Press release

Usage-based Insurance Market for PAYD segment to register an excellent CAGR of over 19% during the forecast timeline | Top Key Company Profiled Allstate, AXA, Liberty Mutual Insurance, MAPFRE, Nationwide, Allianz Insurance

This Research study on the Global Usage-based Insurance Market offers detailed and insightful information on major regional markets and related sub-markets.Usage-based Insurance market is projected to surpass USD 107 billion by 2024. The growing implementation of vehicle telematics to improve driving behavior and align car insurance premiums with the actual vehicle condition via UBI has accelerated the automotive insurance industry profitability.

Get Sample Copy of This Report @ https://www.gminsights.com/request-sample/detail/3020

UBI relies on telematics data to evaluate risks based on each individuals driving behavior, inclination towards safe driving practices, the current condition of vehicles and trip characteristics.

The PHYD segment is projected to hold a major market share of around 66% by 2024. PHYD insurance aims at charging premiums according to an individual?s driving habits, which help insurers to offer premiums that are more tailored to individual drivers. The insurers can set the rates based on driving skills and the time from when the user is most likely to be driving. Many insurers also share data with their clients to allow them to monitor their own driving behavior.

Industry Growth drivers:

1. Growth of the automobile industry

2. Shifting focus towards remote diagnostic technology

3. Growth in the number of the connected cars bringing new UBI opportunities

4. Rising penetration of smartphones integrated with vehicle connectivity systems

5. Rapid use of UBI by insurance companies to improve profitability

6. Growing trend of Try-Before-You-Buy (TBYB) insurance model

Company profiled in this report based on Business overview, Financial data, Product landscape, Strategic outlook & SWOT analysis:

1. Allianz SE

2. Allstate Insurance Company

3. ASSICURAZIONI GENERALI S.P.A.

4. AXA

5. Cambridge Mobile Telematics

6. Danlaw, Inc.

7. Desjardins Group

8. Insure The Box Limited

9. Intelligent Mechatronic Systems Inc.

10. Liberty Mutual Insurance

11. Mapfre, S.A.

12. Metromile Inc.

13. Nationwide

14. Octo Technology

15. Progressive Casualty Insurance Company

16. Sierra Wireless

17. State Farm Mutual Automobile Insurance Company

18. TomTom International BV

19. UnipolSai Assicurazioni S.p.A.

20. Vodafone Automotive SpA

21. Zubie, Inc.

Make an Inquiry for purchasing this Report @ https://www.gminsights.com/inquiry-before-buying/3020

The commercial vehicles segment is estimated to show the fastest growth rate of over 18% from 2018 to 2024 due to the adoption of telematics and other vehicular technologies to support the growth of the commercial vehicle transportation industry. Commercial vehicles leverage these technologies to increase the driving efficiency via real-time communications. Transportation companies can share the telematics data with the insurance companies and help them in setting premium rates and discounts for customers based on their driving behavior records. UBI helps in improving driver safety and reducing accidents by encouraging safe driving practices with a real-time feedback. Also, it provides fleet managers with deep insights about the drivers behavior, along with the fleet operating data that ensures safer fleet operations.

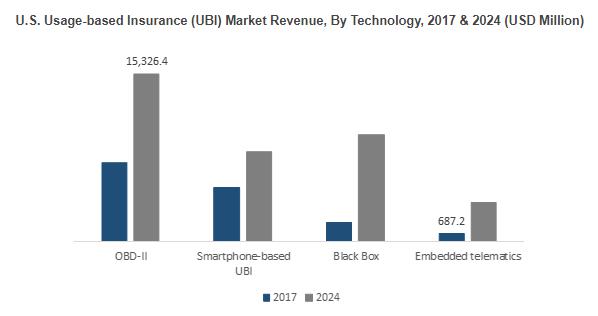

North America is projected to hold a dominant share of around 38% in the UBI market by 2024. The market growth is driven by an increase in the use of telematics systems that are equipped with features such as vehicle tracking systems, remote theft alarm, and driver assistance systems. The rising incidents of vehicle theft in this region are expected to augment the UBI market growth. According to the Insurance Information Institute, in 2017, around 773,139 vehicles were stolen in the U.S. as compared to 767,290 vehicles in 2016. The adoption of telematics-driven UBI helps insurers to improve profitability and reduce fraudulent claims. A massive growth of the connected cars market and an increased use of smartphone telematics for monitoring driver behavior will accelerate the UBI market growth over the forecast timeline.

Browse Report Summery @ https://www.gminsights.com/industry-analysis/usage-based-insurance-ubi-market

Some of the major players of the operating in the UBI market are Progressive, Allstate, State Farm, AXA, Allianz, Liberty Mutual, Nationwide, Vodafone Automotive, UnipolSai, Generali, Octo, Metromile, TomTom, Insure The Box, Mapfre S.A, Zubie, Desjardins Group, Sierra Wireless, IMS, Cambridge Mobile Telematics, and Danlaw.

About Global Market Insights:

Global Market Insights, Inc., headquartered in Delaware, U.S., is a global market research and consulting service provider; offering syndicated and custom research reports along with growth consulting services. Our business intelligence and industry research reports offer clients with penetrative insights and actionable market data specially designed and presented to aid strategic decision making. These exhaustive reports are designed via a proprietary research methodology and are available for key industries such as chemicals, advanced materials, technology, renewable energy and biotechnology.

Contact Us:

Arun Hegde

Corporate Sales, USA

Global Market Insights, Inc.

Phone:1-302-846-7766

Toll Free: 1-888-689-0688

Email: sales@gminsights.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Usage-based Insurance Market for PAYD segment to register an excellent CAGR of over 19% during the forecast timeline | Top Key Company Profiled Allstate, AXA, Liberty Mutual Insurance, MAPFRE, Nationwide, Allianz Insurance here

News-ID: 1649541 • Views: …

More Releases from Global Market Insights, Inc

Point of Care Ultrasound Market Outlook 2021-2025 | Analogic, Canon Medical Syst …

Growing demand for fast and accurate diagnostic tools is expected to drive point of care ultrasound market growth in the ensuing years. Point-of-care ultrasound (POCUS) has become a standard tool in the emergency department, as it answers to specific clinical queries that narrow differentials, guide clinical therapy, and direct consultations and disposition.

Recent technological advancements have led to the development of miniature POCUS that range from stationary high-end systems to small…

Medical Tourism Market Forecast 2027 By Top Players Asklepios, KPJ Healthcare Bh …

Medical Tourism Market report offers in-depth analysis of the industry size, share, major segments, and different geographic regions, forecast for the next five years, key market players, and premium industry trends. It also focuses on the key drivers, restraints, opportunities and industry challenges.

Every year millions of people travel abroad seeking medical treatment and efficient surgical procedures such as cosmetic surgery, cardiovascular surgery, orthopedic and dental surgery which is referred to…

Medical X-ray Market Outlook 2021-2027 | Top Players Siemens Healthcare, GE Heal …

Medical X-ray Market report offers in-depth analysis of the industry size, share, major segments, and different geographic regions, forecast for the next five years, key market players, and premium industry trends. It also focuses on the key drivers, restraints, opportunities and industry challenges.

Researchers at Northwestern University have designed a new AI-based platform that analyses lung X-rays and detects COVID-19. The machine-learning (ML) algorithm, named DeepCOVID-XR, was able to outperform a…

Biosensors Market 2021 by Top Industry Players Abbott Laboratories, Bio-Rad Inte …

Biosensors Market report offers in-depth analysis of the industry size, share, major segments, and different geographic regions, forecast for the next five years, key market players, and premium industry trends. It also focuses on the key drivers, restraints, opportunities and industry challenges.

Rising incidences of several serious disorders among the global population has evoked the need to detect these at early stages in order to obtain appropriate treatment on time. This…

More Releases for Insurance

Household Insurance market by top keyaplayers - Discount Insurance Home Insuran …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance marketgrowth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market have also been included in…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Non-Life Insurance Market :Health Insurance, Property Insurance, Cargo Insurance …

Non-Life Insurance Market Overview:

Summary:Excellence consistency maintains by Garner Insights in Research Report in which studies the global Non-Life Insurance market status and forecast, categorizes and Equipment market value by manufacturers, type, application, and region.

Get Access to Report Sample: http://bit.ly/2Q9Hd8z

Non-Life Insurance market was valued at Million US$ in 2017 and is projected to reach Million US$ by 2025, at a CAGR of during the forecast period. In this study, 2017 has been…

Agricultural Insurance Market 2018-2023: AnHua Agricultural Insurance, Anxin Agr …

A new research study titled, “Global Agricultural Insurance Market” has been added to the comprehensive repository of Orbis Research

Agricultural Insurance Market - Global Status and Trend Report 2018-2023 offer a comprehensive analysis of the Agricultural Insurance industry, standing on the readers’ perspective, delivering detailed market data and penetrating insights. No matter the client is the industry insider, potential entrant or investor, the report will provide useful data and information.

The…

Insurance Market-Saga’s Retail Broking Business Offers Motor Insurance, Pet In …

Orbis Research Market brilliance released a new research report of 33 pages on title ‘Insurance Company Profile: Saga’ with detailed analysis, forecast and strategies.

Insurance Company Profile: Saga", profile provides a comprehensive review of Saga and its UK business. This includes its strategy for growth and focus on digitization as well as its performance in the UK and marketing and distribution strategy.

Request a sample of this report at http://orbisresearch.com/contacts/request-sample/2026595

Saga…