Press release

Quick Ways To Increase Your Credit Score

The credit score, unfortunately, dictates numerous important things in your financial life from being approved for credit cards to interest rates offered for most loans. The economy is teetering and there is a pretty high risk of dealing with the recession in the near future. This is why it is the perfect time to think about your financial security.Fortunately, it is very easy to increase your credit score when you know what to do. Use the following strategies first to help you out, as they were curated and recommended by:

https://www.financialtipsor.com/

Clean Up The Credit Report

The very first thing you need to do is to check your credit report. The good news is you can get one for free from all the large reporting companies: TransUnion, Experian, and Equifax. According to the law, you get a free report every year. Get it, print it, and then save it so you can analyze it.

After you get the report, simply examine everything. Look for all the accounts showing unpaid bills and late payments. When information is inaccurate, the report includes information about where disputes can be sent.

Pay Down The Balance

Remember that 30% of the FICO score will be calculated based on how much you owe. This is compared with the credit. The ratio is called the credit utilization rate. As a result, when you pay down your balance, your credit score goes up.

If the credit utilization rate is too high, the simple step of paying down balances is one of the fastest ways to boost the score and lower the rate.

Make Payments Two Times Per Month

Many believe they can pay off the card one time per month and everything is ok. However, the creditors just report your balances once per month. When the balance is big every month, some might think you overuse the credit.

Alleviate this problem by making 2 payments per month. Charge all to get your rewards and send payments 2 times per month or more. This helps you keep the running balance much lower.

Increase Credit Limits

There are situations in which paying down the balance is difficult. A way to get rid of the problem is to increase credit limits since this improves credit utilization rates.

For instance, when your credit card limit is $1,000, you can increase the limit to $2,000. This cuts the credit utilization rate to 50%. Just do not spend anything from the new credit you get. This defeats the entire purpose of the move.

Open New Accounts

When the credit card issuer is not willing to increase the credit limit, you can apply for a brand new card from someone else. This helps with the credit utilization rate as this takes into account all balances and lines of credit.

The problem is when you open many accounts you might have problems. When you have many accounts opened, you can look desperate. Just do not risk the credit score through the application of more than just one new credit card. Use this as a last resort to reduce the credit score.

Sava Mutkurov 53

Finance blog

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Quick Ways To Increase Your Credit Score here

News-ID: 2320792 • Views: …

More Releases from ESBO ltd

Supporting Compliance with Law Firm Consultants

In the U.S., law firm non-compliance costs an average $14.82 million per year, nearly triple the cost of compliance. This can be attributed to the ever-expanding regulatory expectations and the evolution of professional standards. However, it's the responsibility of every law firm to treat compliance as a key part of how the organization operates, and not just as a background task.

As regulatory expectations expand across data protection, financial transparency,…

How to plan moving with kids

How to plan moving with kids

Moving is always a big event for a family, but when children are part of the picture, it can feel like you're juggling ten things at once. Between packing boxes, sorting paperwork, and saying goodbye to a familiar home, kids often pick up on the stress just as much as adults do. Some families choose to bring in professional help, like movers in Airdrie https://easymovingcalgary.com/airdrie-movers/…

How to Read Market Cycles Like a Professional Trader

Market cycles represent the natural rhythm of financial markets as they move through periods of growth, peak performance, decline, and recovery. These cycles occur across all timeframes, from short-term daily fluctuations to multi-year trends that shape entire economic eras. When you learn to identify these patterns, you gain a significant advantage in timing your trades and investment decisions.

Professional traders don't rely on luck or gut feelings. They study these…

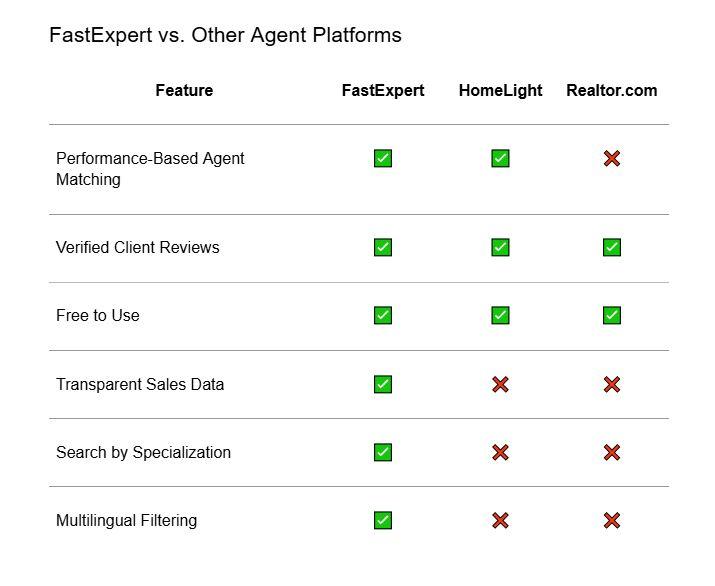

FastExpert Review: Is This Agent-Matching Platform Worth It?

When you're buying or selling a home, one of the most important decisions you'll make is choosing the right real estate agent. But with so many agents out there, how do you know which agents are experienced and right for what you need?

We've looked at countless online services that claim to help you find the best real estate agent. There are a lot out there, and they promise you the…

More Releases for Credit

Credit Scores, Credit Reports & Credit Check Services Market Set for Explosive G …

Global Credit Scores, Credit Reports & Credit Check Services Market Report from AMA Research highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans…

Credit Repair Service Market Size in 2023 To 2029 | AMB Credit Consultants, Cred …

The Credit Repair Service market report provides a comprehensive analysis of the market-driving factors, major obstacles, and restraining factors that can impede market growth during the forecast period. This information can be particularly useful for existing manufacturers and start-ups as they develop strategies to overcome challenges and capitalize on lucrative opportunities. The report also offers detailed information about prime end-users and annual forecasts during the estimated period. This can help…

Credit Scores, Credit Reports & Credit Check Services Market is Going to Boom | …

Latest Study on Industrial Growth of Global Credit Scores, Credit Reports & Credit Check Services Market 2022-2028. A detailed study accumulated to offer Latest insights about acute features of the Credit Scores, Credit Reports & Credit Check Services market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market,…

Credit Scores, Credit Reports and Credit Check Services Market is Booming Worldw …

Credit Scores, Credit Reports and Credit Check Services Market - Global Outlook and Forecast 2022-2028 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Credit Scores, Credit Reports and Credit Check Services Market. Some of…

Credit Scores, Credit Reports & Credit Check Services Market is Booming With Str …

The latest study released on the Global Credit Scores, Credit Reports & Credit Check Services Market by AMA Research evaluates market size, trend, and forecast to 2027. The Credit Scores, Credit Reports & Credit Check Services market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends,…

Credit Scores, Credit Reports & Credit Check Services Market May See Big Move | …

Global Credit Scores, Credit Reports & Credit Check Services Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure…