Press release

Cyber Insurance Market to grow at 33.7% CAGR and Expected to reach USD 29800 Million by 2023 | Top International Brands are AIG, Chubb, XL Group, Beazley, Allianz, Berkshire Hathaway, AON

The exclusive research report on the Global Cyber Insurance Market 2019 examines the market in detail along with focusing on significant market dynamics for the key players operating in the market. Global Cyber Insurance Industry research report offers granulated yet in-depth analysis of revenue share, market segments, revenue estimates and various regions across the globe.Global Cyber Insurance Market Overview:

The report spread across 90 pages is an overview of the Global Cyber Insurance Market Report 2019. The Global Cyber Insurance Market is projected to grow at a healthy growth rate from 2019 to 2023 according to new research. The study focuses on market trends, leading players, supply chain trends, technological innovations, key developments, and future strategies.

The Global Cyber Insurance Market size was 2920 Million US$ in 2018 and it is expected to reach 29800 Million US$ by the end of 2023, with a CAGR of 33.7% during 2019 - 2023.

Available Exclusive Sample Copy of this Report @ https://www.businessindustryreports.com/sample-request/142819 .

According to the market report analysis, the Cyber-insurance is an insurance product used to protect businesses and individual users from Internet-based risks, and more generally from risks relating to information technology infrastructure and activities. Risks of this nature are typically excluded from traditional commercial general liability policies or at least are not specifically defined in traditional insurance products. Most cyber insurance writers have shifted their writings to standalone policies and away from packaged policies; we found that more than 67% of the $2.19 billion total direct premiums written in 2016 were on a standalone basis. Insurers view standalone policies as more efficient and effective than packaged policies.

The top 3 cyber insurance writers are American International Group (AIG), Chubb and XL Group; these 3 companies had a combined market share of over 30 percent in 2016. The top 15 writers of cyber in this report held approximately 64 percent of the market in 2016.

In terms of the regional analysis, North America dominates the Cyber Insurance Market and accounts for around 89% of the overall Cyber Insurance Market in 2016. Mandatory legislation regarding cyber security in several U.S. states has led to higher penetration of cyber liability insurance policies. Europe has very less penetration of cyber insurance liability policies as compared to that of the U.S. The European council has recently passed regulations regarding data protection and security, which are projected to be brought into effect in 2019. These regulations would oblige companies to purchase cyber insurance policies. Though APAC accounts for negligible percentage share, it is expected to grow at a significant CAGR during the forecast period owing to a significant increase in ransomware attacks.

Purchase this report online with 90 Pages, List of Tables & Figures and in-depth Table of Contents on “Global Cyber Insurance Market Report 2019” @ https://www.businessindustryreports.com/buy-now/142819/single .

Major Key Players:

1 AIG

2 Chubb

3 XL Group

4 Beazley

5 Allianz

6 Zurich Insurance

7 Munich Re Group

8 Berkshire Hathaway

9 AON

10 AXIS Insurance and More……………..

Market segment by Regions/Countries, this report covers

1 North America Country (United States, Canada)

2 South America

3 Asia Country (China, Japan, India, Korea)

4 Europe Country (Germany, UK, France, Italy)

5 Other Country (Middle East, Africa, GCC)

Grab Your Report at an Impressive Discount @ https://www.businessindustryreports.com/check-discount/142819 .

Major Points in Table of Contents:

Global Cyber Insurance Market Report 2019

1 Cyber Insurance Product Definition

2 Global Cyber Insurance Market Manufacturer Share and Market Overview

3 Manufacturer Cyber Insurance Business Introduction

4 Global Cyber Insurance Market Segmentation (Region Level)

5 Global Cyber Insurance Market Segmentation (Product Type Level)

6 Global Cyber Insurance Market Segmentation (Industry Level)

7 Global Cyber Insurance Market Segmentation (Channel Level)

8 Cyber Insurance Market Forecast 2019-2023

9 Cyber Insurance Segmentation Product Type

10 Cyber Insurance Segmentation Industry

11 Cyber Insurance Cost of Production Analysis

12 Conclusion

About us

BusinessindustryReports.com is digital database of comprehensive market reports for global industries. As a market research company, we take pride in equipping our clients with insights and data that holds the power to truly make a difference to their business. Our mission is singular and well-defined – we want to help our clients envisage their business environment so that they are able to make informed, strategic and therefore successful decisions for themselves.

Media Contact

Business Industry Reports

Pune – India

sales@businessindustryreports.com

+19376349940

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cyber Insurance Market to grow at 33.7% CAGR and Expected to reach USD 29800 Million by 2023 | Top International Brands are AIG, Chubb, XL Group, Beazley, Allianz, Berkshire Hathaway, AON here

News-ID: 1740190 • Views: …

More Releases from BIR Markets

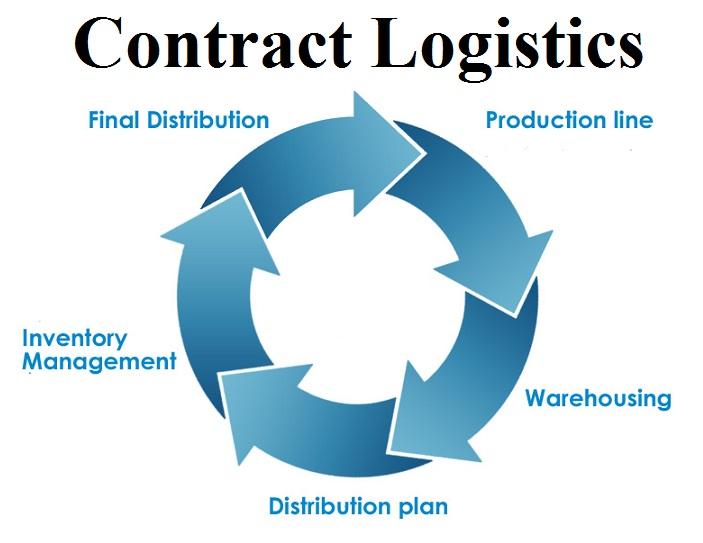

Big boom by Contract Logistics Market 2019 with an impressive double-digit growt …

The demand for Contract Logistics Market 2019 is anticipated to be high for the next few years. By considering this demand we provide latest Contract Logistics Market Report which gives complete industry analysis, market outlook, size, growth and forecast till 2023. This report will assist in analyzing the current and future business trends, sales and revenue forecasts.

Global Contract Logistics Market Overview:

The report spread across 90 pages is an overview of…

Outstanding Growth of Multi-factor Authentication (MFA) Market is estimated to r …

The exclusive research report on the Global Multi-factor Authentication (MFA) Market 2019 examines the market in detail along with focusing on significant market dynamics for the key players operating in the market. Global Multi-factor Authentication (MFA) Industry research report offers granulated yet in-depth analysis of revenue share, market segments, revenue estimates and various regions across the globe.

Global Multi-factor Authentication (MFA) Market Overview:

The Global Multi-factor Authentication (MFA) Market is Valued at…

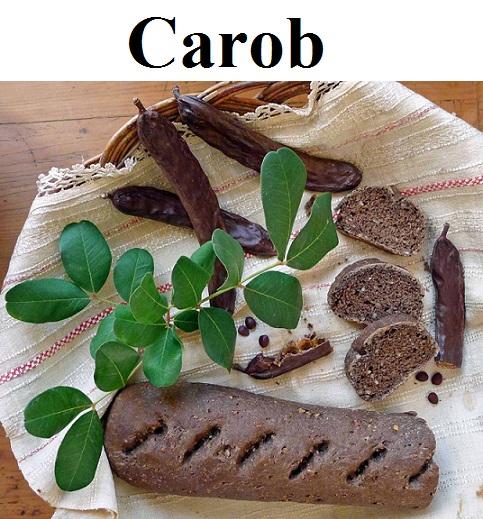

Carob Market Incredible Possibilities, Growth Analysis with Top International Ke …

A market study ”Global Carob Market” examines the performance of the Global Carob Market 2019. It encloses an in-depth Research of the Carob Market state and the competitive landscape globally. This report analyzes the potential of Carob Market in the present and the future prospects from various angles in detail.

Global Carob Market Overview:

This report studies the Global Carob Market over the forecast period of 2019 to 2023. The Global Carob…

Future Scope of Hazardous Waste Management Market 2019: Top Leading Players - Su …

The demand for Hazardous Waste Management Market 2019 is anticipated to be high for the next few years. By considering this demand we provide latest Hazardous Waste Management Market Report which gives complete industry analysis, market outlook, size, growth and forecast till 2025. This report will assist in analyzing the current and future business trends, sales and revenue forecasts.

Global Hazardous Waste Management Market Overview:

The report spread across 120 pages is…

More Releases for Insurance

Household Insurance market by top keyaplayers - Discount Insurance Home Insuran …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance marketgrowth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market have also been included in…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Non-Life Insurance Market :Health Insurance, Property Insurance, Cargo Insurance …

Non-Life Insurance Market Overview:

Summary:Excellence consistency maintains by Garner Insights in Research Report in which studies the global Non-Life Insurance market status and forecast, categorizes and Equipment market value by manufacturers, type, application, and region.

Get Access to Report Sample: http://bit.ly/2Q9Hd8z

Non-Life Insurance market was valued at Million US$ in 2017 and is projected to reach Million US$ by 2025, at a CAGR of during the forecast period. In this study, 2017 has been…

Agricultural Insurance Market 2018-2023: AnHua Agricultural Insurance, Anxin Agr …

A new research study titled, “Global Agricultural Insurance Market” has been added to the comprehensive repository of Orbis Research

Agricultural Insurance Market - Global Status and Trend Report 2018-2023 offer a comprehensive analysis of the Agricultural Insurance industry, standing on the readers’ perspective, delivering detailed market data and penetrating insights. No matter the client is the industry insider, potential entrant or investor, the report will provide useful data and information.

The…

Insurance Market-Saga’s Retail Broking Business Offers Motor Insurance, Pet In …

Orbis Research Market brilliance released a new research report of 33 pages on title ‘Insurance Company Profile: Saga’ with detailed analysis, forecast and strategies.

Insurance Company Profile: Saga", profile provides a comprehensive review of Saga and its UK business. This includes its strategy for growth and focus on digitization as well as its performance in the UK and marketing and distribution strategy.

Request a sample of this report at http://orbisresearch.com/contacts/request-sample/2026595

Saga…