Press release

Business Catastrophe Insurance Market Rising Trends, Size, Share, Key Drivers, Future Growth & Segmentation Analysis by 2025 | Top Players – Allianz, AXA, Nippon Life Insurance, American Intl. Group, Aviva, Assicurazioni Generali, Cardinal Health

Orian Research recently published a latest research report titled ‘Global Business Catastrophe Insurance Market 2019’ a comprehensive study enumerating the latest price trends and pivotal drivers rendering a positive impact on the industry landscape. Further, the report is inclusive of the competitive terrain of this vertical in addition to the market share analysis and the contribution of the prominent contenders toward the overall industry.Get Sample Copy at https://www.orianresearch.com/request-sample/970853

The key players covered in this study:

• Allianz

• AXA

• Nippon Life Insurance

• American Intl. Group

• Aviva

• Assicurazioni Generali

• Cardinal Health

• State Farm Insurance

• …

Business Catastrophe Insurance market report provides a comprehensive landscape of the industry, accurate market estimates and forecast split by product, application, technology, region and end-use. All quantitative information is covered on a regional as well as country basis. The report provides valuable strategic insights on the Business Catastrophe Insurance market, analyzing in detail industry impact forces including growth drivers, pitfalls and regulation evolution. The report also includes a detailed outlook on the Business Catastrophe Insurance market competitive environment, diving into the industry position of each major company along with the strategic landscape.

Business Catastrophe Insurance market study, in essence, comprises an extensive evaluation of this industry vertical focusing on the regional scope of this market as well as a slew of deliverables – like the insights with regards to market share, revenue estimation, market concentration rate, market competition trends, and sales volume. Further, the Business Catastrophe Insurance market report encompasses information with regards to the sales channels that are adopted by diverse vendors to make sure that the best methodology for product marketing is chosen.

Get Direct Copy of This Report https://www.orianresearch.com/checkout/970853

Market segment by Type, the product can be split into

• Commercial Property Insurance

• Commercial Health Insurance

• Other

Market segment by Application, split into

• Large Corporations

• Small and Medium-Sized Companies

• Personal

What does the report encompass with respect to the competitive and regional landscapes of Business Catastrophe Insurance market?

• The Business Catastrophe Insurance market research report endorses a detailed evaluation of the competitive spectrum of the industry.

• Information pertaining to the market share that each company procures as well as the sales area has been mentioned in the report.

• The products manufactured by these companies, product details, and product specifications, and their application frame of reference have been specified.

• The report includes other details as well, as such as a basic company outline, profit margins, pricing trends, etc.

• The geographical spectrum, as per the report, has been segregated into United States, China, Europe, Japan, and Southeast Asia & India.

• Explicit details about the market share that every region accounts for as well as the growth prospects of every topography have been outlined.

• The growth rate which every geography is expected to register over the forecast timeframe has been discussed.

Inquire more or share questions if any before the purchase on this report @ https://www.orianresearch.com/enquiry-before-buying/970853

There are Chapters to thoroughly display the Business Catastrophe Insurance Market. This report included the analysis of market overview, market characteristics, industry chain, competition landscape, historical and future data by types, applications and regions.

1 Report Overview

1.1 Study Scope

1.2 Key Market Segments

1.3 Players Covered

1.4 Market Analysis by Type

1.4.1 Global Business Catastrophe Insurance Market Size Growth Rate by Type (2014-2025)

1.4.2 Commercial Property Insurance

1.4.3 Commercial Health Insurance

1.4.4 Other

1.5 Market by Application

1.5.1 Global Business Catastrophe Insurance Market Share by Application (2014-2025)

1.5.2 Large Corporations

1.5.3 Small and Medium-Sized Companies

1.5.4 Personal

1.6 Study Objectives

1.7 Years Considered

2 Global Growth Trends

2.1 Business Catastrophe Insurance Market Size

2.2 Business Catastrophe Insurance Growth Trends by Regions

2.2.1 Business Catastrophe Insurance Market Size by Regions (2014-2025)

2.2.2 Business Catastrophe Insurance Market Share by Regions (2014-2019)

2.3 Industry Trends

2.3.1 Market Top Trends

2.3.2 Market Drivers

2.3.3 Market Opportunities

3 Market Share by Key Players

3.1 Business Catastrophe Insurance Market Size by Manufacturers

3.1.1 Global Business Catastrophe Insurance Revenue by Manufacturers (2014-2019)

3.1.2 Global Business Catastrophe Insurance Revenue Market Share by Manufacturers (2014-2019)

3.1.3 Global Business Catastrophe Insurance Market Concentration Ratio (CR5 and HHI)

3.2 Business Catastrophe Insurance Key Players Head office and Area Served

3.3 Key Players Business Catastrophe Insurance Product/Solution/Service

3.4 Date of Enter into Business Catastrophe Insurance Market

3.5 Mergers & Acquisitions, Expansion Plans

4 Breakdown Data by Type and Application

4.1 Global Business Catastrophe Insurance Market Size by Type (2014-2019)

4.2 Global Business Catastrophe Insurance Market Size by Application (2014-2019)

5 United States

5.1 United States Business Catastrophe Insurance Market Size (2014-2019)

5.2 Business Catastrophe Insurance Key Players in United States

5.3 United States Business Catastrophe Insurance Market Size by Type

5.4 United States Business Catastrophe Insurance Market Size by Application

6 Europe

6.1 Europe Business Catastrophe Insurance Market Size (2014-2019)

6.2 Business Catastrophe Insurance Key Players in Europe

6.3 Europe Business Catastrophe Insurance Market Size by Type

6.4 Europe Business Catastrophe Insurance Market Size by Application

7 China

7.1 China Business Catastrophe Insurance Market Size (2014-2019)

7.2 Business Catastrophe Insurance Key Players in China

7.3 China Business Catastrophe Insurance Market Size by Type

7.4 China Business Catastrophe Insurance Market Size by Application

8 Japan

8.1 Japan Business Catastrophe Insurance Market Size (2014-2019)

8.2 Business Catastrophe Insurance Key Players in Japan

8.3 Japan Business Catastrophe Insurance Market Size by Type

8.4 Japan Business Catastrophe Insurance Market Size by Application

9 Southeast Asia

9.1 Southeast Asia Business Catastrophe Insurance Market Size (2014-2019)

9.2 Business Catastrophe Insurance Key Players in Southeast Asia

9.3 Southeast Asia Business Catastrophe Insurance Market Size by Type

9.4 Southeast Asia Business Catastrophe Insurance Market Size by Application

10 India

10.1 India Business Catastrophe Insurance Market Size (2014-2019)

10.2 Business Catastrophe Insurance Key Players in India

10.3 India Business Catastrophe Insurance Market Size by Type

10.4 India Business Catastrophe Insurance Market Size by Application

11 Central & South America

11.1 Central & South America Business Catastrophe Insurance Market Size (2014-2019)

11.2 Business Catastrophe Insurance Key Players in Central & South America

11.3 Central & South America Business Catastrophe Insurance Market Size by Type

11.4 Central & South America Business Catastrophe Insurance Market Size by Application

12 International Players Profiles

13 Market Forecast 2019-2025

13.1 Market Size Forecast by Regions

13.2 United States

13.3 Europe

13.4 China

13.5 Japan

13.6 Southeast Asia

13.7 India

13.8 Central & South America

13.9 Market Size Forecast by Product (2019-2025)

13.10 Market Size Forecast by Application (2019-2025)

14 Analyst's Viewpoints/Conclusions

15 Appendix

Customization Service of the Report:

Orian Research provides customization of reports as per your need. This report can be personalized to meet your requirements. Get in touch with our sales team, who will guarantee you to get a report that suits your necessities.

Contact Us

Ruwin Mendez

Vice President – Global Sales & Partner Relations

Orian Research Consultants

US +1 (415) 830-3727 | UK +44 020 8144-71-27

Email: info@orianresearch.com

About Us

Orian Research is one of the most comprehensive collections of market intelligence reports on the World Wide Web. Our reports repository boasts of over 500000+ industry and country research reports from over 100 top publishers. We continuously update our repository so as to provide our clients easy access to the world's most complete and current database of expert insights on global industries, companies, and products. We also specialize in custom research in situations where our syndicate research offerings do not meet the specific requirements of our esteemed clients.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Business Catastrophe Insurance Market Rising Trends, Size, Share, Key Drivers, Future Growth & Segmentation Analysis by 2025 | Top Players – Allianz, AXA, Nippon Life Insurance, American Intl. Group, Aviva, Assicurazioni Generali, Cardinal Health here

News-ID: 1829994 • Views: …

More Releases from Orian Research

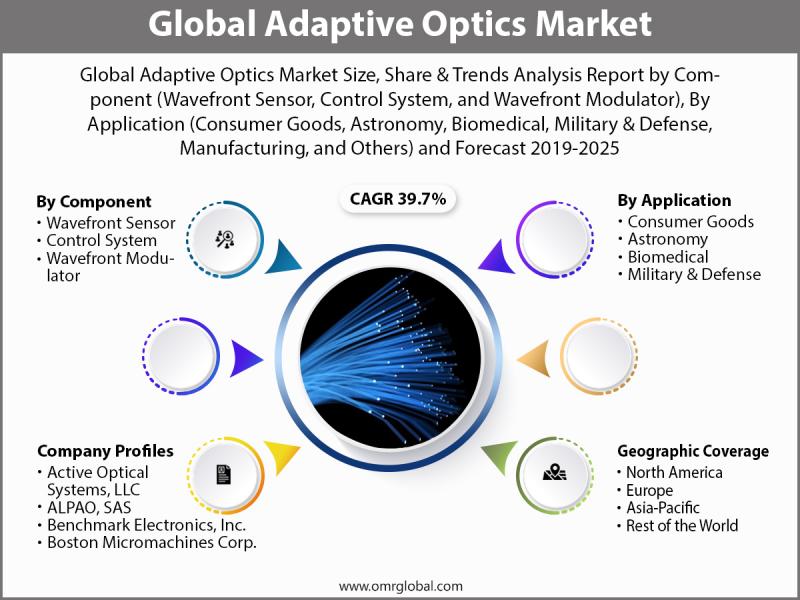

Adaptive Optics Market Size, Competitive Analysis, Share, Forecast- 2019-2025

The global adaptive optics market is projected to grow at a significant CAGR of 39.7% during the forecast period owing to the increasing application of adaptive optics in retinal imaging and ophthalmology to reduce the optical aberrations. The integration of adaptive optics converts an ophthalmoscope into a microscope, allowing visualization of and optical access to individual retinal cells in living human eyes.

To learn more about this report request a…

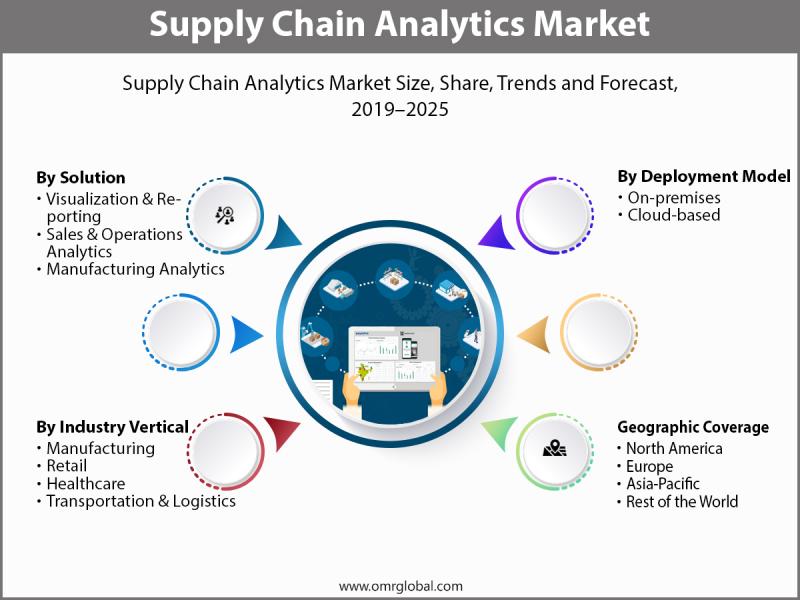

Supply Chain Analytics Market Size, Competitive Analysis, Share, Forecast- 2019- …

The Global Supply Chain Analytics Market is estimated to grow at a significant CAGR during the forecast period 2019- 2025. The impact of e-commerce on retailers and manufacturers is driving a revolution in many sectors and business organization. This has led to the introduction of supply chain analytics solution, which offers mathematics, statistics, predictive modeling and machine-learning techniques to find meaningful patterns and knowledge regarding order, shipment and transactional data.…

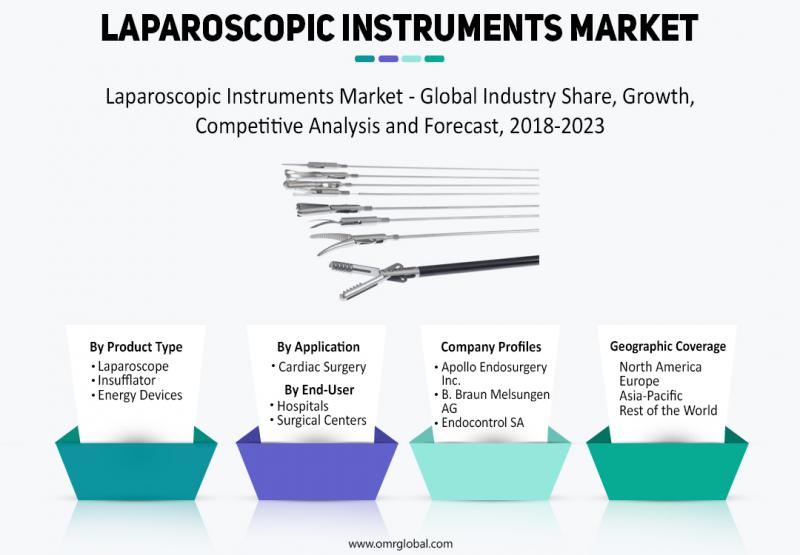

Laparoscopic Instruments Market Size, Competitive Analysis, Share, Forecast- 201 …

The laparoscopic or minimally invasive surgery uses a special surgical instrument known as laparoscope to look inside the body and carry out certain procedures. The laparoscopic instruments market is projected to witness a steady growth rate during the forecast period 2018-2023. The rise in preference of minimal invasive method over invasive surgeries, the high prevalence of lifestyle-oriented diseases, high global expenditure on the laparoscopic market, increasing healthcare market in emerging…

Fertility Drug Market Size, Competitive Analysis, Share, Forecast- 2018-2023

Infertility is one of the major issue now a day due to change in life style & cultural shift. There are various fertility drugs available in market for infertility related problems. Fertility drugs enhance the reproductive ability by improving quality of egg or sperms by increasing the levels of certain hormones in human body. The major factors that are responsible for the growth of fertility drug market are Change in…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…