Press release

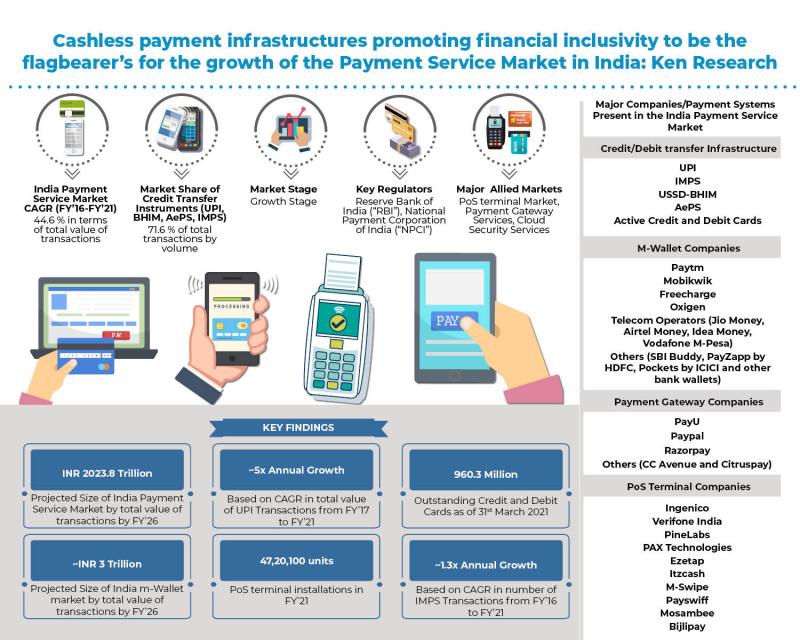

India Payment Services Market is expected to reach ~INR 2,023 Trillion in Transaction Value by FY’26: Ken Research

• A shift in consumer’s payment preference was noted with the advent of unprecedented situation of COVID-19 wherein individuals are relying more on online transactions rather than the traditional medium of cash based transactions.• Surge in growth of electronic payments in India, along with rising E-commerce and M-commerce transactions are further expected to give a boost to numerous entities including payment gateway service providers and payment aggregators that facilitate online payments in the country.

• The India M-Wallet market is anticipated to grow at an exorbitant rate, with a CAGR of 13.7% during the forecast period FY’21-FY’26.

Digital India Campaign and Economic Goals: The government of India has been extensively focusing on “Digital India” campaign initially launched in 2015 to improve the online infrastructure of the country to ensure that the government services are made available to citizens electronically. E-Rupi is one such program developed by Department of Financial Services (DFS), National Health Authority (NHA) and NPCI, under the broader “Digital India” campaign formulated in order to enhance cashless payment transaction for COVID-19 vaccination. As citizens are more concerned for their health and safety followed by the aftermath of COVID-19, the implementation of e-RUPI program is a pragmatic development by the government to not only promote the idea of digital payments but also ensuring safety of citizens as the whole process is based on cashless transaction without the need of physical payments. Before the advent of COVID-19, the government of India had set an economic target of achieving a USD 5 trillion economy by FY’2024-FY’2025, to be driven by the digitalization of the economy. With policies such as demonetization being framed since 2016 in order to achieve the digital goals of the government, emphasis has been on shifting to an online medium of transaction considered to be hassle free, convenient, transparent and most importantly, secure form of payment. Adaptation to digital medium of transactions ensure a greater opportunity for the digital payment services, gateway and security market in the future.

Credit and Debit Card Coverage: Over the years, money has transformed from coins to physical cash and is now available in electronic / digital form or plastic cards. Plastic cards for instance, ATM cards, debit and credit cards are used by customers as an electronic payment tool, thereby helping in clearing and settling the payment process. Increasing penetration of credit cards in metro areas coupled with rising usage of RuPay cards in tier 2 and tier 3 cities are some of the driving forces in India consumer payments landscape. With recent initiatives and emphasis by the government in banking the unbanked population, the user base of debit and credit cards have witnessed tremendous surge in recent years. However with the advent of COVID-19, the preference of consumers have shifted towards cashless transaction rather than traditional medium of cash based transactions. The shift to cashless transaction could prove to be a major downside to the credit and debit card market in the coming years.

For More Information, refer to below link:-

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/india-payment-services-market-outlook-to-2026/472829-93.html

Launch of New and Innovative Payment Products: The launch of new and innovative payment products like Unified Payments Interface (UPI), National Electronic Toll Collection (NETC) FASTag and Bharat Bill Pay Service (BBPS) have firmly placed the digital payment industry on an upward growth trajectory. With the surge in adoption of these newer payment methods, global giants such as Whatsapp, Google and Amazon Pay are aiming to improve their on-platform transaction convenience to enhance customer retention.

Increased Mobile and Internet Penetration in India: Increased mobile and internet penetration in the country has resulted in significant shift towards use of mobile/internet-based payment systems, for effecting payments for purchase of goods and services. It is estimated that as of FY’2020, 53% of India’s total population had access to internet from their mobile phones. Introduction of lightweight acceptance infrastructure (QR codes) has further facilitated the use of mobile-based payments across the country. This has led to a larger population accessing digital payment services having access to convenient payment systems at their disposal. India is ranked second in the world in terms of active internet users, having merely a 4% internet penetration rate in FY’2007 increasing to a striking 50% penetration rate of the overall population as of FY’2020. The gradual increase in internet penetration rate enables the consumer in accessing digital payment services such as UPI, m-wallets and QR based transactions among others. With the advent of COVID-19, consumers are relying on digital payment methods rather than traditional medium of cash based transactions which is contributing in rise of contactless payments.

Point of Sale (PoS) Terminal Market in India: PoS terminals were launched as a computerized replacement of cash register where customers can make an online transaction with the help of their debit or credit cards. India PoS terminal market is heavily dependent up on the card acceptance infrastructure consisting of ATMs and PoS terminal devices. In terms of number of device installations, metro cities dominate India PoS terminal market majorly due to higher usage and penetration of debit and credit cards in these cities whereas, non-metro cities were observed to catch up by spreading awareness regarding PoS devices enabled with Adhaar enabled Payment System (AePS) and Micro ATMs in rural India. Large retail formats, such as Big Bazaar, Shoppers Stop and other malls in recent times, have initiated the process of installing traditional PoS systems that work on GPRS technology. Integration in the rural region along with lower TIER cities could contribute in PoS market witnessing massive growth in coming years.

Digital Incentive as Mentioned in Union Budget 2021: A striking announcement in the Budget 2021 revealed an allocation of Rs 1,500 crore towards MeitY for the promotion of digital payments. Other incentives such as tax audit exemptions for businesses utilizing digital payments and the establishment of Fintech hub were also announced. These funds are expected to be utilized in encouraging digital payments for toll transaction and investments for marketing campaigns to raise awareness not only in the urban areas but also rural regions. These incentives exacerbates the opportunity of various players in the payment services market to integrate into lower tier cities to expand their presence and to build a robust payment infrastructure in the country.

Payment Security Services: With more emphasis on technological dependence in recent years, cyber security has emerged to be a domain of tremendous value. Following the aftermath of COVID-19, interned adoption rate surged. As physical restrictions were imposed globally, people started utilizing digital means for communication, work, shopping etc. The shift to internet domain was not only specific to individuals but even businesses wherein "Work from Home" became the norm. However with increased dependence on internet and digital medium, there lies security concerns related to cyber threats. To enhance security and compliance standard, governments throughout the world initiated shaping polices and regulations for strengthening the cyber security ecosystem. With increased dependence on digital payment mediums, entities, government agencies, organizations, e-commerce platforms need to ensure that they provide a safe and secure platform for their consumers for a transparent transaction procedure. India in 2017 ranked among top five countries to be affected by cybercrime. The rising cybercrime incidences would ensure Indian entities emphasizing on strengthening their IOT and cloud security framework in the coming years eventually leading to a growth opportunity for the payment security services market.

The report titled “India Payment Services Market Outlook to 2026”by Ken Research suggested that the India payment services market is expected to grow further in the near future, with the growing dependence on digital payment ecosystem. The market is expected to register a positive CAGR of 7.0% in terms of transaction value during the forecast period ofFY’21-FY’26.

Key Segments Covered in India Payment Services Market

• India Payment Services Market

By Payment Card Usage (Cash Payments and Cash Withdrawals)

By Number of Outstanding Debit Cards (PSU and Private Banks)

By Number of Outstanding Debit Cards: Market Share of Banks (State Bank of India, Bank of Baroda, Paytm Payments Bank, Punjab National Bank, Union Bank of India, Bank of India, Canara Bank, ICICI Bank and others)

By Number of Outstanding Credit Cards (PSU and Private Banks)

By Number of Outstanding Credit Cards: Market Share of Banks (HDFC Bank, State Bank of India, ICICI Bank, Axis Bank, Ratnakar Bank, Citi Bank, Kotak Mahindra Bank, American Express and others)

By Modes of Payment (RTGS, Credit Transfers, Debit Transfers, Direct Debits and Card Payments)

• Credit and Debit Card Coverage

By Number of Credit Card Transactions (PoS and ATM)

By Credit Card Transaction Value (PoS and ATM)

By Number of Debit Card Transactions (PoS and ATM)

By Debit Card Transaction Value (PoS and ATM)

By Number of ATMs and PoS Terminals

By Number of Outstanding Cards (Credit and Debit Cards)

• Immediate Payment Service (IMPS) Consumer Payment Landscape

By Type of Institution (Small Finance Bank, PSU, Private and Payments Bank, Public and Private Institutions, Regional Rural Bank and Co-operative Banks)

• Aadhaar Enabled Payment System (AePS) Consumer Payment Landscape

By Types of Banks: Number of AePS Operator (Mainline Commercial Banks, Regional Rural Banks, Co-operative Banks, Payment Banks and Small Finance Banks)

• India PoS Terminal Market

By Number of Terminals (Active and Inactive Terminals)

By Metro and Non-metro cities

By End User Industry (Large Enterprises, SME’s and Micro Merchants)

By Metro and Non-metro cities

Key Target Audience

Banks and Financial Institutions

Cash Reconciliation Companies

Payment Aggregators

Payment Network Companies

Payment Interface Companies

M-Wallet Companies

Payment Gateway Companies

PoS Terminal Companies

M-PoS Terminal Companies

Time Period Captured in the Report:

• Historical Period: FY’15-FY’21

• Forecast Period: FY’21-FY’26E

Payment Service Companies in India:

M-Wallet Companies

Paytm

Mobikwik

Freecharge

Oxigen

Telecom Operators (Jio Money, Airtel Money, Idea Money, Vodafone M-Pesa)

Others (SBI Buddy, PayZapp by HDFC, Pockets by ICICI and other bank wallets)

Payment Gateway Companies

PayU

Paypal

Razorpay

Others (CC Avenue and Citruspay)

PoS Terminal Companies

Ingenico

Verifone India

PineLabs

PAX Technologies

Ezetap

Itzcash

M-PoS Companies

M-Swipe

Payswiff

Mosambee

Bijlipay

Key Topics Covered in the Report

India Payment Services Market

Regulatory Framework in India Payment Services Market

India Payment Services Market Segmentation

India Payment Services Market Future Outlook and Projections

Credit and Debit Card Coverage

Immediate Payment Service (IMPS) Consumer Payment Landscape

Aadhaar Enabled Payment System (AePS) Consumer Payment Landscape

Unstructured Supplementary Service Data - Bharat Interface for Money (USSD-BHIM) Consumer Payment Landscape

Unified Payments Interface (UPI) Consumer Payment Landscape

Cross Comparison of Different Payment Modes (IMPS, AePS, USSD-BHIM and UPI) in India Payment Services Market

India Bill Payment Market

India Omni-Channel Payments Processing Market

India Bank Reconciliation Software Market

India Digital Payment Market

India Cloud Security Services Market

India Payment Security Services Market

India M-Wallet Market

Market Share of M-Wallet Players in India

Competitive Landscape of India M-Wallet Market

Trends and Developments in India M-Wallet Market

India Payment Gateway Market

India Point of Sale (PoS) Terminal Market

India Point of Sale (PoS) Terminal Competitive Landscape

India Point of Sale (PoS) Terminal Market Segmentation

India Point of Sale (PoS) Terminal Market Future Outlook and Projections

India m-PoS Market

CUG Cards / Prepaid Closed Loop Cards

Cloud / Security Outsourcing in Payments Technology

Government Regulations

Assessment of COVID Impact on Contactless Transactions and POS Terminals

Coverage on OMC Digital Space

For More Information, refer to below link:-

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/india-payment-services-market-outlook-to-2026/472829-93.html

Related Reports:-

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/asia-credit-cards-market-outlook/289128-93.html

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/global-payment-gateway-market-outlook/263650-93.html

https://www.kenresearch.com/banking-financial-services-and-insurance/banking/india-atm-cash-management-market-forecast-2023-/154994-93.html

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

Support@kenresearch.com

+91-9015378249

Ken Research Pvt. Ltd.,

Unit 14, Tower B3, Spaze I Tech Business Park, Sohna Road, sector 49 Gurgaon, Haryana - 122001, India

Ken Research is a research based management consulting company. We provide strategic consultancy to aid clients on critical business perspective: strategy, marketing, organization, operations and technology transformation, advanced analytics, corporate finance, mergers & acquisitions and sustainability across all industries and geographies. We provide business intelligence and operational advisory across 300+ verticals underscoring disruptive technologies, emerging business models with precedent analysis and success case studies. Some of top consulting companies and Market leaders seek our intelligence to identify new revenue streams, customer/ vendor paradigm and pain points and due diligence on competition.

We currently cater to 300+ sectors with 150,000+ research repository across 196+ countries serving 1000+ clients and have partnered with almost 25+ content aggregators.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release India Payment Services Market is expected to reach ~INR 2,023 Trillion in Transaction Value by FY’26: Ken Research here

News-ID: 2388969 • Views: …

More Releases from Ken Research Pvt Ltd

Increase in cybercrime results in India Digital Forensic Market to rise, with an …

With the rise in digital threats and cybercrimes, India Digital Forensic Market makes successive changes like integration of Artificial Intelligence, and marking its overall growth.

STORY OUTLINE

Using techniques like Data Recovery, Log Analysis and more, India Digital Forensic Market enhances its Computer Forensics.

Upgrades towards Network and Mobile Forensics are improving in cyber threats prevention, marking its increase in efficiency and security.

With the incorporation of Cloud Based services, advanced methods and easy…

Global Health Insurance market is expected to grow at a CAGR of ~6% by 2028: Ken …

Due to recent pandemic of Covid 19 health insurance market has grabbed growth ensuring economic help to comman man for better health care facilities with easy money handling and increasing awareness especially after COVID 19.

STORY OUTLINE

Launch of new policies, mergers, acquisitions and partnerships to propel growth in future

Covid 19 has a huge impact on the health insurance market on Global level.

Factors, which are responsible for the growth, are the higher…

Exploring the Investment Landscape in the UK Agricultural Equipment Market

Anticipated to achieve a CAGR of approximately 3.5% (2022-2027), the UK's agricultural equipment market expanded between 2014 and 2018, yet faced a significant downturn in 2019-2020 due to COVID-19.

STORY OUTLINE

The investment landscape in the UK agricultural equipment market is diverse, offering a spectrum of opportunities from established manufacturers to startups driving disruptive change.

Investors can benefit from the technological prowess of leading manufacturers like John Deere, CNH Industrial, and AGCO Corporation…

Unveiling the Thriving Landscape of UAE's IT Service Market

The IT services sector encompasses a diverse range of offerings, including but not limited to Cloud services, Cloud Applications, Datacenters, Artificial Intelligence (AI), Consulting Services, Connectivity Solutions, Security services, and other related services.

STORY OUTLINE

Digital Transformation Drive: UAE's IT market thrives on visionary government initiatives like "Smart Dubai" and "UAE Vision 2021," spurring sectoral evolution.

Cloud's Ascendancy: Rapid cloud adoption, coupled with AI, IoT, and blockchain, reshapes industries for scalability and innovation.

Security…

More Releases for Pay

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Mobile Wallet (NFC, Digital Wallet) Market to Witness Stunning Growth | Apple Pa …

HTF MI recently introduced Global Mobile Wallet (NFC, Digital Wallet) Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Apple Pay, Google Pay, Samsung Pay, PayPal, Alipay, WeChat Pay,…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…