Press release

Neo and Challenger Bank Market 2021 Size, Share and Banking Industry Analysis Basis of Service Type, End User, and Region 2027

Neo and Challenger Bank Market by Service Type (Loans, Mobile Banking, Checking & Savings Account, Payment & Money Transfer, and Others) and End User (Business and Personal): Global Opportunity Analysis and Industry Forecast, 2020–2027Neo and Challenger Bank Market by Service Type, and End User: Opportunity Analysis and Industry Forecast, 2020-2027,” the global Neo and challenger bank industry was valued at $20.4 billion in 2019, and the market size is projected to reach $471.0 billion by 2027, growing at a CAGR of 48.1% from 2020 to 2027.

Download Research Sample with Industry Insights (250+ Pages PDF Report) @ https://www.alliedmarketresearch.com/request-sample/1798

The latest analysis on Global Neo and Challenger Bank Market is based on several organizations from different regions leading across the globe. The 200+ pages report offers significant information along with highlighting the drivers, restraints, and opportunities of the market. The study also aims to provide comprehensive information on the latest market trends, strategies, and competitions among the market players in the global Neo and Challenger Bank Market. The analysis covers both the historical and forecasted data from 2014 to 2021 and 2021 to 2027 along with other segments including product overview, material required, and other growth aspects.

Neo and Challenger Bank Market Competitive Analysis:

Leading market players profiled in the global Neo and Challenger Bank Market report include Atom Bank plc, Fidor Solutions AG, Monzo Bank Limited, Movencorp, Inc., MYbank, Number26 GmbH, Simple Finance Technology Corporation, Tandem Bank, UBank limited, and WeBank. These players have adopted several strategies including joint ventures, expansions, mergers & acquisitions, collaborations, and new product launches to strengthen their position in the industry.

Covid-19 Impact on the Global Neo and Challenger Bank Market:

Neo and Challenger Bank Market Research Report offers an outline of the market based on basic parameters such as market size, sales analysis, and key drivers. The market is expected to expand on a large scale during the forecast period (2021-2027). This report includes COVID-19 impacts on the market. The unprecedented arrival of the coronavirus pandemic (COVID-19) has troubled the complete lifestyles. This in turn has affected some of the market situations along with introducing new norms. The broad view of the research report, therefore, provides the users with the total impacts of covid19 on the industry and the market players.

Get detailed COVID-19 impact analysis on the Neo and Challenger Bank Market @ https://www.alliedmarketresearch.com/request-for-customization/1798?reqfor=covid

Neo and Challenger Bank Market Segmentation:

The research provides an in-depth segmentation of the global Neo and Challenger Bank Market based on the basis of service type, end user, and region. It also presents a comprehensive examination of sales, revenue, growth rate, and market share of each for the historic period and the forecast period.

Neo and Challenger Bank Market Regional Analysis:

The report offers a region-wise analysis of the market along with the competitive landscape in each region. The study covers regions including North America (the United States, Canada, and Mexico), Europe (Germany, France, UK, Russia, and Italy), Asia-Pacific (China, Japan, Korea, India, and Southeast Asia), South America (Brazil, Argentina, and Colombia), Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria, and South Africa). These insights assist to formulate strategies and create new opportunities to accomplish remarkable outcomes.

Make Purchase Inquiry at https://www.alliedmarketresearch.com/purchase-enquiry/1798

Key Findings Of The Study

By service type, the loan segment led the neo and challenger bank market size, in terms of revenue in 2019.

By end user, the business segment accounted for the highest neo and challenger bank market share in 2019.

By region, Europe generated the highest revenue in 2019.

Get more info about neo and challenger bank market at https://www.globenewswire.com/news-release/2020/05/04/2026793/0/en/Global-Neo-and-Challenger-Bank-Market-to-Reach-471-0-Billion-by-2027-at-48-1-CAGR.html

Key market segments

By Service Type

Loans

Mobile Banking

Checking & Savings Account

Payment & Money Transfer

Others

By End User

Business

Personal

Contact:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022, +1-503-446-1141

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Neo and Challenger Bank Market 2021 Size, Share and Banking Industry Analysis Basis of Service Type, End User, and Region 2027 here

News-ID: 2262240 • Views: …

More Releases from Allied Market Research

Mobile Application Security Market Growing at 26.3% CAGR Reach USD 37.1 Billion …

Allied Market Research published a new report, titled, "Mobile Application Security Market Growing at 26.3% CAGR Reach USD 37.1 Billion by 2032." The report offers an extensive analysis of key growth strategies, drivers, opportunities, key segments, Porter's Five Forces analysis, and competitive landscape. This study is a helpful source of information for market players, investors, VPs, stakeholders, and new entrants to gain a thorough understanding of the industry and determine…

MarTech Market Witnessing CAGR of 18.5% Hit USD 1.7 Trillion by 2032

The global marketing technology market is experiencing growth due to several factors, including the increasing digital transformation, the surge in demand for personalized experience, and the proliferation of automation and efficiency. However, data privacy and compliance, and the high cost of implementation are expected to hamper market growth. Furthermore, the growing integration of AI and ML technologies and the increase in demand for real-time marketing are anticipated to provide lucrative…

Feedback Management Software Market Growing with CAGR of 12.9% Reach USD 28.7 Bi …

Allied Market Research published a new report, titled, "Feedback Management Software Market Growing with CAGR of 12.9% Reach USD 28.7 Billion by 2031 ." The report offers an extensive analysis of key growth strategies, drivers, opportunities, key segment, Porter's Five Forces analysis, and competitive landscape. This study is a helpful source of information for market players, investors, VPs, stakeholders, and new entrants to gain thorough understanding of the industry and…

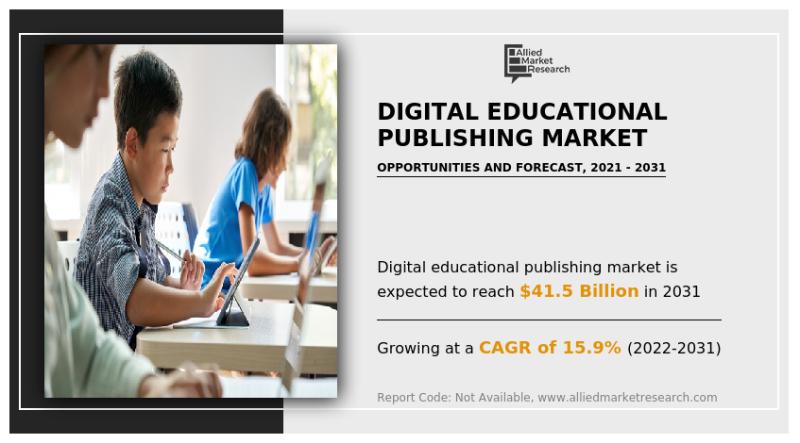

Digital Educational Publishing Market Growing at 15.9% CAGR Reach USD 41.5 Billi …

The Market report provides an extensive analysis of changing market dynamics, major segments, value chain, competitive scenario, and regional landscape. This research offers a valuable guidance to leading players, investors, shareholders, and startups in devising strategies for the sustainable growth and gaining competitive edge in the market.

The global Digital Educational Publishing Market was valued at $9.9 billion in 2021, and is projected to reach $41.5 billion by 2031, growing at…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…