designed to empower organizations of all sizes and industries to streamline their asset-related processes, enhance control, and maximize the value of their assets.

Key Features and Benefits:

Comprehensive Asset Tracking: Our software provides a centralized platform to track and manage assets, offering real-time visibility into asset location, condition, and history, reducing the risk of…

Asset Evaluation Service Market 2023-2030 Comprehensive Research Study and Stron …

Infinity Business Insights published a new research publication on Asset Evaluation Service Market Insights, to 2030 with 113+ pages and enriched with self-explained Tables and charts in presentable format. The worldwide Asset Evaluation Service market is expected to grow at a booming CAGR during 2023-2030. It also shows the importance of the Asset Evaluation Service market main players in the sector, including their business overviews, financial summaries, and SWOT assessments.

The…

Big Boom in Asset Recovery Software Market 2020-2027 |HPE , Terrapin Systems , C …

According to a report on Asset Recovery Software Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Asset Recovery Software Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study…

Crypto Asset Management Market | Digital Asset Custody Company, Crypto Finance A …

Global Crypto Asset Management Market: Snapshot

The demand within the global market for crypto asset management has been rising on account of advancements in the field of crypto currency. The past years have been an era of advancements in the global digital industry and have paved way for several new technologies. In this stampede of digital transformations, crypto currency has emerged as a matter of discussion and recourse. Hence, the global…