Press release

Kasasa Changes The Face of Local Banking in Portland

Northwest Resource Introduces Kasasa, a Striking Alternative to the Mega Bank RollercoasterPortland, OR, April 24, 2012 - Northwest Resource asks consumers, “Do you Kasasa?” as it becomes the first financial institution in Portland to launch the country’s most innovative financial products.

Kasasa® is a new brand of free checking and savings accounts that pays consumers to use their account with what interests them most—high interest or automatic savings. These accounts, combined with the personal service that only community financial institutions can deliver, are offering residents a better checking account option than the mega bank experience.

“Consumers deserve to wake up to happier days of banking and leave behind the nightmare of mega bank fees and mistreatment. We are pleased to be the first in Portland to offer these unique products,” said Kim Faucher, VP of Marketing at Northwest Resource. “Kasasa delivers what research shows people really want but believe they can’t have—great financial products with the personal service of a community based financial institution.”

Northwest Resource is offering two Kasasa financial products, including Kasasa Cash? and Kasasa Saver?. All Kasasa products are free, reward-based accounts, with no minimum balance to earn the rewards, no monthly service fee, free online banking and nationwide ATM fee refunds.

Kasasa Cash - A free checking account that rewards consumers with high interest for every month they qualify.

Kasasa Saver - A free, high interest saver account linked to a Kasasa Cash checking account. The interest and ATM fee refunds earned in the Kasasa Cash account are automatically deposited into the Kasasa Saver account when the account holders qualify. The balance in the Kasasa Saver account also earns a high rate of interest.

To receive the Kasasa account benefits, each monthly qualification cycle account holders are asked to do a few simple things like, receive an eStatement, use a debit card a minimum number of times, and have an electronic transaction (such as direct deposit) post and clear their account. If an account holder does not meet the qualifications in a given month, Northwest Resource will alert the individual, who will be eligible the following month for the benefits.

“Extensive research has shown us that consumers would prefer to do business with community financial institutions, but feel they would lose access to products,” continued Faucher.

“Kasasa is opening people’s eyes to a new banking model where no sacrifices are necessary. It’s a win-win because account holders get innovative products and personalized service.”

In 2009, Kasasa was piloted in six other markets across the U.S. In just the first two months of offering Kasasa, participating community financial institutions reported growth rates upwards of 150% on new account openings and 372% in deposits at institutions focused on deposit growth.

Kasasa is being introduced with an aggressive, highly engaging marketing campaign. It comes to life through a fresh mix of eye-popping advertising, the likes of which exceed the typical mega bank’s high-budget programs. The ads feature America’s top slam poets www.kasasa.com/news-and-media/advertising riffing lyrical threads around the theme of “Do you Kasasa?”

Kasasa is distributed to Northwest Resource from BancVue, the leading provider of innovative products, dynamic marketing, and data-driven consulting solutions to community financial institutions nationwide to help them win the war against the megabanks.

For more information on Kasasa accounts, consumers can visit www.nrfcu.org or www.kasasa.com/nwresource.

Do you Kasasa?

Kasasa® is the first national brand of the most innovative checking accounts available today. The accounts, offered exclusively by the finest community financial institutions, are designed to be the first and only accounts that actually take an interest in their account holders by paying them to use their account with what interests them most—high interest, cash back, automatic savings, money to donate to charity or iTunes® or Amazon.com downloads. Kasasa, developed and distributed by BancVue, marries innovative banking products with the personal touch of community financial institutions. For more information, visit www.kasasa.com.

About Northwest Resource:

Northwest Resource Federal Credit Union is a not-for-profit financial cooperative established in 1935 as the credit union for NW Natural employees. Today, Northwest Resource has $91 million in assets and is federally chartered to serve people who live, work, worship, or attend school in Portland’s central city neighborhoods. For more information, visit www.nrfcu.org or call (503) 220-2592 or (800) 942-9408.

Contact:

Katie Weathers

CSG PR

3225 East 2nd Avenue

Denver, CO 80206

(404) 791-8245

kweathers@csg-pr.com

http://www.csg-pr.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Kasasa Changes The Face of Local Banking in Portland here

News-ID: 219155 • Views: …

More Releases from CSG PR

Consumers Invited to Take Control of Health Insurance Company

Colorado’s Health Insurance CO-OP Opens Board of Directors Applications

Denver, CO, May 20, 2014 — Colorado HealthOP, Colorado’s first statewide health insurance CO-OP, has initiated a significant shift in how insurance companies are run, introducing greater member control into an industry that historically has had very little. The CO-OP announced today it is now seeking applications for its board of directors, inviting nearly 14,000 of its new Colorado members to run…

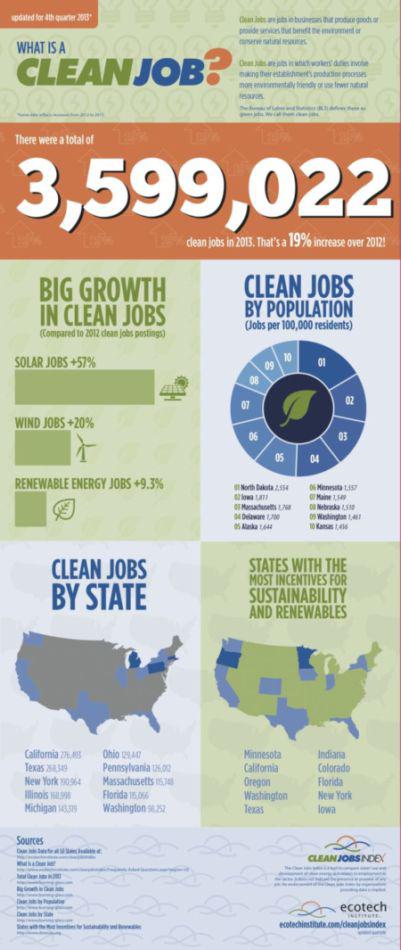

Ecotech Institute’s Clean Jobs Index Shows a 19 Percent Increase in Clean Jobs …

National study shows more than 3.5 million clean jobs available in 2013, with a 57 percent increase in solar jobs

Denver, CO, March 07, 2014 - Ecotech Institute’s Clean Jobs Index, a tool to compare states’ use and development of clean and sustainable energy, found more than 3.5 million job postings in the clean energy sector last year. This is a 19 percent increase from 2012. The Clean Jobs Index classifies…

Ecotech Institute to Host Webinar, “Launching a Career in Engineering Technolo …

Thirty-minute webinar will discuss career training and employment opportunities in engineering technology

Denver, CO, March 04, 2014 - On Tuesday, March 4, Ecotech Institute will hold a free 30-minute afternoon webinar, “Launching a Career in Engineering Technology,” that takes a look at how to have a successful career in engineering technology. The session is part of an exclusive webinar series offered by Ecotech Institute, the first and only college entirely…

More Releases for Kasasa

Kasasa Changes The Face of Local Banking in Fairmont

Profinium Financial Introduces Kasasa, a Striking Alternative to the Megabank Rollercoaster

Fairmont, MN, May 03, 2012 - Profinium Financial asks consumers, “Do you Kasasa?” as it becomes the next financial institution in Minnesota to launch the country’s most innovative financial products.

Kasasa® is a new brand of free checking and savings accounts that pays consumers to use their account with what interests them most—high interest or automatic savings. These accounts,…

Kasasa Changes The Face of Local Banking in Macon

BankFirst Financial Introduces Kasasa, a Striking Alternative to the Mega Bank Rollercoaster

Macon, Mississippi, May 03, 2012 - BankFirst Financial asks consumers, “Do you Kasasa?” as it becomes the first financial institution in Mississippi to launch the country’s most innovative financial products.

Kasasa® is a new brand of free checking and savings accounts that rewards consumers for using their account with what interests them most—high interest, cash back, automatic savings, money to…

Kasasa Changes The Face of Local Banking in Louisiana

Pelican State Credit Union Introduces Kasasa, a Striking Alternative to the Mega Bank Rollercoaster

Baton Rouge, LA, April 16, 2012 - Pelican State Credit Union asks consumers, “Do you Kasasa?” as it becomes the first financial institution in Baton Rouge to launch the country’s most innovative financial products.

Kasasa® is a new brand of free checking and savings accounts that pays consumers to use their account with what interests them most—high…

Kasasa Changes The Face of Local Banking in Utah

First Utah Bank Introduces Kasasa, Offering Consumers a Better Banking Experience

Salt Lake City, UT, April 04, 2012 - First Utah Bank asks consumers, “Do you Kasasa?” as it becomes the first financial institution in Utah to launch the country’s most innovative financial products.

Kasasa® is a new brand of free checking and savings accounts that pays consumers to use their account with what interests them most—high interest and automatic savings. …

Capital Bank Introduces Kasasa, Changing Local Banking

A Striking Alternative to the Mega Bank Rollercoaster

Fort Oglethorpe, GA, February 08, 2012 - Capital Bank asks consumers, “Do you Kasasa?” as it becomes the first financial institution in Georgia to launch the country’s most innovative financial products.

Kasasa® is a new brand of free checking and savings accounts that pays consumers to use their account with what interests them most—high interest or cash back. These accounts, combined with the personal…

Kasasa Changes The Face of Local Banking in Faribault Minnesota

1st United Bank Introduces Kasasa, a Striking Alternative to the Megabank Rollercoaster

Faribault, MN, February 06, 2012 - 1st United Bank asks consumers, “Do you Kasasa?” as it becomes the third financial institution in Minnesota to launch the country’s most innovative financial products.

Kasasa® is a new brand of free checking and savings accounts that pays consumers to use their account with what interests them most—high interest or automatic savings.…