Press release

Post-Pandemic, Warehouse Automation Market to hit the mark of $30B driven by E-Grocery

Year 2020 and COVID-19 pandemic along with lots of uncertainty has put a bigger spotlight on the use of automation in warehouses worldwide. Whether they’re adapting to new social distancing rules, under pressure to distribute a higher volume of essential goods, struggling to meet same day delivery or trying to add more remote work capabilities. Our post-pandemic version is having a detailed market analysis of more than 650+ players (part of our exclusive Market Map), 10 solutions, 7 industries and 30 countries along with 440 pages, 355 Market Tables, 210 Exhibits and 110 Company Profiles. Analysis is validated through 100+ in-depth interviews across the value chain with components and technology providers, system integrators & manufacturers and end-user industry verticals.Download Sample: https://www.thelogisticsiq.com/research/warehouse-automation-market/

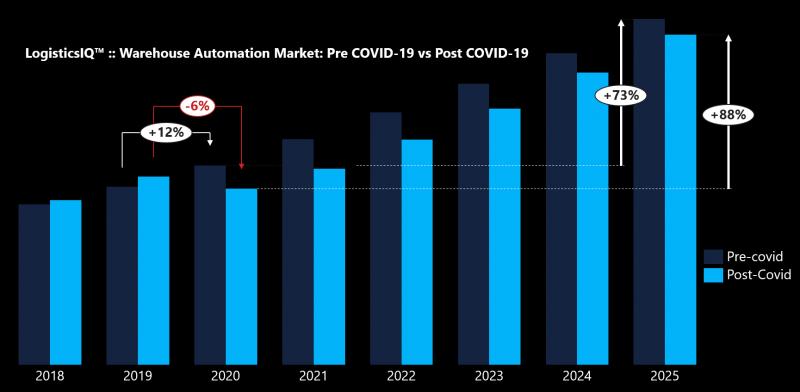

Despite of the temporary reduction in retail and e-commerce caused by lockdown and economic distress in this pandemic, we have seen a strong order intake of warehouse automation in 2020 which may reflect in revenues of these system integrators and manufacturers in 2021 or 2022. At the same time, a revenue dip of 6% is expected in 2020 as compared to our pre-pandemic forecast of 12% growth because projects were put on hold due to supply chain disruption and covid-19 locked down guidelines. It has also increased the order backlog at a record level for warehouse automation players.

Of course, the push to automate the warehouses was in full force before the Covid-19 but global pandemic forced the companies to change their strategy w.r.t warehouse automation from “good to have” category to “must to have” if they have to sustain in this industry. One of the learnings from the COVID-19 pandemic is that mega-trends like aging population, globalisation, health & safety, mobility, green logistics, autonomous world, urbanisation, individualisation and digitization need to be given more consideration and weight than in the past with a long-term vision so that we are ready with any challenge.

As per our post-pandemic market research and analysis, warehouse automation market is expected to touch the mark of $30B by 2026, at a CAGR of almost 14% between 2020 and 2026. The growth of this market can be attributed to the growth in the e-commerce industry, multichannel distribution channels, globalization of supply chain networks, emergence of autonomous mobile robots and rising need for same day delivery. The boom in e-commerce is compounding the major labour challenges faced by the $5T global logistics industry. Not only are shipment volumes growing rapidly, but online retail also typically requires more logistical work per item than brick & mortar retail. Indeed, online purchases require individual picking packing and shipping, as opposed to the bulk transportation models of traditional brick & mortar retail.

Post COVID-19, most important and emerging trends have been eGrocery growth, Micro-Fulfillment Centers, Urban Warehouses and automated cold storages. Huge investment for start-ups like Takeoff technologies ($86M+), Fabric ($136M+), Attabotics ($82M+), Exotec Solutions ($111M+) and Alert Innovation are witnessing this growth along with presence of existing players like Dematic, Swisslog, Knapp, Opex Corporation, Muratec, AutoStore, Honeywell Intelligrated and Toyota Industries. Retailers such as Walmart, Kroger, Woolworth, Amazon, Ocado, Meijer, H-E-B, Albertsons, and Ahold Delhaize have already started adopting and implementing these new technologies during pandemic. Apart this, piece picking players like Berkshire Grey, Righthand Robotics, Kindred AI, Covariant, OSARO, Plus One Robotics, XYZ Robotics have established a new attractive capability for order picking in ecommerce fulfillment.

Analytical Insights

• Among all regions, US has been the key region to target having more than $4B market size in 2019 with a growth rate of 12% in next 5 years. Germany is the traditional hub in Europe apart having ~35% market share in the region apart from some attractive markets like UK, Nordic region and France. It is expected that next wave of opportunity is going to be originated from South East Asia, India & Australia which are the key market in APAC after China, Japan and South Korea. This group (SEA) of 10 countries is leading the adoption of robotics automation to match the GDP growth of around 5% but pandemic has put down this growth in short term.

• AGV/AMR market is expected to cross $5B mark by 2026 with a CAGR of ~32%. AMR (without any external support of optical tape, sensor or vision) is going to be main contributor in retail warehouses due to high demand in e-commerce sector and its flexibility to deploy the robot without any major change in the existing warehouse infrastructure. However, it is a bit slow in terms of pick rate per hour as compared to ASRS but is preferred in small and medium warehouses due to lower cost and quick deployment. It is expected that AGVs/AMRs are going to have more than 18% market share by 2026 in overall warehouse automation market led by AMR players like Geek+, Grey Orange, HikRobot, Locus Robotics, Fetch Robotics, Shopify (6 River Systems), Teradyne (MiR, AutoGuide Mobile Robots), Quicktron etc.

• The Grocery industry is one of the most challenging and attractive industries from a logistics perspective. Grocery distributors ship high cubic volumes of merchandise to retail stores with frequent deliveries to ensure product freshness. Grocery distribution center operations are amongst the most labour intensive of any industry. Higher automation driven by online grocery, micro-fulfillment centers and COVID-19 is going to be biggest opportunity in next 2-3 years led by cube ASRS, Delivery Robots and Micro-Fulfillment players such as AutoStore, Takeoff Technologies, Exotec, Fabric, Attabotics, Dematic, Nuro, Tele Retail, KiwiBot, Robby Technologies, and Starship It will witness an opportunity worth ~$5B by 2026 with ~18% growth rate. Kroger has already partnered with Ocado to bring its stores and supply chain to deliver best-in-class service to its customers. The first phase of the plan involves building 20 automated customer fulfillment centers across the United States to modernize and streamline operations.

Talk to Analyst: https://www.thelogisticsiq.com/research/warehouse-automation-market/

Key Highlights

.

• Warehouse automation equipment suppliers and industry consultants expect broadly double-digit growth in sales driven by demographic changes, increased penetration in e-commerce and the advent of the Industrial IoT, that will drive demand for data analytics and automated operations, especially after COVID-19.

• Competitive landscape - There are 10 large and 10-20 medium-size companies operating in the material handling equipment space capable of delivering comprehensive automated warehouse solutions. Top 10 large companies (including Dematic, Daifuku, SSI-Schaefer, Honeywell Intelligrated, Knapp, Toyota, Muratec, Swisslog) are capturing more than 50% of market share although lots of start-ups are emerging in new categories like AMRs, Picking Robots, Micro-Fulfillment, Autonomy Service Providers etc.

• Service model importance increasing - Over the time as the installed base of automated warehouse solutions grows, industry players expect an increase in revenues from services and maintenance, which would have a positive impact on profitability as the service business typically has 15-20% operating margins, versus 3-5% margins for new equipment. It is expected to be ~$7B worth market by 2026.

• Business models are also changing considering the real time pain points of end-users for high capex. Businesses are increasingly intrigued with RaaS because of its flexibility, scalability, and lower cost of entry than traditional robotics programs. The business model for picker-as-a-service is usually on a per-pick basis, ranging from 6 cents to 10 cents per pick, while AMR-as-a-service is usually leased on a monthly basis, from US$711 per robot per month to several thousands of dollars per month, depending on the commitment period.

• Industry Consolidation - The past 3-4 years have seen an increase in consolidation amongst material handling equipment providers as traditional players see acquisition of technology leaders as an increasingly attractive way of positioning themselves in response to changing market trends. Acquisitions like KION (Dematic), KUKA (Swisslog), Toyota (Vanderlande, Bastian Solutions), Hitachi (JR Automation), Honeywell (Intelligrated, Transnorm), Korber (Cohesio Group), Teradyne (MiR, Energid, AutoGuide Mobile Robots) are just some of the examples of this consolidation.

Facts to Know

• Global e-Commerce sales have grown at a CAGR of 20% over the last decade, reaching ~$3.5 trillion worldwide in 2019 and expected to grow to ~$7.5 trillion by 2026. The share of online retail sales has gone from ~2% of total to ~13%, and is further expected to reach ~22% by 2026

• Existing fully automated systems can reduce warehouse related labour costs by up to 65% and logistics-related spatial use by up to 60% at the same time as it increases the maximum output capacity.

• The adoption of technology is by no means uniform. While one-hour delivery is available when buying online in some parts of the U.S. and Europe, the average promised delivery time in Brazil is nine days. JD.com had a record-breaking Singles Day in 2019, with transaction volume exceeding CNY204 bn (US$29 bn), up by 27.9% on the previous year. Logistics played an important role, with 90% of areas achieving same-or next day delivery and 108% YOY increase in number of orders fulfilled by automated warehouses.

• Amazon Robotics automates the company’s fulfillment centers using more than 200,000 autonomous mobile robots, up more than 600% from 30,000 at the end of 2015. Last year, DHL announced an investment of $300 million to modernize 60% of it warehouses in North America with IoT and autonomous robots. Company also committed a deployment of 1,000 LocusBots for delivery fulfillment. The funds are earmarked to bring emerging technology to 350 of DHL Supply Chain's 430 operating sites.

• Warehouse labour shortages are also an issue with peak labour demands occurring around major shopping holidays viz. Black Friday, Cyber Monday, Amazon Prime day, Thanksgiving Day and Singles Day. Warehouses have to hire temporary labour around these peak times to meet the customer delivery schedules. Supply chain robotics company Cainiao has installed 700 robots at China’s largest robot-run warehouse to process orders on Singles Day.

Key Players Mentioned:

• Material Handling Equipment: Dematic, DAIFUKU, Honeywell Intelligrated, Murata Machinery, FIVES, Raymond, Conveyco, Savoye, Witron, Beumer Group, Swisslog, TGW, Interlake Mecalux, Knapp, OPEX Corporation, Inther, Westfalia, IHI, Vanderlande, MHS, Bastian Solutions, SIASUN, Kuecker, Lodige, Kardex, HANEL, Jungheinrich, Dambach, PSB Intralogistics, Gudel, Korber

• AGV/AMR: Geek+, Quicktron (Flashhold), Amazon Robotics (Kiva System), Grey Orange, HikRobots, MiR, inVia Robotics, Guidance Automation, IAM Robotics, EiraTech Robotics, Aethon, 6 River Systems (Shopify), Caja System, Cobalt , Sherpa (Norcan), Syrius Robotics, Locus Robotics, Matthews Automation Solutions, Waypoint Robotics, iFuture Robotics , SMP Robotics, Milvus Robotics, ALOG Tech, Vecna Robotics, Fetch Robotics, Tompkins Robotics, Scallog, MegVII, Malu Innovation, EuroTec (Lowpad), Cohesio Group (Korber), OTTO Motors (Clearpath Robotics), BLEUM, Ubiquity Robotics, Neobotix, IQ Robotics, Next Shift Robotics, KnightScope, Magazino, Intelligent Robots, Yandex, Savioke, Gideon Brothers, The Hi-Tech Robotic Systemz Ltd., ForwardX , Omron Adept, Milrem Robotics, Cainiao, Cohesio, DS Automation, Ro-ber, Rocla AGV, Active Space Automation, AgiLox, John Bean Technologies Corporation (JBT), AGVE Group, EK Automation, Transbotics (SCOTT), ESTI Mobile Robotics, America in Motion (AIM), Kivnon, Oceaneering AGV, Casun, Savant Automation, AGV International, Creform, PAL Robotics, Pulse Integration

• Warehouse Management System (WMS): AFS Technologies, Aptean, Consafe Logistics, DataByte, Davanti, Deposco, DSI, Ehrhardt + Partner Group, EVS, Generix Group, HAL, Hardis Group, HighJump, inconso, Infor, Iptor, JDA, Made4net, Manhattan Associates, Mantis, Mecalux Software, Microlistics, Oracle, Reply, SAP, Softeon, SSI SCHÄFER IT, Synergy Logistics, Tecsys, Tradelink, TTX, Vinculum, vTradEx, Savant Software, envista, Fishbowl

• Micro-Fulfillment: Takeoff Technologies, Fabric (Commonsense), Dematic, Knapp, Murata Machinery, Alert Innovation, Opex Corporation, Attabotics, Autostore, Exotec, Swisslog, Clevron, i-collector, Storojet, Konecranes, Ocado Technology, Pulse Integration, Geek+

• Piece Picking Robots: Righthand Robotics, Kindred AI, Knapp, Universal Robotics, Berkshire Grey, Plus One Robotics, XYZ Robotics, Swisslog, Grey Orange, OSARO, Dematic

• Last Mile Delivery: Myrmex Robotics, Cleveron, Starship Robots, Nuro, Refraction AI, LogiNext, PostMates, Bringg, Matternet, what3words, Deliv, Roadie, Routific, Gatik AI, iMile, Robby Technologies, Marble.io, BoxBot

• Automatic Identification and Data Capture (AIDC): Zebra Technologies, Datalogic, Cognex, SATO, Honeywell AIDC, SICK, BLUEBIRD, DENSO, Panasonic, Toshiba TEC, TSC, CASIO, SNBC, AVERY DENNISON, NCR, Scan Source, Newland America, CAB, EPSON, Unitech, M3 Mobile

• Autonomy Service Providers (ASP): Covariant AI, Brain Corp, Balyo, Mov AI, Amazon Canvas, WIBOTIC, Realtime Robotics, Seegrid, Kollmorgen, Oceaneering, MEGVII, MOVEL AI, PerceptIn, RoboCV, Robominds, SlamTec, Freedom Robotics, Humatics, Clearpath Robotics, Bluebotics, ASI, Exyn Technologies, BITO Robotics, Vecna Robotics, Robust AI, Stanley Innovation, Southie Autonomy

• Warehosue Drones: PINC Solutions, Drone Delivery Canada, Dronescan, Eyesee Drone, Infinium Robotics, Matternet, Workhorse Group, Skycart, Skysense, Zipline, Flirtey, Flytrex, Altitude Angel, Airmap, H3 Dynamics, Edronic, Cheetah Logistics Technology, Multirotor, Skyward.io, Unify, Sensefly, Volocopter GmbH, Ehang, Uber

Key Questions to be answered through this report

• What are the major trends and drivers impacting the Warehouse Automation Market in post-pandemic scenario?

• What is the revenue outlook (TAM) and forecast till 2026 for Warehouse Automation Market by segments such as End-user Industries, Regions, and Technologies?

• What are the key investments and M&A in Warehouse Automation space?

• Who are the major participants across Warehouse Automation Ecosystem and by key segments?

• What are the competitive dynamics of Warehouse Automation Market in each segment?

• What are the strategic imperative and calls to action that will define growth and success within Warehouse Automation for next 5 years?

Buy the report: https://www.thelogisticsiq.com/research/warehouse-automation-market/

LogisticsIQ

A/334, Janakpuri, New Delhi, India - 110046

Press Contact:

Sunny M.

sales@thelogisticsiq.com

LogisticsIQ™ is a research and advisory firm empowering decision makers from top fortune 1000 companies, financial and research institutions, private equity and high potential start-ups with market insights in Supply Chain & Logistics sector to make better decisions. We enable this by analysing the right mix of the best data, the best research methodologies, and the best industry panel to deliver value to our clients.

Our goal is to do the analysis of Supply Chain and Logistics sector with a focus on Automated Material Handling and Next Generation Supply Chain Technologies like Internet of Things (IoT), Artificial Intelligence (AI), Blockchain, Augmented and Virtual Reality (AR/VR), Cyber Security, 5G, Big Data and Robotics Automation. We prefer to work on latest concepts like Micro-Fulfillment, Urban Warehouses, Digital Twin, Last Mile Delivery, Autonomous Mobile Robots, Piece Picking Robots, Pick By Light, Cube-ASRS, Delivery Robots etc.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Post-Pandemic, Warehouse Automation Market to hit the mark of $30B driven by E-Grocery here

News-ID: 2158056 • Views: …

More Releases from LogisticsIQ

Micro Fulfillment Market - An opportunity worth $36B driven by eGrocery, Ultrafa …

INTRODUCTION

Micro Fulfillment Centers (MFCs), a highly recommended popular e-commerce fulfillment strategy, is an effective way to meet the rising volumes, the changing geographical nature of e-commerce demand, and the growing desire for same-day or same-hour delivery. As per the latest market research study, Micro Fulfillment Market is expected to have a cumulative opportunity worth ~$36B in next 10 years by 2030 with an installed base of ~6600 MFCs if the…

AGV & AMR Market (Mobile Robots) - More than 150,000 Installed Base in next 5 ye …

Mobile robots (AGV and AMR Market) are enabling the optimization of space in warehouse facilities in logistics and manufacturing and can reduce the need for new and costly green field fulfillment and distribution centers. While new centers are still being built, they are being built with robots and other automation in mind. Even these robotic systems are flexible and can be added or removed as per the requirement. But we…

Micro Fulfillment Market - A cumulative opportunity worth ~$10B by 2026

Micro Fulfillment Centers (MFCs), a highly recommended popular e-commerce strategy, is an effective way to meet the rising volumes, the changing geographical nature of e-commerce demand, and the growing desire for same-day delivery. As per LogisticsIQ's latest market research study, Micro Fulfillment Market is expected to have a cumulative opportunity worth ~$10B in next 6 years by 2026 with an installed base of ~2000 MFCs if the technology and concept…

Logistics Automation Market worth $27B by 2025 driven by AGVs, Mobile Robots (AM …

This report analyses the Global Logistics Automation Market, Trends, Future Forecast, Growth opportunity, Emerging Technologies, Market Share Analysis, Major Investments and Key Players. The objective of the study is to present the Logistics Automation opportunities in US, Europe, Canada, China, Japan, South Korea, Southeast Asia, Australia, India, Middle East and Latin America.

Ask for Sample: https://www.thelogisticsiq.com/research/warehouse-automation-market/

Warehouse automation market will grow more than 2x from $13 Billion in 2018 to $27 billion…

More Releases for Robotic

Robotic Vacuum Cleaner Market

Redding California- Meticulous Research®, a premier global market research firm, has announced the release of its latest comprehensive report, titled "Robotic Vacuum Cleaner Market." This meticulously curated study delves deep into the dynamics of the market, offering invaluable insights and forecasts that illuminate key trends shaping the industry landscape.

Download free sample report here: https://www.meticulousresearch.com/download-sample-report/cp_id=5181

The global robotic vacuum cleaner market is poised for remarkable growth, projected to attain a valuation of…

Robotic Catheterization System Market Analysis by Type, by Technology - Electrom …

Global Robotic Catheterization System Market: Description

The robotic catheterization system is predominantly designed to ensure the stable and correct placement of catheter inside a patient’s cardiovascular system during peripheral vascular and percutaneous coronary procedures. It enables a physician to get access to the target organs without performing open surgery. This system is also equipped with the ability to assure the safety of patients during cardiac arrhythmia procedures. Moreover, the robotic catheterization…

Robotic Process Automation Market

Robotic Process Automation Market recently published Verified Market research study with more than 100 industry informative desk and Figures spread through Pages and easy to understand detailed TOC on “Robotic Process Automation Market”.

The Robotic Process Automation Market is a valuable source of insightful data for business strategists. It provides the industry overview with growth analysis and historical & futuristic cost, revenue, demand and supply data (as applicable). The research…

Ground Military Robotic Market

Military robots are autonomous robots or remote-controlled mobile robots designed for military applications, from transport to search & rescue and attack.

According to this study, over the next five years the Ground Military Robotic market will register a xx% CAGR in terms of revenue, the global market size will reach US$ xx million by 2024, from US$ xx million in 2019. In particular, this report presents the global market share (sales…

Medical Robots Market 2019-2030 for into surgical robotic systems, rehabilitatio …

10 May 2019 Press Release

MIR presents "Medical Robots Market With Global Analysis and Forecast 2019-2030" with innovation and optimization, integrity, curiosity, customer and brand experience, and strategic business intelligence through our research.

Medical robots are the robots that are used in hospitals and medical institutions to perform highly complex surgeries. Robots can be utilized as surgical assistants to surgeons that perform minimally invasive procedures. Rehabilitation robots play an important role…

Robotic Lab Automation: Specimen Transport Robots, Robotic Centrifugation, Cappi …

New sellers in the market are confronting extreme competition from set up universal merchants as they battle with mechanical developments, dependability and quality issues.

Global Robotic Lab Automation Market provides a basic overview of the markets including definitions, classifications, applications and industry chain structure. The Robotic Lab Automation Market analysis is provided for the international Industry including development trends, competitive landscape analysis, and key regions development status.

The Robotic Lab Automation…