Press release

Global Tax and Accounting Software Market Expected to Witness a Sustainable Growth over 2026

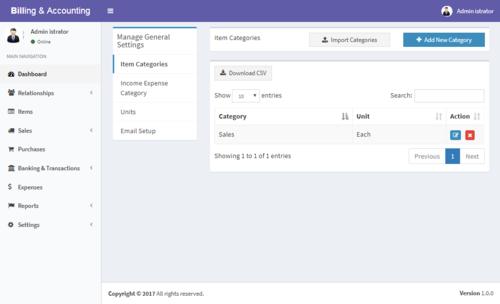

Market Research Report Store offers a latest published report on Tax and Accounting Software Market Analysis and Forecast 2019-2025 delivering key insights and providing a competitive advantage to clients through a detailed report.This study mainly helps understand which market segments or Region or Country they should focus in coming years to channelize their efforts and investments to maximize growth and profitability. The report presents the market competitive landscape and a consistent in depth analysis of the major vendor/key players in the market.

The report further predicts the size and valuation of the global market during the forecast period.Some of the key players profiled in the study are INTUIT, Formalwill, Sage, NCH, Budget Express.

The Tax and Accounting Software market was valued at xx Million US$ in 2020 and is projected to reach xx Million US$ by 2026, at a CAGR of xx% during the forecast period. In this study, 2018 has been considered as the base year and 2020 to 2026 as the forecast period to estimate the market size for Tax and Accounting Software.

Click to view the full report TOC, figure and tables:

https://www.marketresearchreportstore.com/reports/1274211/global-tax-accounting-software-market-size

Each segment and sub-segment is analyzed in the research report. The competitive landscape of the market has been elaborated by studying a number of factors such as the best manufacturers, prices and revenues. Global Tax and Accounting Software Market is accessible to readers in a logical, wise format. Driving and restraining factors are listed in this study report to help you understand the positive and negative aspects in front of your business.

This intelligence report provides a comprehensive analysis of the "Global Tax and Accounting Software Market. This includes Investigation of past progress, ongoing market scenarios, and future prospects. Data True to market on the products, strategies and market share of leading companies of this particular market are mentioned. It’s a 360-degree overview of the global market's competitive landscape.

Market Segment by Type, covers

Web-Based

Installed

iOS

Android

Market Segment by Applications, can be divided into

Personal Use

General Company

Listed Company

Government

Other

For More Information On This Report, Please Visit @

https://www.marketresearchreportstore.com/reports/1274211/global-tax-accounting-software-market-size

Objectives of the Study :

• To Define, Describe, and Segment The Global Tax and Accounting Software Market On The Basis Of Type, Function, Application, And Region.

• To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and industry-specific challenges)

• To estimate the size of the Global Tax and Accounting Software Market in terms of value.

• To study the individual growth trends of the providers of Global Tax and Accounting Software Market, their future expansions, and analyze their contributions to the market

• To strategically analyze micro-markets with respect to individual growth trends, future prospects, and contribution to the total market, covered by Global Tax and Accounting Software Market and various regions.

• To track and analyze competitive developments such as joint ventures, mergers & acquisitions, and new product launches, in Global Tax and Accounting Software Market.

• To strategically profile key market players and comprehensively analyze their market position and core competencies

Contact US

Market Research Report Store

E-mail: info@marketresearchreportstore.com

Tel: CN:0086-13660489451 HK: 00852-58081523 USA:001-626-3463946

Add: 17890 Castleton Street Suite 218 City of Industry CA 91748 United States

Website: https://www.marketresearchreportstore.com

About Us

Market Research Report Store (MRRS) is a professional organization related to market research reports in all directions .To provide customers with a variety of market research reports, MRRS cooperates with a large of famous market report publishers all over the world. Owing to our good service and the professional market reports in the wide range, MRRS enjoys a good reputation in the market. In pace with the development of MRRS, more and more customers and market report publishers choose to cooperate with us. As a specialized platform, MRRS upholds the supremacy of customers and aims to provide customers with better service and richer select.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Tax and Accounting Software Market Expected to Witness a Sustainable Growth over 2026 here

News-ID: 1900242 • Views: …

More Releases from Market Research Report Store

Global and United States Food Corrugated Box Packaging Market Report & Forecast …

This report focuses on global and United States Food Corrugated Box Packaging market, also covers the segmentation data of other regions in regional level and county level.

Global Food Corrugated Box Packaging Scope and Market Size

Food Corrugated Box Packaging market is segmented by region (country), players, by Type and by Application. Players, stakeholders, and other participants in the global Food Corrugated Box Packaging market will be able to gain the upper hand as they use…

Polymer-coated Sulfur-coated Urea (PCSCU) Fertilizers Market Size, Share, Develo …

LP INFORMATION offers a latest published report on Polymer-coated Sulfur-coated Urea (PCSCU) Fertilizers Market Analysis and Forecast 2019-2025 delivering key insights and providing a competitive advantage to clients through a detailed report.

This intelligence Polymer-coated Sulfur-coated Urea (PCSCU) Fertilizers Market report by LP INFORMATION includes investigations based on the current scenarios, historical records, and future predictions. An accurate data of various aspects such as type, size, application, and end user have…

Global Micro and Mini LED Display Market Expected to Witness a Sustainable Growt …

Market Research Report Store offers a latest published report on Micro and Mini LED Display Market Analysis and Forecast 2019-2025 delivering key insights and providing a competitive advantage to clients through a detailed report.

This study mainly helps understand which market segments or Region or Country they should focus in coming years to channelize their efforts and investments to maximize growth and profitability. The report presents the market competitive landscape and…

Global COPD and Asthma Drug Devices Market to Witness a Pronounce Growth During …

Market Research Report Store offers a latest published report on COPD and Asthma Drug Devices Market Analysis and Forecast 2019-2025 delivering key insights and providing a competitive advantage to clients through a detailed report.

This study mainly helps understand which market segments or Region or Country they should focus in coming years to channelize their efforts and investments to maximize growth and profitability. The report presents the market competitive landscape and…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…