Press release

Trade Finance Market: Year 2020-2027 and its detail analysis by Focusing on Top Key Players like BNP Paribas, Citi, Euler Hermes, HSBC Holdings PLC, JPMorgan Chase, Mitsubishi UFJ Financial, Royal Bank of Scotland, Standard Chartered

Trade finance is a type of commercial activity that is closely associated with the story of human trade evolution. In trade businesses it is highly critical to understand the role of trade finance as the former rarely takes place securely and safely without the latter. Besides, the trade finance can also be defined as a center where financial institution facilitate credit facilities like short-term finance for guarantee of exchange of goods. A trade finance might also use medium or long term loans.Get a Sample PDF of Trade Finance Report: https://bit.ly/3aDs7hy

Increasing adoption of pricing and structuring tools is projected to be one of the vital trade finance trend, which during the forecast period will gain noteworthy traction. By implementing pricing and structuring tools enables management of individual portfolios and dodge the risk through automation, consistency, and transparency provided by algorithmic trading throughout the company. Hence, the adoption of these tools is projected to optimistically impact the growth of trade finance market.

The report aims to provide an overview Trade Finance market with detailed market segmentation by offering, business function, deployment type, application, end-user, and geography. The global Trade Finance market is expected to witness high growth during the forecast period. The report provides key statistics on the market status of the leading Trade Finance market players and offers key trends and opportunities in the Trade Finance market.

Few of the main competitors currently working are -

1. Asian Development Bank

2. Bank of America Merrill Lynch

3. BNP Paribas

4. Citi

5. Euler Hermes

6. HSBC Holdings PLC

7. JPMorgan Chase

8. Mitsubishi UFJ Financial

9. Royal Bank of Scotland

10. Standard Chartered

Get Attractive Discount on This Report:@https://bit.ly/2w6BE1A

Reasons for buying this report:

-It offers an analysis of changing competitive scenario for making informed decisions in the businesses.

-it offers analytical data with strategic planning methodologies.

-It offers a seven-year assessment of Trade Finance Market.

-It helps in understanding the major key product segments.

-Researchers throw light on the dynamics of the market such as drivers, restraints, trends, and opportunities.

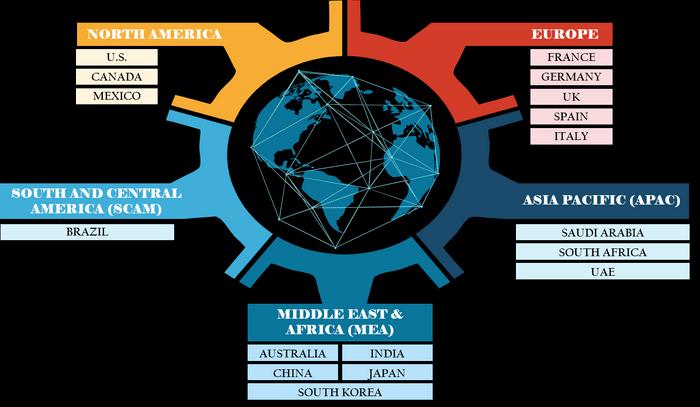

-It offers a regional analysis of Trade Finance Market along with business profiles of several stakeholders.

-It offers massive data about trending factors that will influence the progress of the Trade Finance Market.

Chapter Details of Trade Finance Market:

Part 01: Executive Summary

Part 02: Scope of The Report

Part 03: Trade Finance Market Landscape

Part 04: Trade Finance Market Sizing

Part 05: Trade Finance Market Segmentation by Product

Part 06: Five Forces Analysis

Part 07: Customer Landscape

Part 08: Geographic Landscape

Part 09: Decision Framework

Part 10: Drivers and Challenges

Part 11: Market Trends

Part 12: Vendor Landscape

Part 13: Vendor Analysis

Contact Us:

Call: +1-646-491-9876

Email: sales@theinsightpartners.com

Website: https://www.theinsightpartners.com/

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We are a specialist in Technology, Healthcare, Manufacturing, Automotive and Defense.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Trade Finance Market: Year 2020-2027 and its detail analysis by Focusing on Top Key Players like BNP Paribas, Citi, Euler Hermes, HSBC Holdings PLC, JPMorgan Chase, Mitsubishi UFJ Financial, Royal Bank of Scotland, Standard Chartered here

News-ID: 1997908 • Views: …

More Releases from The Insight Partners

Photocurable Resins Market Forecast to 2031 Highlights Emerging Opportunities

The global photocurable resins market is gaining increasing attention as industries seek materials that support speed accuracy and consistent performance. Photocurable resins cure quickly under controlled light exposure enabling efficient production processes and superior finish quality. These advantages have led to growing adoption across sectors such as electronics healthcare printing and industrial manufacturing.

Industry participants are focusing on developing advanced resin systems that meet evolving technical and regulatory requirements. Enhanced material…

Organic Snacks Market Witnesses Surge in Health-Conscious Choices Amid Rising De …

United States of America - January 14, 2025 - The organic snacks market continues to flourish as consumers worldwide prioritize nutritious, sustainable snacking options free from synthetic additives and GMOs. Driven by heightened awareness of wellness and environmental impact, leading companies are innovating with flavorful, plant-based offerings that blend taste with health benefits.

Get a Sample Copy At - https://www.theinsightpartners.com/sample/TIPRE00019545/?utm_source=OpenPR&utm_medium=10826

This boom reflects a broader shift toward mindful eating habits, where organic…

Allnex Belgium SA/NV Leads Innovation in Saturated Polyester Resin Market with N …

United States of America - January 14, 2025 - According to The Insight Partners, The Saturated Polyester Resin Market is expected to register a CAGR of 5% from 2025 to 2031. The saturated polyester resin market continues to evolve as key players like Allnex Belgium SA/NV (formerly Cytec) announce strategic expansions to meet rising demand across automotive, building and construction, paints and coatings, and electrical and electronics sectors. This development…

Feed Grade Mono Calcium Phosphate (MCP) Market Forecast to 2031 - Trends, Segmen …

With livestock farming intensifying globally to meet growing demand for meat, dairy, and related animal‐products, feed additives have become central to maintaining animal health, growth, and productivity. One such additive, Feed Grade Mono Calcium Phosphate , is especially important for supplying calcium and phosphorus in feed. According to reports from The Insight Partners, the MCP market is set for robust growth from now through 2031.

Check valuable insights in the…

More Releases for Trade

Trade Intelligence for Global Trade: Benchmarking Competitors with Verified Trad …

In the modern supply chain battlefield, knowledge is not just power-it's leverage. Understanding how your competitors move in the global trade space can make the difference between a strategic win and a costly misstep. Yet, many companies still rely on fragmented or outdated information, missing out on key shifts that trade intelligence platforms can now uncover easily.

The Blind Spot in Traditional Competitive Research

Traditional competitor analysis typically relies on market reports,…

Decoding Chongqing's Cross-Border Trade through the Yumaotong Smart Trade Platfo …

Since its launch on May 13, the New Western International Land - Sea Corridor - Yumaotong Smart Trade Platform (hereinafter referred to as the 'Yumaotong Smart Trade Platform') has welcomed 420 enterprises, including over 100 foreign companies. At the 7th Western China International Fair held in Chongqing on May 22, Deng Ai, head of the platform, said that it offered global businesses a one-stop, full-chain, professional service from capturing trade…

Trade Show Displays: Maximizing Your Trade Show Booth Design

Trade shows are a critical aspect of any business that wants to showcase its products, services, and brand to potential customers, partners, and investors. Trade show displays are one of the most crucial elements in trade show marketing, and they play a significant role in determining the success of a company's presence at a trade show. In this article, we'll explore the different types of displays for trade shows and…

The future of international trade and worldwide network: Global Trade Plaza

The future of international trade and worldwide network: Global Trade Plaza

A radical change to support continuous growth in supply traffic.

Connecting all manufacturers, suppliers, traders, exporters, and importers.

Open the door to the future of safe international trade.

B2B marketplace Global Trade Plaza wants to redefine the supply chain. The growth due to digitalization has touched multiple fields, but couldn't do much for the intercountry supply. We are here with…

US-China trade war shifting cement seaborne trade flows

In 2018, the total number of active cement carriers surpassed 360 units, with the total dead weight tonnage topping 2.7 million, the highest figure recorded since 2010.

According to CW Research’s 2019 update of the World Cement, Clinker & Slag Sea-Based Trade Report, the upward trend was underpinned by a growing demand for cement carriers in key domestic trade markets.

Specialized cement carriers move about 25 million tons of cement per…

Suisse Trade – Holding Trade Seminar in Tokyo in December 2016

Suisse Trade is a full-fledged Forex trading firm that is renowned worldwide for rendering clients with the best assistance in commodity and Forex based trading. The company has been consistently successful in presenting clients with the most formidable instruments to trade in currency and commodities markets. The tasks undertaken by the company also involve spot and cash trades, limited risk options on futures as well as contracts. It has always…