Press release

Long-Term Care Insurance Claims Paid For 2021 Reported

Some $12.3 Billion in claims was paid out by the nation’s long-term care insurers in 2021. The figure represents a significant increase over prior years according to the American Association for Long-Term Care Insurance (AALTCI).“Consumers question the value of long-term care insurance protection,” says Jesse Slome, AALTCI’s director. “They ask whether insurers are paying claimants. The latest data shows that indeed they are paying more dollars to more people than in any prior year.”

According to the AALTCI year-end report, the amount of claim benefits paid to policyholders in 2021 grew by some $700 million compared to 2020.

“The $12.3 billion paid represents an increase of $2 billion over the total claim benefits paid by the industry in 2018,” Slome reports. “Benefits were paid to some 336,000 policyholders in 2021 which is 11,000 more than a year ago” Slome shares. “Some claims amount to small amounts and some can be significant, totally over $1 million,” the expert explains. “Even if you do a simple calculation, the average claim amount paid out for the year would equal $36,600. And, claims can last for several years.”

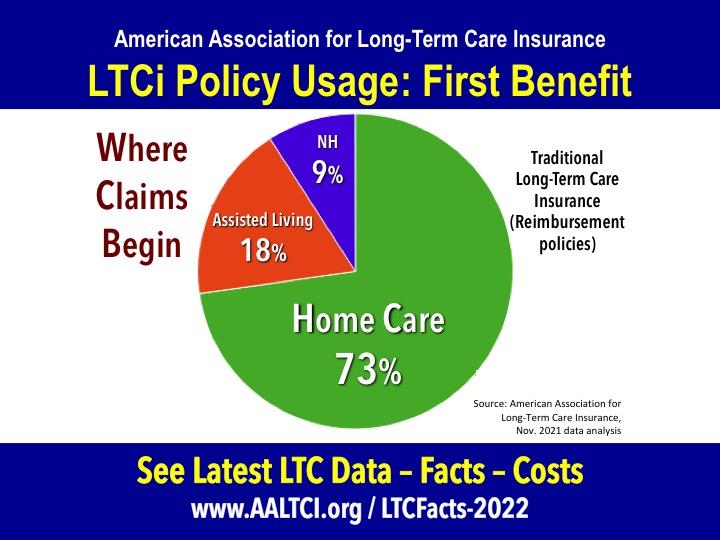

The data represents claims for those owning traditional or health-based long-term care insurance. Roughly six million policies are owned by individuals. The Association report does not include data for linked-benefit policies. These include life insurance or annuity policies that can also provide a payout for qualifying long-term care needs.

Data on long-term care insurance claim payments along with other current data can be accessed on the Association’s website. To see 2020 statistical reports, go to https://www.aaltci.org/long-term-care-insurance/learning-center/ltcfacts-2022.php.

AALTCI

32504 Carrie Place

Westlake Village, CA 91361

Jesse Slome

The American Association for Long-Term Care Insurance advocates for the importance of long-term care planning. The organization connects consumers with knowledgeable professionals who are independent advisors. Visit the website https://www.aaltci.org to connect with a specialist who can provide information along with long-term care insurance costs quotes and policy comparisons for both traditional and linked benefit long-term care insurance options.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Long-Term Care Insurance Claims Paid For 2021 Reported here

News-ID: 2511873 • Views: …

More Releases from American Association for Long-Term Care Insurance

Hybrid Long-Term Care Price Index Released

A 55-year-old male can expect to pay between $5,200 and $6,100 annually for a typical hybrid long-term care insurance policy according to the American Association for Long-Term Care Insurance (AALTCI). A woman, also age 55 will pay between $1,000 and $2,000 more.

"Hybrid or linked-benefit long-term care policies are growing in popularity but there can be significant differences in price and future benefit values," explains Jesse Slome, director of the…

New Linked Benefit Long-Term Care Insurance Resource Center Launched

A new online resource center focused on linked benefit long-term care insurance has been launched by the American Association for Long-Term Care Insurance.

"Linked benefit long-term care insurance is now the favored choice of consumers buying protection," states Jesse Slome, director of the American Association for Long-Term Care Insurance. "However, there are many things consumers don't know about these products. The Association's new resource center will be designed to…

Association Launches Campaign Focused On Long-Term Care Insurance Claims

An awareness and educational campaign focused on long-term care insurance claims is being initiated by the American Association for Long-Term Care Insurance.

"If you want to know how much long-term care insurance protection to buy, it's helpful to know how and how much insurance benefits people actually use," explains Jesse Slome, director of the long-term care insurance organization. "Information on policy claims can be very valuable for consumers considering buying…

Covid-Experience Creating New Insurance Sales Opportunities For Agents

The Covid experience is going to make people very aware of their health vulnerability and that presents insurance agents with an opportunity.

"Covid has changed how people view their health and more individuals will be interested in understanding how to plan for future risks," explains Jesse Slome, director of the American Association for Long-Term Care Insurance as well as the American Association for Medicare Supplement Insurance. "Insurance agents are already…

More Releases for Slome

Millions Of Seniors Should Expect Significant 2025 Medicare Changes

Some 67 million Americans are enrolled in Medicare, according to the American Association for Medicare Supplement Insurance.

"It's important to know that some significant changes are coming in 202," explains Jesse Slome, director of the advocacy information. "These changes are likely to impact millions who will want to be ready to act when Medicare's Annual Enrollment Period (AEP) begins." AEP begins October 15th 2024.

According to Slome, the Inflation Reduction Act of…

Seniors Can Save On Medicare Prescription Drug Plans

The typical senior can save between $400 and $1,100 yearly by comparing and switching to a better Medicare prescription drug plan estimates the American Association for Medicare Supplement Insurance.

More than 50 million Americans now have Medicare drug plan coverage reports Jesse Slome, director of the Medicare insurance advocacy organization. "Unfortunately, far too few take advantage of the opportunity Medicare provides to find and switch to better coverage," Slome states.

Medicare allows…

Association Announces Senior Travel Discount Offers

A special 2024 $100 senior discount with two leading tour operators has been announced by the American Association for Medicare Supplement Insurance.

"Seniors are back to traveling the globe and this savings offer has been well received," explains Jesse Slome, director of the senior-focused insurance organization. Slome, himself, has just returned from a three-week tour to Japan.

The special discount enables seniors booking a first-time land tour or cruise with either Grand…

Directory Connects Seniors With Local Medicare Insurance Agents

A free online directory hosted by the American Association for Medicare Supplement Insurance connects seniors with local Medicare insurance professionals.

"Medicare is a national program but Medicare plan options are local," explains Jesse Slome, director of the national organization. "Finding the best Medicare option for your needs and budget is a lot more complex than just calling a toll-free number advertised on television."

According to the Medicare insurance expert, the typical seniors…

Seniors Urged To Compare All Medicare Insurance Options Before Deciding

When it comes to Medicare insurance options, seniors have more choices than ever. More options are resulting in more confusion and an increase in mistaken choices. An educational effort has been launched to help educate seniors who are eligible for Medicare.

"The typical senior has 100 or more different options to choose from," explains Jesse Slome, director of the American Association for Medicare Supplement Insurance. "While Medicare is a national program,…

Critical Illness Insurance Association Relaunches Website

The American Association for Critical Illness Insurance has relaunched the organization's website designed to create heightened awareness of and interest in cancer insurance as well as critical illness insurance.

"We intend for the new website to be the nation's primary and trusted resource for information," shares Jesse Slome, director of the organization first founded in 2009. "Millions of Americans between the ages of 35 and 55 could greatly benefit…