Press release

Global Analytics and Risk Compliance Solutions for Banking Market Report 2019|Key Players : included CMO, EMC, IBM, MetricStream, Nasdaq

Another report has been added to the wide database of Business Industry Reports. The examination think about is titled " Analytics and Risk Compliance Solutions for Banking Market 2019" by Manufacturers, Countries, Type and Application, Forecast to 2022 which give freshest industry data and industry future examples, empowering you to perceive the things and end customers driving Revenue advancement and efficiency.Global Analytics and Risk Compliance Solutions for Banking Market Overview:

The Analytics and Risk Compliance Solutions for Banking industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years. Analytics and Risk Compliance Solutions for Banking market size to maintain the average annual growth rate of 7.25% from 321 million $ in 2014 to 396 million $ in 2017, Market analysts believe that in the next few years. Analytics and Risk Compliance Solutions for Banking market size will be further expanded, we expect that by 2022. The market size of the Analytics and Risk Compliance Solutions for Banking will reach 510 million $.

Accessible Exclusive Sample Copy of this Report @ https://www.businessindustryreports.com/sample-request/108690 .

The major Factors of Global Analytics and Risk Compliance Solutions for Banking market, such as the Exponential growth in data and portfolio risk solutions, increased need to comply with regulatory requirements and Greater efficiency and productivity.

The report also covers segment data: Product type, application, end user, and region.

According Report Analysis, Banking and financial services are focusing on improving their internal processes with respect to day-to-day reporting analytics. The incorporation of data analytics in banking businesses will help enhance product design, customer targeting, and agency management. Moreover, implementing BI solutions will be advantageous for banks as they can identify negative trends in costs and performances and identify the actual cause of the issue.

Banks are increasingly adopting automated portfolio monitoring to stay updated with the credit flow of their client segment and take appropriate steps with immediate effect. Such initiatives help banks reduce their risks of lending to enterprises, and generating higher revenues and profits. With the exponential growth in data and portfolio risk solutions, the use of analytics ad risk compliance solutions will increase significantly in the banking sector.

According on region, The Americas dominated the global market during Forecast Period and accounted for the largest market share.

Purchase this report online with 117 pages list of tables and figures and all around table of contents on @ https://www.businessindustryreports.com/buy-now/108690/single .

Significant key players:

1 CMO

2 EMC

3 IBM

4 MetricStream

5 Nasdaq

Analytics and Risk Compliance Solutions for Banking market, by region:

1 North America Country

2 South America

3 Asia Country

4 Europe Country

5 Other Country

Global Analytics and Risk Compliance Solutions for Banking market 2019-2022: From raw materials to downstream buyers of this industry will be analyzed scientifically, the feature of product circulation and sales channel will be presented as well. In a word, this report will help you to establish a panorama of industrial development and characteristics of the Analytics and Risk Compliance Solutions for Banking market.

Snatch your report @ https://www.businessindustryreports.com/check-discount/108690 .

This investigation answers to the underneath key inquiries:

1 What is the current size of the Analytics and Risk Compliance Solutions for Banking market in the world and in different countries?

2 How is the Analytics and Risk Compliance Solutions for Banking market divided into different product segments?

3 How are the overall market and different product segments growing?

4 How is the market predicted to develop in the future?

5 What is the market potential compared to other countries?

In the end this report covers information and information on limit and generation outline creation piece of the pie investigation deals review supply deals and lack import fare and utilization and additionally cost value income and gross margin of Analytics and Risk Compliance Solutions for Banking.

Significant points in table of contents:

1 Analytics and Risk Compliance Solutions for Banking Definition

2 Global Analytics and Risk Compliance Solutions for Banking Market Major Player Share and Market Overview

3 Major Player Analytics and Risk Compliance Solutions for Banking Business Introduction

4 Global Analytics and Risk Compliance Solutions for Banking Market Segmentation (Region Level)

5 Global Analytics and Risk Compliance Solutions for Banking Market Segmentation (Type Level)

6 Global Analytics and Risk Compliance Solutions for Banking Market Segmentation (Industry Level)

7 Analytics and Risk Compliance Solutions for Banking Market Forecast 2019-2022

8 Analytics and Risk Compliance Solutions for Banking Segmentation Type

9 Analytics and Risk Compliance Solutions for Banking Segmentation Industry

10 Analytics and Risk Compliance Solutions for Banking Cost Analysis

11 Conclusion

About us

Businessindustryreports.com is digital database of comprehensive market reports for global industries. As a market research company we take pride in equipping our clients with insights and data that holds the power to truly make a difference to their business. Our mission is singular and well-defined – we want to help our clients envisage their business environment so that they are able to make informed strategic and therefore successful decisions for themselves.

Media contact

Business industry reports

pune – india

sales@businessindustryreports.com

+19376349940.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Analytics and Risk Compliance Solutions for Banking Market Report 2019|Key Players : included CMO, EMC, IBM, MetricStream, Nasdaq here

News-ID: 1660251 • Views: …

More Releases from Business Industry Reports

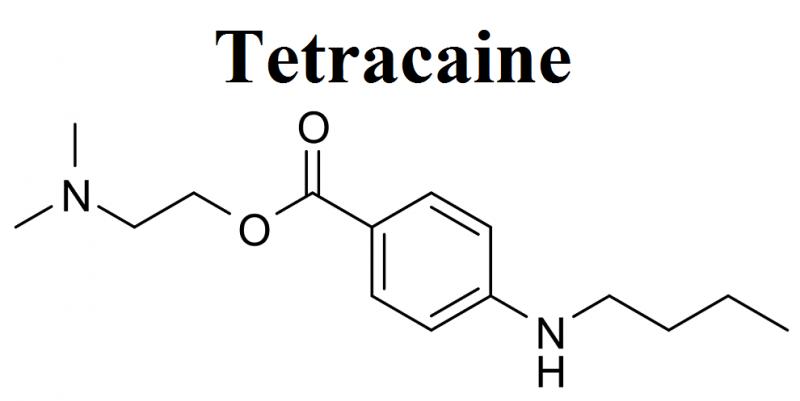

Tetracaine Market Exhibits a Lucrative Growth Potential during 2021-2025 | Endo …

BusinessIndustryReports has recently broadcasted a new study to its broad research portfolio, which is titled as “Global Tetracaine Market” Research Report 2021 provides an in-depth analysis of the Tetracaine with the forecast of market size and growth. The analysis includes addressable market, market by volume, market share by business type and by segment (external and in-house). The research study examines the Tetracaine on the basis of a number of criteria,…

Cyber Warfare Market Evenly Poised To Reach A Market Value of US$ By Share, Size …

Overview of Global Cyber Warfare Market:

This report provides in-depth study of “Global Cyber Warfare Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cyber Warfare Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, the Cyber Warfare is virtual conflict between state, organization, or country by the use of computer technology to disrupt activities…

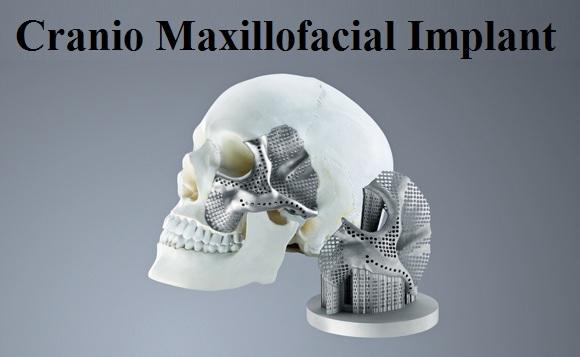

Covid-19 Impact on Cranio Maxillofacial Implant Market 2021-2025: Business Growt …

Overview of Global Cranio Maxillofacial Implant Market:

This report provides in-depth study of “Global Cranio Maxillofacial Implant Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cranio Maxillofacial Implant Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, Craniomaxillofacial Implants are medical implants used in surgeries of maxillofacial region such as, head, face, neck, oral,…

Beginning of the bloom: The Rise of the Biohacking Market 2021-2025 | Global Key …

Global Biohacking Market Synopsis:

The report covers a forecast and an analysis of the Biohacking Market on a global and regional level. The study provides historical data for 2015, 2016, 2017 and 2018 along with a forecast from 2020 to 2025 based on revenue (USD Million) and volume (Kilotons). The study includes drivers and restraints of the Biohacking Market along with the impact they have on the demand over the forecast…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…