Press release

Insurtech Market Augmented Expansion to Be Registered by 2022-2032

The global Insurtech market is estimated to grow US$ 6.5 Bn in 2022, and would reach US$ 20 Bn by 2032, at a high CAGR of 15%, from 2022-2032. Insurtech is primarily the usage of technology innovations designed to make the existing insurance model more effective and technologically sound. Technology giants are entering the insurance sector while bringing in the full force of their innovations.Get In-depth Insights Request for Brochure here: https://www.factmr.com/connectus/sample?flag=B&rep_id=6191

Through the new research report, analysts focus on offering a panoramic view of the Insurtech market at regional, country, and global levels. The report gives significant data and analysis on different major factors such as challenges, drivers, growth avenues, threats, and restraints of the market for Insurtech throughout 2022-2032.

Top Companies Covered in this Report:

• Alan SA

• Shift Technology

• Cytora Ltd.

• simplesurance GmbH

• Haven Life Insurance Agency LLC

• Quantemplate Technologies Inc.

• Oscar Insurance Corp.

• Trov Insurance Solutions LLC

• ZhongAn Online P&C Insurance Co. Ltd.

• Others

NOTE: The report has been assessed in accordance with the COVID-19 Pandemic and its impact on the Insurtech market.

Request Customized Report as Per Your Requirements: OR Get Access to Table of Content: https://www.factmr.com/connectus/sample?flag=RC&rep_id=6191

Key Segments:-

By Type

Health insurance

Life insurance

Travel insurance

Auto insurance

Business Insurance

Others

By Services

Consulting

Support & Maintenance

Managed Services

By End Use Industry

Automotive

BFSI

Healthcare

Manufacturing

Retail

Transportation

Others

The report covers key regions of the Global Insurtech Market:

North America: U.S., Canada, Mexico

South America: Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, Costa Rica

Europe: U.K., Germany, Italy, France, Netherlands, Belgium, Spain, Denmark

APAC: China, Japan, Australia, South Korea, India, Taiwan, Malaysia, Hong Kong

The Middle East and Africa: Israel, South Africa, Saudi Arabia

US and Canada Insurtech Market Outlook

The U.S. is projected to hold the largest share of the market in North America region. The growth in the U.S. is primarily attributed to the huge consumer base and presence of major solution providers in the region. The U.S. is one of the largest markets for insurtech globally. The U.S. Insurtech market is set to walk on the historic pattern of bust and boom during the assessment period 2022-2032.

Enquire Before Buying Here: https://www.factmr.com/connectus/sample?flag=EB&rep_id=6191

Insurtech Market Report Highlights:

Detailed overview of parent market

Changing market dynamics in the industry

In-depth market segmentation

Historical, current and projected market size in terms of value

Recent industry trends and developments

Competitive landscape

Strategies of key players and products offered

Potential and niche segments, geographical regions exhibiting promising growth

A neutral perspective on market performance

Must-have information for market players to sustain and enhance their market footprint

Related Reports:

Cross Border E-Commerce Software Market: https://www.factmr.com/report/cross-border-e-commerce-software-market

e-Learning Apps Market: https://www.factmr.com/report/e-learning-apps-market

Contact:

US Sales Office :

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

E-Mail: sales@factmr.com

Blog URL: https://blog.factmr.com/

Corporate Headquarter:

Unit No: AU-01-H Gold Tower (AU),

Plot No: JLT-PH1-I3A,

Jumeirah Lakes Towers,

Dubai, United Arab Emirates

About Fact.MR

Market research and consulting agency with a difference! That's why 80% of Fortune 1,000 companies trust us for making their most critical decisions. We have offices in US and Dublin, whereas our global headquarter is in Dubai. While our experienced consultants employ the latest technologies to extract hard-to-find insights, we believe our USP is the trust clients have on our expertise. Spanning a wide range - from automotive & industry 4.0 to healthcare & retail, our coverage is expansive, but we ensure even the most niche categories are analyzed. Reach out to us with your goals, and we'll be an able research partner.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurtech Market Augmented Expansion to Be Registered by 2022-2032 here

News-ID: 2664286 • Views: …

More Releases from Fact.MR

Kids Bicycle Market Set for Remarkable Growth, Expected to Surpass US$ 29.64 Bil …

By 2023, the kids bicycle market is projected to be valued at US$ 18.7 billion, and by 2033, it is anticipated to grow at a compound annual growth rate (CAGR) of 4.7% to reach US$ 29.64 billion. By the end of 2023, sales of children's bicycles are predicted to make up over 37% of the worldwide bicycle market.

A positive shift in the demand for bicycles has been attributed to a…

U.S. Population Health Management (PHM) Solutions Market Set to Hit US$ 34.59 Bi …

The global market for population health management (PHM) solutions in the United States is expected to expand at a compound annual growth rate (CAGR) of 14.8% between 2021 and 2028, according to a recently released Fact.MR analysis. By the end of 2028, the market is projected to reach US$ 34.59 billion. Over the projected period, there is anticipated to be an increase in demand for U.S. Population Health Management (PHM)…

Bleaching Clay Market is Anticipated to Grow at a CAGR of 7.2% to Top US$ 1.86 B …

The bleaching clay market was valued at US$ 932.2 million in 2022. Moreover, growth is anticipated to pick up speed at a robust 7.2% CAGR during the evaluation period of 2022-2032, culminating in US$ 1.86 billion. Bleaching clay has been widely utilized for edible oil purification since the nineteenth century. Variations in the yield of oilseed crops are anticipated to positively affect the global market for bleaching clay since bleaching…

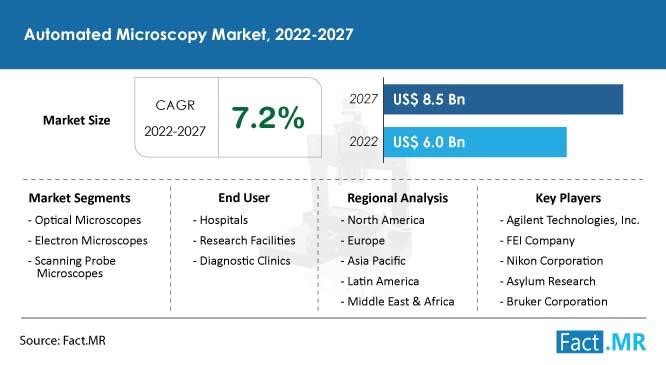

Automated Microscopy Market to Reach US$ 8.5 Billion by 2027, Grow at a CAGR of …

According to the most recent analysis conducted by market research and competitive intelligence company Fact.MR, the automated microscopy market is expected to be valued US$ 8.5 billion globally by 2027.

With the use of sophisticated monitoring techniques, automated microscopy is a contemporary technology that enhances the monitoring of biological material. In addition to reducing human error, automated microscopy offers accurate, automated magnification for topic examination and analysis. Because automated microscopy is…

More Releases for Insurtech

Insurtech Market Outlook 2022: Big Things are Happening

HTF Market Intelligence released a new research Study of 46 pages on title 'Insurtech - Thematic Research' with in-depth analysis, forecast and business moves. The market Study is segmented by key a region that is accelerating the marketization. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China and important players such as Aviva, AXA, Neos, Floodflash, Google,…

DQLabs Appoints Leandro DalleMule to InsurTech Advisory Board

PASADENA, Calif. | October 26, 2021

DQLabs.ai, a visionary in augmented data quality management, today announced that Leandro DalleMule has joined its InsurTech Advisory Board. Mr. DalleMule is currently the North America General Manager for Planck, a leading AI platform for commercial insurance. Previously, he spent five and half years as AIG’s Chief Data Officer, leading the Data Management function across AIG, as well as for the P&C and General Insurance…

Artificial Intelligence In Insurtech Market 2021 | Detailed Report

A fresh report titled “Artificial Intelligence In Insurtech Market” has been presented by ReportsnReports. It evaluates the key market trends, advantages, and factors that are pushing the overall growth of the market. Global Artificial Intelligence In Insurtech market to grow at a CAGR of around xx% during the forecast period. It outlines the market shares for key regions such as the Americas, APAC, Europe, and MEA. An exclusive data offered…

COVID Impact On Global Insurtech Market 2020-2025

COVID-19 has impacted the insurance industry, especially in Asia Pacific and Middle East & Africa, and thus the market share of that region has sparked the insurance industry, to capture that market insurance companies are adopting new business strategies in payment methods and services which create revenue opportunities during lockdown situations.

COVID-19 has increased the health risk in the human beings and opened new market opportunities for insurance companies.

The demand…

Digital InsurTech Market: 3 Bold Projections for 2020

Latest 2020 version of Global Digital InsurTech Market study of 108+ data Tables, Pie Chat, Graphs & Figures spread through Pages and easy to understand in depth analysis. "Digital InsurTech Market by Type (, Retail & Commercial), by Application (Health Insurance, Property and Casualty Insurance, Life Insurance & Others) and Region - Forecast and Status to 2025". At present, the market is developing its presence. The Research assessment of the…

Insurtech and Customer Services: Lessons for the Incumbents

MarketResearchReports.Biz announces addition of new report "Insurtech and Customer Services: Lessons for the Incumbents" to its database.

The emergence of insurtech has been fueled by new digital capabilities and Internet of Things (IoT) devices that are reducing costs, changing systems and processes, and enhancing the consumer experience. From an industry burdened by outdated systems and paper-based operations, the insurtech space has emerged as one of the largest innovation ecosystems globally in…