Press release

Global housing boom shifts focus

Eurozone slows, but Asia-Pacific house prices surgeThe global house price boom continues in 2007, albeit at a much slower pace and with different set of countries, according to the online research house, the Global Property Guide (http://www.globalpropertyguide.com).

A dramatic slowdown has taken place in several countries in Europe. House prices in Estonia, 2005 and 2006’s star performer, rose only 5.68% y-o-y to Q1 2007, dramatically lower than the 77.52% y-o-y increase to Q1 2006.

Higher interest rates and an overheating market were the main causes of the slowdown. The key interest rate of the European Central Bank (ECB) has been raised nine times to 4% in June 2007, from its historic low of 2% in Nov 2006.

Other European countries that experienced lower house price changes y-o-y to Q1 2007 than in 2006 included France, Sweden, Ireland, Spain, Greece, the Netherlands, Switzerland and Portugal.

Ireland’s annual house price growth slowed to 7.44% y-o-y to Q1 2007, a deceleration from 12.07% y-o-y to Q1 2006. Apart from the higher interest rate, the heating issue on Stamp Duty also contributed to the decline.

The US house price rise also slowed to 4.07% y-o-y to Q1 2007, down from 12.78% y-o-y to Q1 2006.

The US Federal Funds rate has risen sharply from its low of 1% in May 2004 to its current

level of 5.25%. The Fed has kept the rate unchanged since June 2006. This rate increase has meant trouble for sub-prime borrowers, leading to delayed payments and foreclosures.

Strong rises in non-Eurozone Europe

Interestingly, European countries which have not adopted the Euro have experienced stronger house price rises y-o-y to Q1 2007, than countries within the zone. Such is the case of Latvia which plans to adopt the Euro in 2010. Latvia took the lead in house price increases y-o-y to Q1 2007.

Latvia's capital, Riga, experienced a remarkable appreciation of 61.91% y-o-y to Q1 2007, higher than the 35.64% y-o-y increase to Q1 2006. However, recent data from Latio, Latvia's leading research-oriented real estate agency, show that prices have started to fall in Q2 2007.

Lithuania’s house prices rose by 26.32% y-o-y to Q1 2007, up from 25% y-o-y to Q1 2006. Lithuania has recently increased its long-term interest rate to 4.6% in June 2007, from 4.2% in March 2007. The European Commission rejected Lithuania’s bid to adopt the euro in 2007 because its inflation breached the required limit.

House prices in Norway were up by 16.69% y-o-y to Q1 2007. Norway rejected EU membership in a referendum in 1972, and again in 1994. Positive factors such as continued economic expansion and the strength of the labour market overpowered the pull exerted by higher interest rates.

After taking a breather in 2005 and early 2006, house price growth in the UK accelerated to 9.25% y-o-y to Q1 2007, up from 5.3% y-o-y to Q1 2006. Particularly, Northern Ireland and London saw double-digit y-o-y house price increases in Q1 2007, at 57.6% and 14.3%, respectively.

Cyprus, which is set to adopt the Euro starting January 2008, is in a middle of a housing boom with house prices rising by almost 10% y-o-y to Q1 2007. Liberalization of the financial sector, a decrease in interest rates, and increased demand for higher quality housing and second homes were the main drivers for the price boom.

Now it’s Asia–Pacific’s turn

The house price boom is now moving towards the Asia-Pacific region. Property prices in countries affected by the Asian Crisis are showing strong signs of recovery, prompting fears that a property bubble is developing anew in the region.

Property prices in the Philippines, Singapore and South Korea rose by more than 10% y-o-y to Q1 2007, higher than in 2006. Although Japan registered a nationwide land price drop of 1.48%, land prices in its six major cities increased by a remarkable 7.75% y-o-y to Q1 2007, suggesting a real recovery from the 15-year house price downturn. There are no official house price statistics in Japan, so land prices are used as a proxy.

Australia has recovered from its 2004-2006 slowdown. Despite higher interest rates, house prices rose by almost 8% y-o-y to Q1 2007, from 4% y-o-y to Q1 2006.

New Zealand’s house prices rose by 11.36% y-o-y to Q1 2007, significantly up from 9.55% y-o-y to Q4 2006. This is despite the fact that the Reserve Bank of New Zealand (RBNZ) has increased interest rates since early 2004 to cool down the housing market.

Elsewhere, South Africa saw 16.74% house price increases y-o-y to Q1 2007. South Africa’s house prices have been escalating for seven continuous years, with price increases peaking at 30% in 2004.

Canada’s house prices moved forward in Q1 2007, thanks to strong economic growth, low mortgage rates and large net immigration. House prices rose 9.30% y-o-y to Q1 2007, up from 7.55% y-o-y to Q1 2006.

The laggards

Thailand and Israel, after suffering from political crises, have not yet recouped the confidence of investors. This resulted in a drop of 5.09% y-o-y to Q1 2007 in Thailand’s house prices, down from an 8.03% y-o-y increase to Q1 2006. Israel’s house prices fell by 10.52% y-o-y to Q1 2007, due to increased political and security concerns in the Middle East.

Portugal’s sluggish economic expansion exacerbated the effect of higher Euro interest rates. House prices have risen by a meager 1.14% y-o-y to Q1 2007, after an already low growth rate of 2.17% y-o-y to Q1 2006.

Full Report:

http://www.globalpropertyguide.com/articleread.php?article_id=94&cid=

Economics Team:

Prince Christian Cruz, Senior Economist

Phone: (+632) 750 0560

Email: prince@globalpropertyguide.com

Publisher and Strategist:

Matthew Montagu-Pollock

Phone: (+632) 867 4220

Cell: (+63) 917 321 7073

Email: editor@globalpropertyguide.com

Terms of Use:

On-line newspapers, magazines, etc wishing to use material from this press release MUST provide a clickable link to www.globalpropertyguide.com.

Address:

Global Property Guide

http://www.globalpropertyguide.com

5F Electra House Building

115-117 Esteban Street

Legaspi Village, Makati City

Philippines 1229

info@globalpropertyguide.com

The Global Property Guide is an on-line property research house.

Terms of Use:

On-line newspapers, magazines, etc wishing to use material from this press release MUST provide a clickable link to www.globalpropertyguide.com.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global housing boom shifts focus here

News-ID: 25799 • Views: …

More Releases from Global Property Guide

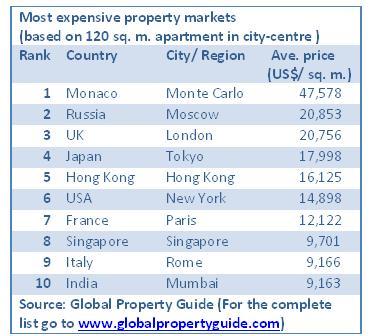

Most expensive real estate markets in 2009

No surprise - Monte Carlo is No 1 in the Global Property Guide’s list of World’s Most Expensive Residential Real Estate Markets 2009, more than twice as expensive, at US$45,000 per square metre, as the runner up. [globalpropertyguide.com]

Battling for the number 2 position are prime central Moscow and London. Prime central Moscow’s US$20,853 per square metre price tag slightly outpaces core Prime London’s US$20,756 per square metre, though it…

World property market slide worsens

As financial markets tumble, the world’s housing markets have continued to slide during the year to end-Q2 2008. Inflation-adjusted house prices fell in 21 out of the 33 countries for which there is up-to-date published data.

The Baltics, the US, the UK and Ireland led the global decline during the year to end-Q2 2008, the latest date for which comprehensive global statistics are available.

The biggest house price declines…

The end of the global house price boom

Weighed down by the credit crunch and high inflation, the global house price boom has ended, according to the latest Global Property Guide survey of house price indicators.

Only 13 countries in which dwelling price indices are regularly published saw prices rise during the year to end Q1 2008, while 21 countries saw dwelling prices fall in real terms, i.e., after adjusting for inflation.

In most countries…

Gloomy days ahead for Asia’s housing markets

Asian property markets, though still relatively unaffected by the credit crunch, will soon be affected by inflation and higher interest rates, warns the Global Property Guide, because of rising food, fuel and other commodity prices.

“Higher food, fuel and other commodity prices affect the housing market negatively in several ways,” says Prince Christian Cruz, senior economist at the Global Property Guide.

“At the micro level, households may postpone their decision to…

More Releases for Euro

Free Euro 2024 Sweepstake Generator

Birmingham, 22nd May - Exciting news for football fans! Clevercherry, a leading creative and digital agency, is thrilled to relaunch their famous sweepstake generator, just in time for Euro 2024.

The agency, known for working with clients such as West Midlands Police, Ducati, and Subaru, and renowned for their World Cup sweepstake generator in 2022, has recently relaunched their sweepstake generator for Euro 2024. This tool was developed in-house by their…

Euro Ophthalmology 2019

The 2nd European Congress on Ophthalmology going to be held amid March 21-22, 2018 at Amsterdam, The Netherlands, which unites a one of a kind and worldwide blend of substantial and medium pharmaceutical, biotech and symptomatic or diagnostic organizations, leading universities and clinical research companies making the meeting an ideal stage to share understanding, encourage coordinated efforts crosswise over industry and the scholarly community, and assess rising advancements over the…

17th Euro Biotechnology Congress

Conference Series LLC extends its warm welcome to 17th Euro Biotechnology Congress during September 25-27, 2017 at Berlin, Germany with a theme “Novel Trends and Innovations in Biotechnology for Making Life Better”. Conference Series LLC through its Open Access Initiative is committed to make genuine and reliable contributions to the scientific community.

Scope and Importance

Euro Biotechnology Conference aims to bring together the Professors, Researchers, scientists, business giants, and technocrats to provide…

Euro Façade Tech Glazing Systems

Virtually any type of glazing system can be used with structural glass facades. Check out the options with Euro Façade Tech.

FRAMED

Framed systems support the glass continuously along two or four sides. There are many variations of framed systems, most of which fall into two general categories. Conventional unitized curtainwall systems are seldom used with structural glass facades.

STICK

Stick-built glass facades are a method of curtainwall construction where much of the fabrication…

Traveltext's alternative Euro 2016

You don’t even have to be a sports fan to know that this summer, the England football team will be heading off to the latest major international tournament with the hopes of a nation resting on the shoulders of the likes of Wayne Rooney, Jamie Vardy and Dele Alli.

The fact that the tournament has expanded this year to include no fewer than 24 nations means that the eyes of Europe…

Euro Coin Exchange Announces Director of New UK Office; Launches Euro-Coins-For- …

Atlanta, GA -- Euro Coin Exchange, the leading buyer of euro coins in the U.S., announced the appointment of Christian Rayner as Director of the company’s U.K. operations. The announcement accompanied the opening of the company’s new coin processing center in the Thames Valley, near London, serving customers throughout the U.K. Initially, the U.K. office will exchange euro coins and banknotes for pounds exclusively.

Kenneth Mitteldorf, the founder of Euro Coin…