Press release

Shadow Banking Market Future Demands, Companies, Trends, Share and Size Forecast

DeepResearchReports has uploaded a latest report on Shadow Banking Industry from its research database. Shadow Banking Market is segmented by Regions/Countries. All the key market aspects that influence the Shadow Banking Market currently and will have an impact on it have been assessed and propounded in the Shadow Banking Market research status and development trends reviewed in the new report.The new tactics of Shadow Banking Industry report offers a comprehensive market breakdown on the basis of value, volume, CAGR, and Y-o-Y growth. For business robust expansion, the report suggests new tools and technology development will drive to boom in the near future by 2027. The Shadow Banking Market report provides a comprehensive outline of Invention, Industry Requirement, technology and production analysis considering major factors such as revenue, investments and business growth.

Download Free Sample PDF at https://www.deepresearchreports.com/contacts/request-sample.php?name=1560041

Shadow Banking Market Regional Analysis –

USA

Canada

Germany

France

UK

Italy

Russia

China

Japan

South Korea

India

Australia

Turkey

Saudi Arabia

UAE

Mexico

Brazil

Next, learn how to build the strategy and business case to implement. Learn about Shadow Banking Market and how it can provide value to your business. In this market, you will find the competitive scenario of the major market players focusing on their sales revenue, customer demands, company profile, import/export scenario, business strategies that will help the emerging market segments in making major business decisions. This report also studies the market competition landscape, market drivers and trends, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter’s Five Forces Analysis.

Shadow Banking Industry discovers diverse topics such as regional market scope, product-market various applications, market size according to a specific product, Shadow Banking Market sales and revenue by region, manufacturing cost analysis, industrial chain, market effect factors Analysis, and more.

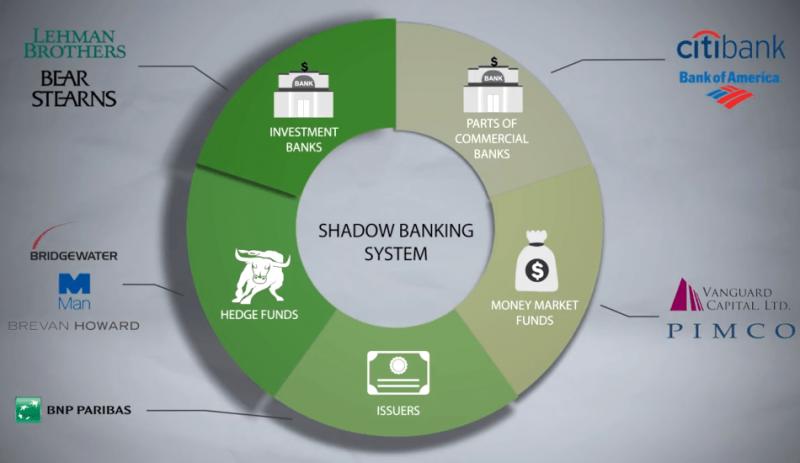

Market segment by Type, the product can be split into:

- Securitization Vehicles

- Money Market Funds

- Markets For Repurchase Agreements

- Investment Banks

- Mortgage Companies

- Other

Market segment by End Users, split into:

- SMEs

- Large Enterpris

Inquire More Details at https://www.deepresearchreports.com/contacts/inquiry.php?name=1560041

Shadow Banking Market Analysis

In the competitive analysis section of the report, leading as well as prominent players of the Shadow Banking market are broadly studied on the basis of key factors. The report offers comprehensive analysis and accurate statistics on revenue by the player for the period 2015-2021. It also offers detailed analysis supported by reliable statistics on price and revenue (Global level) by player for the period 2015-2021.

The Major Key Players in the Market:

- Bank of America Merrill Lynch

- Barclays

- HSBC

- Credit Suisse

- Citibank

- Deutsche Bank

- Goldman Sachs

- Morgan Stanley

- Credit Suisse

Download Complete Report at https://www.deepresearchreports.com/contacts/purchase.php?name=1560041

Contact Us

+ 1 888 391 5441

sales@deepresearchreports.com

About Us-

Deep Research Reports is digital database of syndicated market reports for Global and China industries. These reports offer competitive intelligence data for companies in varied market segments and for decision makers at multiple levels in these organizations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Shadow Banking Market Future Demands, Companies, Trends, Share and Size Forecast here

News-ID: 2229916 • Views: …

More Releases from DeepResearchReports

Todays Trending Report on 08 Sep 2023

Edge Computing Market to Reach USD 111.3 billion by 2028

"The rise in IoT technology adoption to drive the growth of edge computing market".

The edge computing market size is expected to grow from USD 53.6 billion in 2023 to USD 111.3 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 15.7% during the forecast period. The requirement of companies to collect and analyze data at the very…

Plasma Knives Market 2023: Sales, Revenue and Future Growth- Medtronic, US Medic …

The Plasma Knives market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status with development…

Venipuncture Needle Market 2023: Sales, Revenue and Future Growth- BD, Greiner B …

The Venipuncture Needle market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status with development…

Emergency Tourniquets Market 2023: Sales, Revenue and Future Growth- HERSILL SL, …

The Emergency Tourniquets market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status with development…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…