Press release

Legal and Financial Due Diligence | K&T Forlex

In the world of mergers and acquisitions, it is important for a purchaser to conduct its “due diligence” with respect to the historical and forecasted activities of a potential target company. Due diligence could include inquiries into the financial, tax, legal, commercial, human resources, regulatory and environmental affairs of the company. The following addresses the financial aspects of due diligence.What is financial due diligence?

For starters, financial due diligence is not an audit. An audit provides an opinion on whether the historical financial statements present fairly the financial position of a company. Financial due diligence, on the other hand, goes deeper to understand the reasons for historical and forecasted trends, and reports on the relevancy of these trends to the purchaser. The scope of financial due diligence differs from business to business depending on the size and industry of the target company. Typically, the scope would include an analysis of the historical quality of earnings (i.e. the sustainability of historical earnings before interest, taxes, depreciation and amortization or “EBITDA”), quality of net assets, working capital requirements, capital expenditure requirements, financial debt and liabilities, and forecasted financial results. Based on the outcome of the due diligence a purchaser should be able to assess, based on their risk profile, whether there are any potential deal breakers, whether the structure and price of the acquisition is appropriate or whether appropriate warranties and representations are included in the purchase agreement.

Visit our website to know more: https://www.ktforlex.com/services

When do I need to conduct financial due diligence?

Financial due diligence should be undertaken whenever a purchaser is considering acquiring a new business. Ideally, the financial due diligence process should commence as soon as possible when negotiating to acquire a business. Once an expression of interest or letter of intent (which lays out the structure of the transaction) has been agreed by both the purchaser and the vendor, the financial due diligence should begin. Adequate time should be allocated to the financial due diligence process. Financial due diligence inquiries can range between two to four weeks depending on the size of the target company and scope of the work.

Who should complete the financial due diligence?

Financial due diligence can be conducted either internally, by the acquirers’ own accounting and finance function, or by external independent due diligence professionals. The benefits of using external professionals include: 1) The diligence is based on an independent viewpoint from a party that has no direct interest in the outcome of the proposed transaction; 2) The diligence is completed by professionals who understand the dynamics of a transaction environment; and 3) Internal resources, which are likely already constrained, can be dedicated to integration and post transaction planning

We at K & T Forlex provide you with legal and financial consultation. Your company might require you to provide a Land draft, Company draft, Monthly, quarterly, or yearly financial reports. We at K & T help you to create that and visualize the best solution for your business based on the reports. We help you stay updated with any kind of data that you need for a smoother run of your business.

• Company Due Diligence, Key Managerial Personnel (KMP) Due Diligence, Land Due Diligence (15/30+ Years) reports

• Monthly/Quarterly/Yearly Due Diligence Reports for IPO purpose

• Audit and Balance Sheet analysis

Contact US:

Warun Kumbhar

Email: warun.k@ktforlex.com

Phone: (+91) 76207 01201

Website: https://www.ktforlex.com/

In the world of mergers and acquisitions, it is important for a purchaser to conduct its “due diligence” with respect to the historical and forecasted activities of a potential target company. Due diligence could include inquiries into the financial, tax, legal, commercial, human resources, regulatory and environmental affairs of the company. The following addresses the financial aspects of due diligence.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Legal and Financial Due Diligence | K&T Forlex here

News-ID: 2456214 • Views: …

More Releases from K&T Forlex

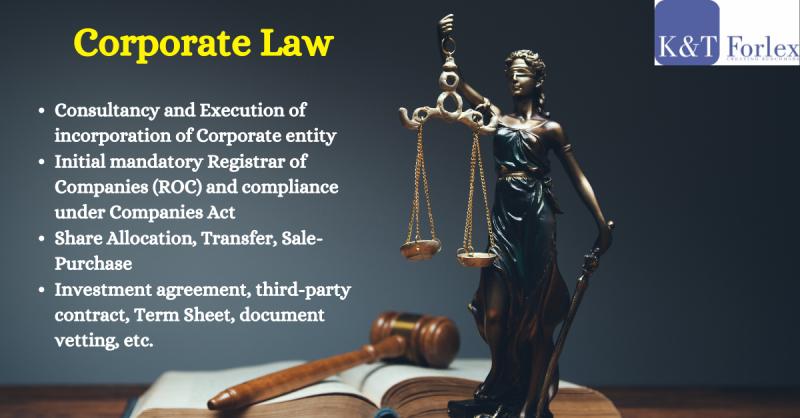

Corporate Law Service | K&T Forlex

K&T Forlex specializes in corporate law, thus if you are looking to establish sole proprietorship, a Private Limited company, LLP, or One Person Company (OPC), and a partnership firm we can provide you with all the assistance you need. Whether it is a corporate partnership, corporate structuring and restructuring, corporate dissolution, corporate sponsorship/funding, and liaison office (LO) or project office (PO)- we have solutions and services for all your needs.…

More Releases for Financial

Financial Leasing Services Market Share, Size, Financial Summaries Analysis from …

Infinity Business Insights has recently released a comprehensive research report titled "Financial Leasing Services Market Insights, Extending to 2031." This publication spans over 110+ pages and offers an engaging presentation with visually appealing tables and charts that are self-explanatory. The worldwide Financial Leasing Services market is expected to grow at a booming CAGR of 6.3% during 2024-2031. It also shows the importance of the Financial Leasing Services market main players…

Global Financial Aid Management Software Market Streamlining Financial Assistanc …

Overview for the report "Financial Aid Management Software Market" Helps in providing scope and definations, Key Findings, Growth Drivers, and Various Dynamics by Infinitybusinessinsights.com. This report will help the viewer in Better Decision Making.

At a predicted CAGR of 10.9% from 2023 to 2028, The Market for Financial Assistance Management Software will increase from USD 1.07 billion in 2022 to USD X.XX billion by 2030. The market's expansion can be attributed…

What will be Driving Growth Financial Leasing Market 2027 | Bank Financial Leasi …

Financial Leasing Market research is an intelligence report with meticulous efforts undertaken to study the right and valuable information. The data which has been looked upon is done considering both, the existing top players and the upcoming competitors. Business strategies of the key players and the new entering market industries are studied in detail. Well explained SWOT analysis, revenue share and contact information are shared in this report analysis.

Ask for…

Financial Leasing Market 2017 Analysis – CDB Leasing, ICBC Financial Leasing C …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

In this report, RRI studies the present scenario (with the base year being 2017) and the growth prospects…

Financial Leasing Market Is Booming | KLC Financial, SMFL Leasing, GM Financial, …

HTF MI recently introduced Global Financial Leasing Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are Sumitomo Mitsui Finance and Leasing, Maldives, HNA Capital, KUKE S.A., KLC…

Financial Analytics Market: Banking & financial sector expected to make most of …

The Financial Analytics Market deals with the development, manufacture and distribution of financial analytics tools for enterprises of all kinds and sizes. Financial data analytics can be described as a set of tools, techniques and processes used to find out answers for various business questions as well as to forecast future scenarios regarding finance and the economy.

The services provided by the Financial Analytics Market are used for analyzing the equity…