Press release

Travel Insurance Market Report 2021 With Industry Size, Share, Revenue Growth, Future Trends, Scope and Competitive Outlook by 2026

According to IMARC Group’s report, titled “Travel Insurance Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2020-2025”, the global travel insurance market reached a value of US$ 15.60 Billion in 2020. Looking forward, IMARC Group expects the global market to continue its strong growth by 2025.Travel insurance offers financial protection against losses and expenses incurred while traveling. It includes costs for medical expenses, flight cancellations, and lost luggage and travel documents. Presently, there is an increase in the demand for travel insurance services on account of the burgeoning travel and tourism sector.

Get a PDF sample of this report for more detailed market insights: https://www.imarcgroup.com/travel-insurance-market/requestsample

Increasing internet penetration, easy availability of online travel bookings and discounted holiday packages are among the significant factors fueling the growth of the travel insurance market. Moreover, the rising number of intermediaries, such as banks, insurance brokers, and insurance aggregators, is providing a variety of options to compare suitable policies and prices, which is bolstering the market growth. Furthermore, leading players are incorporating digital tools, such as data analytics, artificial intelligence (AI), application program interface (API) and global positioning system (GPS), to improve distribution systems. Besides this, the outbreak of coronavirus disease (COVID-19) pandemic has increased individuals who are investing in travel insurance policies to secure their future travels. This is anticipated to drive the travel insurance market further in the coming years.

Travel Insurance Market 2020-2025 Competitive Analysis and Segmentation:

Competitive Landscape:

The competitive landscape of the travel insurance market has been studied in the report with the detailed profiles of the key players operating in the market.

Some of these key players include:

AXA SA

Seven Corners Inc.

Allianz SE

Generali Group

Zurich Insurance Group AG.

Insure & Go Insurance Services (Mapfre S.A.)

American Express Company

USI Affinity (USI Insurance Services)

American International Group

Travel Insured International Inc. (Crum & Forster)

Berkshire Hathaway Specialty Insurance Company

The report has segmented the global travel insurance market on the basis of insurance type, coverage, distribution channel, end user and region.

Breakup by Insurance Type:

Single-Trip Travel Insurance

Annual Multi-Trip Insurance

Long-Stay Travel Insurance

Breakup by Coverage:

Medical Expenses

Trip Cancellation

Trip Delay

Property Damage

Others

Breakup by Distribution Channel:

Insurance Intermediaries

Banks

Insurance Companies

Insurance Aggregators

Insurance Brokers

Others

Breakup by End User:

Senior Citizens

Education Travelers

Business Travelers

Family Travelers

Others

Breakup by Region:

North America

Asia Pacific

Europe

Latin America

Middle East and Africa

Explore full report with table of contents: https://www.imarcgroup.com/travel-insurance-market

Key highlights of the report:

Market Performance (2014-2019)

Market Outlook (2020-2025)

Market Trends

Market Drivers and Success Factors

The Impact of COVID-19 on the Global Market

Value Chain Analysis

Structure of the Global Market

Comprehensive mapping of the competitive landscape

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

Browse Related Report:

Basalt Fiber Market Report: https://www.imarcgroup.com/basalt-fiber-market

Network-Attached Storage Market Report: https://www.imarcgroup.com/network-attached-storage-market

Contact US

IMARC Group

30 N Gould St, Ste R

Sheridan, WY 82801, USA

Email: sales@imarcgroup.com

Americas: +1-631-791-1145 | Europe & Africa: +44-753-713-2163 | Asia: +91-120-433-0800

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Travel Insurance Market Report 2021 With Industry Size, Share, Revenue Growth, Future Trends, Scope and Competitive Outlook by 2026 here

News-ID: 2263471 • Views: …

More Releases from IMARC Group

India Two-Wheeler Loan Market to Reach USD 14.55 Billion by 2033 | 6.43% CAGR | …

India Two-wheeler Loan Market Report Introduction

According to IMARC Group's report titled "India Two-Wheeler Loan Market Size, Share, Trends and Forecast by Type, Provider Type, Percentage Amount Sanctioned, Tenure, and Region, 2025-2033" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Free Sample Download PDF (Exclusive Offer on Corporate Email): https://www.imarcgroup.com/india-two-wheeler-loan-market/requestsample

Note : We are in the process of updating our reports to cover…

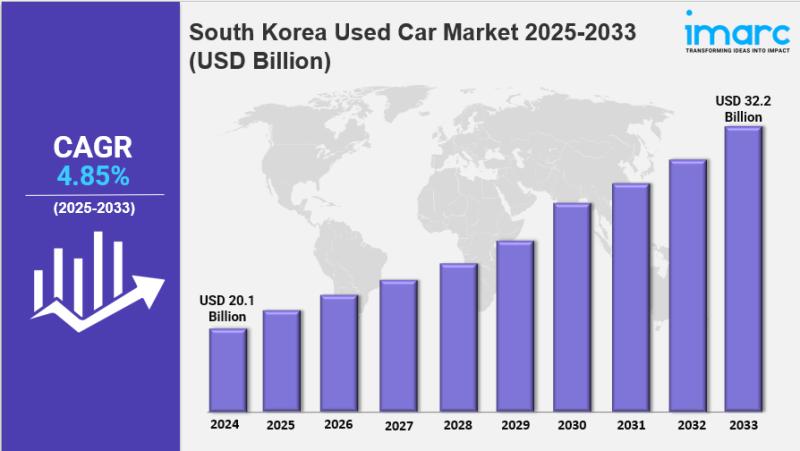

South Korea Used Car Market Size, Share, Industry Overview, Trends and Forecast …

IMARC Group has recently released a new research study titled "South Korea Used Car Market Report by Vehicle Type (Hatchback, Sedan, Sports Utility Vehicle, and Others), Vendor Type (Organized, Unorganized), Fuel Type (Gasoline, Diesel, and Others), Sales Channel (Online, Offline), and Region 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Used Car Market…

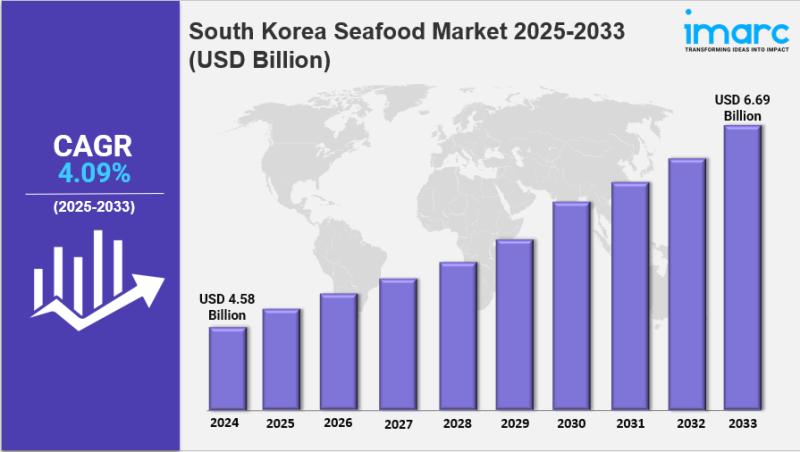

South Korea Seafood Market Size, Share, Industry Overview, Trends and Forecast 2 …

IMARC Group has recently released a new research study titled "South Korea Seafood Market Size, Share, Trends and Forecast by Type, Form, Distribution Channel, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Seafood Market Overview

The South Korea seafood market size was valued at USD 4.58 Billion in 2024 and is forecast…

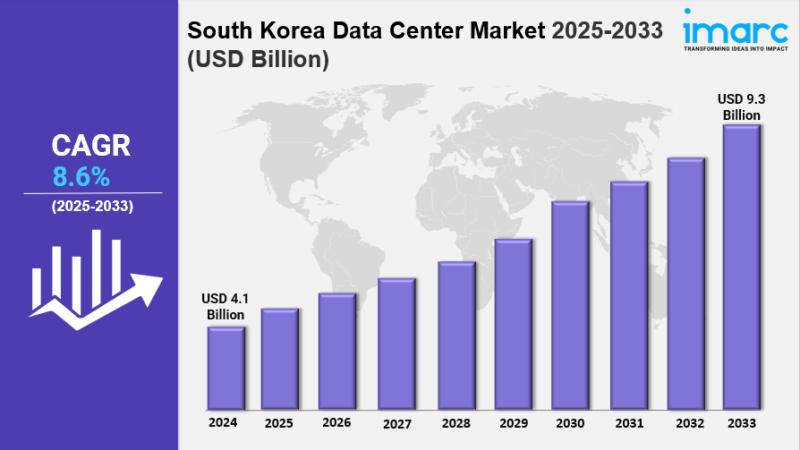

South Korea Data Center Market Size, Share, Industry Overview, Trends and Foreca …

IMARC Group has recently released a new research study titled "South Korea Data Center Market Report by Data Center Size (Large, Massive, Medium, Mega, Small), Tier Type (Tier 1 and 2, Tier 3, Tier 4), Absorption (Non-Utilized, Utilized), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Data Center Market Overview

The South…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…