Press release

Artificial Intelligence (AI) in BFSI Market 2024 Trends Analysis By Top Players: Amazon Web Services, Baidu, Inc., Digital Reasoning, Google, Intel Corporation, Ipsoft, Microsoft, Oracle, Palantir Technologies, Salesforce, SAP, ZestFinance

Artificial Intelligence (AI) in BFSI Market in the customer behavior analytics solution market is estimated to grow at a CAGR of over 35% during the forecast timespan. The growing demand to analyze the structured and unstructured customer data among the financial institutes to provide a personalized experience to the customers is a major factor affecting the growth of the market. This solution can mine a vast volume of data to extract actionable insights and recommend appealing & personalized offers to the individual customers. Furthermore, the ability of the solution to transform the marketing activities and enhance the customer engagement also drives the demand.Sample Copy of this Report @ www.gminsights.com/request-sample/detail/2605

The risk management, compliance, and security applications of the Artificial Intelligence (AI) in BFSI market are anticipated to grow noticeably at a CAGR of about 40%. The market is driven by the improved demand for advanced machine learning algorithms in Anti-Money Laundering (AML) and fraud detection applications. Unlike the traditional security systems, the AI-powered system can actively learn and calibrate as per the new potential security threats. This solution can detect unique security issues & vulnerabilities and flag the security teams.

Company profiled in this report based on Business overview, Financial data, Product landscape, Strategic outlook & SWOT analysis:

1. Amazon Web Services

2. Avaamo

3. Baidu Inc.

4. Cape Analytics

5. CognitiveScale

6. Comply Advantage.com

7. Descartes Labs

8. Digital Reasoning Inc.

9. Google Inc.

10. Inbenta Technologies

11. Intel Corporation, Interaction LLC

12. Ipsoft Inc.

13. Lexalytics Inc.

14. Microsoft Corporation

15. NEXT IT

16. Oracle Corporation

17. Palantir

18. Salesforce.com Inc.

19. SAP SE

20. Zest Finance

The insurance market is estimated to grow at a CAGR of over 38% during 2018-2024. The growth of the market is credited with the adoption of advanced data models and analytics solution among the insurance companies to identify and quantify risks in a better manner. Furthermore, increasing collaboration & partnership activities between the insurers and fintech companies are also the major factors propelling the Artificial Intelligence (AI) in BFSI market growth.

Make an Inquiry for purchasing this Report @ www.gminsights.com/inquiry-before-buying/2605

The customer behavior analytics solution market is estimated to grow at a CAGR of over 35% during the forecast timespan. The growing demand to analyze the structured and unstructured customer data among the financial institutes to provide a personalized experience to the customers is a major factor affecting the growth of the market. This solution can mine a vast volume of data to extract actionable insights and recommend appealing & personalized offers to the individual customers. Furthermore, the ability of the solution to transform the marketing activities and enhance the customer engagement also drives the demand.

artificial intelligence in BFSI market is driven by a rapid surge in the digital data. The digital data is anticipated to grow at an annual growth rate of about 40% over the next 10 years. The increasing adoption of IoT devices and advanced technologies, such as Big Data, are the major factors responsible for the surge in the data. Furthermore, the growing adoption of smart devices and internet services across the globe also fuels the growth of the data. It is estimated that by the year 2020, approximately 1.7 megabytes of the new data will be generated every second. This encourages organizations to deploy advanced technologies to extract insights from large disparate data sets.

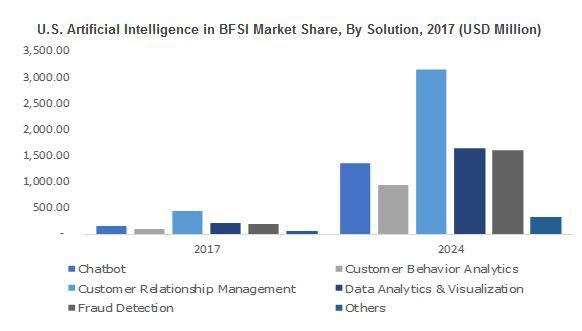

The solution market accounts for over 85% share in the artificial intelligence in BFSI market. The increasing adoption of the customized software among the financial institutes is propelling the market growth. Banks, insurance companies, and wealth management companies are using various AI-based solutions such as chatbot, customer behavior analytics, customer relationship management, and data analytics & visualization solutions to extract the actionable insights and improve the customer experience.

The machine learning and deep learning market is dominating the technology space with over 38% share in the artificial intelligence in BFSI market. The growth of the market is attributed to the increasing investments in the technology across the globe; as in 2016, approximately USD 6 billion was invested in AI. Furthermore, the wide adoption of the advanced machine learning algorithms in the trading, fraud detection, and anti-money laundering (AML) application promotes the demand for the technology among the financial institutes.

Browse key industry insights spread across 320 pages with 200 market data tables & 25 figures & charts from the report, Artificial Intelligence (AI) in BFSI Market in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/artificial-intelligence-ai-in-bfsi-market

North America held more than 50% share in the global AI in BFSI market. It is one of the early adopters of the AI technology in BFSI sector. The major factors that are driving the growth of the market are the increasing investments in the AI by the technology giants such as Google, AWS, and IBM. For instance, in 2016, Google has invested approximately USD 20 billion in AI. Furthermore, the favorable condition in the region for the technology start-ups also backs the market.

Asia Pacific Artificial Intelligence in BFSI market is estimated to grow at a CAGR of over 40%. The growth is owing to the rising venture capital investments in AI and fintech. China is leading the investment landscape in Asia Pacific with more than USD 8.0 investment in the fintech sector in 2016. Furthermore, the country also accounts for more than 11% share in the global AI investments in 2016. Similarly, India also accounts for significant investments in the AI and fintech sectors.

Europe held more than 20% share in Artificial Intelligence (AI) in BFSI market. The investments by the tech giants in the region support the market growth. For instance, Amazon Web Services (AWS) invested approximately USD 2.3 million in Max Planck Institute for Intelligent Systems, a Germany-based AI research center for the development of AI and robotics technology. Similarly, in 2016, Google announced the establishment of a new research and development facility in Zurich, Germany.

Some of the major vendors present in the artificial intelligence in retail market are AWS, Baidu, Google, Intel, Microsoft, IBM, Salesforce, Interactions, Lexalytics, NEXT IT, Nvidia, Oracle, RetailNext, SAP, Sentient, and Visenze.

Browse Related Reports: https://www.openpr.com/news/1583550/Global-Network-Traffic-Analysis-Market-to-see-20-CAGR-till-2024-By-Top-Key-Players-IBM-Juniper-Networks-Microsoft-Nokia-SolarWinds-Symantec-Cisco-Accenture-Allot-Ascom-Holding-AG-Zenoss-Huawei-Technologies.html

About Global Market Insights

Global Market Insights, Inc., headquartered in Delaware, U.S., is a global market research and consulting service provider; offering syndicated and custom research reports along with growth consulting services. Our business intelligence and industry research reports offer clients with penetrative insights and actionable market data specially designed and presented to aid strategic decision making. These exhaustive reports are designed via a proprietary research methodology and are available for key industries such as chemicals, advanced materials, technology, renewable energy and biotechnology.

Contact Us

Arun Hegde

Corporate Sales, USA

Global Market Insights, Inc.

Phone: 1-302-846-7766

Toll Free: 1-888-689-0688

Email: sales@gminsights.com

Web: www.gminsights.com

Blog: www.industry-source.org

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Artificial Intelligence (AI) in BFSI Market 2024 Trends Analysis By Top Players: Amazon Web Services, Baidu, Inc., Digital Reasoning, Google, Intel Corporation, Ipsoft, Microsoft, Oracle, Palantir Technologies, Salesforce, SAP, ZestFinance here

News-ID: 1587018 • Views: …

More Releases from Global Market Insights, Inc.

Hepatitis B Vaccine Market Set to Surpass $12 Billion by 2034

The global hepatitis B vaccine market is poised for significant expansion over the next decade, fueled by rising liver disease cases, expanded immunization coverage, and advancements in vaccine development. Valued at USD 6.7 billion in 2024, the market is projected to reach USD 7.3 billion in 2025 and surge to USD 12 billion by 2034, reflecting a healthy compound annual growth rate (CAGR) of 5.7%.

A major driver behind this growth…

Rare Sugar Market Top 3 Trends, Covid-19 Outbreak, Factors Driving, Threats, Cha …

Rising awareness regarding health & fitness and the subsequent shift in consumer trends towards low-calorie sweeteners will boost rare sugar market share over the forecast spell. Recent years have marked a steady rise in the prevalence of cardiovascular ailments, diabetes, and obesity, among other chronic conditions, which have triggered a massive change in consumer perceptions towards health.

This in turn has led to a surge in demand for various functional foods…

Global Selenium Yeast Market Industry Assessment, Trends, Competitive Landscape, …

The selenium yeast market is anticipated to register substantial gains on account of rising inclination towards organic additives in animal nutrition, with an aim to improve livestock health and production. Consumers are steadily becoming aware of the downsides associated with using synthetic additives. As a result, they are preferring selenium yeast feed grades over other counterparts to provide balanced nutrition to their livestock.

According to Global Market Insights Inc estimates…

Power Distribution Component Market Share, Size, Trends by 2025 | Leading Key pl …

Global Power Distribution Component Market Report offers market overview, segmentation by types, application, countries, key manufactures, cost analysis, industrial chain, sourcing strategy, downstream buyers, marketing strategy analysis, distributors/traders, factors affecting market, forecast and other important information for key insight.

Request a sample of this research report @ https://www.gminsights.com/request-sample/detail/3091

Voltage rating have acted as a standard industry protocol toward the installation of power components reliant on regulatory preference, deployment areas, and the group…

More Releases for BFSI

Evolving Market Trends In The Robotic Process Automation In BFSI Industry: Advan …

The Robotic Process Automation In BFSI Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Robotic Process Automation In BFSI Market Size During the Forecast Period?

In recent times, the market size for robotic process automation in bfsi has witnessed a significant surge.…

Evolving Market Trends In The Banking, Financial Services and Insurance (BFSI) S …

The Banking, Financial Services and Insurance (BFSI) Security Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Banking, Financial Services and Insurance (BFSI) Security Market Size During the Forecast Period?

The market size for security within the banking, financial services and insurance (BFSI)…

Key Trend Reshaping the AI in BFSI Market in 2025: Transforming The BFSI Sector …

What combination of drivers is leading to accelerated growth in the ai in bfsi market?

The anticipated surge in the AI in BFSI market may be traced back to the mounting use of AI in improving efficiency. Artificial intelligence (AI) comprises various technologies and algorithms that simulate human intelligence, including problem-solving, drawing insights from data, and making effective decisions. This growing usage of AI for enhancing efficiency could be attributed to…

Mumbai's BFSI Sector Gears Up for Transformation at the 24th Edition of BFSI IT …

Mumbai: The banking, financial services, and insurance (BFSI) sector in Mumbai is currently undergoing a profound transformation, fueled by rapid technological advancements and a significant increase in digital adoption. Emphasizing a strong commitment to digitalization, key stakeholders in Mumbai are championing initiatives akin to advancements in digital payments and the establishment of the Digital Banking Transformation Office. These efforts are propelling the BFSI landscape forward, fostering innovation and paving the…

Empowering BFSI Security: Safeguarding Futures Amid Evolving Threats, BFSI Secu …

Guarding the financial backbone against evolving cyber threats fuels the burgeoning, emergence of tailored solutions, biometrics, and IoT-based cybersecurity solutions significantly enhancing online banking Opportunities for the market.

The BFSI Security Market, valued at USD 61.6 billion in 2022, is poised to witness exponential growth, reaching USD 166.2 billion by 2030, reflecting a robust CAGR of 13.2%. This escalating trajectory is primarily attributed to the stringent regulatory environment governing the banking,…

IoT in BFSI Market : How the Business Will Grow in 2026?�Top Players in IoT in B …

The global internet of things (IoT) in banking, financial services, and insurance (BFSI) market is predicted to reach USD 116.27 billion by 2026, exhibiting a CAGR of 26.5% during the forecast period. The increasing investment of banks and financial institutions in IoT technologies will stimulate the growth of the market in the foreseeable future. According to the studies conducted by Tata consultancy services, financial institutions spend an average IoT budget…