Press release

Europe Travel Insurance Market Expected to Reach $7,583 Million | By Top Leading CompaniesGenerali Group (Italy), Allianz Group (France), AXA Group (France), Insure and Go Insurance Services Limited (UK), The April Group (France), Mutuaide Assistance (Fra

According to a new report published by Allied Market Research, titled, Europe Travel Insurance Market by Distribution Channel, Insurance Cover, and End User: Global Opportunity Analysis and Industry Forecast, 2016-2022, the Europe travel insurance market was valued at $5,390 million in 2016, and is estimated to reach $ 7,583 million by 2023, registering a CAGR of 5.9% from 2016 to 2022. In 2016, the insurance intermediaries segment is estimated to dominate the Europe travel insurance market.Rise in tourism, stringent government regulations, and rise in travel by baby boomers have propelled demand for travel insurance in Europe. Furthermore, a notable increase in the number of business travelers would have positive impact on travel insurance industry boost the market growth in the years to come.

Download PDF Report Sample @ https://www.alliedmarketresearch.com/request-sample/2291?utm_source=OPR

The key driver for the growth of Europe travel insurance market is the trend of countries within the region adopting travel insurance as a prerequisite for obtaining VISA. Furthermore, government and insurance regulatory bodies are creating a high-level awareness to the population and generating the demand for the growth of Europe travel insurance market. Low penetration level of insurance market and less awareness about the benefit related to travel insurance restrain the market growth.

UK is the market leader and accounted for 29% share of the Europe market in 2016, followed by Germany. UK is expected to maintain its dominance in the Europe travel insurance market, due to the process of Brexit, as the majority of the UK travelers are rely on European Health Insurance Card (EHIC) instead of purchasing a travel insurance policy to save money. However, Austria and Switzerland is estimated to grow at the highest CAGR of 7.5% and 7.1% during the forecast period, respectively. Exponential market growth in Austria is due to the gradual improvement in its economy and increase in tourism promotional activities by the Austria National Tourist Office.

Based on distribution channel, traditional sources such as tour operators and travel agents have maintained their dominance in providing insurance policies with the help of advanced technology, combined with good training, and competitive pricing. However, with the changing consumer behavior and growth in digitalized channels, the online insurance aggregators have also gained market share. During the forecast period insurance aggregator is projected to grow at a CAGR of 10.6%.

The key players profiled in this report include Generali Group (Italy), Allianz Group (France), AXA Group (France), Insure and Go Insurance Services Limited (UK), The April Group (France), Mutuaide Assistance (France), Aon Plc (UK), Aviva Plc (UK), Saga Plc (UK), and Atlas Travel Insurance Services Ltd (England).

Analyst Review:

Travel insurance is an important part of travel planning which is aimed at safeguarding the tourist from unforeseen events during their travel. It offers a relief in the form of monetary compensation to tackle intense travel situations. It provides a wide range of benefits to the tourists in terms of financial cover for medical and hospitalization expenses. In the event of evacuation or repatriation during an emergency, a valid travel insurance policy act as an authentic document for re-imbursement of expenses. Another added benefit of travel insurance includes protection against trip cancellation or interruption

Make a Purchase Enquiry @ https://www.alliedmarketresearch.com/purchase-enquiry/2291?utm_source=OPR

The growth in the tourism sector is expected create a huge demand of travel insurance in the European region. Moreover, the rising travel trend among senior citizen and baby boomer, government initiatives to create awareness and transformation towards digitalized platform are expected to drive the growth of Europe travel insurance market

Travel insurance services provider are offering several types of policy based on different requirement and needs. These policies are categorized into single trip travel insurance, annual multi-trip travel insurance and long stay travel insurance. Amongst these, single trip insurance dominates the Europe travel insurance market, owing to the growing travel among middle income group. Moreover, senior citizens and family traveler is considered as a most prominent end user segment for single trip travel insurance policy. However, long stay travel insurance policy is expected to grow at a relatively high growth rate owing to the rising educational travelers or sabbaticals.

The companies operating in the Europe travel insurance market are shifting their focus towards digitalized channel in order to increase their customer reach. Amongst the various distribution channel, insurance aggregators are expected to grow at a relatively high growth rate and gain market share during the forecast period. This segment is expected to be highly popular among younger generation as they are more tech savvy as compared to other generations. However, insurance intermediaries are expected to maintain its dominance in the Europe travel insurance market, due to their trust and goodwill among senior citizens and baby boomers in delivering services.

Established market players have maintained their dominance in the Europe travel insurance industry even after the emergence of many new companies. However, taking advantage of the growing internet penetration, these budding companies are adopting marketing strategies such heavy discount options, and similar other value-added schemes to capture higher market share.

LIST OF TABLES

Table 1. Europe Travel Insurance Market, by Distribution Channel, 2014-2022 ($Million)

Table 2. Europe Travel Insurance Market, by Insurance Cover, 2014-2022 ($Million)

Table 3. Europe Travel Insurance Market, by End-User, 2014-2022 ($Million)

Table 4. UK Travel Insurance Market Revenue by Distribution Channel, 2014-2022 ($Million)

Table 5. UK Travel Insurance Market Revenue by Insurance Cover, 2014-2022 ($Million)

Table 6. UK Travel Insurance Market Revenue by User, 2014-2022 ($Million)

Table 7. Germany Travel Insurance Market Revenue by Distribution Channel, 2014-2022 ($Million)

Table 8. Germany Travel Insurance Market Revenue by Insurance Cover, 2014-2022 ($Million)

Table 9. Germany Travel Insurance Market Revenue by User, 2014-2022 ($Million)

Table 10. France Travel Insurance Market Revenue by Distribution Channel, 2014-2022 ($Million)

Table 11. France Travel Insurance Market Revenue by Insurance Cover, 2014-2022 ($Million)

Table 12. France Travel Insurance Market Revenue by User, 2014-2022 ($Million)

Table 13. Spain Travel Insurance Market Revenue by Distribution Channel, 2014-2022 ($Million)

Table 14. Spain Travel Insurance Market Revenue by Insurance Cover, 2014-2022 ($Million)

Table 15. Spain Travel Insurance Market Revenue by User, 2014-2022 ($Million)

Table 16. Italy Travel Insurance Market Revenue by Distribution Channel, 2014-2022 ($Million)

Table 17. Italy Travel Insurance Market Revenue by Insurance Cover, 2014-2022 ($Million)

Table 18. Italy Travel Insurance Market Revenue by User, 2014-2022 ($Million)

Table 19. Netherlands Travel Insurance Market Revenue by Distribution Channel, 2014-2022 ($Million)

Table 20. Netherlands Travel Insurance Market Revenue by Insurance Cover, 2014-2022 ($Million)

Table 21. Netherlands Travel Insurance Market Revenue by User, 2014-2022 ($Million)

Table 22. Switzerland Travel Insurance Market Revenue by Distribution Channel, 2014-2022 ($Million)

Table 23. Switzerland Travel Insurance Market Revenue by Insurance Cover, 2014-2022 ($Million)

Table 24. Switzerland Travel Insurance Market Revenue by User, 2014-2022 ($Million)

Table 25. Austria Travel Insurance Market Revenue by Distribution Channel, 2014-2022 ($Million)

Table 26. Austria Travel Insurance Market Revenue by Insurance Cover, 2014-2022 ($Million)

Table 27. Austria Travel Insurance Market Revenue by User, 2014-2022 ($Million)

Table 28. Generali Group: Company Snapshot

Table 29. Generali Group: Operating Segments

Table 30. Allianz Group: Company Snapshot

Table 31. Allianz Group: Operating Segments

Table 32. AXA Group: Company Snapshot

Table 33. AXA Group: Operating Segments

Table 34. Insure and Go Insurance Services Ltd.: Company Snapshot

Table 35. Insure and Go Insurance Services Ltd: Operating Segments

Table 36. The April Group: Company Snapshot

Table 37. The April Group: Operating Segments

Table 38. Mutuaide Assistance: Company Snapshot

Table 39. Mutuaide Assistance: Operating Segments

Table 40. Aon Plc: Company Snapshot

Table 41. Aon Plc: Operating Segments

Table 42. Aviva Plc: Company Snapshot

Table 43. Aviva Plc: Operating Segments

Table 44. Saga Plc: Company Snapshot

Table 45. Saga Plc: Operating Segments

Table 46. Atlas Travel Insurance Services Ltd: Company Snapshot

Table 47. Atlas Travel Insurance Services Ltd: Operating Segments

Access Full Summery @ https://www.alliedmarketresearch.com/europe-travel-insurance-market?utm_source=OPR

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

Toll Free (USA/Canada):

+1-800-792-5285, +1-503-894-6022, +1-503-446-1141

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1?855?550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Europe Travel Insurance Market Expected to Reach $7,583 Million | By Top Leading CompaniesGenerali Group (Italy), Allianz Group (France), AXA Group (France), Insure and Go Insurance Services Limited (UK), The April Group (France), Mutuaide Assistance (Fra here

News-ID: 1704175 • Views: …

More Releases from Allied Market Research

Out-of-Band Authentication Market Insights and Projections: High Hopes for Futur …

According to the report, the global out-of-band authentication industry generated $553.45 million in 2020, and is expected to reach $4.2 billion by 2030, witnessing a CAGR of 22.8% from 2021 to 2030.

Out-of-band (OOB) authentication refers to a method of confirming a user's identity or verifying a transaction using a separate communication channel from the one being used for the main interaction.

Request Sample Report at: https://www.alliedmarketresearch.com/request-sample/4536

For example, if you're logging into…

Philippines Beauty & Personal Care Market to rise up to the USD 4.7 billion by 2 …

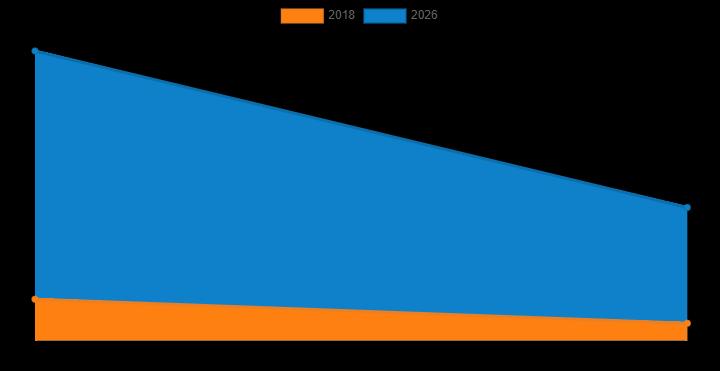

The Philippines beauty & personal care market size was valued at $3.3 billion in 2018 and is projected to reach $4.7 billion by 2026, registering a CAGR of 4.8% from 2019 to 2026.The Hypermarket/Supermarket segment was the highest contributor to the market, with $801.5 million in 2018.

Request The Sample PDF of This Report: https://www.alliedmarketresearch.com/request-sample/6493

Market Overview

Beauty & personal care products are the products that are used for…

Online Entertainment Market Exhibit a Remarkable CAGR of 20.82% and is estimated …

The global online entertainment market size is expected to reach $ 652.5 billion by 2027 at a CAGR of 20.82% from 2021 to 2027.

Get Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/6778

Online entertainment refers to entertainment over the internet through smart devices such as smartphones, smart TVs, laptops, and tablets. Proliferation in adoption of smartphones and affordability of internet have led to increase in online traffic, which…

3D Rendering Services Market is Forecasted to Attain US$ 61.65 Billion by 2026, …

The global 3D Rendering Services industry was valued at $8.56 billion in 2018, and is projected to reach $61.65 billion by 2026, growing at a CAGR of 28.10% from 2019 to 2026.

Modelling service is expected to experience significant growth in the upcoming years, as these services are becoming extremely popular marketing services that are used for design, presentation, and sales of any residential or commercial buildings.

Request Sample Report: https://www.alliedmarketresearch.com/request-sample/6174

3D rendering…

More Releases for Insurance

Household Insurance market by top keyaplayers - Discount Insurance Home Insuran …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance marketgrowth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market have also been included in…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Non-Life Insurance Market :Health Insurance, Property Insurance, Cargo Insurance …

Non-Life Insurance Market Overview:

Summary:Excellence consistency maintains by Garner Insights in Research Report in which studies the global Non-Life Insurance market status and forecast, categorizes and Equipment market value by manufacturers, type, application, and region.

Get Access to Report Sample: http://bit.ly/2Q9Hd8z

Non-Life Insurance market was valued at Million US$ in 2017 and is projected to reach Million US$ by 2025, at a CAGR of during the forecast period. In this study, 2017 has been…

Agricultural Insurance Market 2018-2023: AnHua Agricultural Insurance, Anxin Agr …

A new research study titled, “Global Agricultural Insurance Market” has been added to the comprehensive repository of Orbis Research

Agricultural Insurance Market - Global Status and Trend Report 2018-2023 offer a comprehensive analysis of the Agricultural Insurance industry, standing on the readers’ perspective, delivering detailed market data and penetrating insights. No matter the client is the industry insider, potential entrant or investor, the report will provide useful data and information.

The…

Insurance Market-Saga’s Retail Broking Business Offers Motor Insurance, Pet In …

Orbis Research Market brilliance released a new research report of 33 pages on title ‘Insurance Company Profile: Saga’ with detailed analysis, forecast and strategies.

Insurance Company Profile: Saga", profile provides a comprehensive review of Saga and its UK business. This includes its strategy for growth and focus on digitization as well as its performance in the UK and marketing and distribution strategy.

Request a sample of this report at http://orbisresearch.com/contacts/request-sample/2026595

Saga…