Press release

Thailand Auto Loan Outstanding is expected to reach around THB 4,500 Billion by 2024: Ken Research

Thailand automotive industry is shifting focus towards electric vehicles (EVs), partly due to tightening regulations as tougher emission duty guidelines are set in major economies such as US, Europe, and China. In alignment with this wave, the Thai Finance Ministry reduced excise tax rates for EV cars since 2017, driving domestic sales of hybrid electric vehicles (HEVs), battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). This trend will likely to continue into 2019 despite the expected decline in the overall domestic automotive sales.• Thailand's household debt rose to THB 12.8 trillion in last year's final quarter, up from THB 12.5 trillion registered in the third quarter, according to central bank data

• Thailand's automotive industry expects cloudy sentiment in the next few months as it suffers from myriad negative factors such as restricted auto loan approvals from banks and an intense trade the war between the US and China, says the Federation of Thai Industries.

Growth Opportunity in Thailand EV market: High growth is projected in the EV segment of Thailand's automotive market will continue to support the industry. The Thai government is persistently trying to encourage the manufacturing of EVs and high-tech auto parts through the promotion of BOI incentive packages. In 2018, the government approved projects to produce HEVs and batteries by Nissan Motor Co and Honda Motor Co valued up to USD 888 million (THB 28 billion). Meanwhile, Mazda Motor Co was granted investment privilege to manufacture HEVs and has decided to apply for the production of full EVs in Thailand. Many other manufacturers also plan to invest and are studying for possible opportunities or are in the process of applying for the BOI package. EV segment still contributes very little to Thailand’s automotive market, but we can expect a ramp-up in production and an increase in adoption over the next few years.

Changing Nature of Ownership: Consumers in Thailand are increasingly moving forward to accommodate newer models of mobility and prefer partial ownership of vehicles instead of full ownership. Leasing and car rental were foreign concepts in Thailand a couple of years ago, however, they are now some of the growing operating models in the automobile industry in Thailand. This perception shift is forcing lenders to adopt new models and incorporate newer products in their portfolio offerings to consumers.

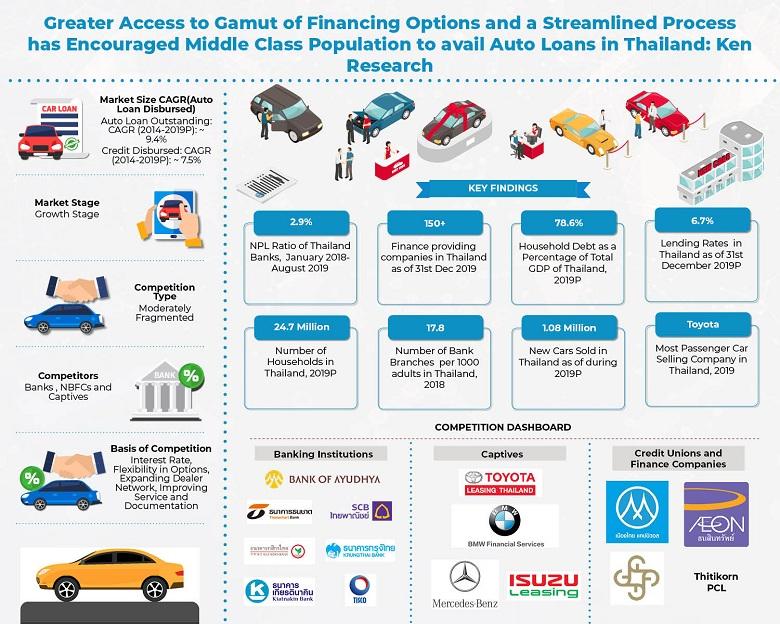

Analysts at Ken Research in their the latest publication “Thailand Auto Finance Market Outlook to 2024: Growing Prominence of Captive Finance Companies and Loan Portfolio of Banks acting as a Catalyst for Market Growth” believe that the market demand is likely to follow a growing trend in the near future due to a forthcoming increase in used cars sales and a shift towards newer models of mobility such as car-sharing and leasing, which will, in turn, help the economy grow as well. Some positive factors expected to impact the market are the influx of digitization based lending models (introduction of fin-tech products), the spread of customized loan products and a further rise in the penetration rate of banks and captive finance. The market is anticipated to register a positive CAGR of 8.8% in terms of credit disbursed and 10.2% in terms of total the loan outstanding during the forecasted period 2019P-2024F.

For More Information On The Research Report, Refer To Below Link:-

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/thailand-auto-finance-market-outlook/299310-93.html

Key Segments Covered:-

By Vehicle Financed

New Vehicles

Used Vehicles

By Lender Institutions

Banks

Captives

Non-Banking Finance Companies (NBFCs)

By Type of Finance

Passenger Vehicle

Commercial vehicles

Registration Pledge

Floor Plan

By Type of Vehicle

New Auto

Used Auto

Motorcycles

By Loan Tenure between New and Used Autos

One Year

Two Years

Three Years

Four Years

Five Years or more

Key Target Audience

Existing Auto Finance Companies

Banks

OEM Dealerships

Captive Finance Companies

Credit Unions

Private Finance Companies

New Market Entrants

Government Organizations

Investors

Automobile Associations

Automobile OEMs

Time Period Captured in the Report:

Historical Period: 2014-2019P

Forecast Period: 2019P-2024F

Key Companies Covered:

Banks

Thanachart Bank

Ayudhya Bank

Siam Commercial Bank

TISCO Bank

Kiatnakin Bank

Kasikorn Bank

ICBC Bank

Krungthai Bank

NBFCs

Muangthai Capital

Asia Sermkij Leasing

Nakhon Luang Capital Limited

Thitikorn

Summit Capital

Group Lease

Aeon Thana Sinsap

G Capital Public Limited

Thai Ace Capital

SGF Capital

JMT Network

Phatra Leasing Company

Mitsib Leasing

Captives

Toyota Leasing Thailand

Mercedes-Benz leasing

BMW Financial Services

MITSU Leasing Thailand

Ford Services Thailand Company Limited

Honda Leasing Thailand Company Limited

Hyundai Motor Thailand Company Limited

KIA Motors Finance

Mazda Financial Services Limited

Suzuki Motor Thailand Company Limited

Volvo Financial Services

Tri Petch Isuzu Leasing Company Limited

Land Rover Financial Services

Mini Financial Services

Porsche Financial Services

Thai Rung Union Auto Public Company Limited

Key Topics Covered in the Report:-

Thailand Auto Finance Market Overview and Genesis

Thailand Auto Finance Market Ecosystem, 2019P

Value Chain Analysis of the Thailand Auto Finance Market, 2019P

Thailand Finance Market Value Chain Analysis

Thailand Auto Finance Market Size, 2013-2019P

Thailand Auto Finance Market Segmentation, 20113-2019P

Major Trends and Development in Thailand Auto Finance Market

Issues and Challenges in Thailand Auto Finance Market

Regulatory Framework in the Thailand Auto Finance Market

Snapshot on Thailand Automotive Sales and Manufacturing Market, 2014-2019P

Ways to Finance Automotives in Thailand (Bank Finance or Multi Financing Companies, Personal Finance, Lease Financing)

Vendor Selection Process for Auto Finance Company in Thailand

Competitive Landscape Containing Company & Product Profiles in the Thailand Auto Finance Market

Financial Penetration of various OEM Brands

Thailand Finance Market Future Outlook and Projections, 2019P-2024

Analyst Recommendations for the Thailand Auto Finance Market

Related Reports by Ken Research:-

Vietnam Auto Finance Market Outlook to 2023 - by Loan Tenure, by Type of Institution (Commercial Banks and Non- Banking Financial Institutions) and by Type of Vehicle (Passenger and Commercial)

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/vietnam-auto-finance-market/180197-93.html

Philippines Auto Finance Market Outlook To 2023 - By Banks And NBFCs Including Captive Units (Auto Loan Portfolio And Motor Cycle Loan Portfolio), By New And Used Motor Vehicles, By Motor Vehicle Financed (Passenger And Commercial Vehicles), By Loan Time Period.

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/philippines-auto-finance-market-outlook/227542-93.html

Indonesia Auto Finance Market Outlook To 2024: Growing Prominence Of Captive Finance Companies Backed By Surging Auto Sales To Drive Market Growth

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/indonesia-car-finance-market-outlook/286575-93.html

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249

Ken Research Pvt. Ltd.,

Unit 14, Tower B3, Spaze I Tech Business Park, Sohna Road, sector 49 Gurgaon, Haryana - 122001, India

Ken Research is a Global aggregator and publisher of Market intelligence, equity, and economy reports. We provide business intelligence and operational advisory in 300+ verticals underscoring disruptive technologies, emerging business models with precedent analysis and success case studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Thailand Auto Loan Outstanding is expected to reach around THB 4,500 Billion by 2024: Ken Research here

News-ID: 1889204 • Views: …

More Releases from Ken Research

Global Synthetic Rubber Market Surpasses USD 36 Billion Milestone - Latest Insig …

Comprehensive market analysis maps the growth trajectory, investment opportunities, and strategic imperatives for industry leaders in the global rubber and polymer ecosystem.

Delhi, India - October 24, 2025 - Ken Research released its strategic market analysis titled "Global Synthetic Rubber Market Outlook to 2030," revealing that the current market size is valued at USD 36 billion, based on a five-year historical analysis. The detailed study outlines how the market is poised…

Top Players Are Reshaping the India Telemedicine Market: Who's Leading and Why I …

In 2024, the India Telemedicine market was valued at USD 2.3 Bn, dominated by players such as Practo and Apollo TeleHealth due to their extensive doctor networks and full-stack digital infrastructure. From strategic acquisitions to AI-driven platforms, these leaders are setting new standards for virtual care delivery across India.

New Delhi, April 14, 2025

Ken Research's latest Competitive Landscape Report 2025 on the India Telemedicine Market dissects how dominant players…

Smart Parking for Smart Cities: Unveiling the Future of US Parking Management

What is the Size of US Parking Management Industry?

US Parking Management industry is growing at a CAGR of ~% in 2017-2022 and is expected to reach ~USD Bn by 2028. The parking management in the United States is a substantial industry, driven by factors such as urbanization, increasing vehicle ownership & the need for efficient parking solutions.

The market consists of various types of parking facilities: on-street parking, off-street parking lots,…

The Transformative Growth of the US Acute Myeloid Leukemia Market

What is the Size of US Acute Myeloid Leukemia Industry?

US Acute Myeloid Leukemia Market is expected to grow at a CAGR of ~ % in 2022 and is expected to reach ~USD Mn by 2028. The US Acute Myeloid Leukemia market is the rapid advancement in precision medicine and targeted therapies. The emergence of innovative treatments tailored to the genetic and molecular characteristics of individual AML patients has transformed the…

More Releases for Thai

Arun Thai Cuisine Named the Best Thai Restaurant on the Northern Beaches for 202 …

Image: https://www.abnewswire.com/upload/2025/05/b96d29e857267b7e32d9da45a2301474.jpg

Northern Beaches, NSW - Arun Thai Cuisine [https://arunthai.com.au/] is proud to announce that it has been named the Best Thai Restaurant on the Northern Beaches by the Quality Business Awards for 2025. This prestigious recognition highlights Arun Thai

Cuisine's unwavering commitment to authentic flavours, outstanding service, and an exceptional dining experience for the local community and visitors alike.

Each year, the Quality Business Awards celebrate businesses that consistently deliver excellence in…

Thai Entertainment Shines Globally: Thai Companies Celebrate Success at FILMART …

Bangkok - The Department of International Trade Promotion (DITP), Ministry of Commerce, along with the Ministry of Culture, the Ministry of Tourism and Sports, and the Subcommittee on Film, Documentary, and Animation Industry Promotion under the National Soft Power Strategy Committee (THACCA), supported 37 Thai companies in participating at the Hong Kong International Film & TV Market 2025 (FILMART). The event was held in the Hong Kong Special Administrative Region,…

At Chong Kho Thai Restaurant Invites Wollongong to Savor Authentic Thai Flavors

Wollongong, NSW: 3rd March

At Chong Kho, a premier Thai restaurant located in Warrawong, is delighted to announce its commitment to providing an exceptional dining experience for residents and visitors of Wollongong. Emphasising real Thai cuisine, friendly surroundings, and unmatched service, At Chong Kho has evolved into a must-visit location for foodies looking to sample Thailand right in New South Wales.

Unforgettable dining for every occasion

From those looking for traditional Thai cuisine…

Lanna Thai Spa Offers Authentic Thai Wellness Experiences in Burnaby

Image: https://www.getnews.info/wp-content/uploads/2024/10/1728218273.png

Lanna Thai Spa, a premier destination for relaxation and rejuvenation, is proud to provide an authentic Thai spa experience in Burnaby. With a focus on holistic wellness and traditional Thai techniques, Lanna Thai Spa has quickly become a go-to spot for locals seeking high-quality massage therapy and spa treatments.

A Sanctuary for Relaxation

Lanna Thai Spa creates a tranquil environment where clients can unwind and escape the stresses of daily life.…

Thai Express McAllen: Elevating the Art of Thai Cuisine in Texas

Image: https://www.getnews.info/wp-content/uploads/2024/04/1713802682.png

McAllen, TX - April 23, 2024 - Thai Express in McAllen, TX, continues to captivate the palates of Texas with its authentic and innovative Thai cuisine. Renowned for its dedication to traditional Thai flavors while embracing local tastes, Thai Express McAllen is a culinary beacon for those seeking a genuine Thai dining experience.

Image: https://lh7-us.googleusercontent.com/heQdEcbRzYS584ml8P4de-FlU9ToTU3MnRUqAiKe1E1Vs9R2BmrAOJnUXt8vIAIz1KkXUilGYmsgvqfiW-2tfzYFCKU4meozHF5dMa6bTqAFXWssU0WobwKpg25xulnqyANDx1c4HyVjOReUU510Ypc

A Culinary Adventure in McAllen

At Thai Express McAllen [https://maps.app.goo.gl/rpn8pGmYRYDa7EnF6], every dish is a story, blending the…

Phaya Naak Announces the First English Version of its Best-Selling Thai Conversa …

The independent publishing house Phaya Naak, which has sold over 5,000 guide books from French into Southeast Asian languages, has decided to go international by offering English speaking travelers a series of funny yet useful conversation guides.

Nong Khai (Thailand) and Paris (France) - March 16, 2020 - Phaya Naak is an independent publishing house created in 2014 in Nong Khai, a city in Northeast Thailand. It is now releasing the…