Press release

Blockchain Supply Chain Finance Market Size, Trends, Industry Outlook, Future Scope, Forecast Report 2027

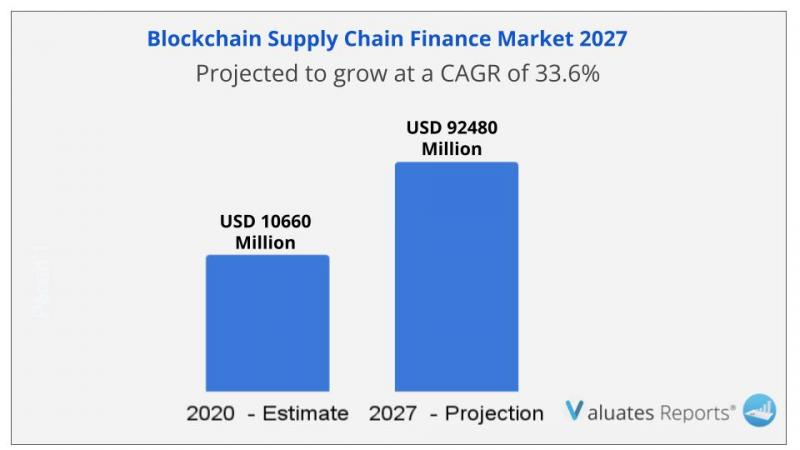

The global Blockchain Supply Chain Finance market size is projected to reach US$ 92480 million by 2027, from US$ 10660 million in 2020, at a Compound Annual Growth Rate (CAGR) of 33.6% during 2021-2027.Blockchain Supply Chain Finance is the application of blockchain technology in the financial field. The financial services industry is the driving force of global economic development and is also one of the most centered industries. The asymmetric information between the two parties in the financial market leads to the failure to establish an effective credit mechanism. There are a large number of central credit intermediaries and information intermediaries in the industrial chain, which slows the efficiency of the system and increases the cost of funds. The open and no tampering properties of blockchain technology provide the possibility for the centralization of the trust mechanism and have the potential to change the financial infrastructure. All kinds of financial assets, such as equity, bond, bill, warehouse receipt and fund share, can be integrated into the blockchain books, and become the digital assets of the chain, in the blockchain. Store, transfer, and trade. It has a broad prospect of application in the financial field. For example, it has a typical application in cross-border payment, insurance claims, securities trading, bills and so on.

Inquire for Sample Report: https://reports.valuates.com/request/sample/QYRE-Auto-20F342/Global_Blockchain_Supply_Chain_Finance_Market

Blockchain Supply Chain Finance Market: Drivers and Restraints

This section covers the various factors driving the global Blockchain Supply Chain Finance market. To understand the growth of the market it is important to analyze the various drivers present the market. It provides data by value and volume of different regions and their respective manufacturers. This data will elaborate on the market share occupied by them, predict their revenue concerning strategies, and how they will grow in the future. After explaining the drivers, the report further evaluates the new opportunities and current trends in the market.

View Full Report: https://reports.valuates.com/market-reports/QYRE-Auto-20F342/global-blockchain-supply-chain-finance

The global Blockchain Supply Chain Finance market is split into two segments, type, and application. The product type briefs on the various types of products available in the market. The report also provides data for each product type by revenue for the forecast time period. It covers the price of each type of product. The other segment on the report, application, explains the various uses of the product and end-users. In the report, the researchers have also provided revenue according to the consumption of the product.

Blockchain Supply Chain Finance Market by Type

o IT Solution

o FinTech

o Bank

o Consulting

o Exchange and Other

Blockchain Supply Chain Finance Market by Application

o Cross-border Payment

o Trade Finance

o Digital Currency

o Identity Management

o Others

Major Players in the Blockchain Supply Chain

o Finance Market

o IBM

o Ripple

o Rubix by Deloitte

o Accentures

o Distributed Ledger Technologies

o Oklink

o Nasdaq Linq

o Oracle

o AWS

o Citi Bank

o ELayaway

o HSBC

o Ant Financial

o JD Financial

o Qihoo 360

o Tecent

o Baidu

o Huawei

o Bitspark

o SAP

Similar Reports:

Trade Finance Market: https://reports.valuates.com/market-reports/QYRE-Auto-6X849/global-trade-finance

Canada Financial Guarantee Market: https://reports.valuates.com/market-reports/ALLI-Manu-2V67/canada-financial-guarantee

Letter of Credit Confirmation Market: https://reports.valuates.com/market-reports/ALLI-Manu-1V31/letter-of-credit-confirmation

Blockchain In Trade Finance and Credit Insurance Market: https://reports.valuates.com/market-reports/QYRE-Othe-2W295/global-blockchain-in-trade-finance-and-credit-insurance

Smart Contracts Market: https://reports.valuates.com/market-reports/QYRE-Auto-31L1599/global-smart-contracts

Valuates Reports

sales@valuates.com

For U.S. Toll Free Call +1-(315)-215-3225

For IST Call +91-8040957137

WhatsApp : +91-9945648335

Website: https://reports.valuates.com

Twitter - https://twitter.com/valuatesreports

Linkedin - https://in.linkedin.com/company/valuatesreports

Facebook - https://www.facebook.com/valuatesreports/

Valuates offers in-depth market insights into various industries. Our extensive report repository is constantly updated to meet your changing industry analysis needs.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Blockchain Supply Chain Finance Market Size, Trends, Industry Outlook, Future Scope, Forecast Report 2027 here

News-ID: 2437764 • Views: …

More Releases from Valuates Reports

High Purity Nitrogen Gas Market Share Driven by Semiconductor Fab Expansion and …

High Purity Nitrogen Gas Market

The global market for High Purity Nitrogen Gas was valued at US$ million in the year 2024 and is projected to reach a revised size of US$ million by 2031, growing at a CAGR of %during the forecast period.

View sample report

https://reports.valuates.com/request/sample/QYRE-Auto-2O3338/Global_High_Purity_Nitrogen_Gas_Market_Insights_Forecast_to_2028

The global high purity nitrogen gas market is entering a phase of accelerated demand, largely due to its critical role as an "invisible utility" in high-tech…

Epoxy Molding Compound in Semiconductor Packaging Market Grows as Advanced Packa …

Epoxy Molding Compound in Semiconductor Packaging Market Size

The global market for semiconductor was estimated at US$ 579 billion in the year 2022, is projected to US$ 790 billion by 2029, growing at a CAGR of 6% during the forecast period.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-25C10139/Global_Epoxy_Molding_Compound_in_Semiconductor_Packaging_Market_Research_Report_2022

By Type

• Normal Epoxy Molding Compound

• Green Epoxy Molding Compound

By Application

• Advanced Packaging

• Traditional Packaging

Key Companies

Sumitomo Bakelite, Nitto Denko, Resonac, Shin-Etsu Chemical, KCC, NEPES, CHANG CHUN SB(CHANGSHU), Hysol Huawei Electronics, Jiangsu Huahai…

Advanced Packaging Inspection Systems Market Accelerates as Semiconductor Packag …

Advanced Packaging Inspection Systems Market Size

In 2024, the global market size of Advanced Packaging Inspection Systems was estimated to be worth US$ 456 million and is forecast to reach approximately US$ 853 million by 2031 with a CAGR of 9.5% during the forecast period 2025-2031.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-10W9117/Global_Advanced_Packaging_Inspection_Systems_Market_Outlook_2022

By Application

• IDM

• OSAT

Key Companies

Camtek, Onto Innovation, KLA, Intekplus, Cohu, Semiconductor Technologies & Instruments (STI), Segment by Power, Optical Based Packaging Inspection Systems, Infrared Packaging…

Aseptic Packaging Market Expands Globally as Demand for Safe, Shelf-Stable Food …

Aseptic Packaging Market Size

The global Aseptic Packaging revenue was US$ 14560 million in 2022 and is forecast to a readjusted size of US$ 18490 million by 2029 with a CAGR of 3.0% during the forecast period (2023-2029).

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-27M15709/Global_and_India_Aseptic_Packaging_Market_Report_Forecast_2023_2029

By Type

• Brick Shape

• Pillow Shape

• Octagon Shape

By Application

• Dairy Products

• Beverage & Drinks

Key Companies

Tetra Pak, SIG, Elopak, Greatview, Xinjufeng Pack, Lamipack, SEMCORP, ipack, Bihai, Coesia IPI, Jielong Yongfa, Yingsheng

Major Trends

• Increasing adoption of aseptic formats for…

More Releases for Finance

Consumer Finance Market to Witness Revolutionary Growth by 2030 | Bajaj Capital, …

Global "Consumer Finance Market" Research report is an in-depth study of the market Analysis. Along with the most recent patterns and figures that uncovers a wide examination of the market offer. This report provides exhaustive coverage on geographical segmentation, latest demand scope, growth rate analysis with industry revenue and CAGR status. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of…

Big Boom in Environmental Finance Market 2020-2027 | Environmental Finance (Fult …

According to a report on Environmental Finance Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Environmental Finance Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study portrays an…

PLATINUM GLOBAL BRIDGING FINANCE - BRIDGING FINANCE, DEVELOPMENT FINANCE AND COM …

If your business is looking to finance bridging, development or commercial financing we have contacts with lenders and banks in over 25 countries around the world. Our specialist knowledge can help you get the ideal financing in place.

Platinum Global Bridging Finance is a specialist bridging loan lender. They deliver the loan financing that suits you and your clients desired financing. Their aim is to be crystal clear, so they offer…

Global Environmental Finance Market Leading Players are Environmental Finance (F …

Global Environmental Finance Market Insights, Size, Share, Forecast to 2025

This report studies the Environmental Finance Market size by players, regions, product types and end industries, history data 2013-2017 and forecast data 2019-2025; this report also studies the global market competition landscape, market drivers and trends, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter's Five Forces Analysis.

The main goal for the dissemination of this information is to…

Global Consumer Finance Services Market Forecast to 2025, Top Key Players- Bajaj …

The Consumer Finance Services Market Research Report is a valuable source of insightful data for business strategists. It provides the Consumer Finance Services overview with growth analysis and historical & futuristic cost, revenue, demand and supply data (as applicable). The research analysts provide an elaborate description of the value chain and its distributor analysis. This Consumer Finance Services market study provides comprehensive data which enhances the understanding, scope and application…

Why Consumer Finance Market is Growing Worldwide? Watch out by top key players B …

The split of retail banking that deals with lending money to consumers.

Consumer finance market is growing due to increasing per capita income, high economic growth, rapid urbanization and rise in consumer spending power. Rising consumer favorite towards the use of credit cards owing to the associated benefits related to it such as reward points and a host of promotional offers like movie tickets, discounts on flight bookings etc., is likely…