Press release

Mutual Funds Investment App By Imperial Money

It’s all just on fingertips, No paperwork, No hassles, Invest in the best mutual funds using Imperial Money. All Indian mutual funds are available in one single app. In Imperial money you can start SIP, lump-sum investment for free. Switching of the funds from one fund to other fund and Systematic withdrawal plan or funds from liquid to equity or equity to liquid while re-balancing of the portfolio you can just do it here anytime anywhere you are.For Mutual Funds Details & Investments Download the App

https://play.google.com/store/apps/details?id=com.iw.imperialmoney

Investing becomes easy with your fingertips

· Get Sign up in minutes,

· One time KYC process within the app

· Buy, Sell, Shift mutual funds within fund family.

· Buying Systematic investment plan or doing the STP or SWP is just simple and easy.

Invest in all mutual funds online for free

· You do not require paying any additional cost for buying funds from Imperial money!!

· Most researched Mutual funds baskets are available.

· Sell anytime - Money comes to your bank account directly

· Learn to invest in mutual funds with as low as Amount of Rs.500/- with respect to your objective and planning of life the portfolio are builder for giving one of the state of art experience

Mutual Fund Investing for You:-

· Simple design, Easy to understand

· Made for beginners and experts both

· Financial planning you can do it here itself Invest in the researched and ready-made basket of mutual funds recommended by experts with years together experience bringing for you.

· Latest finance news and insights, notifications

· Most important is the teams of experts are available here to help you out in any type of Issues.

Steps After Imperial Money App Install:

· Verify your KYC

· If the KYC is not available then use following process

· PAN/KYC

· Profile set up

· Make an investment of sip or lumpsum

Need of KYC for mutual funds as per process of the Government of India for making a Tax saving funds (ELSS mutual funds):

Invest in tax saving mutual funds to get tax exemption under section 80c. The total exempt limit is 1.5 Lakhs. Invest in equity mutual funds - small cap, large cap, mid cap, multi-cap - for the long term and higher returns. Check out SIP Calculator to know how much returns you can make.

Safe & Secure: We use the latest security standards to keep your data safe and encrypted.

IMPERIAL MONEY is secure and does not store any information on your device or SIM card. Download and stay connected to your Mutual Fund investments always. Imperial Money uses NSE (National Stock Exchange) for transactions. We support all RTAs - CAMS, Karvy and Franklin.

Following AMC’s are supported on IMPERIAL MONEY Mutual Fund App:

SBI Mutual Fund,NIPPON Mutual Fund,ICICI Prudential Mutual Fund,HDFC Mutual Fund,Aditya Birla Sun Life Mutual Fund,Franklin Templeton Mutual Fund DSP Mutual Fund,Kotak Mutual Fund, Mirae Asset Mutual Fund, Axis Mutual Fund Motilal Oswal Mutual Fund, L&T Mutual Fund,IDFC Mutual Fund,INVESCO Mutual Fund UTI Mutual Fund,Sundaram Mutual Fund,Tata Mutual Fund,ITI MUTUAL FUND,BNP PARIBAS MUTUAL FUNDS,EDELWEISSS MUTUAL FUND,HSBC MUTUAL FUND MAHINDRA MUTUALA FUND,PGIM MUTUAL FUND,PRINCIPLE MUTUAL FUND UNION MUTUAL FUND

IMPERIAL MONEY - KEY FEATURES

Access your investments across multiple Mutual Funds through a Single Gateway; No more managing multiple PINs, Folios numbers, login ids;

· Mobile PIN & Pattern login– Simplified your Imperial Money App login process now. Just pick your preferred login methods – Mobile PIN, Pattern or Password right away

· Paperless Investing: Quick & paperless account creation and instant Activation. Within a couple of minutes, you are all set to ride the new wave of investing.

· Instant SIP: Once you are registered. It takes less than a minute to start a SIP.

· SIP Calculators: With the help of our calculators plan your investment needs to achieve your Financial Goals. Happy investing with Imperial money!!!

Investment Sahi…Future Sahi

IMPERIAL FINSOL PVT. LTD.

302, Royal Vista Building. Opp.Dhantoli Garden, Dhantoli

Nagpur. 440012

Contact Us : 8793187860 / 9595889988 / 7887800057

Email Us : wecare@imperialfin.com

Follow Us: https://www.facebook.com/imperialfinsol

Follow Us: https://www.linkedin.com/company/imperialfinsol/

Visit Us : www.imperialfin.com

Imperial Finsol, a Firm committed for providing a personalized solution for your Wealth Management needs. We help you to make smart investment choices with your money to get maximize returns. Knowledge of the financial markets and dedicated Client service team, are the pillars of our success. We now catering to 2000 plus clients. We are a preferred choice of Clients when it comes to Wealth Management.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mutual Funds Investment App By Imperial Money here

News-ID: 2083723 • Views: …

More Releases from Imperial Finsol Pvt.Ltd.

How to Find the Best Mutual Fund Advisor in India?

How to Find the Best Mutual Fund Advisor in India?

Among the decisions to make when you wish to invest in life, Mutual Funds are what company to select. With countless Mutual Funds advisors competing for your business, you can be attracted to select a Mutual Fund Distributor based on the service alone. However, numerous other aspects are just as vital as service. It is often even a lot more vital…

Do You Want to Know Where Market Will Be Going? Solution in Volatile Market

Solution for Investors in Volatile Market

Volatility is one thing which nobody likes, and the biggest reason most people don’t want to invest the money in the market place, however, it’s very much correlated to the human heart in terms of ECG GRAPH.

To Earn Profits in any type of Market Conditions, Download the Imperial Money App at - https://play.google.com/store/apps/details?id=com.iw.imperialmoney

But still, everyone wants to know always “Baazar kya bolta hai?” and the…

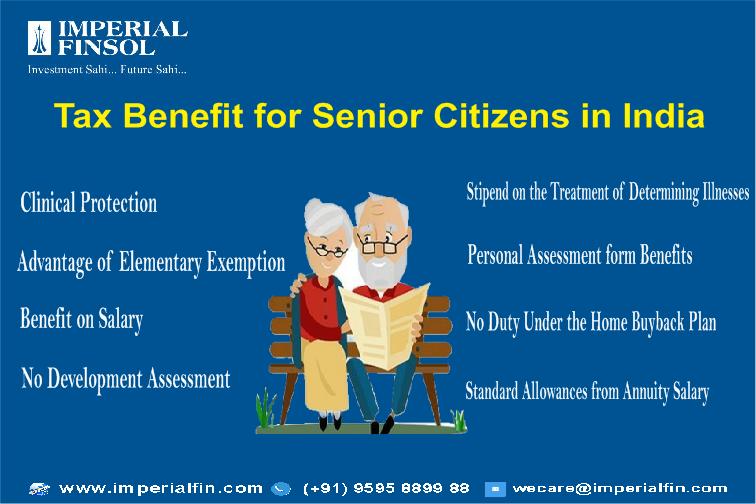

Tax Benefits for Senior Citizens in India

Tax Benefits for Senior Citizens in India:-

The Indian government has granted the significance of backing out the monetary weight of those in their retirement years. This has been reflected in the spending recommendations of 2018 and 2019, the two of which have presented a few changes that just offer tax reduction to senior citizens.

Download the Mutual Fund Investment App For Better Retirement Planning at -

https://www.imperialfin.com/mutual-fund-investment-app/

For annual duty purposes, those…

How to Get Back Your Home Loan Interest Amount?

How to Get Back Your Home Loan Interest Amount?

Today in this Blog we are going to tell one story and the story is about the “LOAN”.

Loan is basically in our view is;

L: Loads

O: Of

A: Absolute

N: Nothing

And today we are going to see various types of roles of Loans in our day to day life.

Loan is the important part for all of us in our life. And this is the…

More Releases for Mutual

Mutual Fund Assets Market Is Booming So Rapidly | Major Giants SBI Mutual Fund, …

HTF Market Intelligence (HTF MI) has published the latest edition of its Global Mutual Fund Assets Market Study, a comprehensive 143+ page research covering market dynamics, industry scope, and future outlook for the period 2025-2032. The study highlights emerging opportunities, challenges, and competitive strategies while offering segmentation by type, application, and geography.

Key Players Profiled in the Report

• SBI Mutual Fund

• ICICI Prudential Mutual Fund

• HDFC Mutual Fund

• Nippon India Mutual Fund

• Kotak Mahindra Mutual Fund

• Aditya…

Mutual Insurance Market Market Comprehensive Study Explores Huge Growth in Futur …

According to HTF Market Intelligence, the Global Mutual Insurance Market market to witness a CAGR of 9% during forecast period of 2023-2028. Global Mutual Insurance Market Breakdown by Type (Life Insurance, Health Insurance, Property Insurance, Casualty Insurance, Liability Insurance, Others) by Policyholder (Individuals, Businesses, Organizations) by Coverage (Personal Coverage, Commercial Coverage) and by Geography (North America, South America, Europe, Asia Pacific, MEA). The Mutual Insurance Market market size is estimated…

Poultry Insurance Market Worth Observing Growth | Prudential, CUNA Mutual, Farme …

A Latest intelligence report published by AMA Research with title "Poultry Insurance Market Insights, Forecast to 2030" provides latest updates and strategic steps taken by competition along with growth estimates of market size. The Poultry Insurance Market report gives clear visions how the research and estimates are derived through primary and secondary sources considering expert opinion, patent analysis, latest market development activity and other influencing factors.

Free Sample Report +…

Mutual Insurance Market To Witness Astonishing Growth With Liberty Mutual, Amica …

LOS ANGELES, UNITED STATES - The report on the global Lighting Distribution Box market is comprehensively prepared with main focus on the competitive landscape, geographical growth, segmentation, and market dynamics, including drivers, restraints, and opportunities. It sheds light on key production, revenue, and consumption trends so that players could improve their sales and growth in the Global Lighting Distribution Box Market. It offers a detailed analysis of the competition and…

Mutual Fund Apps for Direct Investment Market Growing Enormously with Top Key Pl …

A wide-ranging analysis of Mutual Fund Apps for Direct Investment Market has recently published by Report Consultant. It has been compiled by using primary and secondary research methodologies. Different dynamic aspects of the businesses have been listed to get a clear idea of business strategies. It includes a blend of several market segments and sub-segments.

Analyzed in a descriptive manner, the global Mutual Fund Apps for Direct Investment market report presents…

Homeowners Insurance Market Share 2019- Farmers Insurance Group, USAA Insurance, …

Homeowners insurance is a form of property insurance designed to protect a home—or possessions in the home—by providing financial reimbursement to the owner in the event of damages or theft. Homeowners insurance may also provide liability coverage against accidents in the home or on the property.

Request a Sample of this Report@ https://www.orbisresearch.com/contacts/request-sample/2572396

In 2018, the global Homeowners Insurance market size was xx million US$ and it is expected to reach xx…