Press release

Corporation Tax Return Software Market Size, Share, Development by 2025

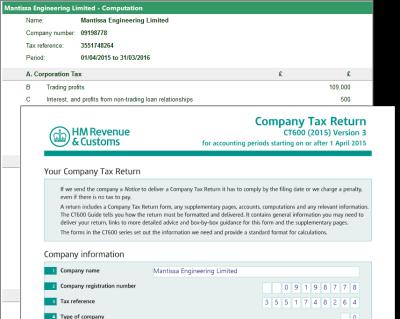

LP INFORMATION recently released a research report on the Corporation Tax Return Software market analysis, which studies the Corporation Tax Return Software's industry coverage, current market competitive status, and market outlook and forecast by 2025.Global “Corporation Tax Return Software Market 2020-2025” Research Report categorizes the global Corporation Tax Return Software market by key players, product type, applications and regions,etc. The report also covers the latest industry data, key players analysis, market share, growth rate, opportunities and trends, investment strategy for your reference in analyzing the global Corporation Tax Return Software market.

Get More Information on this Report:

https://www.lpinformationdata.com/reports/464032/global-china-corporation-tax-return-software

According to this study, over the next five years the Corporation Tax Return Software market will register a xx%% CAGR in terms of revenue, the global market size will reach $ xx million by 2025, from $ xx million in 2019. In particular, this report presents the global revenue market share of key companies in Corporation Tax Return Software business, shared in Chapter 3.

This study specially analyses the impact of Covid-19 outbreak on the Corporation Tax Return Software, covering the supply chain analysis, impact assessment to the Corporation Tax Return Software market size growth rate in several scenarios, and the measures to be undertaken by Corporation Tax Return Software companies in response to the COVID-19 epidemic.

Top Manufactures in Global Corporation Tax Return Software Market Includes:

Thomson Reuters

BTCSoftware

UFileT2

TaxCalc

Mercia Group

H&R Block

Absolute Tax

...

Market Segment by Type, covers:

Cloud-based

On-premises

Market Segment by Applications, can be divided into:

Small and Medium Enterprises (SMEs)

Large Enterprises

In addition, this report discusses the key drivers influencing market growth, opportunities, the challenges and the risks faced by key manufacturers and the market as a whole. It also analyzes key emerging trends and their impact on present and future development.

Browse the Full Research Report at:

https://www.lpinformationdata.com/reports/464032/global-china-corporation-tax-return-software

Related Information:

North America Corporation Tax Return Software Market Growth 2020-2025

United States Corporation Tax Return Software Market Growth 2020-2025

Asia-Pacific Corporation Tax Return Software Market Growth 2020-2025

Europe Corporation Tax Return Software Market Growth 2020-2025

EMEA Corporation Tax Return Software Market Growth 2020-2025

Global Corporation Tax Return Software Market Growth 2020-2025

China Corporation Tax Return Software Market Growth 2020-2025

Customization Service of the Report :

LP INFORMATION provides customization of reports as per your need. This report can be personalized to meet your requirements. Get in touch with our sales team, who will guarantee you to get a report that suits your necessities.

Contact US

LP INFORMATION

E-mail: info@lpinformationdata.com

Tel: 001-626-346-3938 (US) 00852-58080956 (HK) 0086 15521064060 (CN)

Add: 17890 Castleton St. Suite 162 City of Industry, CA 91748 US

Website: https://www.lpinformationdata.com

About Us:

LP INFORMATION (LPI) is a professional market report publisher based in America, providing high quality market research reports with competitive prices to help decision makers make informed decisions and take strategic actions to achieve excellent outcomes.We have an extensive library of reports on hundreds of technologies.Search for a specific term, or click on an industry to browse our reports by subject. Narrow down your results using our filters or sort by what’s important to you, such as publication date, price, or name.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Corporation Tax Return Software Market Size, Share, Development by 2025 here

News-ID: 2092779 • Views: …

More Releases from LP Information

Industrial Hearing Protection Market is expected to grow at a CAGR of 2639.8 by …

Industrial Hearing Protection devices are protective equipment which safeguard employees and the workers hearing ability in construction, mining, oil & gas, metal manufacturing and food industries.

LPI (LP Information)' newest research report, the "Industrial Hearing Protection Industry Forecast" looks at past sales and reviews total world Industrial Hearing Protection sales in 2022, providing a comprehensive analysis by region and market sector of projected Industrial Hearing Protection sales for 2023 through 2029.…

Anti-Slip Sheet Market is expected to grow at a CAGR of 518.6 by 2029-end

Anti-Slip Sheets are flexible sheets of paper-like material which take on the shape of the bags or boxes that are stacked above and below the sheets. Anti-Slip Sheets increase the coefficient of friction between layers and provide better interlocking characteristics between stacked items to prevent the items from shifting and sliding.

LPI (LP Information)' newest research report, the "Anti-Slip Sheet Industry Forecast" looks at past sales and reviews total world Anti-Slip…

Fine Chemicals Market is expected to grow at a CAGR of 7.3% by 2029-end

Fine chemicals are produced in limited volumes and at relatively high prices according to exacting specifications, mainly by traditional organic synthesis in multipurpose chemical plants. Fine chemical industry is one of the most dynamic new fields in chemical industry and an important part of new materials. The fine chemical products have many kinds, high added value, wide applications and high industrial relevance, which directly serve many industries of national economy…

Traction Chains Market Projected to Exhibit Growth at a CAGR of 412.8 by 2029

Traction Chains are nets made up of chains that fitted to the tires of vehicles to provide maximum traction when driving through snow and ice. Snow chains attach to the drive wheels of a vehicle or special systems deploy chains which swing under the tires automatically.

LPI (LP Information)' newest research report, the "Traction Chains Industry Forecast" looks at past sales and reviews total world Traction Chains sales in 2022, providing…

More Releases for Tax

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…

Industry Leading Tax Software Market For High-Volume Tax Businesses with Online …

Market Highlights

Tax software is software that ensures tax compliance for income tax, corporate tax, VAT, service tax, customs, sales tax, use tax, or other taxes its users may be required to pay. The software automatically calculates a user's tax liabilities to the government, keeps track of all transactions, keeps track of eligible tax credits, etc. The software can also generate forms or filings needed for tax. The software will have…

Kreston Reeves Tax Director achieves leading international tax qualification

Kreston Reeves, one of the leading accountancy and financial services firms located across London, Kent and Sussex, is proud to announce that Matthew Creevy, Corporation Tax Technical Director, has achieved the Advanced Diploma in International Taxation (ADIT), placing him in the highest echelons of international tax professionals.

ADIT is an advanced level designation in international cross-border tax. The credential is designed by a board of world-leading experts and has been created…

SMP Accounting & Tax appoints Rachael Hooper as Tax Manager

Russell Bedford member SMP Accounting & Tax Limited, one of the Isle of Man’s largest accounting and tax firms, has appointed Rachael Hooper as a manager in its Tax Department.

Rachael will be working in all areas of UK, Isle of Man and International taxation, with a particular focus on UK resident non-UK domiciled individuals, Trusts and Inheritance Tax.

After qualifying as a Chartered Accountant with a Big Four accountancy firm, Rachael…

United Tax Group Announces Effective Tax Negotiators

United States (June 2011) – United Tax Group announces effective tax negotiators for clients. Tax negotiators work directly with the IRS so tax payers do not. The expertise of tax negotiators helps save clients thousands.

Tax negotiators from United Tax Group are assigned individual clients. This means tax negotiators are working on particular cases assigned. Therefore, clients receive individualized attention for their case.

This individualized attention by United Tax Group gets results.…