Press release

Marine Insurance Market to Exceed Valuation of US$ 36.8 Bn by 2031: Transparency Market Research

Transparency Market Research delivers key insights on the global marine insurance market. In terms of revenue, the global marine insurance market is estimated to expand at a CAGR of 3.3% during the forecast period, owing to numerous factors regarding which TMR offers thorough insights and forecasts in its report on the global marine insurance market.Insurance companies are expanding their product lines to meet the increasing demand for marine insurance. Moreover, strong product innovation among insurance companies with newer features in marine insurance plans is expected to boost the marine insurance market during the forecast period. In addition, marine insurance companies are adopting latest technologies to help their clients in risk management and loss prevention efforts, and also to boost their own efficiencies. All this is expected to have a positive impact on the global marine insurance market during the forecast period.

Request a sample to get extensive insights into the Marine Insurance Market

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=82421

Marine Insurance Market: Key Segments

In terms of risk type, the ocean cargo segment is expected to dominate the market during the forecast period. In terms of growth rate, ocean cargo is projected to grow at the fastest rate during the forecast period. The growing free trade agreements across the world is likely to increase the demand for ocean cargo shipping. In addition, the demand and supply for sea transportation has increased across the world, which is likely to lead to increase in demand for higher ocean cargo marine insurance globally during the forecast period.

Based on policy type, the floating segment is anticipated to hold a major market share and maintain its share during the forecast period. In terms of growth rate, the multinational policy plan is expected to expand at the fastest rate during the forecast period. The growing awareness about the various benefits associated with multinational policy plans among different end-use applications such as cargo owners, ship owners, governments, and others is expected to increase the demand for multinational policy plans across the world during the forecast period.

In terms of premium type, the large premium type segment contributed a major revenue share to the global marine insurance market and is expected to expand at the fastest rate as compared to other premium types during the forecast period. Significant challenges in the shipping industry such as climate change, shifting regulations, local compulsory insurance, and pollution legislation are increasing the need for large premium marine insurance.

To understand how our report can bring difference to your business strategy, Ask for a brochure

https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=82421

Marine Insurance Market: Prominent Regions

Based on region, the global marine insurance market can be categorized into North America, Europe, Asia, Oceania, Middle East, Africa, and Latin America. Europe accounted for the largest share of the global marine insurance market in 2020 and is expected to remain dominant over the forecast period. Marine transport is one of the most important drivers of the European economy. This factor is expected to have a positive impact on the Europe market during the forecast period.

Asia is anticipated to register the highest CAGR in the future in the global marine insurance market. Key players operating in the marine insurance market in the region are adopting new technologies to provide quality services to their customers. Increasing trade activities is also projected to have a positive impact in the region.

Marine Insurance Market: Key Players

Key players operating in the global marine insurance market are American International Group, Inc., American Financial Group, Inc., Allianz SE, Axa S.A., Arthur J. Gallagher & Co., Aon Plc, Aspen Insurance Holdings Limited, Berkshire Hathaway Specialty Insurance, Swiss Re, Zurich Insurance Group, Tokio Marine Holdings, Inc., Chubb Limited, The Hanover Insurance Group, Inc., Markel Corporation, HDI Global SE, Intact Insurance Company, ProSight Global, Inc., RLI Corp, Sompo International Holdings Ltd, The Hartford, The Travelers Indemnity Company, Assicurazioni Generali S.p.A., Beazley Group, Starr International Company, Inc., and Marsh LTD., among Others.

Contact

Transparency Market Research,

90 Sate Street, Suite 700,

Albany, NY 12207

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Email: sales@transparencymarketresearch.com

Website: https://www.transparencymarketresearch.com/

About Us

Transparency Market Research is a global market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision makers. Our experienced team of analysts, researchers, and consultants use proprietary data sources and various tools and techniques to gather and analyze information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Marine Insurance Market to Exceed Valuation of US$ 36.8 Bn by 2031: Transparency Market Research here

News-ID: 2392101 • Views: …

More Releases from Transparency Market Research

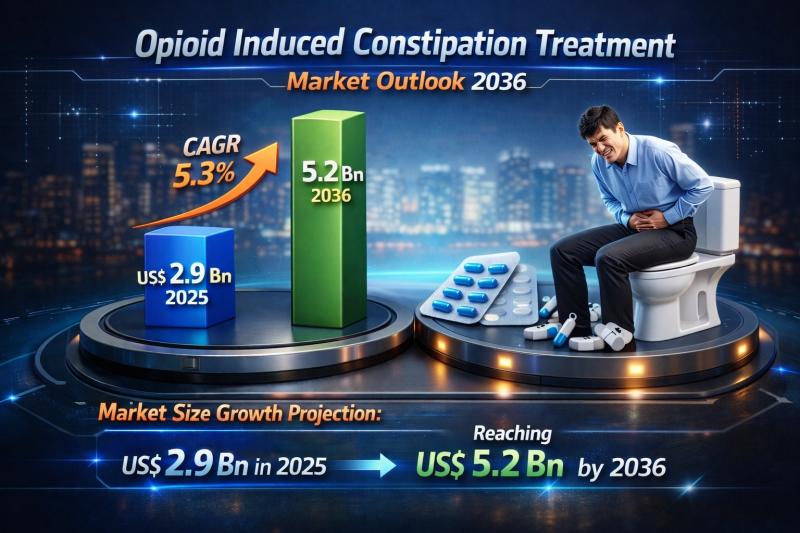

Global Opioid Induced Constipation Treatment Market Set to Reach USD 5.2 Billion …

The global opioid induced constipation (OIC) treatment market is witnessing steady and sustained growth as healthcare systems worldwide place increasing emphasis on comprehensive pain management and supportive care. Valued at US$ 2.9 billion in 2025, the market is projected to reach US$ 5.2 billion by 2036, expanding at a compound annual growth rate (CAGR) of 5.3% from 2026 to 2036. Growth is primarily fueled by the rising prevalence of chronic…

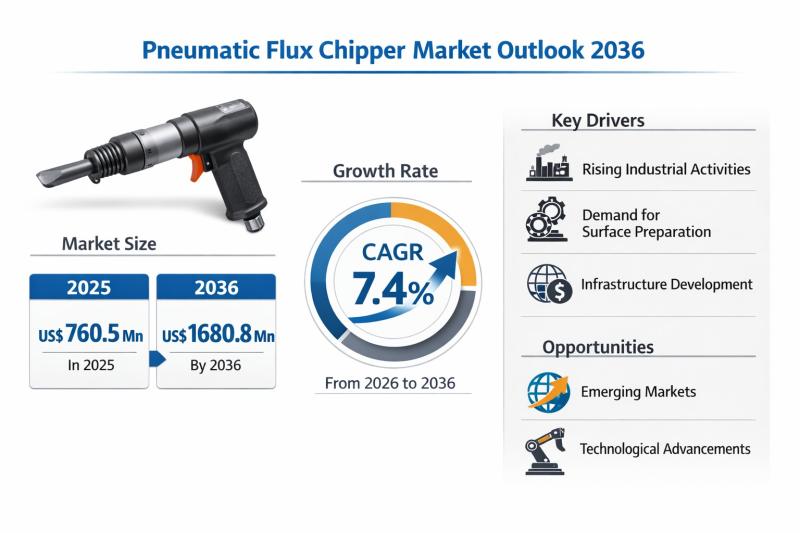

Pneumatic Flux Chipper Market Expanding at 7.4% CAGR Through 2036 - By Product T …

The global Pneumatic Flux Chipper Market is set to witness sustained and resilient growth over the next decade, underpinned by expanding heavy manufacturing activities, rising welding and fabrication demand, and continuous investments in industrial infrastructure across emerging and developed economies. According to the latest industry analysis, the market was valued at US$ 760.5 Mn in 2025 and is projected to reach US$ 1,680.8 Mn by 2036, expanding at a compound…

AI in Automotive Market Outlook 2036: Global Industry to Surge from US$ 19.8 Bil …

The AI in automotive market is entering a phase of exponential expansion, supported by rapid digitization of vehicles, growing safety mandates, and consumer demand for intelligent mobility. The global market was valued at US$ 19.8 Bn in 2025 and is projected to reach US$ 244.4 Bn by 2036, registering a remarkable CAGR of 27% from 2026 to 2036.

This growth trajectory reflects the transition of automobiles from mechanically driven products to…

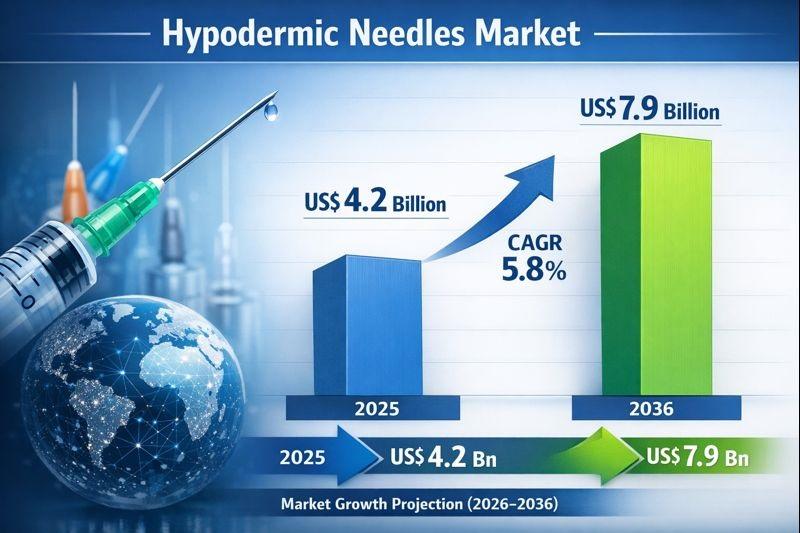

Hypodermic Needles Market to Reach US$ 7.9 Billion by 2036 on Rising Injectable …

The global hypodermic needles market was valued at approximately US$ 4.2 billion in 2025 and is projected to reach around US$ 7.9 billion by 2036, expanding at a CAGR of nearly 5.8% from 2026 to 2036, driven by the rising prevalence of diabetes, cancer, and chronic diseases, growing demand for injectable drugs and biologics, and the expansion of global vaccination and immunization programs; increasing adoption of safety-engineered and disposable needles,…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…