Press release

Booming Growth in Automotive Financing Market and Forecast to 2023 by Worldwide Top Key Manufacturers – Bank of America, Ally Financial, Hitachi Capital Asia-pacific, HDFC

The report covers a forecast and an analysis of the Automotive Financing Market on a global and regional level. The study provides historical data for 2016, 2017, and 2018 along with a forecast from 2019 to 2023 based on revenue and volume.Overview of the Global Automotive Financing Market:

The report spread across 91 pages is an overview of the Global Automotive Financing Market - Analysis of Growth, Trends and Forecasts (2018 - 2023). These report study based on the Automotive Financing Market. It is a complete overview of the market, covering various aspects prevailing market landscape. It accumulates comprehensive information and research methodologies. Automotive Financing Market Research Report is a meticulous investigation of current scenario of the market, which covers several market dynamics.

Get a Sample Copy of this Report @ https://www.marketprognosis.com/sample-request/15836 .

The Automotive Financing Market has already matured in the industrialized nations but there are untapped opportunities in the developing countries, where the market has extremely low penetration. The major laggards in the world are Latin American and Eastern European countries where some countries have registered a double-digit fall in vehicle sales in the past 5 years. Brazil, which was a big contributor to the car market, has suffered one of the biggest falls in the past few years. The economic recession continued well into 2017, the Brazilian market is expected to continue to lag.

One of the chief reasons for the low automobile sales in the African countries is the unavailability of finance options. The base interest rate in Ghana is 26% and this indicates that automobile loans are out of reach for most people. This is a major cause for concern in many emerging economies. The Iran automobile market which would otherwise offer great opportunities due to the removal of sanctions faces a similar problem. The base rate of interest in a very promising automobile market is as high as 21%.

The loan market for second-hand cars would increase at a faster pace on account of increased demand from the Asia-Pacific region. The premium cars segment that had seen shrinking of market share in the past few years as customers opted to go for the luxury brands, will register strong sales. Financing of premium cars will see a high rate of growth in the forecasted period. On account of strong demand in the industrialized and emerging economies, financing of passenger vehicles is forecasted to register the strongest rate of growth by 2023.

Purchase this report online with 91 Pages, Top Key Players Analysis and List of Tables & Figure @ https://www.marketprognosis.com/buyReport/15836 .

Major Key Players:

1 Bank Of America

2 Ally Financial

3 Hitachi Capital Asia Pacific

4 HDFC Bank

5 HSBC

6 Industrial And Commercial Bank Of India

7 Bank Of China

8 Capital One

9 Wells Fargo

10 Toyota Financial Services and More……………..

Request a Discount on standard prices of this premium report @ https://www.marketprognosis.com/discount-request/15836 .

Table of Contents:

1 Introduction

2 Research Methodology

3 Executive Summary

4 Key Findings Of The Study

5 Market Overview And Trends

6 Market Dynamics

7 Global Auto Financing Market, Segmented By Source (Scope, Feasibility, And Popularity)

8 Global Automotive Financing Market, Segmented By Purpose (Growth, Trends, And Forecasts)

9 Global Automotive Financing Market, Segmented By Vehicle Type (Trends And Scenario)

10 Global Automotive Financing Market, Segmented By Geography (Growth, Trends, And Forecasts)

11 Competitive Landscape

12 Company Profiles

13 Future Outlook Of The Market

About us:

We at Market Prognosis believe in giving a crystal clear view of market dynamics for achieving success in today’s complex and competitive marketplace through our quantitative & qualitative research methods.

We help our clients identify the best market insights and analysis required for their business thus enabling them to take strategic and intelligent decision.

We believe in delivering actionable insights for your business growth and success.

Contact us:

ProgMark Pvt. Ltd.

Thane – 421501

India.

sales@marketprognosis.com

+1 973 241 5193

https://www.marketprognosis.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Booming Growth in Automotive Financing Market and Forecast to 2023 by Worldwide Top Key Manufacturers – Bank of America, Ally Financial, Hitachi Capital Asia-pacific, HDFC here

News-ID: 1747969 • Views: …

More Releases from ProgMark

Present Scenario and Growth Prospects of Micro-Hybrid Vehicles Market Over the P …

This comprehensive Micro-Hybrid Vehicles Market research report 2019 – 2024 includes a brief on these trends that can help the businesses operating in the industry to understand the market and strategize for their business expansion accordingly. The research report analyzes the market size, industry share, growth, key segments, CAGR and key drivers.

Overview of the Global Micro-Hybrid Vehicles Market:

The report spread across 91 pages is an overview of the Global Micro-Hybrid…

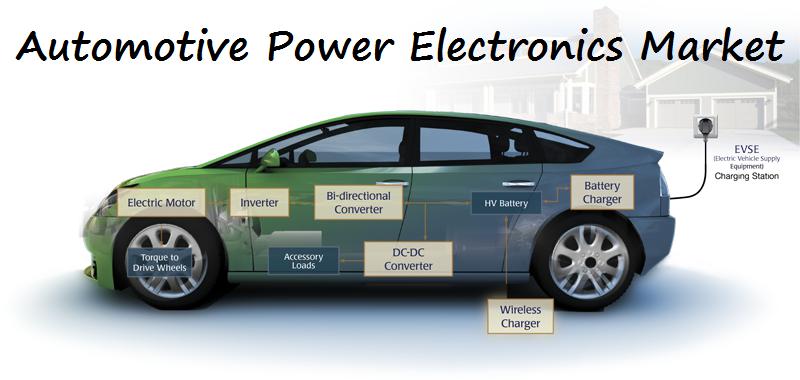

Excellent Growth of Automotive Power Electronics Market 2019: Comprehensive Stud …

This comprehensive Automotive Power Electronics Market research report 2019 – 2023 includes a brief on these trends that can help the businesses operating in the industry to understand the market and strategize for their business expansion accordingly. The research report analyzes the market size, industry share, growth, key segments, CAGR and key drivers.

Overview of the Global Automotive Power Electronics Market:

The report spread across 87 pages is an overview of the…

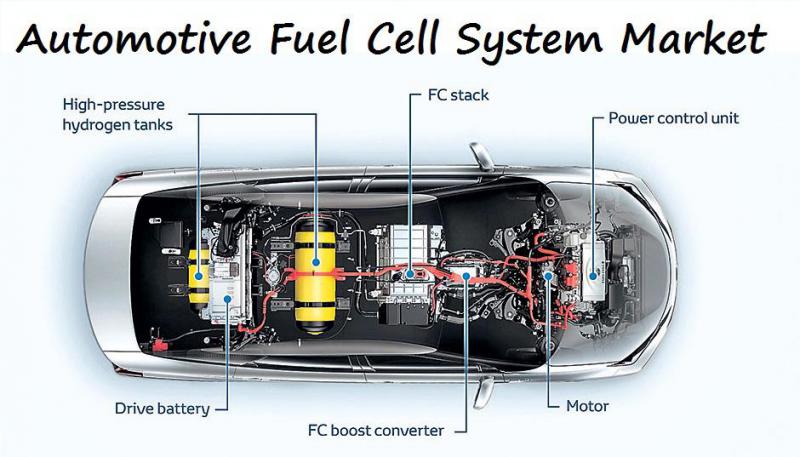

Automotive Fuel Cell System Market 2019: A Comprehensive Insights with Top Key V …

The report covers a forecast and an analysis of the Automotive Fuel Cell System Market on a global and regional level. The study provides historical data for 2016, 2017, and 2018 along with a forecast from 2019 to 2023 based on revenue and volume.

Overview of the Global Automotive Fuel Cell System Market:

The report spread across 86 pages is an overview of the Global Automotive Fuel Cell System Market - Analysis…

Rapid Growth of Agricultural Robots and Mechatronics Market 2019 – 2023 | 3D R …

Global Agricultural Robots and Mechatronics Market research report 2019 - 2023 provides the newest industry data and industry future trends, allowing you to identify the products and end users driving Revenue growth and profitability.

Overview of the Global Agricultural Robots and Mechatronics Market:

The report spread across 88 pages is an overview of the Global Agricultural Robots and Mechatronics Market - Analysis of Growth, Trends and Forecasts (2018 - 2023). These report…

More Releases for Financing

ADB should end fossil fuel financing

NGO Forum on ADB, a network of over 250 civil society organizations across Asia calls out the Asian Development Bank to end its green posturing and make real commitments towards a Paris aligned policy and appropriate clean energy investments. This demand coincides with this year's Asia Clean Energy Forum (ACEF) 2020 which started yesterday, June 16.

This year ACEF’s thematic focus is centered upon building an inclusive, resilient sustainable energy future,…

vasopharm Closes Series F Financing Round

- Company receives additional €5 million for preparation of Phase III study -

Wuerzburg, Germany; June 24, 2013 – vasopharm GmbH, a privately held biopharmaceutical company focusing on novel therapeutics for the treatment of cerebro- and cardiovascular diseases, today announced the successful completion of a Series F financing round totalling €5 million (~ US$6.5 million). The round was led by existing investors HeidelbergCapital Private Equity and Entrepreneurs Fund (EF Investments S.à.r.l.).…

Benefits of EastBank Capital’s Monetization Financing

EB Capital, LLC (“EastBank Capital”), a leading corporate financier that specializes in Monetization Financing, announces the Features and Benefits of this excellent program.

As banks continue to re-capitalize their balance sheets, EastBank Capital has been stepping into this funding breach, offering Monetization Financing to companies with Financial Guarantees. The client base is diverse, covering commodities, energy, real estate, entertainment and more.

“Our ability to innovate and seize opportunities…

Shaw Capital Management and Financing Benefits from Factoring Financing

How Distribution Companies can benefit from Factoring Financing

Product distribution companies can be very capital intensive businesses. Read this article to learn how to get working capital for your distribution company and avoid scam.

Shaw Capital Management and Financing provide same-day-funding. We can help you meet your cash flow needs immediately without entering into a long term factoring relationship. The money you get for the freight bills we purchase is payment in…

Shaw Capital Management and Financing

Shaw Capital Management and Financing provides export trade financing to clients in every major world market and can convert accounts receivable finance transactions in 17 currencies. Avoid scams and other fraudulent transactions. Deal with the best financing companies only. No registration fee needed.

We have no minimum or maximum monthly volume requirements. Other factoring companies require a financial commitment for the amount of freight bills you factor each month.

Our highly skilled…

IPeak Networks Secures Series A Financing

Ottawa CANADA, 7 July 2009 – IPeak Networks announced today that Miralta Capital (www.miralta.com), one of Canada’s oldest private equity investment firms, has invested in the company. The Series A round of financing was closed on June 30 2009 to build on success made possible with the earlier financial support of the Ottawa Angel Alliance (OAA, ottawaangelalliance.angelgroups.net) and the Province of Ontario’s Investment Accelerator Fund (IAF, ) administered by…