Press release

Association Launches Campaign Focused On Long-Term Care Insurance Claims

An awareness and educational campaign focused on long-term care insurance claims is being initiated by the American Association for Long-Term Care Insurance."If you want to know how much long-term care insurance protection to buy, it's helpful to know how and how much insurance benefits people actually use," explains Jesse Slome, director of the long-term care insurance organization. "Information on policy claims can be very valuable for consumers considering buying a policy."

Each year insurance companies pay benefits to several hundred thousand individuals placing long-term care insurance claims on their policy. "There is a ton of information online recommending that people purchase coverage," Slome admits. "However, much of it focuses on older concepts and, in my opinion, doesn't help consumers make better decisions."

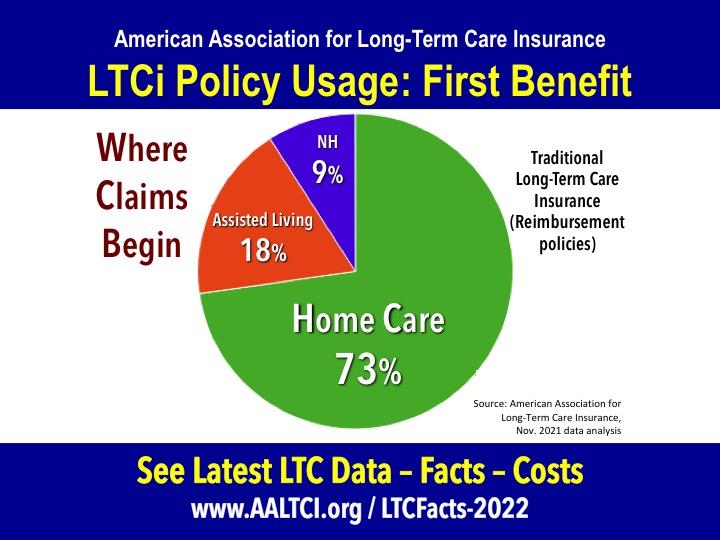

The first piece of information released by the Association focuses on where claims start. Access the latest statistics and facts about long-term care insurance at https://www.aaltci.org/long-term-care-insurance/learning-center/ltcfacts-2022.php.

According to the Association, some 73 percent of new long-term care insurance claims begin with the policyholder receiving care in their own home. Some 18 percent begin their claim receiving care in an assisted living facility. Eight percent start with care in a nursing home. The data is based on traditional long-term care insurance policies which constitute the majority of policies written over the past three decades.

"The typical consumer associates long-term care insurance with a nursing home need," Slome admits. "And since they don't really consider a nursing home stay a risk, that's one reason they do not learn more about this protection."

"You buy insurance to protect against real risks and real needs," Slome adds. "The risk of needing care in your own home is real. Next we'll look at the reasons why people need care at home, how long care is needed and what it costs."

AALTCI

32504 Carrie Place

Westlake Village, CA 91361

he American Association for Long-Term Care Insurance (AALTCI) advocates for the importance of planning and supports insurance professionals who market both traditional and hybrid LTC solutions. To obtain long-term care insurance costs from a long-term care insurance specialist call the organization at 818-597-3227 or visit their website https://www.aaltci.org/long-term-care-insurance/.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Association Launches Campaign Focused On Long-Term Care Insurance Claims here

News-ID: 2472083 • Views: …

More Releases from American Association for Long-Term Care Insurance

Hybrid Long-Term Care Price Index Released

A 55-year-old male can expect to pay between $5,200 and $6,100 annually for a typical hybrid long-term care insurance policy according to the American Association for Long-Term Care Insurance (AALTCI). A woman, also age 55 will pay between $1,000 and $2,000 more.

"Hybrid or linked-benefit long-term care policies are growing in popularity but there can be significant differences in price and future benefit values," explains Jesse Slome, director of the…

New Linked Benefit Long-Term Care Insurance Resource Center Launched

A new online resource center focused on linked benefit long-term care insurance has been launched by the American Association for Long-Term Care Insurance.

"Linked benefit long-term care insurance is now the favored choice of consumers buying protection," states Jesse Slome, director of the American Association for Long-Term Care Insurance. "However, there are many things consumers don't know about these products. The Association's new resource center will be designed to…

Long-Term Care Insurance Claims Paid For 2021 Reported

Some $12.3 Billion in claims was paid out by the nation’s long-term care insurers in 2021. The figure represents a significant increase over prior years according to the American Association for Long-Term Care Insurance (AALTCI).

“Consumers question the value of long-term care insurance protection,” says Jesse Slome, AALTCI’s director. “They ask whether insurers are paying claimants. The latest data shows that indeed they are paying more dollars to more…

Covid-Experience Creating New Insurance Sales Opportunities For Agents

The Covid experience is going to make people very aware of their health vulnerability and that presents insurance agents with an opportunity.

"Covid has changed how people view their health and more individuals will be interested in understanding how to plan for future risks," explains Jesse Slome, director of the American Association for Long-Term Care Insurance as well as the American Association for Medicare Supplement Insurance. "Insurance agents are already…

More Releases for Slome

Millions Of Seniors Should Expect Significant 2025 Medicare Changes

Some 67 million Americans are enrolled in Medicare, according to the American Association for Medicare Supplement Insurance.

"It's important to know that some significant changes are coming in 202," explains Jesse Slome, director of the advocacy information. "These changes are likely to impact millions who will want to be ready to act when Medicare's Annual Enrollment Period (AEP) begins." AEP begins October 15th 2024.

According to Slome, the Inflation Reduction Act of…

Seniors Can Save On Medicare Prescription Drug Plans

The typical senior can save between $400 and $1,100 yearly by comparing and switching to a better Medicare prescription drug plan estimates the American Association for Medicare Supplement Insurance.

More than 50 million Americans now have Medicare drug plan coverage reports Jesse Slome, director of the Medicare insurance advocacy organization. "Unfortunately, far too few take advantage of the opportunity Medicare provides to find and switch to better coverage," Slome states.

Medicare allows…

Association Announces Senior Travel Discount Offers

A special 2024 $100 senior discount with two leading tour operators has been announced by the American Association for Medicare Supplement Insurance.

"Seniors are back to traveling the globe and this savings offer has been well received," explains Jesse Slome, director of the senior-focused insurance organization. Slome, himself, has just returned from a three-week tour to Japan.

The special discount enables seniors booking a first-time land tour or cruise with either Grand…

Directory Connects Seniors With Local Medicare Insurance Agents

A free online directory hosted by the American Association for Medicare Supplement Insurance connects seniors with local Medicare insurance professionals.

"Medicare is a national program but Medicare plan options are local," explains Jesse Slome, director of the national organization. "Finding the best Medicare option for your needs and budget is a lot more complex than just calling a toll-free number advertised on television."

According to the Medicare insurance expert, the typical seniors…

Seniors Urged To Compare All Medicare Insurance Options Before Deciding

When it comes to Medicare insurance options, seniors have more choices than ever. More options are resulting in more confusion and an increase in mistaken choices. An educational effort has been launched to help educate seniors who are eligible for Medicare.

"The typical senior has 100 or more different options to choose from," explains Jesse Slome, director of the American Association for Medicare Supplement Insurance. "While Medicare is a national program,…

Critical Illness Insurance Association Relaunches Website

The American Association for Critical Illness Insurance has relaunched the organization's website designed to create heightened awareness of and interest in cancer insurance as well as critical illness insurance.

"We intend for the new website to be the nation's primary and trusted resource for information," shares Jesse Slome, director of the organization first founded in 2009. "Millions of Americans between the ages of 35 and 55 could greatly benefit…